CBDC Update and Win A Pass to Consensus 2023 (2-day Pass $1499 Value)

Level 2 - Value Investor

Welcome Avatar! Part 1 is a guest post from BowTiedScholar. The timing is quite good as we have witnessed a few banks go under and watched as Jerome Powell suggested we’re working on real time payments through a digital currency.

Separately, we’re going to do a Q&A (along with the DeFi Team on Reddit with Coindesk/Consesnsus 2023.

As part of this Q&A on Wednesday all you need to do is ask good questions (you do not need to be a BowTied to participate) and two people will win a $1,499 value 2-day pass. Simply need to ask a good question and make it to the event. That’s it!

Part 1: CBDC Update with BowTiedScholar

“We don't know who's using a $100 bill today and we don't know who's using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.”

- Agustin Carstens, General Manager of the Bank for International Settlements

Hello everyone. Scholar here again to provide a much needed CBDC update. Thanks to BTB for this opportunity.

Before getting started, this post is going to provide you with a number of updates: A spotlight of the current state of CBDC developments, overview of ongoing major CBDC projects, updates on CBDCs in major economies, and content from interviews I conducted to provide you with experiences given from Nigerian citizens and the eNaira.

In case you missed the last post on CBDCs it included a thorough overview of the Digital Yuan and the Sand Dollar, the implications CBDCs will have on your life, and current warnings of what to expect from a CBDC. In short, like the quote from Carstens, CBDCs mean surveillance and complete control over your day to day. Your freedom to transact as you wish goes down the drain.

Recall the Canadian Emergencies Act?

The Freedom Convoy in Feb 2022 was a citizen’s response to disruptive and intense covid protocols in Canada and parts of the US. As a measure of disproportional response, the Canadian government asserted their powers and froze the bank accounts of protestors and those who funded the protestors. They also gathered data from financial institutions to track “suspicious accounts” and suspend accounts without notice. This is exactly what you should expect from CBDCs.

Recently, the Canadian Government reported on the “success” of their Emergencies Act utilization.

“Freezing bank accounts was a powerful tool to discourage participation and to incentivize protestors to leave...I am satisfied it played a meaningful role…This was done without violence…In the event this ever happens again, for sure, there were some lessons for us."

Current CBDC Spotlight

It is Q1 of 2023 and CBDCs continue to grow and move toward launches globally. CBDCs are coming into the spotlight as central banks across the world began to move CBDCs into development.

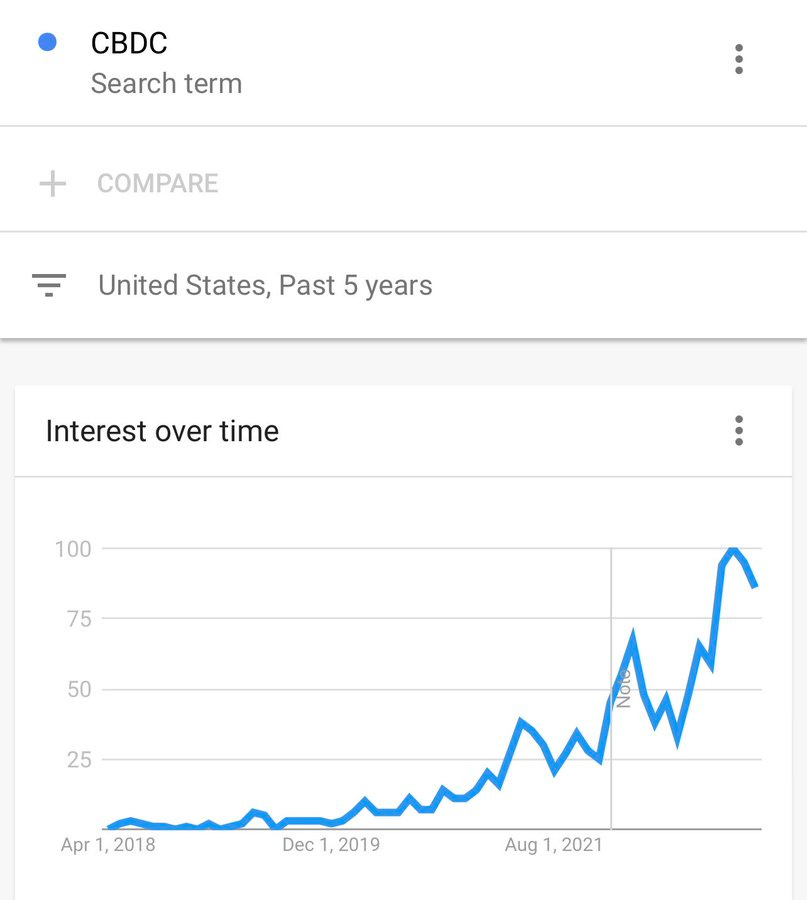

US Google search metrics below for “CBDC” over the last 5 years.

As of this writing there are 100 countries (95% of global economy) actively working on CBDC developments involving 90% of all central banks, the BIS, IMF, and World Bank developing CBDCs. All G7 nations, and 18 of the G20 are developing CBDCs.

11 countries having already launched a CBDC, 17 are in pilot, and 33 in development. Developing CBDCs dates back to 2014 with the BIS and IMF. The uptrend began around May 2020 where only ~35 countries were even considering a CBDC.

Fast forward to today, and the Bank for International Settlements oversees 15-20 CBDC projects across dozens of central banks.

The OMFIF (Official Monetary and Financial Institutions Forum) Digital Monetary Institute projected that out of all 100, almost a quarter are expecting to launch within the next one or two years. By the end 2023 another 15 - 20 CBDCs are expected to move toward a pilot. More than doubling the number of projects in pilot at this very moment.

See below for a snapshot of the current level of global development for CBDCs. (Filtered to view for active projects)

Ending 2022 the last CBDC to launch was Jamaica’s JAM-DEX and India’s major Digital Rupee pilot. Since then much progress has occurred in the high stakes area of CBDC developments. Looking ahead for the rest of 2023, you can expect more CBDC pilots. Australia, Russia, Brazil, Japan, and Thailand have all announced a pilot for this year.

US CBDC

The US, since the release of their Crypto Executive Order shifted the US toward the direction of a US Digital Dollar. The CBDC is an issue that has been receiving an overwhelming level of bipartisan support

Last year, Aug 2022 (~8 months ago) Rep. Maxine Waters (@RepMaxineWaters, D-Calif.) and Rep. French Hill (@RepFrenchHill, R-Ark.) announced support for the U.S. to launch its own CBDC in order “to counter other nations” (Hint: BRICS Nations) in order to reinforce the USD as the reserve currency of the world.

Both Hill & Waters serve on the House Financial Services Committee. Waters has referred to the efforts to launch a central bank digital currency (CBDC) as “a new digital assets space race.”

The term space race refers to the urgency to develop of CBDC from a central bank/government perspective.

You can find times dating back to 2020 when Jerome Powell mentioned the need to develop a CBDC, or risk the USD losing it’s place as the world reserve currency.

Today, BRICS nations (Brazil, Russia, China and South Africa) are leading the charge of the de-dollarization efforts among nations. US sanctions as an economic weapon being one primary reason, but this process started long ago during the non-stop quantitative easing after the 2008 GFC.

The advantages of CBDC bringing enhanced portability and potential to spread certain central bank’s operations concerns many nations like the US. This new ambition by BRICS nations poses a major threat to USD dominance. Enemy number one being China’s Digital Yuan, eCNY. (More on this subject later)

“The digital dollar may be a necessary defensive move.”

The Federal Reserve Board of Governors (Jan 2022)

US Project Cedar

As a response and an act with major urgency, the US officially moved the digital dollar into development via Project Cedar in Q4 2022. This is adding to the list of a number of Digital Dollar projects such as Project Hamilton and The Digital Dollar Project.

The NYIC, New York Innovation Center, is leading Project Cedar in its development. The NYIC is a collaboration between the Federal Reserve Board of Governors, The NY FED, and The Bank for International Settlements. Other notable partners of this project are: BNY Mellon, Citigroup, PNC, TD Bank, Truist, U.S. Bank, Wells Fargo Mastercard and SWIFT.

Phase 1 of Project Cedar was launched in November 2022 this officially moved the US from researching to developing CBDCs at full scale. The project started to improve cross-border payments (the primary use for Wholesale CBDCs) after the 12 week experiment to test how DLT (distributed ledger technology) enhances cross border payments.

The testing demonstrated foreign exchange spot settlements finalize in less than 10 seconds, as opposed to the current international wire taking multiple business days. Distributed Ledger Technology (DLT) and the propositions of wholesale CBDC proved to be an early success in the multi-phase project.

Phase 2 is designing for an enhancement of settlements for cross-border transactions through atomic transactions and hash time lock contracts (HTLCs).

Short explanation of each below:

Atomicity: means that multiple operations can be grouped into a single logical entity, and other threads of control accessing the database will either see all of the changes or none of the changes.

The point here is to make transactions “atomic” so different transactions don’t disrupt each other, especially if you’re working across networks. A different number of networks can be included in a single transaction when working cross-border transactions. What enables this is the feature of hashed time-locked contracts.

Hashed-Time-Locked Contracts: a special feature that is used to create smart contracts that are able to modify payment channels. Technically, the HTLC feature enables the implementation of time-bound transactions between two users. In practice, the recipient of a HTLC transaction has to acknowledge the payment by submitting a cryptographic proof within a specified timeframe (number of blocks). If the recipient forfeits or fails to claim the payment, the funds will be returned to the original sender.

These hashed-time-locked contracts are used to allow swaps to take places across different chains. Regarding wholesale CBDC cross-border transactions the protocol can be used to manage both parts of the transaction across networks.

EU

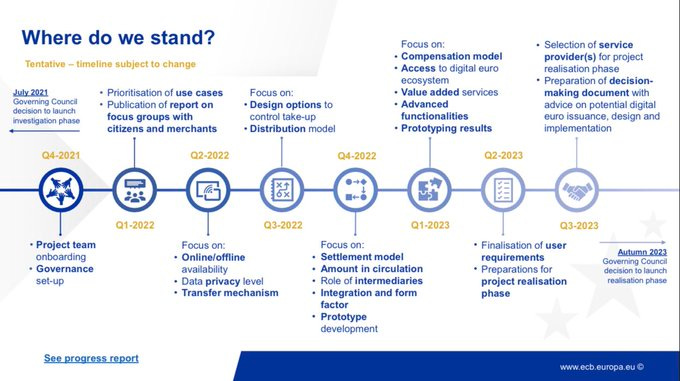

An updated timeline for the European Central Bank CBDC, the Digital Euro, released. Their work on a wholesale CBDC with Project Stella in partnership with the Bank of Japan has been a long standing project dating back to 2016.

When the ECB released the International Role of the Euro in 2021, Christine Lagarde (Head of ECB), announced her and “several EU officials” expect to see a Digital Euro official launch within 5 years.

The recent updates from the ECB show the Digital Euro Retail CBDC pilot could be released by Q4 2023.

Last September the ECB announced a partnership with Amazon to help develop the infrastructure and design of the Digital Euro. Expectations are for a big announcement in October pertaining to their plans to move into the next phase as you can see below.

Prototypes are actively being developed for an interface for the retail digital euro. ECB President Christine Lagarde, following the announcement of the Amazon partnership, stated that legislation for detailing privacy features and the legal status of the digital euro will be released soon.

Japan

The Bank of Japan (BoJ) announced a pilot for the Digital Yen which is set to launch in April. This is massive news as Japan is predominantly a cash based society. Massive implications to consider as this applies the pressure to the EU, UK, and the US.

The central bank’s plan is to run the digital Yen pilot for two years and then decide whether to move forward with a Digital Yen launch in 2026

Russia

We are now less than a month away from a pilot. Back in October of 2020 the Bank of Russia released the consultation paper, A Digital Ruble, discussing the motives for launching a CBDC. The biggest reason: Digital Ruble would also enable them to be less dependent on the USD giving them a chance to mitigate the economic sanctions. (2020)

Now the BoR is officially launching their Digital Ruble Pilot on April 1st for their Retail CBDC. The pilot involves 13 other banks as part of their initial large “test run”. to run involving some parts of the economy with numerous merchants for retail to use it P2P and to interact with merchants.

“The digital ruble platform is a new opportunity for citizens, businesses, and the state. We plan that for citizens, transfers in digital rubles will be free and available in any region of the country, and for businesses, this will reduce costs and create opportunities for the development of innovative products and services. The state will also receive a new tool for targeted payments and administration of budget payments.”

- Olga Skorobogatova, First Deputy Chairman of the Bank of Russia.

According to their central bank, 2024 is expecting a full scale CBDC launch, and an offline application for the Digital Ruble in 2025.

India

Originally proposed in 2017, the Digital Rupee just launched back in Q4 2022. Earlier in 2022 the Reserve Bank of India (RBI) listed their motivations for aggressively developing both retail and wholesale CBDCs in a paper to the Bank for International Settlements in November.

Those reasons and motivations were: Removing the burdens and cost of storing, printing, transporting, and using cash & the widespread adoption of crypto. India has been notoriously hostile toward crypto.

The most recent CBDC pilot launch came from India on Dec 1, 2022 when the Reserve Bank of India (RBI) followed the launch of their Wholesale CBDC pilot from November with their new Retail CBDC to end the year.

(Note: Wholesale CBDC launches normally precede Retail CBDC launches.)

Nigeria

Governor of the Nigerian Central Bank, Godwin Emefiele, states the goal of the eNaira:

“The destination, as far as I am concerned, is to achieve a 100% cashless economy in Nigeria.”

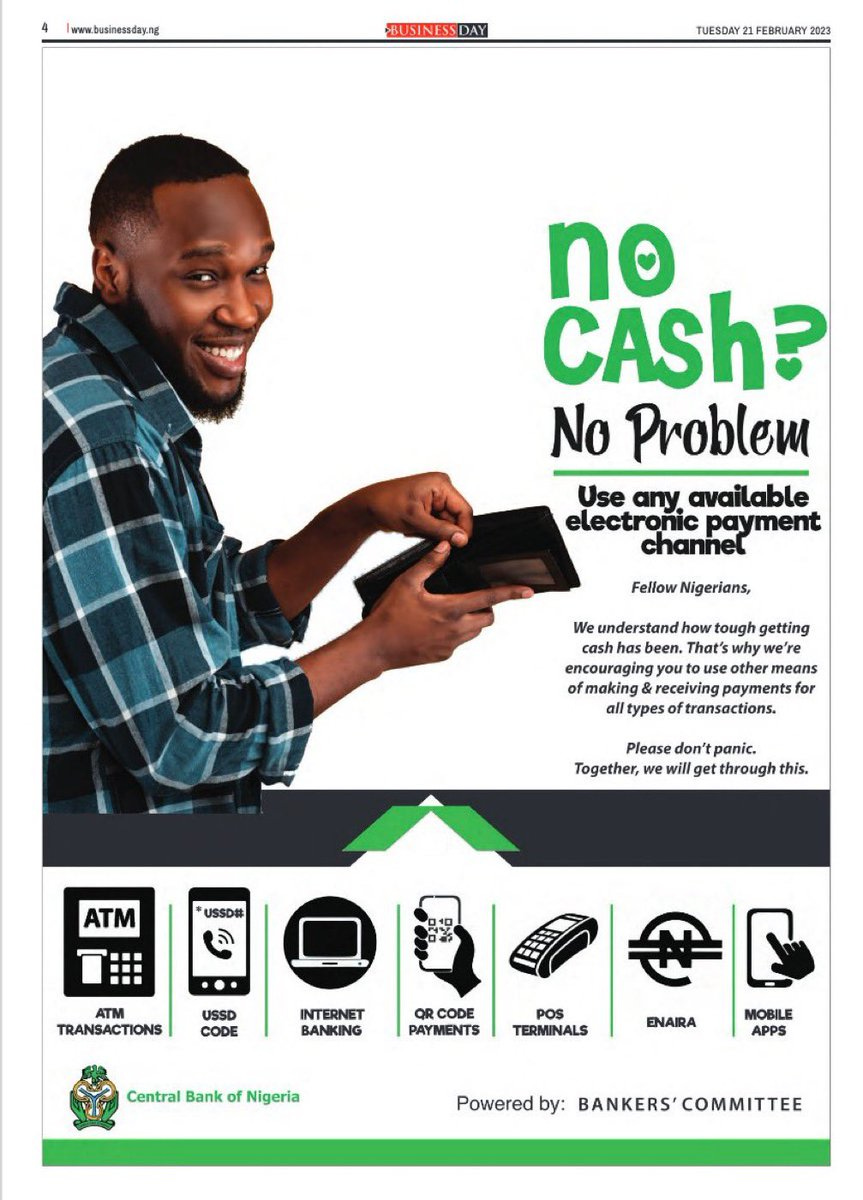

It has been over a year since the eNaira launched and adoption has been less than stellar. October 25, 2021. End of 2022 estimates show approximately only 0.5% of Nigerians have used the CBDC or opened a SpeedWallet account with the Central Bank.

The citizens began adopting crypto more so during the last bull run cycle after crypto caught their attention. During the same time they continued to lose trust in their currency as the central bank estimates the eNaira has depreciated against the USD by 25.97% since Jan 2022.

Regardless of the benefits the central bank tried to provide for eNaira adoption, the citizens still had no interest or education of the eNaira. By August 2022 there was only ~$10M (measured in USD) in total transaction volume. As a comparison, that same year Nigerians conducted ~$30M in ATM transactions. A failure of a launch, and as a result of this the Nigerian Central Bank went on the offensive.

On February 15 the central bank declared “old” 2022 dated 500 and 1000 Naira bills to be considered expired regardless of the original “swap out” of old bank notes that took place in Q4 in 2022 to help support the economy.

This triggered cash shortages causing the government to respond by placing ATM withdrawal limits equal to $45 daily, or $220 weekly. Clearly this wasn’t malicious in nature, right? Despite all central bank efforts leading up to this, and the ban of financial institutions involving themselves in crypto?

The central bank isn’t giving up any time soon though. CBN is now partnering with R3 to revamp their launch. R3 is one of the big names in CBDC developments and one who is popular with the BIS. Their CORDA platform played a pivotal role in the success of the BIS’s Project Dunbar.

Quick Primer on Corda

Corda is a Permissioned Distributed Ledger Technology (DLT) platform, designed by R3. The platform is specific for financial institutions. The Corda platform provides very basic transaction confidentiality, even on peer-to-peer transactions. Any regulatory body will be able to identify data and information present. Corda design is to provide “full transaction lineage”.

Corda also has a service on the network that locates and identifies the identities of nodes on the network, reinforcing oversight of the network. The service is fully centralized, regardless of their attempt to build “CordApps” for “decentralized applications”. (There is no such thing as a decentralized CBDC)

Interviews for the eNaira

I had the pleasure of interviewing two local Nigerian citizens to gather first hand insight into the experience and perspective of what it is like to live with a central bank enforcing adoption of their CBDC.

Here are major takeaways from my interviews with Oluwasegun Kosemani and BowTiedNaija:

The lack of education and comfort is the number one reason why people have yet to onboard themselves to the eNaira. This same reason applies to other CBDCs like the Sand Dollar and Digital Yuan. Even though eNaira CBDC applications are much easier to use than current banking applications.

Private and commercial banks in Nigeria are being “kicked to the curb” while the central bank launches the eNaira. The central bank is effectively creating “new rules for interoperability” with how the CBDC wallets are designed. A simple API would have sufficed for onboarding users. Instead, users have to create their own accounts separate from their bank accounts, creating a “disconnection”. The opposite to how China launched the eCNY pilots. The Central Bank of Nigeria (CBN) is enforcing adoption rather than incentivizing it.

There is a tiny circular crypto economy forming in Nigeria with crypto being considered the “top of the food chain” by both interviewees. “The Crypto ban was a massive failure.” - BowTiedNaija

“Crypto opened our perspective, the last bull run attracted many adopters, there is currently BTC proliferation, BTC is perceived as a store of value…and, if bitcoin adoption is 10X larger than eNaira adoption, stablecoin adoption is easily 10X larger than BTC adoption” - Oluwasegun Kosemani

Exchange rate hurdles are easier to navigate with stablecoins. Naira exchange rate has been difficult to navigate for us.

Nigerians are HEAVY Binance users, it is their preferred exchange. USDT is the preferred stablecoin for Nigerian crypto users.

Like Canadian Emergencies act, there has been problems with banks shutting down user accounts over protesting. Nigeria preceded the actions and Canada followed because of the success Expectations are this is to come to the eNaira within the next few years.

Conclusion

In the end it will be Crypto vs CBDC (BowTiedScholar Opinion)

CBDCs are already struggling with adoption. Crypto is outperforming globally, and locally when compared to launched CBDCs in their respective jurisdictions. If anything, CBDCs are the biggest reason for crypto.

If you care to extrapolate out the projections for pilots and launches, it seems the answer is a world where it is Crypto vs CBDC.

Central banks are already competing against each other for CBDC dominance. You and I can open up Digital Yuan wallets today and open up accounts and buy the eCNY. Which is pre-existing competition for the Digital Dollar, Euro, Rupee, etc.

We are entering into global competition of digital currencies. Ending with the choices being crypto and CBDC for individuals and governments. Central banks are building out infrastructure to onboard millions/billions, globally.

Crypto currently is, and will continue to be, a decentralized check in power against CBDC centralization. Thus posing the biggest competition to CBDCs. CBDCs have already begun the competition against one another to grow central bank operations/oversight.

They must also compete against crypto, which already has a lengthy lead, better ownership/property rights, and able to be used for anyone and by everyone 24/7/365.

In the end, the recent fallouts of the banks like Silvergate, Silicon Valley Bank, and Signature Bank introduce many implications for a quicker rollout of a CBDC.

Why? One of the primary features of a CBDC eliminates the third-party risk of events like bank failures or bank runs. Any risk that is left remains with the central bank. That pretty much sums up the path forward from here. Be glad you found this corner of the internet.

Thank you for reading, and again special thanks to BTB for the guest post. Follow me on CBDC Watch for my newsletter for regular CBDC news and updates. You can also find me on Twitter.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money. At 10,000+ Instagram follows we will publish some city guides ranking each region we’ve been to.

Great article Scholar!

A potential scenario of the future "co-existence" between CBDCs and crypto (BTC for the example, given regulatory uncertainty):

- Most nations, even those that are crypto-friendly, implement a CBDC as it becomes the only way to buy and hold foreign reserves (no idea how you'd move the entire FX market into adoption but less imagine it happens) -> you want to hold in your reserves tokens from the most productive/stable nations, to buy you need to use a CBDC as well.

- Most western nations ban any on/off ramps platform to get crypto from a CBDC (we're going in that direction). Perhaps they allow only BTC/ETH to allow for taxation + tracking of anyone offloading their wealth into their nation token.

- Small crypto-friendly and African+Asian nations allow for a wider use of on/off ramp mechanisms as they see the benefit.

- Hence North Americans and Europeans choose to have a % of their wealth allocated in Asian CBDCs, as it allows them to bank and access the crypto market.

- The consequence? US, CA and EU CBDCs become devalued in the FX markets. Two courses of action are considered:

1. Banning EU, US citizens+businesses from holding any Asian CBDC, which leads to a currency war as Asian nations retaliate, further accelerating the demise of the US/EU axis.

2. Allowing again the on/off ramps to crypto, attracting more capital and industry.

One way or another, Banks go to Zero, Orange Coin wins.

I never thought of it as Crypto vs CBDC, its been more like CBDC are the flip side of CRYPTO. I've always believed CRYPTO was introduced to the masses as a way to to lead to the adoption of CBDCs.