Beginners Guide to the Future - Decentralization Power to Collective Individuals

Level 3 - Virgin DeFi Analyst

Welcome Avatar! One of the complaints is that the jungle is moving too fast. This is fair as we spent minimal effort for a decade on this hobby (2 hours a week) and now we’ve ramped up quite a bit and are gearing up to go full time.

This is a crash course on crypto assuming you know nothing. Luckily, you still have 2-3 years to figure it out and you’ve come to the right place. The world is changing fast.

Big Picture Part 1 – Money is Controlled and Printed at Will

Central banks and governments have 100% control over the money supply. If they feel like it? They can just add money to the system and give it out for free. They just change digits on a screen or turn on a printing press. If you want proof of this, just look at M1 money supply.

As you can see from February of 2020 to today, the amount of M1 money supply increase was around $13-14 trillion (Link here: https://fred.stlouisfed.org/series/M1SL). For a clearer understanding, M1 money supply “M1 is the money supply that is composed of physical currency and coin, demand deposits, travelers' checks, other checkable deposits, and negotiable order of withdrawal (NOW) accounts” - Investopedia

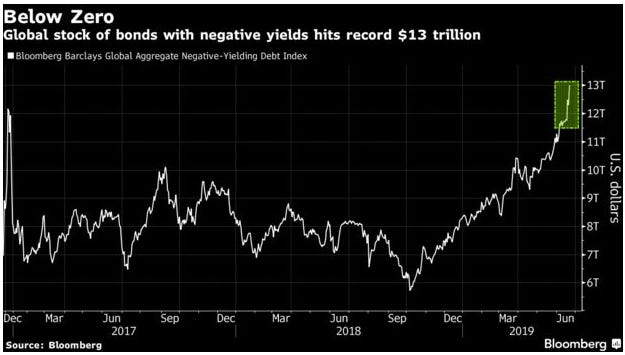

Bonds: The total market for *negative* yielding bonds (where you lose money for parking your money) is around $13T. Total market cap of crypto is around $2T. You can decide if some of this money will flow into crypto or not.

Enter Crypto: Since printing tons of fiat decreases the value of the money, there needs to be a solution. During the past 100 years or so, it used to be Gold. Why? Gold increases in supply by about 2% per year. This is nothing compared to the money supply increase.

The problem? Now, we have Bitcoin and other crypto currencies (stick with BTC for now). Bitcoin has a fixed supply of 21 million units no matter what happens. The long-term supply increase is 0%. It is fixed. Unlike gold, if the price of Bitcoin goes up, there is no way to get extra Bitcoins. If the price of Gold goes up, it is possible to mine more gold. Again. Not the case with BTC.

Put Two and Two Together: In thelong-term, even if we enter fully digital transactions (no physical cash – just venmo and other forms of digital cash), why would people choose a system where their savings can be diluted overnight?

If you have $10,000 US Token in a checking account and your government inflates the currency by 50% in a day… This means your purchasing power just went down substantially. This is exactly what happened in 2020. Asset prices go up. Anyone with money in a checking account gets diluted.

If your purchasing power goes down it means the cost of an asset goes up. This means homes, food, gas and other products must go up in price. This is why the stock market, real estate market and food prices went up.

Enter The Logical Conclusion: If you follow this logic so far, then fast forward 5-10 years. Citizens have two choices: 1) transact and accept a currency that can be devalued with two clicks, *OR* 2) choose a currency that cannot be diluted by anyone as it is backed by code.

Big Picture Part 2 – Inflation

If we agree on step one… we then have to ask what happens in the future? You should see more inflation and more wealth disparity. If you are forced to print money, asset prices go up! The recent news articles around inflation have been laughable. Mainstream media is effectively saying “Inflation is up so stocks are down”. This makes zero sense.

Think This Through: Interest rates cannot go up in a big way because people will default. This is a huge disaster. There is only one solution. Keep interest rates at zero and do a lot of money printing when needed. Also. When the economy opens up since M1 money supply is massively higher, inflation should increase.

Equation for inflation= Total Money Supply multiplied by How Fast the Money is Changing Hands (Velocity). We can call agree that if people go out to spend and life goes back to normal… money will be changing hands *much* faster when compared to 2020. We already know the money supply went vertical in 2020. You can decide what this means.

Autist Note:Decreasing stock prices likely reflect increases in future taxes. If taxes go up in the future dividends and stock price appreciation is not as valuable (since it is taxed of course!). If assets are simply “inflating” this is good for stocks not bad. This is why mainstream news isn’t worth reading. They can’t even comprehend this basic stuff.

Big Picture Part 3 – You Are Early (Enough)

The big pieces are clear now. The last part is recognizing that you are early. Run some simple Autist math (not even Turbo Autist math).

Bitcoin Market cap is around $1 Trillion or just under. Gold Market cap is $11-12 Trillion give or take. Bitcoin is a superior version compared to Gold so that is an 11-12x opportunity alone

There are around 50 million millionaires. This means that a millionaire can hold a maximum of 0.42 bitcoins (21 million/50 million). Therefore, owning even one puts you ahead.

Around 2.0 million people are worth $5-25M US Token. This means that 10.5BTC would put you into the same category as these individuals from a *percentage* standpoint. It is not mathematically possible for all of them to own more than 10.5BTC

If you haven’t figured out that you’re early “enough”, please re-read the bullets. You were not an innovator (these people were early in 2010-2015) but you are certainly not “late” from a math perspective.

Big Picture Part 4 – Increase Complexity Remove Middlemen

Bitcoin makes banks irrelevant. They are irrelevant because banks waste ungodly amounts of energy: 1) heating/cooling of branches, 2) transportation of money, 3) cost of security of holding money, 4) all computers, 5) all overhead cost of people, 6) insane wire transfer fees/FX conversion fees and 7) the physical cash/check creation is also a massive energy loss.

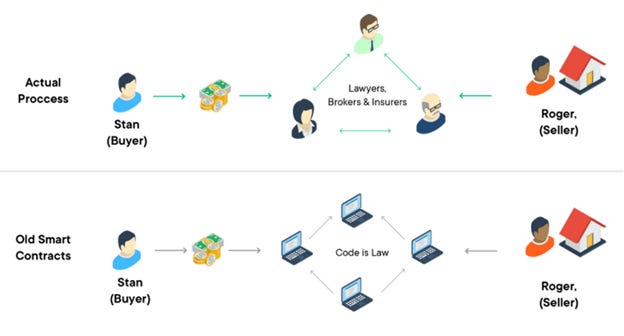

Here most people lose it. Enter Ethereum (also jokingly called Efferium on Twitter and here). Ethereum says “okay Bitcoin makes you your own bank. What if we could make you become your own exchange, lending protocol, etc.”

Pause.

Bitcoin is basically a basic checking account in your pocket. You send and receive money to an address. That is it.

Ethereum is saying… What if we made a more *flexible* blockchain that allows you to offer all banking*services* as well? This includes: 1) lending out money, 2) borrowing money, 3) creating agreements with one another – such as basic if à then contracts and 4) any other application you can think of.

Ethereum In Basic Terms: Bitcoin has a complex software code that makes it *difficult* to build on top of. No need for a technical explanation beyond that, you can join the Jungle or read up on the technical details on your own time. In short, it is hard to build *applications* on bitcoin at this time.

Ethereum is similar to Bitcoin except you can build actual applications on it (*relatively* easily). Many of these applications are popping up in the news: DeFi, NFTs, DEXs etc. Here is how it works.

BTC vs. ETH First Example: While BTC only has a “send and receive” function. Ethereum can create basic contracts such as: “If Mayweather wins the boxing fight, address A sends money to address B” with no middle man to broker the transaction and take a fee! (Hint: address B gets them coins)

Second Example: Instead of going to a bank you can lend an anonymous person 1.0 ethereum at a 12% interest rate. If the loan isn’t paid back in a month, he owes you 0.01ETH (about a percentage). Also. His loan is collateralized. If he never pays you back? Eventually the debt reaches a point where his address is liquidated and you obtain all of his funds! (collateralized loans are better for the lender as well)

Example Three: You want to sell something. You put it up for sale and usually a middleman takes a cut for helping you find a buyer. Instead, you place it onto the Blockchain and people can bid on it. You then choose the highest bidder and send him/her/it the product at no material cost/fee.

Big Picture Part 5 – Implication of Removing Middlemen

How many industries are based on being a middleman? Thousands/millions. This means that power goes directly to the individual (you). The second implication here is that you will learn (for better or worse) how much you are worth. Many are making $250,000 US Token a year and are adding nothing to society… they have to learn a new skill.

Others may be making $40K US Token and they are worth $4M US Token. So on and so forth.

Fairer Society: If the value of being a middleman is removed, it helps reduce crony capitalism. Where someone is rich just because mom/dad is rich. Those days are dwindling. This is fantastic for society as a whole. These rich talentless individuals will not go down without a fight. They will try to manipulate everything to recreate the same scam but in the long-term they will lose.

Currently, money is certainly concentrated in the crypto sphere as well. However. If you’ve been paying attention, new projects have created new wealth which is creating dispersion. Early investors to DeFi, some particular NFTs etc. have made a lot of money (in both US Token and ETH Terms). This is positive for the *long-term* fairness of the system. Eventually, people who contribute nothing are forced to sell their coins and bleed out as they have no value to add.

Painful Transition: Many businesses rely heavily on simply being a middle person: “connectors”. As this business model dies out, tangible skills balloon in value. IE. the music industry is going to go ballistic. The music industry has a ton of middle-men/red-tape and if money can go directly to creators they will end up becoming rich. In fact, that’s one area where we see massive growth: work in anything creative.

This is one of the main reasons for our entire plan/marketing/scaling strategy. By being creative, fun and informative it isn’t possible to copy. It just isn’t and it’s too late. By the time someone does something else like “RolexHoldingPlants” they will be obvious copy cats.

Creativity cannot have competition by definition. Only copied.

Conclusion

Now that you get the big picture: 1) money printer has gone mad, 2) inflation will likely increase, 3) asset inflation causes problems between rich and poor, 4) Bitcoin solves this by acting as a store of value with a fixed supply and 5) Ethereum – or a competitor similar to Ethereum – will dismantle all businesses with middlemen… It is time to take action! This means you need to get involved.

Getting Involved How to Get and Store Your Coins

You’re on the free substack so that is a start. We strongly recommend upgrading because we can use the funds to build out the Jungle and other avenues over time (helping everyone at the same time). That said, if you want to start learning from scratch go take a look at our free content and the Jungle. Once you realize how much value is being added you’ll be ready to get into crypto.

Get Coins: No one will listen but go peer-to-peer if/when you can. If forced to go to a centralized exchange, buy and send directly to cold storage wallet. See below.

Get a Wallet: You need a Trezor or Ledger S at minimum (Cold Card is even more secure). Simply purchase a hardware wallet. If you want to do it the *right* way, ie. the Turbo Autist way, here is a great thread. We recommend saving it all down just in case the link changes in the future.

Play Down: Rich people lie down. Poor people lie up and flex. This is how the real world works and if you don’t believe this you haven’t been rich or been around really rich people. Only athletes and forced public figures (musicians) flex in public. Real wealth doesn’t do this as it invites unwanted attention from criminals and other bad actors who could cause harm to them or their families.

Playing down means the following: 1) never say you have more than 1 Bitcoin, 2) never say if you have more than 10 Eth, 3) never disclose your addresses and 4) don’t mention crypto to people with closed minds. This is the general framework.

You want to help people understand it and get involved (friends/family). And. You do not want anyone to know how much you have. If you try to convince new people to get involved, you should “make up” a reasonable amount to have relative to *their* net worth.

If the price rises just say you sold some and didn’t keep it all.

Find Your Own Source: If you decide to use a centralized exchange that is fine (we wouldn’t, but that is your call). You have to take your funds off of the centralized exchange and move it to your cold storage wallet (Trezor or computer etc.). Once you find your way of buying and holding it, you then need to learn about Ethereum and DeFi.

Decentralized Wall Street: Decentralized finance is about recreating the entire Wall Street ecosystem without them in the middle. We’ll have an educational product on this coming in June. Effectively, once you have a decent amount of BTC/ETH and are ready to learn about new complex technology, you move over into DeFi.

DeFi is not for newbies as they will likely mess up the staking process or fall for blatant rugs/scams. Our goal is to move down the risk curve getting everyone acquainted with blue chips and from there… moving to more complex projects.

Even the above sounds complicated. In a sentence: DeFi is the ability for you to loan out your crypto currencies without an intermediary and earn a return on it. Until you are comfortable with Bitcoin/Ethereum, this isn’t for you.

Join the Jungle for Free (Maybe)? If you have some sort of niche skill, go ahead and make an anon-Twitter account in the BowTiedJungle. We’ll monitor tweets that come from that account to see if there are people adding value. If so, we will do random giveaways (subscriptions, US Token, maybe events etc.). This is a way for you to continue to learn and potentially make some money. No. It’s not some scam “paid private group” it is FREE. Just be smart about building a reputation over time and only interacting with others who have a built reputation.

Quick Technology Catch Up

Here goes nothing. Can’t say we didn’t try. This is the beginners guide to understanding what in the world is going on in crypto.

Bitcoin

Bitcoin uses SHA-256 which is an ASIC driven mining system. Mining equipment for Bitcoin is largely done by Bitmain and Whatsminer as of May 2021

Bitcoin’s code prevents the issuance of move than 21M units. As more people mine Bitcoin, the network becomes more secure.

Bitcoin miners get paid based on a block reward and a fee for confirming transactions

Ethereum

Similar to Bitcoin, new Ethereum hits the network in block rewards. The difference is that Ethereum does not have a hard supply cap. Why?

When you use the Ethereum system, gas/Ethereum is burned. This acts as a helpful feedback loop. As new applications are built on the network, gas is burned constantly which causes supply to be kept in check

Right now gas fees are INSANE (May 16, 2021). Too many people are using the network (a good long-term sign a bad near-term issue). EIP-1559 launches in July which attempts to reduce the fees.

Proof of Work (same system as Bitcoin) is going to shift to Proof-of-Stake (a new voting based system)

Ethereum is being mined with GPUs and not ASICs (ASICs were made for a while but the DAG file size became too large, they may come back – who knows)

DeFi

In summer of 2020, smart contracts were finally formulated to help individuals lend out their crypto at a reasonable interest rate

There are competing centralized platforms, but they defeat the purpose of DeFi in the first place. Don’t use centralized lending platforms unless you want to risk losing everything

In 2021, institutional investors started to look at Ethereum which is why it was wise to own a lot of it to start the year. Our bet is that this will shift to DeFi in the future (paid substack members will see portfolio movement and timing expectations)

In the long-run, instead of having a bunch of worthless paper. Your home/apartment will just be a smart contract on the blockchain. This allows you to buy or sell a home without a middleman through a token exchange

NFTs

Primarily junk right now. Art and other collectables are easily scammed/replicated because physical fake versions can be made

Technology now exists to make digital art scarce because you own a particular hash/number so everyone knows which image is the real one. Can’t just copy down the JPEG and claim it is yours

In the long-run it will be a huge industry. As NFTs develop you will be able to own the rights to the next hit song or hit album. This is an amazing opportunity if you wan to do research (long-term)

Current state of market is a bunch of celebrities dumping on their fan base. Also. Successful NFT artists making tons of new projects to dump on their fanbase diluting their brand/image

Scams “Rugs”

In the crypto world, a rug is when a project is launched and suddenly the value disappears as the creators run off with the funds or some sort of “hack” unfortunately happens

This is a massive risk when a new project opens up

When you see a major firm like SBF Alameda jump into a new project, that *usually* means it is *not* a scam. Our goal on the paid Substack is to find these items before the big money moves in so you can profit. This can be a small cap or a large cap where big money is about to flow in

On that note if you understood this post so far: Fiat is a Rug

Transaction Fees

Bitcoin and Ethereum are being used quite a bit on a daily basis. In simple terms, if a ton of people use the network it costs more money in fees (btc/eth miners make more money)

Many solutions are coming out: Layer 2, lightning network, proof of stake, vertical/horizontal blockchain scaling solutions, sharding… We can go on and on

In simple terms they are trying to find ways to splice up the data making it easier to send. They are looking to scale vertically and horizontally. They are using other new technologies to send/receive in chunks vs. every transaction being forced into a block

If the above was confusing, imagine people trying to put money into a vending machine. If everyone lines up and puts in their coins, it takes a long time. Instead, people are taking paper slips writing down all the orders and just feeding that into the machine. This makes the process a lot more time and energy efficient

Since DEXs and DeFi are still pretty new, in times with volatility/low liquidity/high usage you see higher fees and more slippage in price. Another headache

Just like how the internet went from 56K to extremely fast internet speeds, the same dynamic will occur as it relates to lowering fees. So don’t worry about it long-term. Near-term you have to learn how to use bridges and swaps intelligently

Cartoon Jungle & Animal Understanding (Part Troll Part Scale)

The next 2-3 years are going to be painfully volatile. You will see many 20-35% down days/weeks. During the bad times you need something fun to do. So. We created Troll Tuesdays where we will randomly hold competitions for US Tokens, Crypto and other random gifts like Ryan Long’s comedy show from time to time.

“Serious” companies cannot market/compete like this because they are too rigid and clamped down by public perception. We will do various troll events/fun events that are not “kosher” if the decentralized scaling attempt is successful.

Jungle: Unless we follow the account, we do not have a direct relationship. If we do follow the account on Twitter, it means we do have a direct relationship. You are free to join/leave the jungle at any time (it is free) and gives you a chance to earn US Tokens, crypto or start a miniature side hustle. Again. We don’t know anyone within the Jungle so be smart about your activities/decisions. We’re not involved in any discord/telegram chat at this time.

Animals: This was done on purpose. The joke is that we’re stealing all the coins from banks/HFs/VCs/Centralized exchanges and getting on a boat (Noah’s Ark) to DeGen Island 2035. Since DeGen island is pure degeneracy, we’re positive on HRT, escorts, strippers, alcohol and anything else that is just for the lolz. In the end… if someone is smart enough to understand crypto they won’t do anything overly dumb (unless they got lucky and lose everything later due to stupidity).

Anonymous: We don’t care who you are, where you live, your age or your gender. If you have something useful to say, we’re more than happy to promote it if we see it in the Jungle. This is fun for anyone who was doing nothing with their twitter account and has some free time.

Disclaimer: As usual none of this is legal or financial advice. These are opinions of a Cartoon Bull. Also. If you are a college student and have a valid .edu email we’re happy to send you our old books. Tag the twitter handle for info. Thanks!

WOW - such amount of value and that too from a free substack.

Accurate analysis of how Crypto industry will eliminate (or minimize) the middlemen across all industries (it's a layer worth 10s of trillions of dollars) - and a lot of that revenue will eventually flow to the Crypto tokens

just commenting to say i love you