Canada RE - Warning Extremely Detailed (Darren Cabral and Daniel Foch)

Level 2 - Value Investor

Welcome Avatar! This is a big overview of Canada RE from Daniel Foch and Darren Cabral. Before anyone gets upset we just put it in alphabetical order hence Cabral first. We’ve never lived in Canada but got curious so if you’re interested in learning about Canada RE here it is!

Part 1: Canada RE according to Darren Cabral

Before we dive too deep, I'll save some time for those of you who are in a hurry by providing a brief summary of the issue at hand. Then we’ll dive into the nuts and bolts of the issue.

The Short Version: Canadian real estate, particularly in the urban center of Toronto has risen to astronomical heights over the past 5-10 years. The main reason is simple, supply and demand. Too many people trying to purchase too few homes. Why are there too few homes? Toronto and Canada as a whole, has become more and more unfriendly to developers and builders. Thanks to never ending increases in corporate, sales, property, and land transfer taxes, it becomes increasingly more difficult to build anything at a profit. Without this incentive, less and less housing get’s built, while the Liberal government continues to flood the gates with immigration to the tune of 1M+ permanent and temporary residents each year. In short, the Government has made it more and more expensive to build homes, while at the same time bringing in more and more foreign nationals who need homes… driving the market sky high with no real solution on the horizon. However, the solution to most Canadians is clear, the government needs to make it easier, and cheaper for builders to build. We need more housing, and we need it fast, that is the only solution.

Now, for the detailed long version… let’s get right into it!

Toronto and the broader province of Ontario stand at the epicenter of one of Canada's most pressing challenges: skyrocketing housing prices. This escalation, while underscoring Toronto's global allure, reveals multifaceted economic drivers and the significant influence of policy decisions. By navigating through intricate elements, we can piece together a narrative of how Ontario's housing market reached its current zenith and ponder the roadmap for its future.

1. Historical Context: Laying the Groundwork

a. Toronto’s Rise as a Global City: From the 1980s onwards, Toronto underwent rapid globalization and urbanization. As Canada's financial hub grew, it magnetized multinational corporations, banks, and talent, thereby seeding the initial uptick in housing demand.

b. The Influx of Immigrants: Statistics Canada reports that one of every three immigrants in Canada resides in Ontario, with a majority gravitating towards Toronto. This steady flow, integral to Canada's demographic strategy, placed consistent upward pressure on housing demand.

2. Examining Supply Constraints in Depth:

a. Green Initiatives and Urban Boundaries: While the Greenbelt’s foundation was environmental preservation, it inadvertently curbed Toronto’s urban sprawl. With fewer areas available for development, builders began eyeing vertical expansion, leading to a surge in condo developments.

b. Urban Planning & Infrastructure Limitations: Toronto's outdated infrastructure struggles to support high-density living in many neighborhoods. Comprehensive overhauls are necessary to accommodate increased populations, especially in water, sewage, and transit systems.

c. The Challenges of Brownfield Sites: Though there's potential for urban renewal through brownfield sites (previously used industrial areas), the costs of remediation, coupled with regulatory red tape, often deter developers.

3. Economic Variables and Financial Dynamics:

a. The Global Perspective on Interest Rates: Low-interest rates weren’t unique to Canada post-2008. However, the longevity of these rates in Canada, coupled with an economic reliance on housing and construction sectors, intensified its impact.

b. Foreign Investment & Global Uncertainties: Beyond the sheer volume of investment, the global landscape influenced Toronto’s market. Economic uncertainties, such as the U.S.-China trade war, and political instabilities in Hong Kong, drove foreign capital into Canada’s stable real estate market.

c. Equity and Loan Practices: Canadians increasingly tapped into home equity lines of credit (HELOCs). The blend of rising property values and easily accessible credit facilitated more investments into real estate, perpetuating the demand-supply gap.

4. Societal Impacts and Changing Demographics:

a. The Condo Boom & Changing Lifestyles: By the 2010s, TREB noted a significant shift towards condo living. The urban youth, prioritizing city living and amenities over suburban space, fueled condo demands. This shift wasn’t just economic but also reflected evolving lifestyle preferences.

b. Gentrification and Neighborhood Transformation: As Toronto’s older neighborhoods underwent revitalization, they attracted affluent buyers, often sidelining long-term, lower-income residents. Kensington Market, Parkdale, and Leslieville stand as testaments to this transformation.

5. Dissecting Government Policies & Their Impacts:

a. Rent Control & Its Double-Edged Sword: While rent control sought to protect tenants from abrupt rent hikes, they potentially stifled new rental developments. Investors, apprehensive about capped returns, might opt for selling over renting, limiting rental availability. This severely lowered overall supply as it became less and less profitable to develop new projects, especially in Toronto.

b. Stress Test and Mortgage Regulations: Introduced by the Office of the Superintendent of Financial Institutions (OSFI), the stress test aimed to ensure borrowers' capability to withstand interest rate hikes. While ensuring long-term market stability, the test might have temporarily sidelined potential first-time buyers.

c. Property Taxes and Municipal Budgets: Toronto’s revenue generation heavily leans on property taxes. As property values rise, so do municipal revenues. It's a delicate balance for the city: ensuring housing affordability while maintaining city services. Currently the City of Toronto has some of the highest property tax rates in Canada, along with an unprecedented “Double Land Transfer Tax”.

It’s important to note that there are cities and states in the US for example with higher property and land transfer tax, however… Those cities and states derive most of their tax revenue from property related tax, and do not have an astronomically high income and sales tax like we have in Toronto. This “perfect storm” of insanely high income tax, corporate tax, sales tax, and property taxes make it next to impossible to develop profitable real estate projects in the current market without government subsidies.

6. Future Trajectories & Potential Solutions:

a. Urban Decentralization & Satellite Cities: As remote work gains permanence post-pandemic, smaller cities around Toronto, like Hamilton and Barrie, might emerge as attractive alternatives, offering a blend of affordability and quality of life.

b. Co-housing and Innovative Living Solutions: Co-housing, where residents share common spaces while maintaining private bedrooms or units, could address both affordability and societal concerns, fostering community living.

c. Revisiting Zoning & Encouraging Mixed-Use Development: Modernizing zoning to facilitate mixed-use developments can rejuvenate neighborhoods, ensuring they cater to living, working, and recreational needs without necessitating long commutes

D. Deregulation and Incentivization The Liberal government currently at the head of our nation along with the local municipal branches, have contributed to an almost unimaginable increase in costs for builders over the past 5-10 years. Layering tax after tax, and fee after fee, until there’s simply nothing left in the way of profit. Not to mention the mindfield of bureaucracy and red tape faced by builders simply to get a shovel in the ground. Limiting development to only the largest and most connected developers in the City. Canada has a very strong real estate development and services sector that is primed and ready to build, that could easily combat the massive supply shortage, if only the government would get out of the way. A step towards deregulation and making it easier, faster, and cheaper for builders to build, would play a massive role in getting more roofs over the heads of Canadians. Make it profitable for builders to build, and the shortage will fix itself.

7. Detailed Analysis of the Financial Climate & Housing Prices

a. Debt-to-Income Ratios and Household Economics: By 2020, Canadian households were among the most indebted globally, with a debt-to-income ratio exceeding 170%. This means that for every dollar of income, Canadian households owed $1.70 in debt. Such high indebtedness, largely driven by mortgage debt, highlights the vulnerability of households to economic shocks, interest rate hikes, or housing price corrections.

b. Property as a Safe-Haven Asset: In periods of economic uncertainty, real estate in stable countries like Canada becomes a safe haven. International investors turn to properties, not just as investments, but as protective measures against economic instability in their home countries.

8. Social Implications of the Housing Surge:

a. Shifts in Homeownership Dreams: As prices soar, the traditional dream of homeownership gets redefined. Younger generations might opt for long-term renting, co-living, or alternative housing options, diverging from their parents' goals.

b. The Implications for Immigrants: While Canada’s immigration strategy focuses on bolstering population numbers, high housing costs can deter potential immigrants. For newcomers, settling in high-cost areas could lead to significant financial stress, affecting their overall integration experience.

c. Urban Homelessness and the Affordability Crisis: Beyond just homeowners and renters, the escalating prices have dire implications for the homeless. As resources are strained, shelters face capacity issues, leading to a societal challenge that requires immediate attention.

9. Policy Reflections and Future Interventions:

a. Reviewing the First-Time Home Buyer Incentive: The Liberal government introduced the First-Time Home Buyer Incentive (FTHBI) to aid first-time buyers. However, in cities like Toronto, where the median house price exceeds the program's limits, its effectiveness is questionable. Like many current housing programs, the FTHBI was designed to sound great from the podium, but is effectively useless in practice as few buyers will ever qualify for it.

b. Land Value Capture: Some experts advocate for Land Value Capture mechanisms, where the government could recoup some of the land value increases resulting from public infrastructure investments. This revenue could then be channeled back into affordable housing projects. However it’s likely this would have the exact opposite effect, making it more costly for infrastructure to be built and therefore less of it will be built.

c. International Examples & Lessons: Examining housing policies from other global cities can offer valuable insights. For instance, Berlin's five-year rent freeze or New Zealand's ban on foreign property buyers could serve as case studies to deduce applicability in the Ontario context.

10. The Evolving Housing Landscape and Innovations:

a. Modular and Prefabricated Homes: Technological advancements could offer solutions to the affordability crisis. Modular homes, built off-site and then assembled, can significantly reduce construction costs and timelines.

b. Sustainable and Green Housing: Future housing developments in Ontario will need to consider environmental impacts. Net-zero homes, which produce as much energy as they consume, represent the future of sustainable living.

c. Public-Private Partnerships (PPP) in Housing: Governments and private entities can join forces to address housing shortages. Through PPP, stakeholders can pool resources, expertise, and risk to accelerate the creation of affordable housing units.

11. The Bigger Picture: Ontario in the National Housing Narrative:

a. Inter-Provincial Migration: With Toronto’s prices soaring, inter-provincial migration trends might shift. Provinces like Manitoba or Nova Scotia, which offer affordable housing and quality of life, might attract more residents in the coming years.

b. National Housing Strategy Reflection: Canada's National Housing Strategy, a 10-year, $40-billion plan, aims at building stronger communities. The strategy's effectiveness, particularly in hotspots like Toronto, requires regular assessments to ensure its objectives align with ground realities.

12. The Role of the Liberal Government in the Housing Landscape:

a. Taxation Policies and Implications: Under the Liberal government, policies such as the non-resident speculation tax (NRST) were introduced in Ontario to cool down the housing market. Aimed at foreign buyers, the NRST imposed a 15% tax on properties purchased by non-citizens, non-permanent residents, or foreign corporations. While such measures sought to curb speculative buying, they also received criticism for potentially stifling genuine foreign investment. This measure accomplished nothing, as most foreign buyers found work around and either avoided paying the taxes or simply didn’t care and proceeded as usual.

b. Financial Oversight and Regulatory Adjustments: The Liberals backed stricter lending rules to reduce risks in the housing market. Measures such as the mortgage stress test were designed to ensure borrowers could handle higher interest rates. However, these measures faced critiques for potentially making home ownership more elusive for many first-time buyers, which further exacerbated the issue.

c. Investments in Affordable Housing: The Liberal government, recognizing the affordability crisis, promised billions in investments towards affordable housing initiatives. Through the National Housing Co-Investment Fund, the government pledged support for the construction of new affordable homes and the renewal of existing ones.

d. Addressing Inflation and Monetary Policy: The Bank of Canada, under the purview of the federal government, has a role in setting interest rates. With inflationary pressures mounting globally and within Canada, interest rate decisions have direct implications on mortgage rates and, by extension, the housing market.

13. Comparing Toronto’s Market Dynamics with Other Global Cities:

a. Vancouver’s Parallel Universe: Vancouver, another Canadian hotspot, shares similarities with Toronto, from foreign investments to geographical constraints. However, policies like the Empty Homes Tax, a levy on homes that aren't primary residences or rented out for at least six months of the year, show varying approaches within the same nation.

b. New York’s Rent Control Evolution: New York City, notorious for its expensive real estate, has a long history with rent control and stabilization. Observing NYC's journey can provide insights on the effectiveness and pitfalls of such strategies over decades.

c. London’s Green Belt and Urban Sprawl: Much like Toronto's Greenbelt, London has its Green Belt aiming to prevent urban sprawl. However, with increasing housing demands, debates continue on whether to maintain these green spaces or open them up for development.

14. Societal Impacts: Digging Deeper:

a. The Generational Divide: Boomers, who might've purchased properties in the 80s or 90s, saw their home's value skyrocket, providing them with significant equity and wealth. In contrast, millennials and Gen Z face entry barriers into the same market. This widening generational wealth gap has broader societal implications, from delayed life milestones for younger individuals to shifts in consumer behaviors and spending patterns.

b. The Rise of Alternative Living Communities: With traditional home ownership slipping out of reach for many, alternative living communities, from tiny home villages to co-housing projects, are gaining traction. These initiatives challenge the traditional North American dream, heralding a potential paradigm shift in how society views housing and community.

c. Mental Health & Housing Insecurity: Continuous stress from rising rents, the threat of eviction, or the elusive chase of homeownership can take a toll on mental well-being. The linkage between housing insecurity and mental health is an area warranting attention from both policymakers and health professionals.

15. Envisioning Future Pathways: Anticipating the Next Decade

a. Tech & Real Estate: PropTech’s Evolution: Property technology or PropTech promises to revolutionize real estate. From virtual home tours to AI-driven property valuations and blockchain in property transactions, the integration of tech can streamline processes, reduce costs, and bring transparency.

b. Urban Design & Community Living: The futu re isn't just about individual homes but reshaping entire communities. Concepts like the 15-minute city, where all essential services are within a 15-minute walk or bike ride, can redefine urban living, making it more sustainable and community-oriented.

c. Preparing for Black Swan Events: The COVID-19 pandemic, a black swan event, altered perceptions about home, work, and life, prompting a reevaluation of urban versus suburban living. Planning for such unpredictable events is crucial for a resilient housing market.

16. A Historical Perspective: Setting the Scene

a. Ontario's Economic Boom: Post World War II, Ontario, particularly Toronto, began a transformation into a bustling economic hub. This economic vigor attracted a surge of internal and external migration. The influx of workers and families coupled with an expanding economy set the stage for an ever-increasing demand for housing.

b. Policy Decisions of Yesteryears: Past government policies, from interest rate decisions to housing subsidies and zoning laws, paved the way for the current housing situation. For instance, the urban sprawl of the '70s and '80s, driven by a car-centric model, led to specific infrastructural and housing choices which resonate today.

17. The Implications for Future Generations:

a. The Locked-Out Generation: Millennials and Gen Z face the prospect of being a "locked-out" generation – those who might never own a home in their lifetime. This is not just about a roof over their heads; homeownership has traditionally been a source of wealth accumulation and financial security.

b. Changing Definitions of Success: Future generations might not equate success with homeownership, redefining it based on experiences, quality of life, or other metrics, distinct from the tangible asset of property.

c. Lifelong Renters & New Financial Models: The European model, where renting for life isn't uncommon, might become more prevalent in Ontario. This shift necessitates new financial planning models, where retirement and wealth planning aren't predominantly anchored to property ownership.

18. Potential Rectifications by a New Government Administration:

a. Comprehensive Zoning Reforms: One of the primary drivers of high housing prices is the lack of supply. A future government could aggressively reform zoning laws to encourage higher-density housing, streamline the approval process for new developments, and incentivize the creation of mixed-use neighborhoods.

b. Financial Incentives & Subsidies: Tax breaks for first-time homeowners, subsidies for developers building affordable housing, or a revamped property tax system that encourages the efficient use of land and property can all play roles in altering the housing landscape.

c. Enhanced Public Transportation Infrastructure: By bolstering public transport, regions outside the primary urban cores become accessible, allowing people to live further out where property might be cheaper while not being disconnected from essential services and employment hubs.

d. Public Housing Initiatives: Looking to models in places like Singapore, where the government plays an active role in housing its citizens, can provide valuable insights. A robust public housing program can ensure that a segment of the population isn't left at the mercy of market dynamics.

e. Active Collaboration with the Private Sector: Government and private sector partnerships can be a formidable force. By providing incentives or simplifying bureaucracy, the government can catalyze the private sector to address the housing shortage.

Summary and Conclusion: The exorbitantly high housing prices in Ontario, particularly in urban centers like Toronto, are a result of a blend of factors: an interplay of supply and demand dynamics, policy decisions, external economic influences, immigration patterns, and speculative behaviors, among others.

However it’s clear that the main driver of housing prices have been poor policy decisions resulting in rapid inflation and a general increase in the cost of living as a result. From printing too much money too fast, and the never ending increase in taxes, fee’s, etc. the result is asset inflation at an unprecedented rate. The more government involvement we see, the worse things seem to get, and the solution becomes more and more clear. The liberal government needs to step back and get out of the way, so the free market economy can do what it does.

For future generations, this housing predicament presents both challenges and opportunities. On one hand, the traditional path to homeownership, a cornerstone of the "Canadian Dream," seems more elusive. On the other, this reality prompts innovative thinking around living arrangements, comI munity designs, and financial planning.

Addressing the housing crisis requires a holistic approach, marrying immediate relief measures with long-term strategic planning. Whether it's through revamping zoning laws, boosting public housing, leveraging technology, or rethinking urban design, solutions lie at the intersection of public policy, private enterprise, and community aspirations.

If a new government administration takes the helm, its success in addressing this issue will not only be gauged by stabilized housing prices but by how it reshapes Ontario's housing narrative for generations to come, ensuring that homes are not just assets but sanctuaries of security, community, and well-being.

About The Author of this Post: Darren Cabral Canadian real estate investor, sales professional, and entrepreneur.

Instagram: darrencabralrealestate

Twitter: Darren_cabral

Website: www.cabralrealestate.ca

Email: darren (at) cabralrealestate (dot) ca

Part 2: Canada RE according to Daniel Foch

HOW CANADA CREATED THE WORST HOUSING MARKET IN THE WORLD

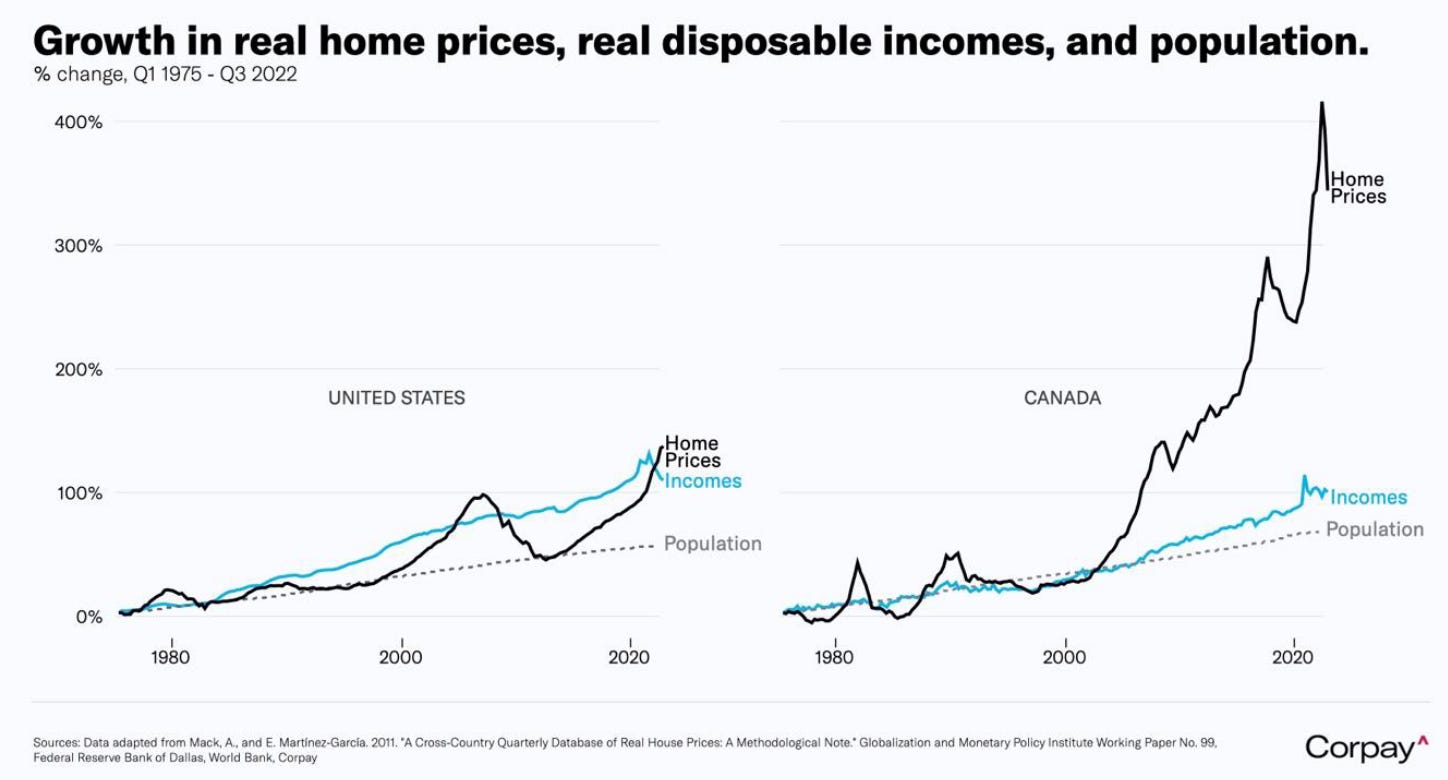

In 2023, a lot of attention has been given to the housing situation in Canada, and rightly so. Since the global financial crisis, real house prices in Canada have vastly outpaced the growth of the US. Beyond that, they’ve also outpaced the growth of another key component – household incomes

This has led to an incredibly disparate and unproductive economy. By most predictions, Canada is expected to see some of the weakest economic performance in the OECD looking toward 2040.

To understand the problem, we’ve got to understand where it started. Generally, this unprecedented growth was able to happen for a few key reasons: 1. Nearly a decade of negative real interest rates 2. Relatively lax policy around foreign investment and money laundering 3. Excess demand, driven by unprecedented population growth 4. Limited supply, squandered by bureaucracy and lack of innovation 5. A generally lagging economy outside of housing

Negative real interest rates: During the Global Financial Crisis, the US detoxed from their addiction to cheap debt. At the same time, Canada just started a credit addiction of their own. From this period on, Canada’s economy spent the vast majority of its time with negative real rates – that is, when inflation is higher than the interest rate. (Source)

During a period of negative real rates – one could argue that the economically sensible thing to do was amass as much debt as humanly possible to buy assets that purportedly hedge against inflation. And that’s exactly what Canadians did. By 2021, Canada led the G7 in household debt to disposable income, as well as household debt levels as a share of GDP:

It is also worth noting that when comparing to the US, Canada’s mortgage industry is structured much differently. Canadians can only lock-in an interest rate for 5 years in most cases – not 30 years like US mortgages. This means that every 5 years, a Canadian borrower has to reset at the new interest rate in the market. Remember your adjustable rate mortgages in 2007? Yeah.

About 50% of outstanding mortgages are expected to renew at higher rates over the next 2 years causing a long, sustained pressure on borrowers and the economy.

Those who elect not to lock in a rate can elect for a variable rate, which is a function of the Bank of Canada’s overnight rate, which climbed from 0.25% to 5.00% in the past 16 months (source)

This has put a lot of stress on households, and led many borrowers to see their payments increase by significant amounts – 10, 20, or 30%. Some borrowers on static-payment variable rate mortgages have seen payments double or triple, and those payments are still negative amortizing. This means that they’re only paying interest, and they’re still not paying enough, so the mortgage is growing in size.

In fact, many banks have mortgages with amortizations over 35 years, hovering at around 25% as you can see by this chart (source)

Snow washing: During the same period of time, Canadian real estate became one of the most efficient places on earth to launder money. Dubbed “Snow Washing”, it refers to hiding illegitimate financial transactions often for purposes of tax evasion in Canada. The global elite, as well as criminals and foreigners avoiding economic sanctions, can set up shell companies to "make suspect transactions seem legitimate" under the cover of Canada's reputation for fiscal integrity. Snow washing is well documented in a 2017 Toronto Star article called “The Canada Papers”. (Source)

In 2019, the Cullen Commission (Source) was established in the wake of significant public concern about money laundering. The Commission resulted in a few key findings: 1. Money laundering is a significant problem requiring strong and decisive action 2. The federal anti–money laundering regime is not effective 3. The RCMP’s lack of attention to money laundering has allowed for the unchecked growth of money laundering since at least 2012 4. The real estate sector is highly vulnerable to money laundering 5. Realtors have a poor record of anti–money laundering reporting and compliance 6. Effective regulation of the mortgage lending industry is essential 7. A corporate benefcial ownership registry is essential to address money laundering risks in the corporate sector

Much of this is detailed further in Sam Cooper’s 2021 book “Wilful Blindness” (source)

Foreign investment: While not directly related, Canadian real estate also saw massive influx of foreign investment during 2016 and 2017 in its two major financial hubs – Vancouver and Toronto.

In 2016, Macleans, one of Canada’s national magazines, published an article entitled “China is buying Canada: Inside the new real estate frenzy.” The article suggests as many as 30% of Vancouver homes sold in 2016 were purchased by foreign investors from China, and as many as 10% of Toronto homes saw the same fate. (Source)

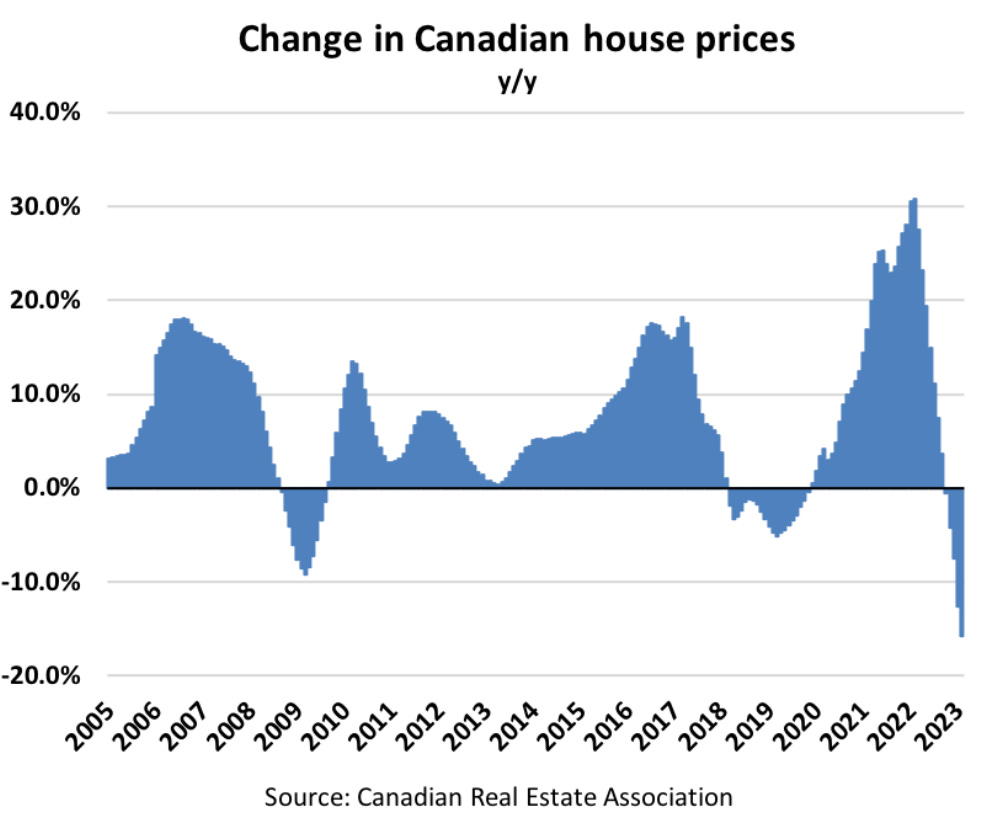

This impact eventually led to double-digit price growth in Vancouver in 2016, which prompted a 15% Foreign Buyer’s Tax by the British Columbia Government: (Source)

Prices in Vancouver area fell about 20-30% thereafter.

Similarly, in 2017, after buyers were shut out of Vancouver, Toronto experienced a similar faceripping rally that ended in the same fate. In April of 2017, Ontario implemented the NonResidents Speculation Tax (NRST) which required foreign investors to pay an extra 20% in The Greater Toronto Area (GTA)

Shortly thereafter, capital flight from Toronto began running house prices up in the double-digit percentage growth range in Tier-2 cities in Ontario, while house prices in the GTA fell 20-40%. This led the provincial government to expand their NRST program to province wide shortly thereafter.

Foreign capital continued moving to new areas of Canada as it was regulated out of others. Compounded by pandemic-driven capital migration to more affordable provinces, areas like Alberta and Nova Scotia saw prices grow at rates only seen before in Toronto and Vancouver. In 2022, Foreign Investment had become enough of an issue that the federal government finally decided to step in with the “Prohibition on the Purchase of Residential Property by NonCanadians Act”, which entirely forbids foreign purchasers from buying Canadian real estate… Unless of course, they meet any of the incredibly liberal exemptions that were quietly snuck in shortly after the policy took place on January 1, 2023.

From Q1 2022 to Q1 2023, Canadian house prices fell by the largest amount ever in history:

Excess demand from population growth

Often-conflated with foreign investment in real estate, Canada’s government also has an aggressive immigration policy designed to offset an aging population. It’s an important distinction to make because this group of purchasers are part of Canada’s growing population, and therefore are a more organic, and less volatile source of growth. Around 500,000 immigrants came to Canada in 2022. Many immigrants do come to Canada with money and purchase real estate, and this can contribute to the excess demand for real estate in Canada, which would cause house prices to continue growing. Statistically, immigrants rent for about 3 years on arrival, so that excess demand is distributed over several years, but it also distributes across both homeownership and rental demand. (Source)

A similar number of non-permanent residents came to Canada in 2022, and they typically do not purchase real estate. This put continued upward pressure on rents by keeping the rental market in a sustained state of excess demand alongside immigration. Growing rents have generally helped keep investor demand strong, since rents are the income portion of a property investment.

Canada’s population is growing at an impressive rate – over 2%: comparable to emerging markets like Africa. The Government deems this necessary to sustain the aging population and I don’t disagree with them. However, the economy just hasn’t kept up. This has led to a decline in GDP per capita and a stagnate economy. In fact, GDP per capita hasn’t improved since 2016.

So, to summarize, so far, your demand pool is comprised of: 1. Domestic buyers hopped up on cheap credit 2. A hot destination for international money laundering 3. Foreign investors fleeing China’s volatile real estate market 4. Immigrants hoping to achieve the Canadian dream of homeownership 5. Investors trying to capitalize on double-digit capital appreciation and growing rents from non-permanent residents.

Frankly, none of this would be a huge problem if Canada could build enough housing to sustain its population growth, but the sad reality is it quite simply cannot. This is where supply enters the conversation: Supply Stifled

Currently, Canada is seeing a record number of net international migrants per unit of housing construction started. This means that we’ve never been building less homes per person. Ever.

Before interest rates rose, bureaucracy was the biggest preventor of housing creation. Zoning is issued by local governments who are quite frankly just not well-capitalized, efficient or agile enough to deal with the increasing demands, urgency, and magnitude of new units.

When the Bank of Canada started hiking interest rates in 2022, it also started to destroy the economics of construction. When developers buy land, they do so with variable-rate mortgages (explained above in heading 1 “Negative real interest rates”). Developers are now burning through cash servicing loans, while construction costs have skyrocketed. Demand for the end units (measured by total dollar volume of real estate traded) has fallen 50%. Facing uncertain absorption and increasing costs, as many as 2/3rds of developers have elected to hold off on building new supply.

Our government literally just decided to do something about this, after saying they would in 2015: (source)

Lagging economy outside of housing: It’s no secret that Canadians love housing. We’ve got something like 70% of our average household net worth tied up in the primary residence. Residential investment makes up 13% of our GDP. This means that we have a lot of capital concentrated into one industry, and it’s not a productive asset.

Although we’re one of the most resource-rich economies in the world, the housing obsession has led to a lack of economic diversification. We have some of the lowest spending on research & development in the developed world. We have a growing portion of GDP concentrated into housing and related industries, such as lending, residential construction, and more. This is precisely why our economy is expected to be one of the slowest-growing GDP-per-capita in the OECD.

Truthfully, none of these factors would have been a silver bullet on their own. But in combination, they tend to compound in a really reckless way.

So now, we’ve got a market being gradually choked out by increasing interest rates, with an ever-growing cost of living and a GDP that is only growing due to record population growth.

When considered in relative terms – many Canadians are stretched thin financially, GDP per capita is in decline, and our greatest asset class, the one that we concentrate most of our wealth in, is being destroyed in real time by the bank of Canada’s rate hiking schedule.

Signing off! - Daniel Foch ←Link

Quite Informative! We learned a ton. As you know we focus on Tech, Crypto, RE and E-com as it relates to the US economy. After seeing how out of hand it got in Canada we feel that we’re at least educated on this topic now. Thank you Daniel and Darren. If paid subs have questions they will likely answer a few with their valuable time in the comments. Thx and stay toon’d…

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

Lacking much detail about the flywheel ponzi-nomics that enabled the entire bubble.

Canada's RE bubble, like all RE bubbles before it, isn't special.

Lots of clowns still claim insufficient supply. Yet, there's never been more vacant dwellings than recent times.

There were two distinct mania phases: 2014-2016; 2020-2022.

Picotop = Q1/Q2 '22, varying per locale.

Imagine the USA bubble then add:

-Generally less intelligent pop'n with less investing savvy/options

-Tax system incentivizing RE speculation (cap-gains free on "primary")

-Absurd level of fraud (easily preventable!) to acquire mortgages (banks happy to oblige)

-Three distinct group of greater fools: "old-stock" cucknadians whom haven't seen downturn 25+ yrs; Chinese immigrants whom never exp'd RE downturn, Largest bagholder demographic Indian immigrants whom again never experienced RE downturn

-Social Media! USA got a RE bubble pre-social media. Imagine what trouble one would get up to if that occurred during the era of social media? Taking investment advice from TikTok, etc. is common: ppl think land-lording is passive income.

CA RE bubble should be 4-10x worse than USA.

Cabral's opinion sounds like the PoV of someone who got some heavy Canada RE bags.

Foch's take is closer to the mark.