Doomsday Crypto (Computer Coins) Planning - Russia/Ukraine

Level 1 - NGMI

Welcome Avatar! As mentioned we’re putting together a newbie guide to computer coins. Unfortunately, the world changed dramatically over the past few days (for the worse) so it is better to share this information now. Many of you will already know the basics but the importance of this post is no laughing matter. If your coins are on an exchange you don’t actually own any crypto. The only reason for holding coins on exchange is if you need a certain amount to trade/convert to US Tokens rapidly.

Russia/Ukraine: Before jumping in, we don’t know enough about what is happening in Russia/Ukraine. All we can say is that it is absolutely terrible for *civilians of both countries* (emphasis on word civilian - person uninvolved). Before someone jumps in the comments and says we’re defending war we’re not. We’re anti-war as it is a brutal thing particularly with the advanced technologies available today.

What we’re referring to is this:

Someone in Ukraine lost their parent/spouse/partner

Someone in Russia who simply works as a waitress just lost access to all of their financial assets (locked down). This individual has a high chance of being against war in the first place as well

Someone in Ukraine can’t get money through the traditional system due to disruptions in the traditional system

If the above does not show the true value of crypto nothing really will. BTC and ETH was raised without an intermediary for the country of Ukraine. It was an actual life saver. You could leave and still have money on your smartphone/stored in your brain. You can’t even cross borders with bricks of gold that would be confiscated immediately.

In short, everyone in Ukraine/Russia got an instant realization that crypto has value. Also. Elon Musk proved with Satellites (Starlink) that you can even have the internet go down on the ground without losing service (insane initiative from Musk)

Before moving on, while we focus on tech investing and crypto, we’d say there are more important things than money - remember that.

We got a request to walk through storing crypto so we’re doing a detailed post now since the timing is correct. Get your coins off exchanges!

The Basics

The entire point of crypto is to exit the traditional financial system for the new decentralized financial system. In the secondary system, you are only in control of your funds if you have the “seed phrase”. A seed phrase is a set of words in a particular order that unlocks your wallet/addresses.

Instead of complicating it, “not your keys, not your coins” means that all of your BTC/ETH/other coins on an exchange (Coinbase/Binance etc.) can factually be bricked. It is because you do not actually own the asset, it is held by a third party. This is effectively a “bank” for your coins.

Note - even the CEO of Kraken stated the above facts publicly (in different words).

At this point you have to look at some options. No matter what we write here people will disagree. If you’re looking for intense security check out one of our paid posts. Also. Check out the VPN article.

Staggered Wallets/Addresses

First Option (<$5,000): If you have around $5,000 or less in crypto (0.1 BTC or 1.5 ETH or so), you can use a “hot wallet”. While this is not perfect by any means, the cost of buying a $100+ trezor/ledger just doesn’t make a lot of economical sense. You can download a hot wallet onto a secure computer with a few simple buttons. An example of a hot wallet would be something like Metamask for your personal computer or an app such as Copay on your smartphone.

Note: even if you have a ton of money in computer coins, it still makes sense to have some money in a hot wallet. Worst case scenario you always have a few coins if you need to send money and one of your apps like venmo gets bricked for some reason.

Second Option ($5,000-$35,000 US Token): At this point, you should invest in a hardware “cold storage” wallet such as Ledger/Trezor/Cold Card. Notice, we’re being pretty loose here because at this level the additional security is likely “enough”. While some will argue that Ledger has better security, for something in the $20,000 US Token value range… all of these are “good enough”.

Note: If you have say $25,000 then you’d keep say $4,000 in your hot wallet and $21,000 stored away on a hardware wallet.

Third Option - Spread ($35,000-$200,000): At this point it isn’t good enough to have everything on a single hardware wallet. You probably want around 2-3 of them. For example if you have 1 BTC and 20 ETH, you could put the BTC on one hardware wallet and the 20 ETH on a *different* hardware wallet. Once again, all three options are “good enough” for 99% of people. Also. You should begin managing your seed phrases intelligently and it would likely be wise to either physically engrave the seeds or purchase a CryptoTag (fires/floods/physical damage to a paper card is not something you want to deal with).

Note: We’re now entering into “significant money” territory. While we realize our audience is wide, it’s tough to say that $60,000 is not significant for most people. $60,000 is enough to live a decent life for a year in many countries and cities so we doubt you’d want to put that money at risk on an exchange/PC hack.

Fourth Option - Spread and Lock ($200,000-$999,999): Here we’re officially in the grey area. You can jump straight to the >$1M US Token security, or you can continue with option three with a few changes: 1) have a separate computer for crypto vs. personal, 2) have multiple types of cold storage scattered with various items holding phrases - physical engraving or locked devices - use imagination and no a “bank safe” is not smart and 3) you can remove the WiFi capabilities/internet capabilities from the computer holding your coins on the PC.

Note: at this point there is no way to claim this is a small sum of money. You should have multiple wallets, multiple seed phrases and multiple ways to protect and remember your keys.

Fifth Option Managing Security with Gnosis Safe for Wallets >$1M

Resident Security Expert BowTiedIguana has suggested Gnosis for the $1M+ category. The below is covered by him.

Gnosis Safe is a formally verified and battle tested smart contract multisig wallet trusted by leading protocols to secure their treasuries. Gnosis Safe supports ETH, ERC-20 (Tokens) and ERC-721 (NFTs). Note: ERC-1155 NFTs aren’t currently supported.

The main feature is the ability to require multiple devices to confirm transactions (hardware wallets, EOA-based wallets, paper wallets, or a combination of them).

For example, you may require 2 signatures from any of the following 5 wallets to approve a transaction:

Metamask wallet on a computer which is only used for signing transactions

Two hardware wallets (different brands: one stored at home, one elsewhere)

A seed phrase stored on a CryptoSteel and buried somewhere on your property abroad

Autist note: this is known as a N of M multisig - you should always have more than 1 device required to sign (N > 1), and you should always have more signers than the threshold (M > N) so you can access your funds even if one key is lost or temporarily unavailable.

For normal use you can approve transactions with your metamask plus one hardware wallet. If your house burns down you can recover from your second hardware wallet stored offsite and a CryptoSteel stored abroad. Here is a simple article from Gnosis explaining common safe setups.

Estate Planning

You can give one key to your heir (perhaps on a hardware wallet) and store a second key in a bank safe deposit box. Neither your heir acting alone or anyone who opens the bank safe deposit box can spend your funds without a second key. When your will is implemented, your heir will receive the second key from the safe deposit box and can then approve transactions.

You can create multiple Gnosis Safes for each beneficiary of your estate. You could also use time locks and vesting smart contracts to ensure that your heirs receive their gifts either gradually or when they reach a certain age.

Overview of Gnosis Safe’s security

Million dollar bug bounty running since July 2018

Audited: each major version of Gnosis Safe has been audited by G0 Group, for a total of 3 full audits. No issues were found in the most recent audit (May 2021)

Formally Verified by Runtime Verification, 27 February 2019

Insurance: Nexus Mutual will insure up to 4,000 ETH or $11m DAI against a bug in the Gnosis Safe smart contract for a premium of 0.8%/year

Battle Tested: First hit $1b value of ETH stored in Gnosis Safes in August 2020

46,702 Gnosis Safes created on Ethereum

432,455 transactions processed on Ethereum

$68.8b value of ERC-20 tokens stored in Gnosis Safes on Ethereum

$107b total asset value secured by Gnosis Safes (all chains)

Compatibility

Gnosis Safe works with all major wallets and can be deployed on Ethereum, Arbitrum, Polygon, and Binance Smart Chain.

Costs

Gnosis Safe is cost effective for seven figure wallets. A typical fee would be 0.04 ETH (~$120) for a vault with 4 signers. Gasless signatures mean that only one signer needs to have an ETH balance to pay gas, and there are plans to upgrade Gnosis to allow gas costs for transactions to be paid from assets stored in the vault.

Protocols

Gnosis Safe is working with Consensys on enterprise grade custody solutions.

Leading DeFi protocols like Yearn, SushiSwap, and many others use Gnosis Safe contracts for their treasuries.

How to Use

Please consult the official documentation and ensure that you understand all the details and make test withdrawals before depositing a large sum to your safe. When dealing with high security measures, it is best practice to follow official guides and documentation, which is why we are linking it here.

Sources

Dune Analytics https://dune.xyz/tschubotz/gnosis-safe_2

Gnosis Safe statistics

Latest G0 Group Audit

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

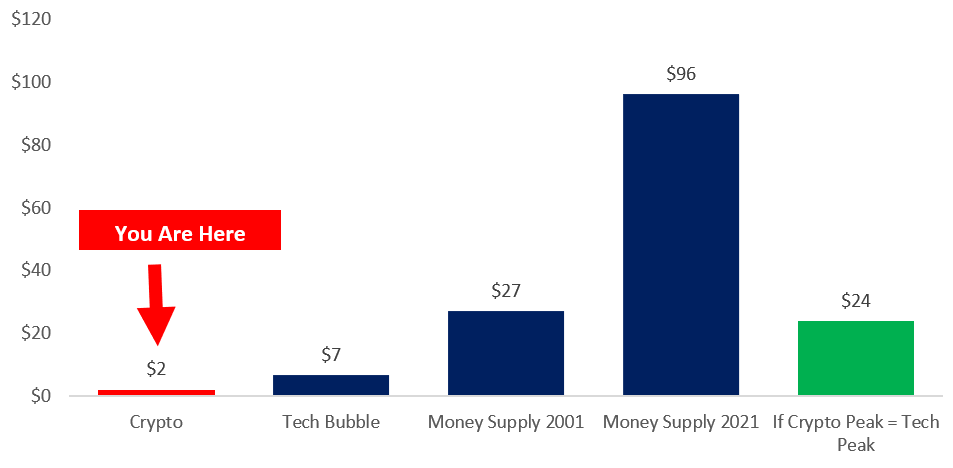

You’re Early: Remember that you’re early. If you need to zoom out see our post here on Crypto versus the Tech bubble (which was only the US stock market).

Below Chart in $Trillions of US Tokens

Money is basically just an accounting journal entry in a computer. SWIFT is just a computer messaging system. What's more likely, Russia just ceases to exist as we now know it, or they set up their own SWIFT-like system (perhaps blockchain based) with China and neutral countries? India and Brazil, plus the Gulf states, seem to be staying out of this fight. Consider that even freaking ISIS was able to sell oil in the 2014s, completely illegally on the black market but still sold. Russian oil isn't going anywhere, and Russia will come up with a method for people to pay for it. SWIFT is giant shot to hit Russia with, but it is a shot that can only be fired once.

All of this is just an observation and analysis, not an endorsement of any faction.

tl;dr, expect more crypto and blockchain adoption.

Has never been a bigger advertisement for the need to self custody then now. I am making it a daily exercise to remember my seed phrase.