87,000 IRS Agents "Inflation Reduction Act" and Stable Freeze

Level 2 - Value Investor

Welcome Avatar! Hope you have enjoyed yet another day of mayhem as it relates to the general economy, crypto regulation and of course slowing consumer demand (see the NVDA earnings report). While we’ll do a quick explainer of why the NVDA miss was obvious on Wednesday, the Inflation Reduction Act and Stable Coin news will be free. We’ve talked for over a year and a half about the dangers of stables coins and centralized scams like BlockFi, Celsius etc. In addition, the Inflation Reduction Act appears to have little to do with Inflation so we’ll start there.

Part 1 - Inflation Reduction Act

Well we took a read of it and we’ve got some news for you, spending $740 Billion unlikely stops inflation. We know this view is controversial but typically when you spend $740 billion it doesn’t do anything to help lower prices. It would be similar expecting prices to go down at a night club when Justin Bieber is showing up that night.

87,000 IRS Agents

Nope this isn’t the Matrix. This is the IRS!

Pretty similar come to think of it but we have to jump straight in. First order of business. If you have any way of moving to a lower tax jurisdiction or lowering your tax rate *legally* you should have done it in 2020, or 2021 and if you haven’t? Do it today.

As usual, there is no way you’re going to avoid paying taxes. If you think you can scam the system you’ll just end up with even more costs as audits/lawyers will eat into your savings over the past several years. The only thing you can do is find the best tax situation for you.

Who Gets Audited? Right now the main people who get audited are people who make $0 or the people who make $10,000,000+ (both a near 9% audit rate). Explaining this is quite simple. Anyone who is making $100,000 to $300,000 for example has a W-2. It’s extremely easy to check these individuals. It is also hard to fake since there is a clear paper trail from day one.

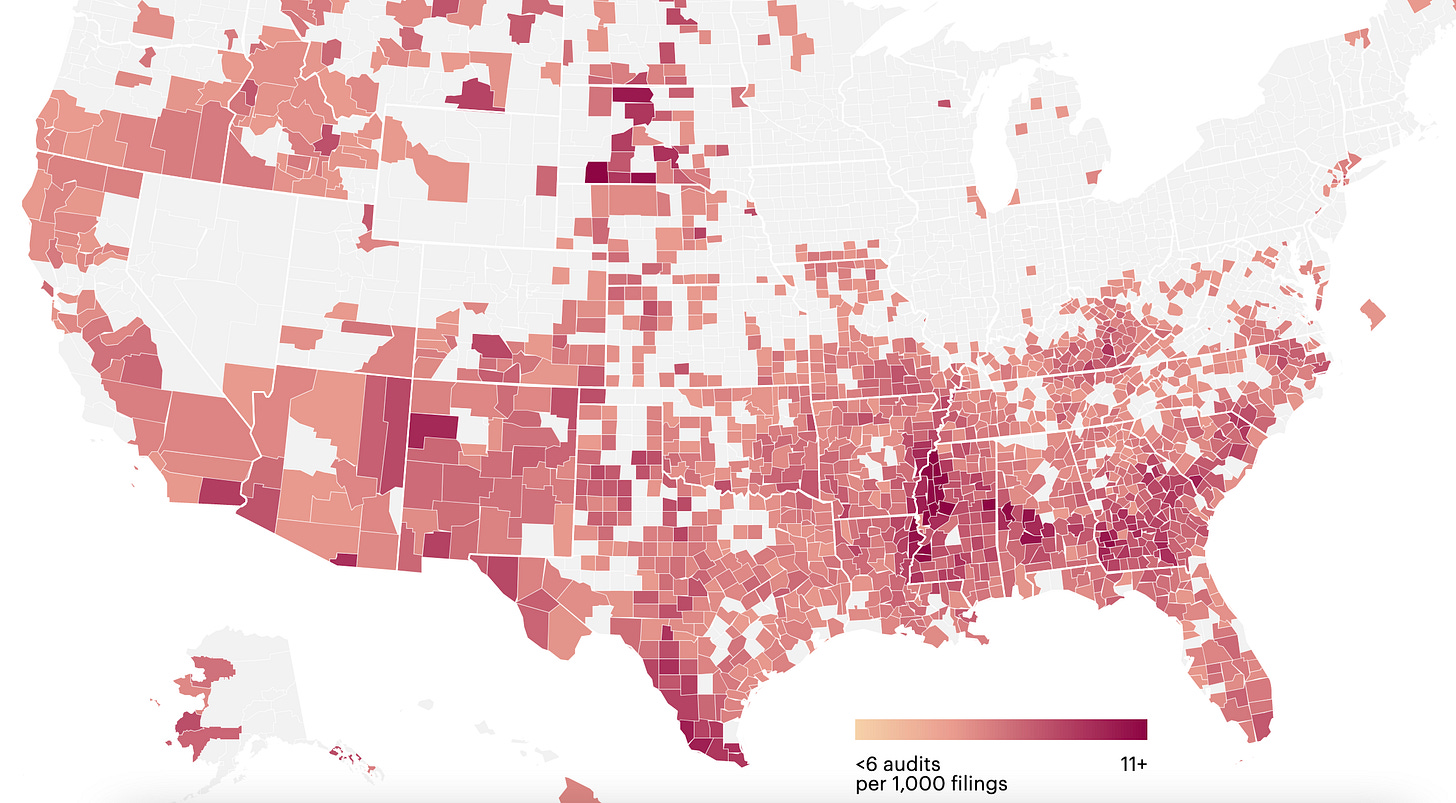

Now that we have 87,000 new IRS agents. Not 87,000 more police (school shootings), not 87,000 more border patrol agents (illegal immigration), not 87,000 more medical workers (health care is a mess) but IRS agents. The question is who will they target? Well we should take a quick glance at how it works right now from the image below.

Rough Idea of Audits by Region (Source)

As you can see there are a lot of audits near the border of Mexico, lots of audits in areas where income is claimed to be zero and *few* audits in major earning regions like the north east and western California since these areas have a *ton* of W-2 people where it is easy to track. No point auditing someone with a single W-2 and one rental in the suburbs.

Ideal Target: The ideal target is as follows: 1) people receiving Venmo/PayPal/CashApp and disclosing zero income as it was all “friends and family”, 2) small businesses making $500,000 to $5,000,000 as they could be audited up to the same 8-9% standard and 3) every single gig economy income stream.

Claim: The claim is that this will only impact rich people. This is unlikely at best. The ultra rich (billionaires) are checked every single year and have teams assigned to them. The rich are also set up in tax shelters (legally), which reduces the amount that can be seized from them in the first place. Why audit someone with a legal 5% tax rate on $1,000,000 if the max you’re going to get is a incorrect expense of $20,000 which results in a whopping $1,000 windfall. Hint: just like your company review, audits are done where there is a high chance of getting something back. In an extreme case if a small business runs at $1,000,000 revenue and has $999,000 in pre-tax income, there is no point in auditing the $1,000 in expense the person claimed. It just isn’t worth it since he/she paid tax on $999,000 pre-tax earnings.

Reality: There are massive holes in the financial system. Before COVID they were a bit less pronounced but now they are massive. How does the IRS go after *BILLIONS* of dollars in random transactions “paid for food”, “friends and family transfer” and “sold $100 item on ebay/craigslist”? They simply can’t. Therefore they have to find new systems to change the reporting standards and slowly but surely bring in more tax revenue for the federal government and the state.

Another reason to go after various small businesses is due to the wide range of LLC scams out there. For those in the know, one of the major reasons for the recent real estate boom is due to scammy LLC practices related to foreclosures for tax and anonymity purposes.

"Over the past two decades, the advent and diffusion of the limited liability company (LLC) has reshaped the legal landscape of rental ownership,” the study found. “Increasingly, rental properties are owned by business organizations that limit investor liability, rather than by individual landlords who own property in their own names.”

Conclusion on IRS: Unless you’re entirely W-2, better be prepared for more oversight and more documentation for all of your audits. No one is going to waste time auditing someone with a $100,000 W-2 and $100,000 brokerage account. That has never been the case. The goal is to go after two sections: 1) the fake transactions that are really payments - Venmo, PayPal, CashApp etc and 2) small business owners. If you are a mega corporation congrats! All of your potential competitors now have new expense line items to deal with as they will be forced to pay for their audits.

Spending on Green Energy

Once again, we’re skeptical of all the climate change bills. While we’re not smart enough to decide if the world is getting hotter and colder, we judge the impact of the environment by what people are doing.

For example, if climate change was really a massive issue we’d probably be using a *TON* of nuclear energy. Nuclear energy is dangerous but it is also quite useful for energy production (probably the best on the planet - just optically dangerous). Why is this related? Well if we see a big push to start building Nuclear we know they are serious because their actions meet their words. They are willing to *take risk* by building nuclear to stop the reliance on fossil fuel.

Currently? Actions don’t line up with words. You can’t fly in on private jets, buy million dollar beach front properties and force people to commute to work and drink out of sippy cups while claiming “climate change”. If it was a real issue, these proponents of climate change shouldn’t be flying private, renting yachts, buying beach front properties or forcing people to commute 45 minutes to work for their $70,000 a year accounting job that can be done anywhere with internet access. In short, you wouldn’t take fitness advice from an obese person.

Conclusion: The money going to green initiatives will likely be plundered into various failed investments. Likely causes a lot of fraud and theft with the easy money going to the wrong hands.

Carried Interest and 15% Rule!

Here are some items that do make sense on a glance. If the carried interest loophole is removed you’ll see more taxes paid by Buyside firms.

The 15% tax rule is interesting as it forces companies to have a minimum tax once they become profitable. From this list (source) you can see that the majority are tech companies. Effectively, tech companies run at losses carry forward those losses to offset profits for years into the future. Now the rules would say “you have to pay 15%”.

The main problem with the tax raise is that it likely leads to more job cuts. There is no way these major tech firms can’t find fat to trim. Majority of people in white collar positions do nothing for half the day anyway. White collar recession acceleration if taxes go up on tech companies and Wall Street.

Conclusion: At least these two items would raise some money to offset the spending on Green initiatives. Will monitor the official changes but we can safely assume that tax audits go up, tax collections go up, govt spending up big and layoffs would certainly occur on a corporate tax increase.

Part 2 - Tornado Cash and USDC

As many of you know. We’ve been yelling for almost 2 years to get out of stables and never use BlockFi/Celsius/Voyager etc. Those recommendations are now getting even more serious. We learned that lending firms consider depositors “creditors” in many case. We also now watched as USDC bricked several accounts.

Approximately 1.5 months later and Tornado cash is banned leading to USDC bricking addresses (Source). If you want a full summary of what this means check out the free post on DeFi Education as well as they were quick to cover the ramifications (source)

Action Steps? Not much honestly. If you’ve been listening you should have your primary funds in BTC/ETH. If you do this and want to “sell to cash” without swapping your coins you can use the futures market. This may cost a small amount or you might even make a few bucks depending on how you structure it. Either way, by utilizing futures markets you can avoid the entire stable coin bricking fiasco altogether. For a line in the sand anything above $10,000 will certainly be on radars as its the same level for flagged transactions in the traditional financial system.

Questions on Tornado Cash and Inflation Reduction Act

If you have anything on these two topics leave it in the comments. All other questions will be deleted/removed.

As usual, save yourself. You should be certain that no one is coming to save you at this point. Not your political party, not your family, not your friends and not your boss. No one.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team

Eagerly awaiting post on the raid of a former president...

Disagree with the take on climate spending. Your advice to judge actions not words is great when applied to normies, but it breaks down when applied to an incompetent or corrupt government.

By that reasoning, government spending and money printing isn’t a real issue, since their actions = continue to spend and print more money.

Much more likely that it’s a “rules for thee not for me” situation mixed with never letting a crisis go to waste. Either way, agree that the money for green initiatives will be probably lead to waste and fraud, like all gov spending.