Countries Competing for Crypto and New Incentives

Level 2 - Value Investor

Welcome Avatar! For people with any social media application, you heard the news: Trump is publicly endorsing Bitcoin and Crypto. Before anyone gets upset about this, we don’t vote and don’t really care about the winner of the US presidential election.

We’re looking at this purely from a “why?” standpoint and future implications. For those that think this is a change of heart, we’d disagree. Politicians are changing purely based on votes and this will lead to *global* policy change as well.

Part 1: Quick History

Prior to the 2020 election, this was the original stance for Trump. Coincidentally, 2019 was not a bull market for Crypto as prices were well below the 2017 highs.

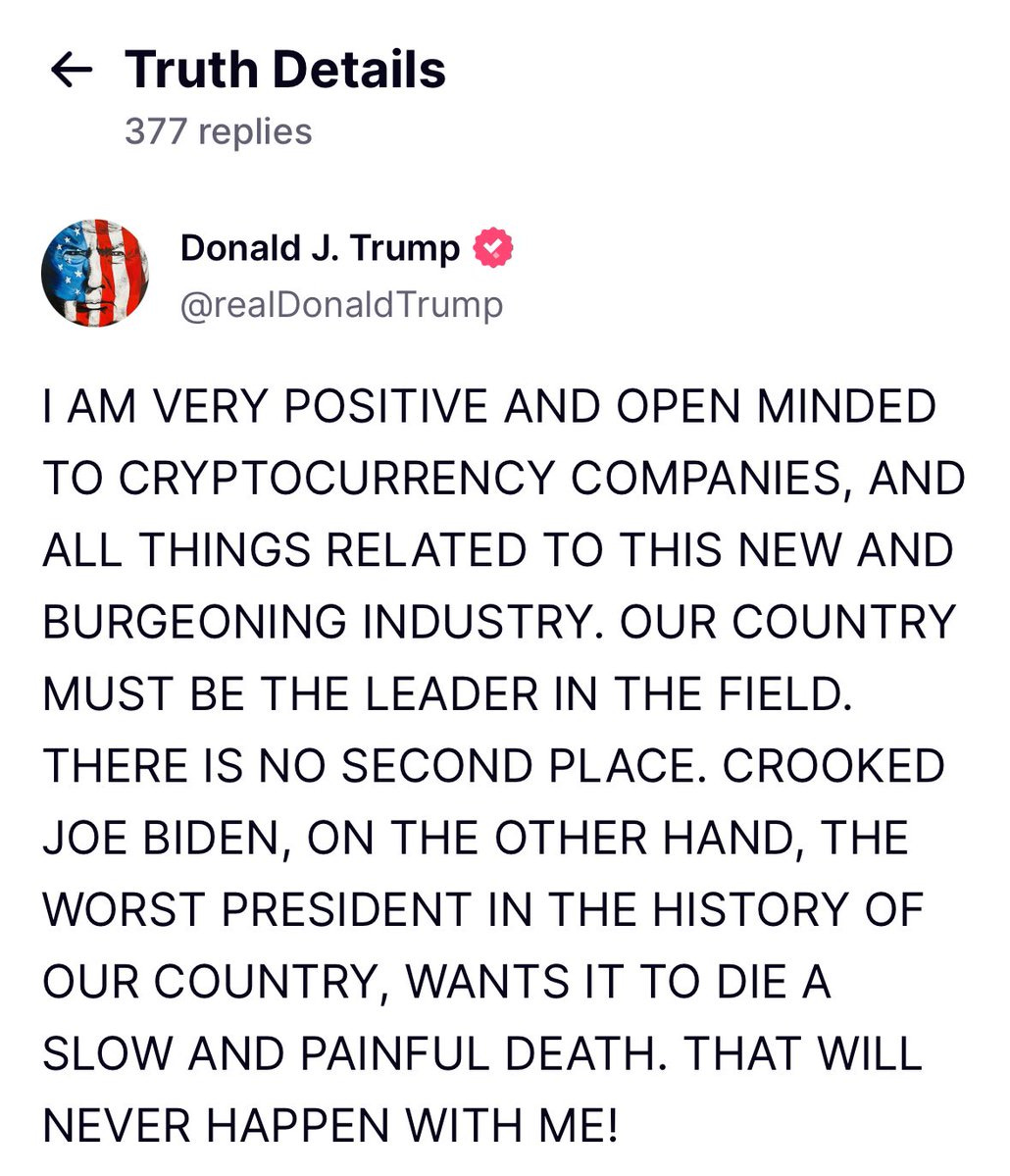

Now he has changed his tune dramatically to the following:

Up until the last couple of weeks, no political party would come out aggressively for the crypto industry. This is because it was not big enough to move the voting block and a large number of people had lost their life savings investing in various scams (ICOs, outright hacks, project rugs, celebrity coins, Mt. Gox… Later on FTX, Celsius, BlockFi, Voyager… you get the idea)

It wasn’t exactly a good idea to align yourself with an industry full of scams. We don’t have the full history on it, but would be interesting to see what happened during the elections as it related to the internet, also rife with theft and degeneracy. (examples were: Communications Decency Act and the Digital Millennium Copyright Act)

What Changed?

Simple really. Price.

If BTC was at $8,000, ETH was at $800 and SOL at $10, we can pretty much guarantee no one would care about crypto. While people claim to be about tech, decentralization and white papers, the reality is that price is everything.

Since price is up into the election, politicians realize that an attack on crypto is an attack on their economic well being (in the eyes of any crypto holder).

Will This Work

Yep. Pretty sure it will. People will claim that it is not important to them but you’re seeing a lot of people who were pretty neutral politically flip to “will vote for him based on crypto alone”. This is the equivalent to buying votes.

Also. He timed this perfectly with the ETH ETF approval.

If you say that it was politically motivated (the change of heart) you’re saying Trump moved the needle!

If you say they were going to do it anyway, you’re stuck looking at the latest commentary from the left which looks like this.

Not great.

Part 2: Implications

Now onto some of the second derivative implications.

If it is politically intelligent to be positive on crypto, that will impact *much* more than just the USA!

Imagine sitting in Asia, Europe, South America or the Middle East (any country is fine). You see that the USA is moving towards a pro-crypto policy to keep innovation stateside, what should you do with your own policy?

Our working assumption is that you’ll see a big push forward from Asia and Europe towards creating a more open framework for investing in crypto. You’ll likely see more ETFs/ETPs.

Example below (Source)

In addition to this, you’ll likely see people loosen up their policy as it relates to onboarding onto *centralized* crypto exchanges like Coinbase/Kraken etc. While we bet it’s hard to get large sums of money onto a cold wallet, buying/trading on a CEX is likely going to loosen up. Particularly in a place like Canada where there are limits to transfers.

It has only been a few days and yet we’re already seeing articles that suggest countries are taking notice. Here is one from Korea. A country notorious for being degenerate gamblers (if bored look up the history of gambling in Korea!)

As you can see, directionally speaking, you’re seeing a shift towards more ways to acquire crypto. The doors that are opening? Highly regulated.

It is surprising that this hasn’t happened earlier. The US and any other intelligent government would *market* these types of products. If the majority of the coins are held by US entities you don’t have to worry about it being a threat to financial stability. Since it is owned by your financial institutions in the first place.

This trend is a net positive for the USA. Assuming ETH demand is even 15-25% the amount relative to BTC, it will be a home-run success.

Part 3: Separation of Trading Patterns and Incentives

Now that we’re going to have two clear crypto ETF winners (ETH and BTC) it’s much more likely that they trade extremely differently when compared to the rest of the industry. While purchasing in a brokerage may not mean much to the majority of you (already involved for years), it is a mega deal for the old timers (BlackRock, Wealth Managers etc.).

If you think about their incentives, they *need* the price to go up. While we can all debate on how much the prices go up from the launch (BTC is already up 40-50%) they don’t want to kill the golden goose. This is a massive fee generating machine for them.

Number Go Up Tech: Hate BlackRock or love them, it simply doesn’t matter. They are going to generate number go up technology and will do their best to make sure the entire ecosystem around BTC and ETH flourishes.

If you believe all of this is happening while Circle intends to go public (source), we’d say… Think again!

Once financial institutions realize they can create a stable coin on ETH that pays 0% interest while generating 5%+ in interest, they will begin building in that direction. That is what Circle represents. It is just a bank on-line with no overhead costs. Hold 100s of billions of dollars in a bunch of T-bills while having degenerates trade crypto coins for stables that generate 0% yield.

Part 4: Enjoy the Good Times

Enjoy this while it lasts. From what we’ve seen retail is still not here. The majority of people don’t even care about crypto, they view it as something that happened back in 2021.

You now have a large number of headaches turning into tailwinds: 1) people now know unstaked ETH is a commodity, 2) large investors don’t have to worry about compliance issues when buying an ETF, 3) buying and selling of BTC/ETH is much easier as you don’t have to worry about your bank freezing your account - this is a major concern for Boomers, 4) other countries need to lean politically positive and 5) green lighting a clear regulatory framework will happen faster - in government terms of course - which will allow large investors to feel comfortable supporting smaller projects.

If you’re not involved for this cycle we’re not sure what else to say. There is very little opportunity outside of tech/crypto and potentially sales. Probably a good idea to get exposure before politicians like Nancy begin to trade them.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

Are we on track for a 8K to 12K ETH and 100K BTC this year? With all these tailwinds supporting the industry?

Hey Bull, been reading & re-reading Efficiency since early 2023 while I was in college.

Graduated this January, hit 5-fig/mo with WiFi money this April.

Consulting business model so probably not sellable in the future.

I'm new to crypto, don't have more than like $10K worth of it.

What would potentially be a smarter move?

A) Scaling consulting biz further, profits into crypto

B) Consulting profits into Ecom Biz, scale, sell & push Ecom profits into crypto

As stated above "If you’re not involved for this cycle we’re not sure what else to say" I have a massive FOMO ngl but don't want to end up making stupid decisions. Does it make sense in my situation to "get exposure before politicians like Nancy begin to trade them."

Thanks!