BlockFi Rescue What is a Bailout? Normie Friendly!

Level 1 - NGMI

Welcome Avatar! Before anyone suggests that we’re “late” we have the following links to prove we’ve been warning about this for over a year. You can check here on July 29, 2021 and a more recent example in May.

Not your keys, Not Your Coins. No exceptions.

Part 1: Bailed Out, But What Happened In Simple Terms

Ah yes one of the main reasons why we don’t let the world post comments? Comments like the following would pop up every day: “Haha they got the money all is fine. It’s safe now!” Missing the forrest for the trees.

Before going into the bailout, one has to wonder, how come they needed to get bailed out in the first place? You know the answer. The people running the business messed up massively and took on excessive risk. The same people will be running the business tomorrow.

BlockFi, Celsius, Voyager etc: None of these companies are “DeFi” in fact they are just like banks “CeFi” with less regulation attached to them (for now!). What you are doing is trusting someone else to hold the money on your behalf in exchange for a return. Depositing your BTC or your ETH into these companies is no different than giving your drunk friend $1,000 and having him say “this time next year i’ll give you $1,100”.

Step 1) you deposit say $10,000 worth of crypto assets, Step 2) you are “promised a yield” of say 10% to make it easy and Step 3) you “see” the balance increasing every month and think all is fine.

Looming Question? How does BlockFi or another centralized firm generate *over* 10% returns?

Generating 10% Returns: There are really two ways to entice users with big returns that will work in the *short* run. In the short run, you can do two things: 1) raise a TON of money like BlockFi which means you’re running cash flow negative every quarter and 2) you can find some rare assets that actually generate over 10% returns.

#1 Raise Money: This is the best possible situation for you. If you have your money deposited at a firm that has raised a ton of money, it means the yield is safe for at least a few months (unless they do something crazy). This is why the recent raise for BlockFi is a perfect time to pull all of your funds. Not only do you get your deposit back but you likely got some small return on it as well (investors in BlockFi Equity get killed but we’re here to protect you from losing everything!).

#2 10%+ Assets: For anyone who has run a small business, you know that there are times when you can easily turn around something for 25%+ profits. If you have a customer ordering say $1M worth of product and your margins are 40%, you should take out a loan immediately, lock in the contract and ship to them.

At that point even with a 10% rate, you’d clear 30%. No brainer.

The issue? As you get bigger, returns go down. People in crypto have learned this the hard way at least two times now (ICO cycle and DeFI/NFT cycle). While you *can* get a huge return on a small amount of money, it becomes harder and harder to generate the same returns. Go back to the product example.

If you got the hottest Xbox/Nintendo/Playstation console, you can probably flip it for 25% in a specific market. If you bought 1,000,000 units, you’re probably in trouble and can’t unload the inventory before the premium goes away.

Now for an Example

To us examples are the best way to learn so we’ll make a simple one before moving onto the high-level actual numbers.

We’ll call the centralized yield company “ScamFi”. At ScamFi they just raised $100M to start a yield generating Bitcoin reward banking system. Since they have $100M and two employees making $1M each to scam the user base, they have about $98M to play with.

Step 1) Users come in and deposit say $750M that earns 10% and the firm at ScamFi has to pay out $75M. No problem, just pay out from the raise $98-75M = $23M

Step 2) Ruh Roh…. $1.25B in deposits come in and now you have $2.0B and have to pay out $200M next year. Unfortunately, you don’t have this money! While you were trying to earn over 10% on the deposits (now $2B!) the returns are falling off a cliff! It is much harder to get 10%+ return on $2B versus a few million.

The first $10M in deposits you beat your 10% hurdle but with $2B there is no way to generate a safe and consistent 10%+ return.

Step 3) Panic sets in. If all your “customers” pull out all of their crypto currencies you actually don’t have enough to pay them the deposit + interest! The customers will realize that ScamFi is a Scam! Can’t have that happen.

Step 4) Figure out how big the hole is. Now you owe $200M but only have $25M in money left. What do you do? You raise money! Go back to step 1 and call a rich whale to take on the risk of the $175M hole.

Step 5) Announce customers can withdraw if they want… but they shouldn’t because they are going to “raise rates” to attract more users!

Conclusion: If a firm like Voyager, BlockFi, Celsius etc is offering a high return of say 10%, there is no way they can sustainably meet that return *if* deposits go up. Talk about a terrible business. The more customers they attract, the harder it is to make money if the yields remain high.

Now if you’re looking at the yields today, many have fallen to 3% or so. There is just no point. You’re better off buying iBonds at 9.6% with $10,000 worth of value and if you have a decent amount of crypto, say 10BTC+, it isn’t worth risking 100% loss for a 3% return.

Part 2: Why You Should Get Every Satoshi Off of BlockFi

Now that you understand how these “companies” work. You can see how dangerous it is to leave your money with them. Again. The only way for them to be alive long-term is if you’re *CERTAIN* they will always be in the green in terms of yield.

The only thing certain about yield is that it won’t be consistent.

System as a Whole: Take a big picture view of this. Add up BlockFi, Voyager etc. All of these yield bearing products. Say they had $10 billion in deposits with a promised yield of 10%. This means they owe $1B to customers and their $10B in deposits.

Problem? They only have $10B in total on the balance sheet. They can pay out the deposits… but they can’t pay the interest if everyone decides to pull their money! ($1B hole).

Next Issue: How do you solve this? Well you take the $10B and loan it out to 3AC since they will “guarantee” a 12% return! Perfect. Now you make 2% on the return. ($1.2B to make up for the $1B hole)

Blow Up: Suddenly 3AC can’t generate 12% return, they are actually losing money. Not only do you get zero return, you actually *LOSE* the money! ($8B in cash comes back but you still owe $11 billion of which $10B is deposits)

Simple Table to Explain the Issue

Industry: In short, a huge portion of the centralized crypto lending industry is underwater. The firms do not have enough money to cover deposits + interest. If you gambled by putting your money into one of these firms and they get bailed out, go call your parents and tell them you love them. You just got saved by a fund raise and can now get your money out and store it on a self custody wallet (as you should have).

You dodged a bullet.

The business model hasn’t changed and the people running the business will likely make the same mistakes again (since they didn’t lose anything by running it poorly anyway, in fact they got paid the whole time).

Traditional Finance! We get to see how bad the traditional financial sector will suffer from a double digit reduction in asset prices (20%+). Hopefully the banks had their risk measures on correctly because if they didn’t you’ll see a lot of bad debt. A lot.

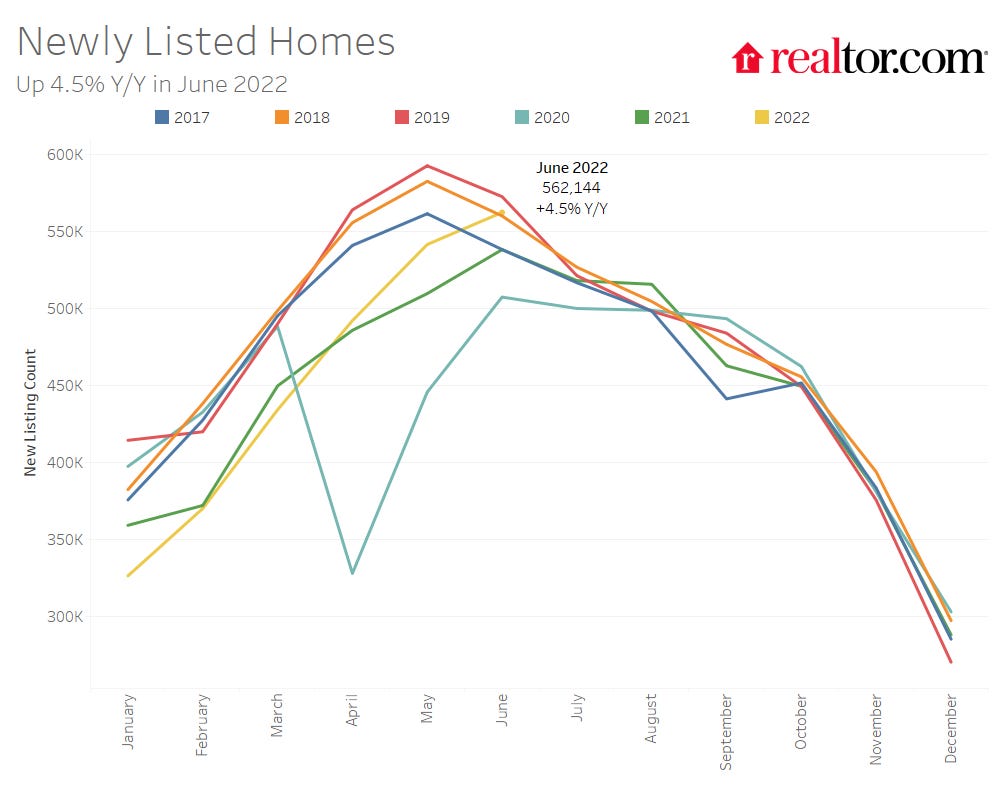

For quick math, with rates jumping from call it 3% to 5% you would have to see a 25% reduction in prices across all homes to hit equilibrium. This is just rough math based on the rapid change in fed policy. To buy any home on a 30 year fixed it is about 25% more expensive which means a price reduction of 25% would get you to the same monthly payment.

Note: Real estate is always local and each firm/bank loans differently. You would need to see every single loan, every single bank, every single mortgage backed security to see what firms/individuals are likely going belly up.

For long-time readers we’re not changing the same view, if you own your *primary* residence and plan to stay there for 10+ years it is difficult to mess up since you would have to rent from someone.

In the end though, we’re not positive on having a bunch of rental properties at this time (tougher to get renters when they are unemployed and also tax issues will likely arise).

On that note if you have questions related to BlockFi or our quick housing math please leave it in the comments. Unrelated questions/comments will be deleted so we can keep the conversation focused on these two big topics.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team

Not only that. They WERE SHORTING assets using users’ deposits as collateral. Double fuckery. Anyone can check their wallets and see for themselves.

Hint: it wasn’t BTC they were shorting, but a much more valuable asset. And try and pinpoint the start of their demise (quickly trying to cover their shorts) with a certain staking announcement. You will be surprised.

Once job layoffs begin to become more common, it's going to be over for a lot of people in regards to their housing. So many people are 100% leveraged. I just don't understand it. People that had no business spending in the last couple of years acquired vehicles at hugely inflated prices, new homes, etc. Economy is cyclical, how do individuals get caught in a mess when they already know what happens?