Bonds for Newbies

Level 1 - NGMI

Welcome Avatar! Since the last post was extremely long with tons of links, figured the paid readers could use a break. That said, if you are on the paid stack but don’t understand bond basics just read this post.

This has been a completely ignored segment of investing for good reason. With inflation at mid-single digits, locking in a '“guaranteed 1% return” doesn’t make sense. This *guarantees* you lose 4% of purchasing power if inflation is 5% (simple example of 5% inflation subtract 1% return on bonds = 4%).

Part 1: The Basics

We’re not even going go into the complexities of convertible bonds. Instead, we’ll keep it real simple and focus only on bonds with interest payments.

Keeping it even simpler we will just assume the bond pays 1x a year in all cases. Example: a 5% 1-year bond would mean that you invest $10,000 and if you hold for the entire year you get $10,500.

Interest Rates Go Up Bond Prices Go Down: This is finance 101. If you can buy a bond that gives a 1% return and 2 years later you can buy a bond for a 5% return… the value of that first bond is worth less since interest rates are now higher (better options).

Various Durations: This simply means how long the payments are expected to continue. If you invest $10K into a 1-year bond, you get the $10,500. If you invest $10K into a 10-year bond, you get annual payments of $500 then the $10,500 as the last payment (assumes purchase date lines up with the $500 payout). For visual learners you can look at this extremely basic explainer from TD Ameritrade on (Youtube)

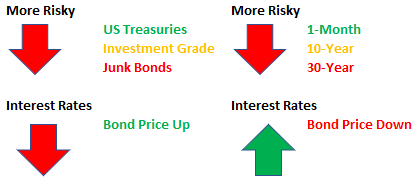

Various Risk: Keeping it simple: Government, Investment Grade and then Junk Grade would be the easiest way to rank the risk from a issuer standpoint.

Interest rates going up would also be a risk. Inflation is also arguably a risk as we’ve seen in 2021/2022. And. Of course the default risk if you are buying a company specific bond.

Example Government: Unless you believe the USA will not pay the interest (when they can print the money to pay it) this is the least risky. Even less risky is a 1-year bond vs. a 30-year bond since anything can happen in a 30-year frame.

Example Company: Unless you think Apple is going bankrupt in the next 1 year, this would likely be seen as an investment grade product. While a 30-year frame would be much more risky considering how fast tech moves.

Example Junk Company: If you try to buy bonds from a company with negative cash flows, declining revenues and debt exceeding cash on the balance sheet already… that is likely going to be a junk bond. Chances of it going under is much higher. You may be able to time a single coupon (6-12 month frame) but buying something like that and trying to hold for 30-years likely leads to significant default risk (no payments and no principal investment returned).

With that here is a simple snapshot to remember

Part 2: Inverted Yield Curve

As you all know this comes up time and time again as the best recession predictor. The part they don’t tell you is the recession is announced *after* we’ve already been inside the recession. For example, if we’re in a recession today, it wouldn’t be announced today it would be announced in 4-6 months or so.

Before we begin…

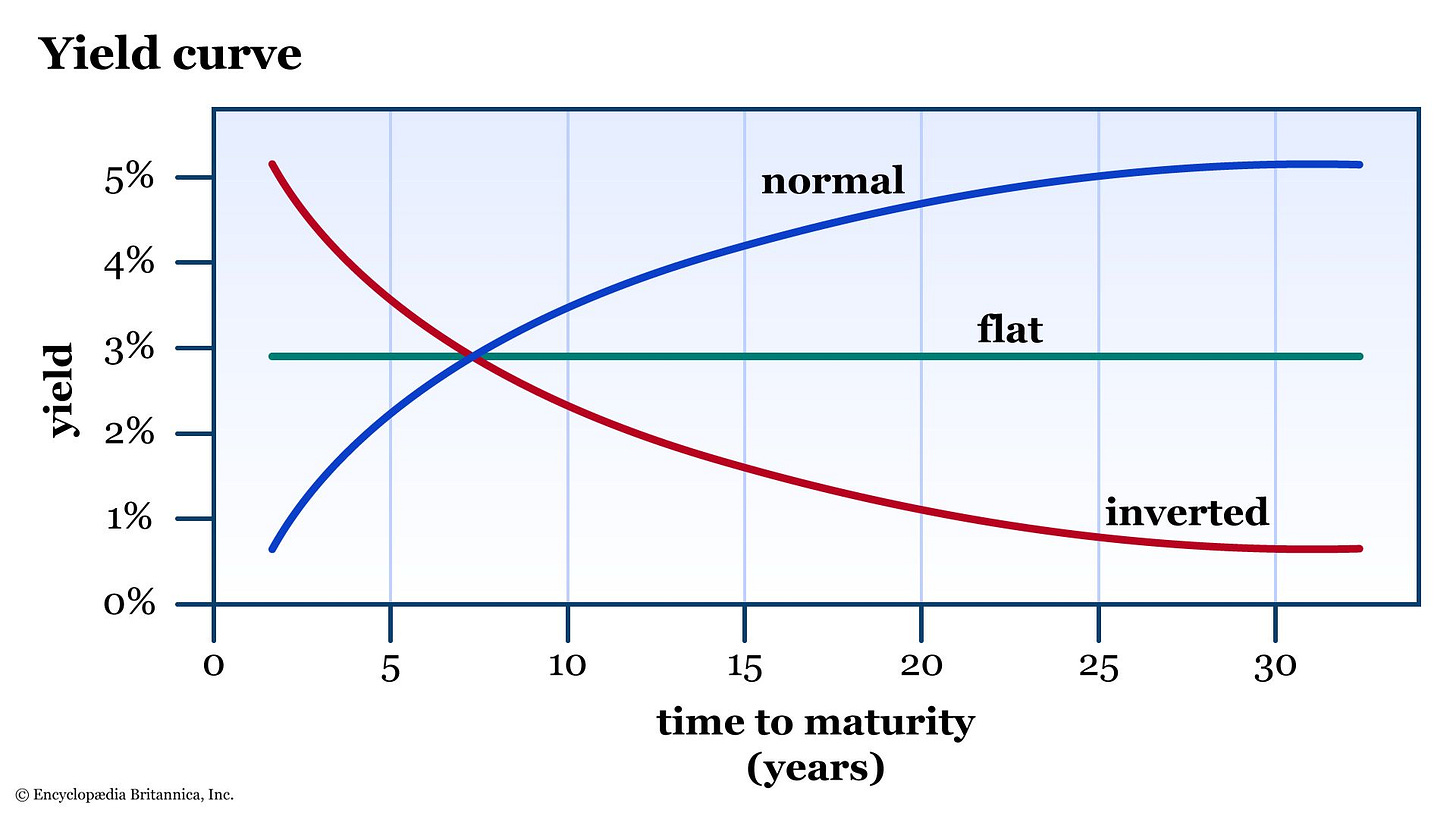

What is the Yield Curve? With the basics out of the way you already know that banks make money by borrowing money short term and lending it long-term. This is because the coupon payment (see interest paid per year) should be *HIGHER* if you are waiting a long time.

In non-number terms, if you let someone borrow $10,000 and not pay it back for 30-years you’d expect the return to be *higher* than if you let them borrow the money for say 2 years.

What is the Inverted Yield Curve? As you can see the red line above depicts an inverted yield curve. In simple terms it means the annual payout on a 2-year bond is higher than a 10-year bond and in some cases a 30-year bond. See below as we are currently in that situation.

Source: Bloomberg.

Currently, you can get $462 each year for 2 years if you put in $10,000. Or you could get a *lower* payout of $381 each year for 10 years or $387 for 30-years.

This does not make sense in a normal market because the bond market is telling you two things: 1) a recession is coming because growth is going to slow or/and 2) inflation is coming down - which means practically the same thing on a long time horizon.

Up to You to Decide: Before laughing at the inverted yield curve remember that yield curves are much more efficient than stocks, crypto and even real estate. Depending on what data you look at, a rough number is that US bond market is 2x size of US stocks.

Which one is it? Growth will slow (recession), Inflation will come down quickly over the next 2 years or so. Both. Or the bond market is wrong? Per usual. Up to you to decide.

Part 3: Okay How to Make Profits

There are many ways to make money with bonds but we’ll walk through the basic ways of doing it. This assumes the bond does *not* default which is always a risk in any bond and a major, major, major risk with junk bonds.

Hold to Maturity: If you buy a bond at 1% yield, 2% yield etc. If you hold it until maturity you will get the income stream and initial investment back.

$1M into a 10-year bond at 4% = $40K a year for 10 years and your $1M back at the end

$1M into a 5-year bond at 3.5% = $35K a year for 5 years and you get your $1M back at the end.

Interest Rate Movement: This is where a lot of money can be made. Say you buy a 10-year bond at the exact top of the market yielding 6% per year with $1M worth of funds. This means it spits out $60K a year for 10 years and then you get the $1M back at the end.

But wait! Say there is a massive pandemic and interest rates drop to 0%. Well, your bond is now worth *much* more than you paid for it. If an investor wants to buy a 6% bond he can’t because they no longer exist. Also. No way you would sell your bond to him for $1M (why would you).

Therefore, the price of the bond has to go up and the investor would have to pay you $1M + a premium (in this case quite large) to take it off your hands.

Re-Rating: On the corporate side a major swing is when a Company goes from junk bond grades to investment grade. This would be a company that seems like it is going out of business. They issue a bond with say 10% interest on it. Luckily, they turn the company around and suddenly you have bond that is now massively valuable.

Example: You buy bonds of Apple when they thought it was going out of business. Then Steve Jobs come in and fixes the Company. Now your 10% yielding Apple bonds are worth massively more than they were when you purchased them. Who really thinks Apple is going to zero in the next 3-5 years?

Short Steps

You Think Rates Go Up: This means the price of bonds now are too high and you should wait. Buy the newer bonds if you think the yields will be better on future bonds. (alternatively you short the bonds)

You Think Rates Are Going Down: Say you think the Fed is done hiking rates by June. Then you would buy up tons of bonds in June because as rates go down those bonds become more valuable. Worst case you hold them to maturity.

You Think a Company Will Turn Around: You see a company struggling and they issue a 9% corporate bond since they desperately need money. You are confident the company will survive and thrive. You buy it and either hold to maturity or wait until the firm is out of the woods.

Part 4: More Conceptual Stuff and How to Buy

TIPS: Generally, wouldn’t touch this stuff. The main reason why is you would have to believe the government reported CPI number. If you really believe this number… well this product is for you.

Mortgages: If you have a mortgage that is below the current treasury yield it would be insane to ignore these flipped numbers. If you have a $1M mortgage at 3% and you can lock in a 5% yield in US treasuries… you can just buy the 5% treasuries and now your mortgage is paid without doing anything. Pretty neat (hint this is exactly what is happening with wealthy people and why we think socio-economic divide will only get worse).

Renting: If you are a home renter it means you think interest rates are on the rise and prices of homes are going down. Conceptually, you are short the bond market.

Tax Stuff: Not going to go through every type of bond. Certain types of bonds allow for no state tax, and some no federal tax (muni bonds). Be sure to look at all of the tax impacts because it will show you the “post tax yield” which is different from the income you get (that is pre-tax).

Dividend Stocks: To attract investors, dividends typically need to increase in order to compete with the bond market. If a stock is largely stable (say $50 a share for the past 10 years), people are probably buying it for the 5% dividend (assumption).

The problem is that with interest rates at 5% for US treasuries there is no reason to buy that stock anymore. Why take the risk of a company going under and why take the risk associated with the stock movement?

This usually forces companies to think about raising dividends if they want to attract investors. As usual, this isn’t a fast moving market and corporations take time to adjust their dividend payouts.

How to Buy

At this point you have a working understanding of bonds, something that was largely meaningless for the past 5-10 years or so. Now that yields are up, we’re certain at least some of our readers are locking in ~5% yields for 12-months.

This stuff may not be for you.

That said, if you do want to buy, major online brokerages will have a tab for income products/bonds. You can buy there in the open market and decide what your strategy is there: 1) hold to maturity, 2) hope for rates to go down or 3) more aggressive strategies such as junk bonds. Per usual, you should make your own educated decisions on what is best for you.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money. At 10,000+ Instagram follows we will publish some city guides ranking each region we’ve been to.

Mortgages: “you can just buy the 5% treasuries and now your mortgage is paid without doing anything.”

Not following this.. is bull saying that you should buy treasuries that mature at the same time as your mortgage loan term AND in the same amount as the current outstanding mortgage amount, therefore giving you the 2% spread over the rest of the loan?

Multi-year guaranteed annuities (MYGAs) exploded in growth in 2022 given the high interest rate environment. Roughly $112B in sales. They behave similar to CDs.

A client deposits an initial premium, earns a guaranteed interest rate for the product duration (typically 2-10 years) and the initial premium and interest earned is tax-deferred. Most of these products also allow up to 10% of the account value to be withdrawn annually without penalty. To give you an idea of the rates they're earning...

3-Year: 5.50%

5-Year: 5.75%

7-Year: 5.65%

They're offered by highly regulated and well capitalized insurance companies. Better yet, spend a couple days and get a life insurance license, sell it to yourself, and collect a commission (2-3% of the initial premium). Could be another option for those considering a safe place to park cash for a few years and earn a competitive rate.