A Quick Look Into More Deficits and Inequality

Level 1 - NGMI

Welcome Avatar! The chickens have officially come home to roost. Inflation isn’t transitory, it is now persistent. Supply chains are a mess and smart people have already picked up inventory for Q4 (to avoid excessive costs). The US has created a new “$0” plan that costs up to $3.5 trillion. And. Mainstream is now pushing for discussion around wealth inequality (finally) vs. Income inequality (meaningless).

Summary of Latest Mainstream Cope

Per usual, we only talk about things you can control. All other discussions are meaningless (complaints never pay the bills). So. We’ll show you what is happening and follow this up with what you should be doing in your day to day life. While investing is clear as day (for paid subs) we can at least help with the day to day struggles by going through the expectations for the next couple of years.

First More Spending: The build back better plan is going to cost $0 according to the White House Twitter account.

We don’t really care for the name of the program (if it was a republican president they would probably do the exact same thing). How does the plan cost $0?

It costs $0 because they are going to kick the can down the road once again. This would be equivalent to spending $100,000 on a car and paying it off 20 years later (or some other distant future). It isn’t free. The debt ceiling simply goes up once again (raising the limit on your credit card does not mean you are richer).

Also. As you can see. They are going to raise taxes on “Income” which just tightens the grip on the middle class. This will send upper middle class earners into middle class living while billionaires with $1 salaries have zero impact (capital gains untouched). We’ve explained this with numbers already and new readers can see that wealth inequality is not even close to income inequality (Article here)

Note: the worst part about this entire plan? Imagine taxing doctors/surgeons who have tons of medical school debt already! This is who the “average person” believes is rich.

Second - Beginning to Highlight Stock Inequality: There was another mainstream article that came out “top 10% own 89% of all the stocks”. You can read the full thing here:

Verbatim from the article: “The top 1% gained over $6.5 trillion in corporate equities and mutual fund wealth during the pandemic, according to the latest data from the Federal Reserve… The bottom 90% of Americans held about 11% of stocks, and added $1.2 trillion in wealth during the Covid-19 pandemic”

Once again we see that wealth inequality increases when we simply print more US tokens. If one person out of 100 (1%) gets $6.5T while $1.2T is split amongst 90 different people (90%), the single individual is expanding his lead by over 400x (Take $6.5 Trillion divide by $1.2 Trillion after dividing by 90 = Roughly 487 times difference)

How to Manage This Situation

Now that you can see where this is all heading (more wealth inequality and an eventual change to “ownership taxes” meaning stocks/rental properties) you should be 100% focused on driving your own equity value.

Step 0 - Get out of Cash: This has been mentioned several times on here but we’re going to say it again since there are new readers every month. Cash is a guaranteed purchasing power loss since the plan is to print more money to fund more infrastructure spending. The tone has finally shifted. Inflation isn’t “transitory” and is likely going to extend into next year. Combine this with Q4 supply chain disruptions across the globe and you get higher costs. Conclusion: buy non-perishables as first course of action especially if you have a low income.

Step 1 - Asset Tax is Coming: We have no idea when. However, an asset tax is going to occur at some point. This will be in the form of capital gains tax increases, a change in how stocks/corporations are taxed or through rental properties. In the end, if asset taxes are going to go up it means you have to move some of your earnings online. In an ideal world all of your earnings are through the internet. This would allow you to move to the best tax situation.

Since our macro opinions are the most popular on the substack our bet is currently on some form of rental property tax. As usual this isn’t investment advice but rather an opinion based on a mosaic of information.

The logic is as follows: 1) most people spend about 25-33% of income on rent, 2) if rent goes up 15-20% this means they are now paying 30-40% of total earnings and 3) if you look at the biggest costs for individuals rent is probably the highest - next to taxes.

The government needs to lower the cost of living and rent is the easiest way to do it. Also. If you were to create a tax for property owners, you would likely reduce the cost of purchasing a home (some would say - forget it, the cash on cash returns aren’t there anymore… and sell). Conclusion: move to liquid assets if you can. Owning your own home isn’t a big deal but try to maintain a portfolio that is highly liquid.

Step 2 - Unrealized Gains too Difficult: While this has come up as *rhetoric* in the news, we view it as “anchoring”. Some people really believe that there is potential for an unrealized capital gains tax (IE. you’re taxed on something you haven’t even sold - a stock goes up 20% for example but you didn’t sell).

Instead, this is simply put out there as an extreme. They can walk this back into something more reasonable, such as a forced selling mechanism for the ultra rich. Conclusion: don’t worry so much about taxes on *unrealized* gains.

Step 3 - Move Locations: This is already happening. Get out of high tax areas and see a professional to lower your tax bill. The COVID-19 pandemic has changed the way we work for good. It will take years for things to go back to any form of “normal” and by that time you could have saved 10-20%+ on your tax bill. Conclusion: get out of California, New York and other high tax states if you can legally do so. Per usual see a professional.

Step 4 - Learn Online: If we’re recommending that you earn online, this means the information you consumer should also be… online. Why? This is where the world is heading. VR/AR environment games where you can earn money. Crypto as a means of payment to disintermediate rent seekers such as Western Union. And. Our social network is becoming more online in nature as it is where we spend most of our time. Conclusion: if you’re learning something new it better be related to online income/revenue if you’re hoping to make it to the right side of pareto distribution

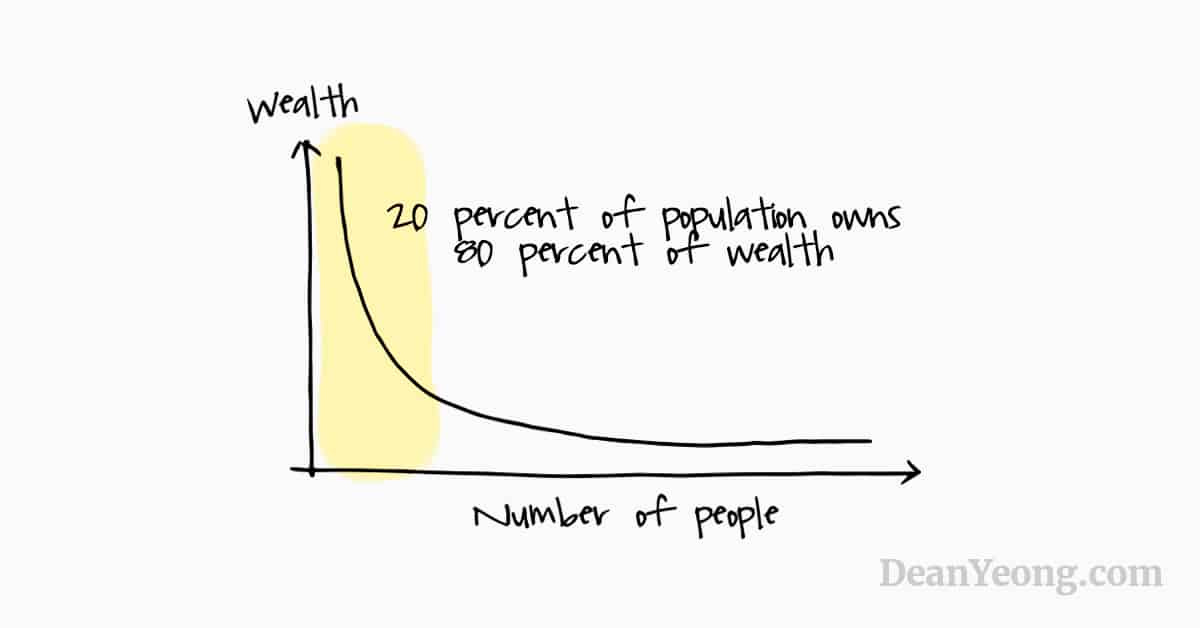

Step 5 - Pareto Will Get Worse! Perfect transition here, if Digital is the new way to get ahead it means that you will be left with a few avenues: 1) you are already rich and you are a capital allocator, 2) you become a top 1% creator - famous individual like Logan Paul or 3) you create a niche business online that allows you to outpace the growth of inflation - e-commerce. As you can imagine, since the number of options are thinning it means the pareto distribution will likely get worse before it gets better. The top 10% will eventually dwindle down to the top 5%.

The below distribution is already getting worse…

Our suggestion remains the same, choose the highest risk/reward route with e-commerce. Becoming a writer/content creator is extremely low income. You can make around $100,000 a year if you’re extremely good and maybe (if you’re lucky) double that. This would require a social media following of 300,000+. Other than that, the real winners will take the majority of the market (influencers like the Kardashians with millions of followers). Conclusion: unless you’re rich or you already have a 300,000+ social media following… go into E-commerce.

Conclusion: Since the internet and technology allows us to connect, it removes friction/costs. This means all middle management layers are removed over time. In our paid post on Wednesday, we will explain how this will impact the NFT space and the new interest in DAOs. We find it fascinating that many DAOs are shooting from the hip and going against the direction of where we’re heading —> the Sovereign Individual.

We’re going to be left with three big tailwinds. 1) people with liquid capital - majority are not here which requires an 8-figure net worth, 2) people who are influencers with over 300,000+ social media followers - a herculean task that takes decades and 3) more transactions online. To us it is clear as day that number three is the highest risk/reward for the majority.

Sounds Impossible? Not Really…

Fortunately, we’ve been writing to a small audience of extremely intense and intelligent people for about a decade. It is possible to get to $1M+ within 10 years assuming you have a high work ethic and average intelligence (we have well over 100 success stories).

If you’re a genius you will combine the e-commerce ramp with smart investing (which we cover on the paid stack) and likely exceed multi-millionaire status in rapid fashion.

You can see a video example of how to get to $1M by checking out our YouTube channel or the prior free posts.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

Daily Reminder: You ARE EARLY. Too much negativity/cope. Everyone reading this is extremely early. If you stay on top of technology, there is always a new opportunity.

Look forward to the commentary on DAOs moving in the wrong direction….see you Wednesday.

Buy an AR-15 or invest in crypto/ecommerce? 😂 Will be researching some profitable niches that don’t have too much overhead