$4M is the New $1M and Why Retirement is a Scam

Level 2 - Value Investor

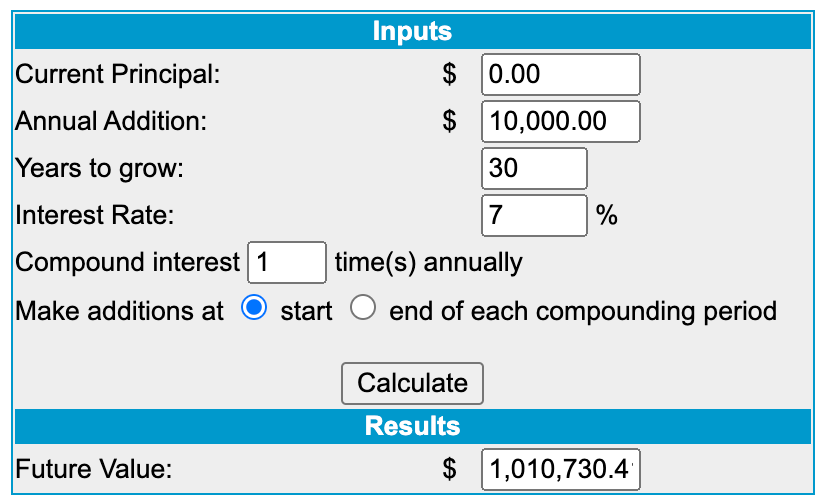

Welcome Avatar! We’re sure you’ve heard the same old investing mantra for years. If you save $10,000 a year for thirty years straight, invest it into long-term stocks with an average return of 7% a year, you will have $1,000,000 thirty years from now! But Wait…

Is this just a psychological operation to make you feel safer than you should?

We are going to show you that we think it is a psyop.

Part 1: The Maths Don’t Lie

We’re not arguing against the math. In fact you can run the exact same math yourself and find out that $10,000 saved for 30 years straight is in fact, just over $1,000,000.

Psyop #1: Say you follow this plan this means that you will have just over $1,000,000. Well guess what? In a retirement account you still have to pay taxes. If you were adding $10,000 a year for 30 years, that is $300,000. This means the remaining $710,730.4 *MUST* be taxed. Unless you want to go to jail for tax fraud.

While most retirement accounts are based on income we’ll be generous and assume a simple 15% tax. This means your *post tax* money is $604,120.84 + $300,000 = $904,120.84.

$900,000? Close Enough! Okay we agree! Getting $900,000 and $1,000,000 is pretty close so what is the point? Well we can move to part 2, the Psychological Operations really begin.

Part 2: What Does $900,000 or even $1,000,000 buy in… Checks Notes… *2053*?

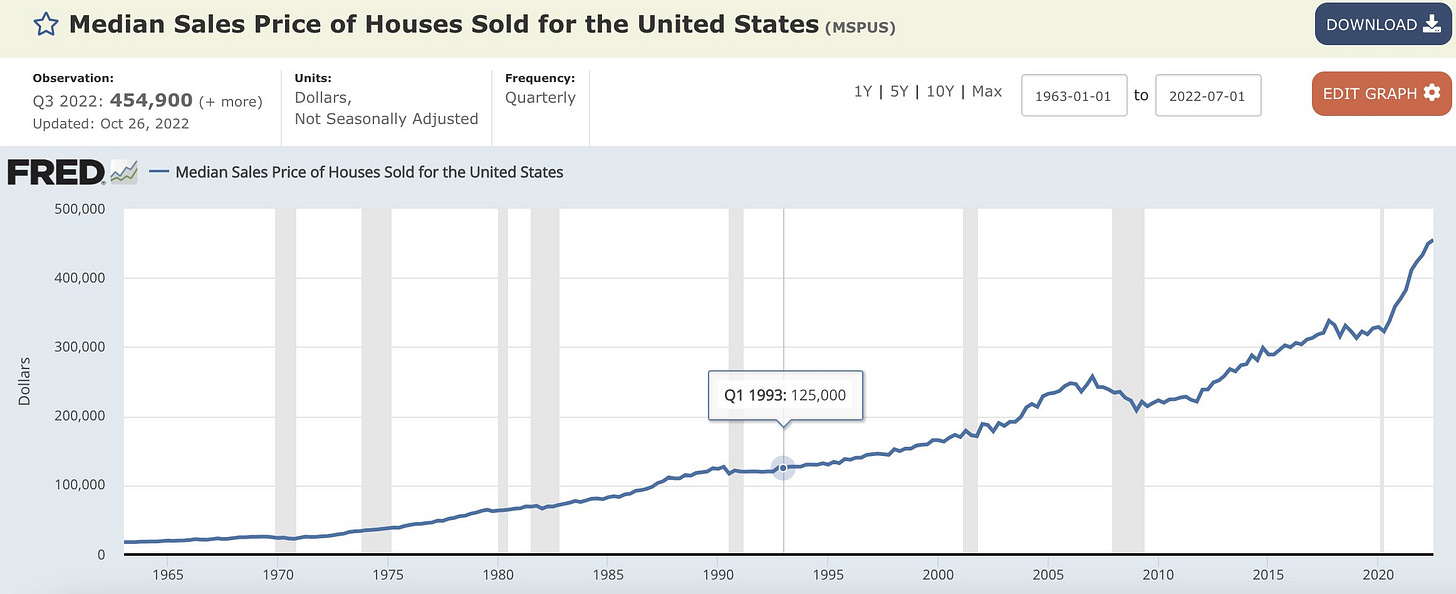

In 1993 (exactly 30 years ago) the median sale price of a home was $125,000. We’re not going to make the whole “choose a city” argument. You don’t even need to go that far. If you want to retire in higher cost areas, this number only goes up. The *NATIONAL* median is the best starting point for the majority because it is the middle.

Start With Your Home: In 1993, a home would cost $125,000. Today it would cost ~$450,000. This means the cost of a home has risen by about 3.6x over the last 30 years.

Housing data is a lot harder to fake due to public filings. In the end this is directionally accurate. To keep it simple assume the price goes up 3x in 30 years. Much easier to remember.

Move to Healthcare: This is another basic necessity, your health. Can’t really spend your $900,000 if you’re in a grave. So. We take a quick glance at healthcare costs and…

Wew! Not looking too great either. It went up about 4x over the past 30 years. Once again, we’ll assume technology improves. And. It isn’t this crazy in the future. So, a simple 3x rule again. Cost of healthcare to 3x over 30 years.

The Rest of Your Stuff, Food etc.: For the remaining part we’ll just use government data. There is no way you can go to a grocery store and think that food prices are only up 5% this year. You know they are up more. That said, we’ll avoid making any crazy claims and use CPI from government data. The rough math is the other expenses go up 2x over 30 years.

#2 Psyop: As you can see the second Psychological operation is clear. The $1,000,000 retirement portfolio doesn’t tell you what it will *BUY*. To recap, you can assume that homes will cost 3x more, healthcare 3x more and the remaining items 2x more.

#3 Psyop: Now with that out of the way we can do some simple projections:

If a home costs $450,000 now in 30 years it will likely cost $1.35M (3x)

If you are spending $12,000 a year on food it will now be $24,000 a year (2x)

If you are spending $6,000 a year on healthcare it would now be $18,000 a year (3x)

Part 3: $4M is the New $1M

Now to solve for all of this.

If you still want to believe in the $1M purchasing power in 2053 (Thirty years from now!) you would have to downsize your living expectations. If a median home is 3 bedrooms and runs $1.35M in 30 years, it means you could probably swing a one bedroom or studio for $400-600K. (Pod/bug eating people coming soon!)

What is the bigger point?

$1M in 1993: Back in the early 90s, this was an enormous amount of money! You had the ability to buy 8 houses with $1,000,000. Take $1,000,000/$125,000. By living in one home and renting out 7 other homes you were living large for the rest of your life.

$4M in 2023: Once again, we see that the median price is $450,000 and $4,000,000 would buy you 8.888 homes. The 0.888 homes we’ll call a “wash” since they make up for the increasing cost of food/healthcare from 1993 to 2023.

$4 million US Tokens is the new $1M US Tokens.

Part 4: Conclusion

This is our argument for why $4 million is the new $1 million from years ago. It is also our argument for why $1,000,000 won’t be all that much money in 2053. People forget that the cost of items go up over 30 year time frames.

No, we’re not saying to buy a house (in fact we expect prices to go down this year) but over the long-term it’ll go up. Emphasis: we would not buy any real estate especially in SE USA at this point in our cartoon opinion.

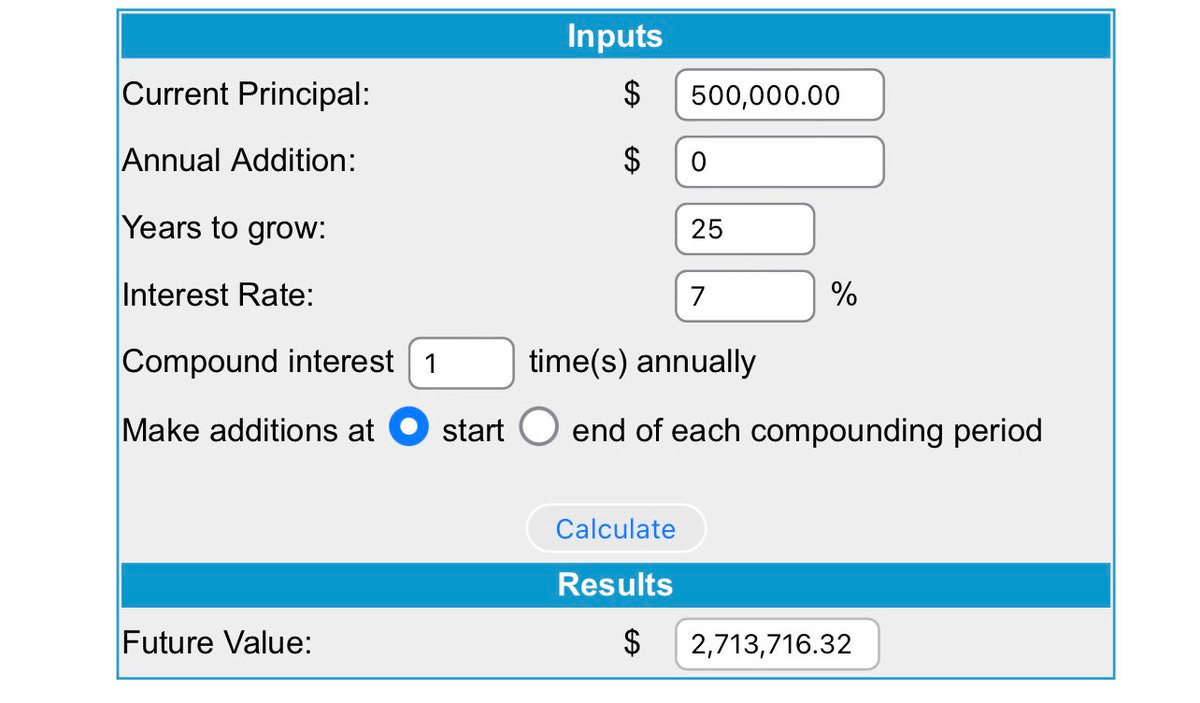

What Should You Do Instead? You should be joining the jungle and spinning up a WiFi business. All you need is a SINGLE one time event of $500,000. Not $1M. Not some crazy $10M VC exit. Just $500,000.

If you create a WiFi business that makes $166,000 per year, you could sell that for 3x earnings on Empire Flippers in many cases.

As you can see a $500,000 exit within 5 years is worth 2.7x more than saving $10,000 a year for 30 years straight. In Five years you can accomplish more than most will accomplish in 30 years of diligent penny pinching (IG Reel).

On that note, our next paid post goes over Private Company valuations. We provide our opinion on when to get into RE (later) and other business + investing options. You’re free to disagree with us on any of these matters. Just remember. Excel doesn’t lie.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type content and Reels related to improvement. Twitter will be for money. At 20,000+ instagram follows we will publish some city guides ranking each region we’ve been to

I'm helping a 23 year old exit his wifi biz for $3.9m (4x sde) that he started in 2020. Already have 2 offers.

Start today!

Scary stuff. Back to work!