Basic Finance 101 - Value of the Company

Level 1 - NGMI

Welcome Avatar! Now that everyone can read an income statement, balance sheet and cash flow statement it is time to talk about valuing each company. As a reminder, when you buy a stock (or share) you’re purchasing a small bit of ownership of the Company. If you were to buy say 1M shares of a stock that has 100M total shares outstanding, you’d own 1% of the company. When you buy a stock you are *not* giving the firm any money. You are acquiring part of the firm that someone else is selling at $X per share.

Importance of Share Count Before Fundamentals

This applies to both crypto and to the stock market. If you own 1M shares of the firm that has 100M shares outstanding. But. The firm is issuing 900M shares next week, it means you don’t own 1% of the Company you only own 0.1%. This is a staggering difference because the Company is *diluting* your ownership.

Bitcoin Example: Since everyone knows that the supply cap is 21M, we can use this as an easy example. If the price of Bitcoin is at $30,000 today and it stays at $30,000 for the next 6 months, the market cap is going up. This is because the supply of BTC is still going up as of this writing. Every single block reward is adding units to the “share count”. While fully diluted count is 21M, total circulating is at roughly 19M.

Example of another Token Schedule

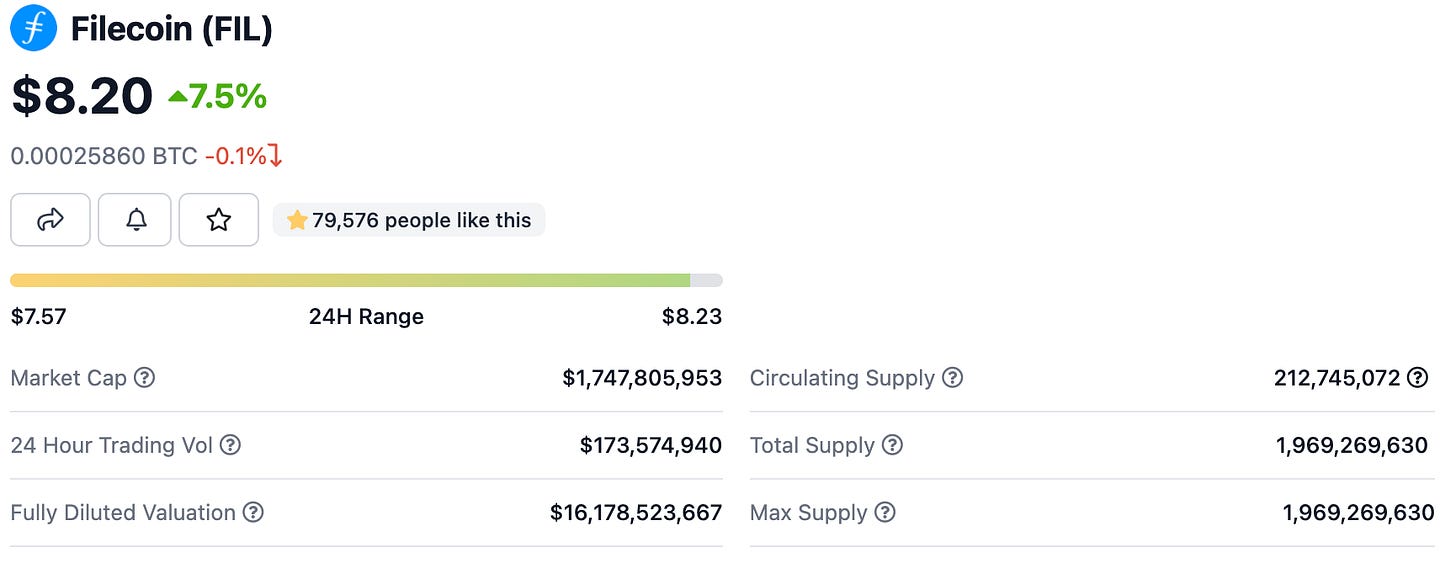

For Computer Coins: Easy to spot check if there is a ton of supply unlocking in the future. Just go onto Coingecko and look at the FDV which is displayed for each token. After that you can get an idea for the real “current” value of the project. Ask yourself if the project is worth $XM based on FDV (never based on current market cap which can be manipulated by the issuance schedule).

Example of a project that is worth $16.2B based on FDV not $1.75B since you know the total supply will go up by roughly 9x.

Simple Conclusion: Majority of crypto projects are “liquidity trades”. This means that the majority start with a tiny amount of coins so there isn’t enough supply. Price goes parabolic and insiders (VCs) get to dump on everyone. If you’re sharp, you will look at the supply schedule, try to buy immediately and jump out as soon as people on Twitter are talking about it. Note this is a dangerous strategy. The focus is really to get everyone to look at coin issuance/share issuance to determine the real value.

Stock Based Comp: In the traditional tech world, stock issuance through employee compensation drive the share count up (along with options for executives/high-paid employees). Instead of giving employees cash, they just issue more stock and dilute current investors (brutal if stock price doesn’t go up as early investors get burned the most).

Conclusion: Double check all the lock-ups. Most IPOs/secondaries have lockups 90, 180 days etc. Do the same for crypto. If you see that a huge number of shares/coins will unlock soon, it usually means the price goes down even if the company makes more money (removing single sided staking = usually people sell a lot of rewards etc.). Before valuing the firm, you should know the ins and outs of the issuance schedule.

Valuing the Actual Company

Fun times. At this point you get to see that best friend Jerome Powell and rates determine practically everything. Since companies are worth as much as their cash flows discounted by interest rates (simplistic assumption), if that rate is zero… it means that the opportunity cost is next to zero (no interest on cash).

Interest Rate Explained: The interest rate determines how valuable the cash flow is this year. If interest rates are at zero percent, it means the money in your account will not grow at all. No difference between cash in bank account and cash in mattress. This is why tech companies go up in value so much in low-interest rate environments. It’s because they don’t earn any money and the value is way out in the future.

If interest rates suddenly go up, now your cash actually has value. At 1% hard to say this is significant. However. Many years ago it was as high as 5%+. At that type of rate there is a lot more value in having cash flows now as you can get a good return with low risk.

Decide on the Future: As a rule of thumb, even in low interest rate environments or high-interest rate environments a long-term return of 4% (extremely low risk) is reasonable (every $600,000 you can save will net you $2,000 a month in passive income). In a low interest rate environment you own more stocks and if rates ever go up significantly you just rotate into yield bearing items like bonds. Currently though, the problem is that inflation is 8%+ which means a 4% investment is still making you poorer from a purchasing power standpoint.

It’s up to you to make a decision. If you’ve followed here we’d recommend getting a career (M&A banking, tech sales, software) since they are pretty stable and then you build a business in a massive audience (diet, skincare etc.). After that you can take investment dollars and focus on bigger swings as your income goes up. This strategy means your personal business is focused on cash flows, while your investment focus is on growth.

What Metrics to Look At: You can really boil it down to three things: 1) is the market going to grow in the future, 2) how much should the company grow over the next 5-years and 3) how much cash/income does it make per year. Then you can decide what type of company it is.

Coca-cola would be an example of something you value purely on income. Hard to see the company ever really finding more people to sell to. It is such a large brand its growth will basically mirror GDP growth/population growth over the long-term. The real money will be made through automation if they can reduce costs of making materials (robots etc.).

Tik-tok would be an example of something you value entirely on growth and operating profits (unsure if profitable or not but the point stands, eventually has to make money unlike Snapchat). The cash flows of high growing tech is usually low. If the firm has been around for many years and still isn’t making money, it would slowly morph into a dying tech company.

As you can see in low interest rate environments there is no real way to compete with growth companies (Source).

Generally speaking, cheap money = tech go up, expensive money = stable biz go up. IF someone gets to 25x their annual spending saved up in stocks, if you go into both growth and value it’ll be hard to fail at the 4% hurdle over multiple years.

Easy Filter for Newbies: If you know an industry well go ahead and throw out all the companies you expect to decline. Investing in fax machines won’t work out so go ahead and throw all old products out the window. A few will change their business model entirely, however, by the time they do you can just buy it when they aren’t selling dead products.

Next step is to ask how much would you pay for it? This is where a lot of the value actually comes in the private market. If you could buy Coca-Cola for 1x earnings you’d be an absolute fool to miss that opportunity. You should sell everything you have and buy it since that’s saying the whole Company will not be around for longer than 12 months. In the private market this can happen frequently where established brands sell for 3-4x earnings (only reason we can see why someone would do this is if they already have a new bigger/better deal lined up)

Last step is going to require basic research (if public) figure out if the company has any major issues: 1) law suits, 2) heavily levered balance sheets and 3) liabilities that need to be paid out soon etc.

Congrats at this point, with some basic checking you can at minimum keep up with the broader stock market. You’ll avoid long-term losers and you’ll be able to spot check for major issues brewing. The hardest part is the last part - do nothing. Since you should be focused on scaling out a wi-fi business the money you’re investing is your extra income. Extra income is anything after living expenses and *all* biz expenses. You’ll never beat increasing the equity value of the firm that you own!

Zoom Out

If you’re under the age of 40 or so, the next 3 years is pretty meaningless for you. Until you get to age 55 or so, there is no real need to focus on wealth preservation. Better to try and grow the pie instead.

Simply way to zoom out is to just ask where the world is heading. It’s up to *you* to decide these things. That said, some easy ones we don’t see coming back any time soon include: 1) massive commutes to cities - over the next 5-10 years the companies that offer remote solutions will take the talents, 2) don’t see a world with less automation, 3) don’t see a world where people speak to robots instead of physical sales people and nurses/doctors, 4) don’t see a world where manufacturing *isn’t* dominated by tech/robots etc and 5) see a world where valuable individuals gain more and more value as low-mid skilled work can be automated away.

These are just broad strokes. We separate them based on how humans operate. Unlikely a human wants to have a robot caring after him in a hospital. On the flip side. Really doubt humans care if their coca-cola was fork lifted by a person or a robot (no human contact = easier to automate).

Congrats! At this point you now have enough information to read basic statements and filings. You don’t have to worry about being psyoped by people on Twitter claiming that MSTR is losing money (they can’t even read a quarterly report but you can!).

The one thing you should take from this is that the interest rate determines a *TON* in the stock market. Fortunately, we don’t get to vote on this and it is determined by a small group of older people who don’t care about what happens to the next couple generations (they won’t be around anyway, neat trick!).

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We may or may not be homeless and set for life. We’re an advisor for Synapse Protocol and on the JPEG team.

Lots of big companies have some pretty sweet tax deals with the state/city.

The state/city give the company a tax break and the workers who are in the office spend at local stores/restaurants/live local. The state/city get tax revenue from these smaller businesses and break even that way (what a great system, big companies get tax breaks and make it up on the back of the corner store).

Will be interesting how this evolves.

Anecdotally have heard rumors of some companies getting pressed from local politicians and warned about losing these tax incentives unless get people back in the office more frequent.

No insider info to any of this and no idea how it ends, but interesting if true.

“That said, some easy ones we don’t see coming back any time soon include: 1) massive commutes to cities - over the next 5-10 years the companies that offer remote solutions will take the talents”

To clarify, you *do* see a shift to massive commutes to cities vs living in city centers? Aka, wealthy people living in exurbs vs suburbs even.