401K Calculation Going *Backward* to See The Truth and Rent vs. Own Maths

Level 2 - Value Investor

Welcome Avatar! Before getting flamed massively, if you are working you should always take *any* employer match. If you make $100,000 a year and the firm will match say $5,000 worth of contributions (5%), it means you *MUST* put in $5,000 every year no matter what. This is because you will get another $5,000 from the firm putting you at $10,000 in total.

We’ll write that again. Unless you have a health emergency or some sort of insane situation to deal with. Take the match as the first investment you make. There are no exceptions.

Even if you withdraw it, there is no way you’re going to pay 100% tax. Locking in a 100% return is practically impossible. Therefore, it’s always first.

Before moving on, we assume you want to get rich. If you don’t want to get rich we have no idea why you read this website or how you found us.

Now onto the real math.

Part 1: “Invest X Get Y in 2053”

This is parroted over and over and over again. “In 30 years you will have $$$ million”.

Okay that is fine, now we can ask the question in reverse. What will that buy in 2023 and 2053 terms?

As you all know, no one can answer that: 1) the USA is not seeing significant population growth which is needed for GDP growth, 2) if you assume prices do not go up or down for 30 years, then you would need to assume you don’t get investment returns and 3) don’t even get us started on the tax argument and just assume that no taxes are ever paid.

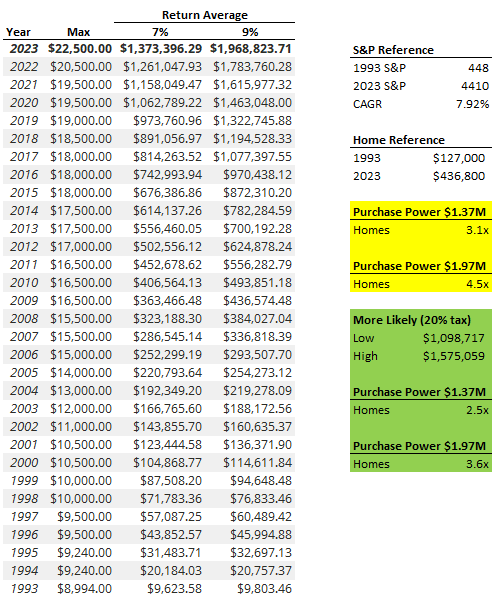

To be clear we will not make any assumptions for 2053. Why? We can just work backward! We can see what would happen if you invested the 100% max from 1993 to 2023 and retired.

This seems like a fair enough time frame. We’re also assuming you pay *no* tax on any of the retirement money.

Assumptions: You will contribute the full max or “Employee Contribution Limit”. We will assume you get perfect 7% or 9% returns. We will assume you pay *NO* taxes on any of this despite 401Ks requiring income tax later. This assumption will remove any complaints about “employee match” potential or “Roth potential”.

We also assume you do not miss a single year. No layoffs ever. No major events requiring you to withdraw money. No nothing. Perfect contributions every year and perfect 7-9% returns with zero down years and zero big up years.

How Can We Do This? Quite simple really. We’ll do the same thing the calculators do. They say if you invest X and get 7% returns you’re worth Y in retirement.

Be sure to avoid that $5 latte!

30 years ago was 1993. Today is 2023. We have all of the maximum limits here (source). Below is the official number after 30 straight years of perfect performance and 7% or 9% returns.

Choose Between 7% and 9% returns.

Note we used June of 1993 to make it match 30 years.

Some Conclusions: You can decide if this is enough money to retire or not in 2023. Instead of looking at the number “$1.3M or $1.9M” ask what it can buy. If you maxed out your 401K for the last 30 years, you’d have enough money for around 3.0-3.5 houses.

These return assumptions are more aggressive than conservative since no one in their retirement years would have 100% stocks due to the risk of a 20% drawdown in a particularly bad year. S&P returns were just under 8% so using 7-9% is a fair range.

Anyway. The better way to explain this. If you max out your 401K for 30-years straight starting today, you will have ~3.0-3.5 median USA homes worth of “value” in the 401K. Ignore the higher numbers the calculator spits out. If the past 30 years are indicative of the next 30-years that is exactly what happens. 401K contributions have gone up the past 30 years and if we assume the exact same set up for the next 30 years it means inflation, home prices etc. would mirror. Again. Don’t think of numbers think of purchasing power.

Assume the Max Today: For the record practically everyone ends up maxing out their 401K anyway. This is some sort of hazing ritual for anyone who eventually becomes rich. Then they look back and realize how much they were losing on cost of capital. If you were running a E-com biz with 30% operating margins you’re puking at this excel sheet since inventory turns of even 60 days means 30% return in 60days (not 3 years!).

If you believe 3.0-3.5 rental homes (exact median) in the USA is enough for retirement for you, then have at it. You’re safe.

Short Conclusion

There is nothing to “argue” here in terms of numbers. You’re free to plug them in and check yourself.

The conclusion is that most never see the value of reinvesting into any business. Ironically, the people most upset about this math typically work on Wall Street or other white-collar professions. The people who see comp tables that prove companies sell at 3, 5, 10, 20x earnings (and have the skill/talent to grow a business!) simply decide to ignore the comp sheets they use every day.

Still haven’t figured out why but that’s how it goes.

What’s a Better Strategy? Net income improvement and reduction of taxes.

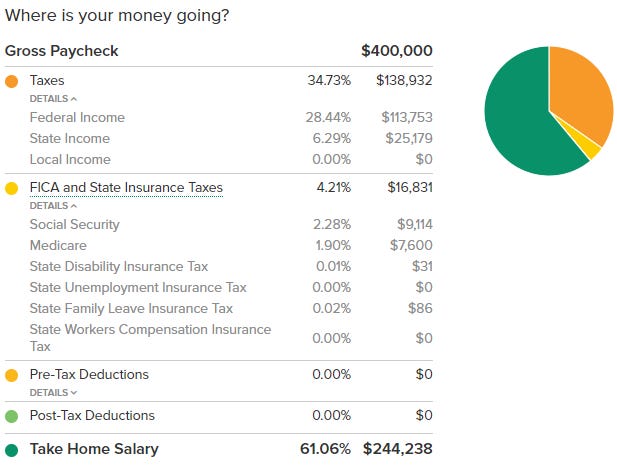

Take the above from NYC. Making $400,000 is over $25,000 in state taxes. Assume you just put that money into the S&P 500 instead? Well, you’re *liquid* you don’t have to wait until you’re 60 years old AND it’s more money than the max!

Not even close to a debate on who wins in this situation. Alternatively, you could start any basic online business and make a whopping $2-3K a month online. That would also dismantle any 401K returns ($2.73M in 30 years at 7% or $4.075M at 9%).

Part 2: Rent vs Own!

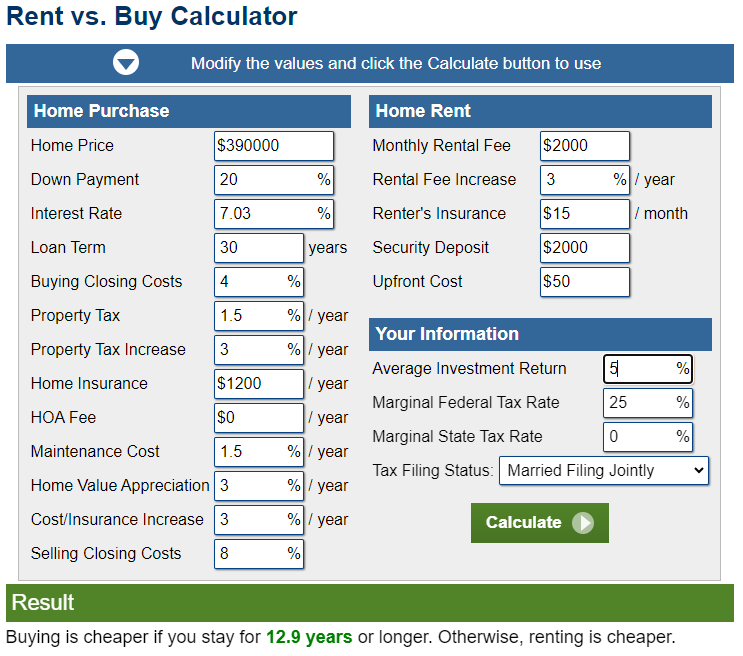

We had some fun trolling Twitter on the Real Estate market again. There is a lot of hope and cope out there as a lot of young people decide to rent. In a ton of cities, it makes a lot more sense to rent since you can avoid the spiking insurance premiums and property tax bills. Unless you have special incentives, the math is pretty simple: can you get better returns at 5%? (for the reply guys about federal taxes, you can buy munis or add some boring bonds of stable AAA companies that yield 5.75%. The point is the same, 5% is the rough proxy today).

Currently you have to stay in the home for 12.9 years (not great but doable if you’re sure you love the city).

The above is a pretty basic calculation and good enough starting point. Now you probably know what is coming next. We do this all the time. How are 401Ks and home ownership related?

Most hold two opposing views at the same time.

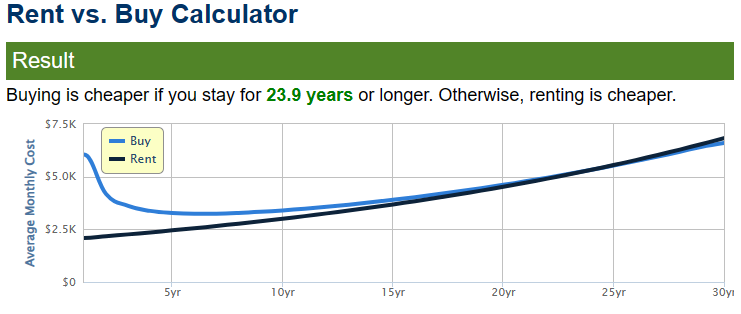

Click Rewind: For the past week or so people said 7-9% returns were all but guaranteed and that home ownership always beats renting. Well, if that is true, instead of using a 5% return we should use a 7-9% return because that is what you could be doing with the money. Remember. If you have ~$80,000 for a down payment this money could be doing something.

First at 7% return… instead of using 5% return. 23.9 years!

At 9% return there is no reason.

If you can generate 9% returns there are *limited* situations in which you buy. (word is limited not all)

Short Conclusion

To be clear, there is no “right” answer here. We’re of the belief that you’re better off avoiding the home purchase for now but personal life circumstances can change that. Finding an amazing deal can change that. Being certain you will stay somewhere for 10+ years will change that. Lifestyle decisions can’t be plugged into a calculator.

With that said, you shouldn’t hold two conflicting views. If you believe stock price returns will be 7-9% per year and you’re sure of it, then that is your opportunity cost. If the cost of buying a home would result in a $8,000 a month payment but you could rent for $4,000 a month (extreme example), the $48,000 saved need to be added to the S&P 500 (or to another vehicle).

Before signing off here, we’ve foolishly maxed out our 401Ks during working years.

In addition, we’re more than happy to say it was a mistake particularly when money was needed to buy more inventory and ad space. Had to learn the hard way.

Fortunately, we’ve avoided the whole housing debate by making the genius decision to be homeless.

In the end, it’s up to you to decide what the opportunity cost is.

Just don’t make two separate assumptions that conflict.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: How to protect and store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

That example on maxing out your 401k should be a mandatory lesson in our education system. Thanks to my grandfather teaching me to “save a dime for every dollar I make”, my wife and I retired at 55 just like he did. We also should use behavioral economics and make 401k elections defaulted to the maximum contribution and go straight into VOO. I was shocked when I found out how low the 401k participation rate was at my company when I became responsible for payroll. Many of the people I worked with are still working and will be for a while because they didn’t follow this simple advice. We need to educate people on basic personal finance principles. It’s almost like we don’t want people to budget, save, and invest.

A better way to think about the 401k is an insurance policy when your ecom website blows up, and you’re out of money to pay for basic bills and your kids. The odds of hitting 7-9% ROI YoY is greater than 50%, whereas the odds of you running a FCF+ ecom business for 3+ years is ~1%. For most people, trading off 401k contributions for Meta ads is a fool’s errand. But if you’re making $400k+ a year, you can do both - max out the 401k and still buy ads for your ecom biz. Or consider a margin loan against your stocks to fund the ecom biz, and have your cake and eat it too! Just don’t pick the wrong stocks.