Five Lies That Can Ruin Your Life

Level 2 - Value Investor

Welcome Avatar! Today we’re going to cover bunch of lies that you were taught. Many of these can ruin your life and they include: 1) needing to give back *before* you’re successful, 2) the belief that your body cannot take more pain in your 20s/30s, 3) the “safety” of bonds/investing, 4) never quitting anything and 5) how/when to work with someone vs. by yourself.

Lie #1 - Giving Back: This concept is drilled into students in College. We know. We went to a “Prestigious University” where we were forced to take classes on Ethnic Studies “Racial Triangulation”, Gender Studies and nonsensical classes like Econ 101 - where you learn that the first theory is wrong… people are not rational.

During your time you’re told that you need to “give back” and many people are tricked to go into the Peace Corps, Teach for America etc. This is the worst possible thing you can do if you are talented. There is no debate here. If Bill Gates or Steve Jobs decided to go and burn 2-3 years of their lives - Microsoft and Apple may not exist. This would cause massive geopolitical changes (not just economic) as the largest computer companies might not even be American! Absolute disaster to not be a a leader in technology.

Also. If you look at the bigger picture, if you can create 100,000+ jobs which feed 400,000+ people and donate *billions* of dollars to fixing problems like world hunger etc. Who had the larger impact? The guy who is physically delivering stuff for a couple of years or the person who employed 100,000+ people to deliver goods and services (also paid for the goods and services). It isn’t debatable.

Therefore, if you want to get rich you can get rid of that first excuse. You don’t owe anyone your time. You owe it to society to become a producer. In fact, if you have the skills to become a producer you’re doing society a *favor* by being selfish in the *beginning*. You are going to create jobs and opportunities for other people. You owe it to yourself and to the country you live in to become a successful individual. That will generate the most value for society over the long-term. No matter what the blue haired ladies tell you.

None of these people used three years of their youth to join the Peace Corps. They donate billions and hire people to do that for them instead.

How This Can Ruin Your Future: If you spend three years out in a small country doing volunteer work, someone else is working 100 hours a week to build a business. Giving competition a heads up of even 1 month is huge, let alone three years. By taking a “gap year” or more, you’re radically changing your options in a bad way. In the beginning you want to choose doors that create the most options (other doors). If the first door you chooses reduces your options, that is generally not a good move.

Lie #2 - “The Best Years of Your Life”: If you want to believe this lie, you will be set back for decades. Your 20s are not the best years of your life. If you live life correctly the general path should be: 20s pain and suffering, 30s tons of excitement change and income, 40s repeat 30s but your body slows down a bit and then 50s = do whatever you like.

Now the biggest trap is all the commercials you see about partying and drinking in your 20s. People think that this is how life is supposed to be. It is not. The same people who spend their 20s chasing girls and alcohol will be the first to admit they should have gotten their finances settled first. It’s cool to be the backpacking hostel dweller at age 20. It isn’t cool at age 30.

Think this through. If you believe that your body can drink and consume drugs in your 20s why wouldn’t your body be able to handle long working hours and stress? In fact the long working hours and stress is a lot less damaging when compared to alcohol and drugs. No one wants to hang out with the boring Aspie who never goes out but if you’re partying to a point where it is *damaging* your future, you’re making a life changing mistake (in a bad way).

If you look at studies on alcohol and health, you find that rich people are the ones who are not *as* impacted by alcohol. Why? They have less stress. For a while there were scientific studies that said 1-2 drinks a day didn’t matter. Until they controlled for wealth and realized that was a the differentiator. So. Which side of the equation do you want to be on. The side that can have a drink here and there because you’re wealthy and stress free or the stressed out guy who is reducing his life expectancy.

Ask yourself this. Is it worth it to be stressed out for 3-4 years in your 20s to be stress free from age 30+? Don’t worry about your health as long as you’re working 60-80 hours a week (not going nuts at 100+), you will be fine after a few years of suffering. People in third world countries don’t even have the opportunity to suffer and succeed. Don’t waste your youth.

As a positive pause here, it is true that earnings should increase for you over time. That said, the world is changing rapidly and if you save/invest money early you can increase the *slope* of the earnings increase. Do you want to earn 2x what you made at age 25 or 20x? There is a huge difference. (Graph below from Financial Times citing PayScale). Also interesting to see the decline in earnings becoming sharper (industries disrupted, early retirements etc.).

Roughly, the average person earns 2x what they made at age 22 by theirs mid- to late- 40s. If you decide not to party and waste years of your life, we’d bet you can do 10-20x or more.

How This Can Ruin Your Future: While you can start a business at any time, starting when you’re young is always best. Think of your life as a growing ship. At age 20 you’re a jet ski that can move fast and change directions if needed. By the time you’re in your 30s you’re more of a small nimble boat. By the time you’re 60 you’re effectively a tanker ship that can change courses but it won’t be swift. No different than the human body, as time goes by directional shifts are harder (you may have kids and other long-term obligations).

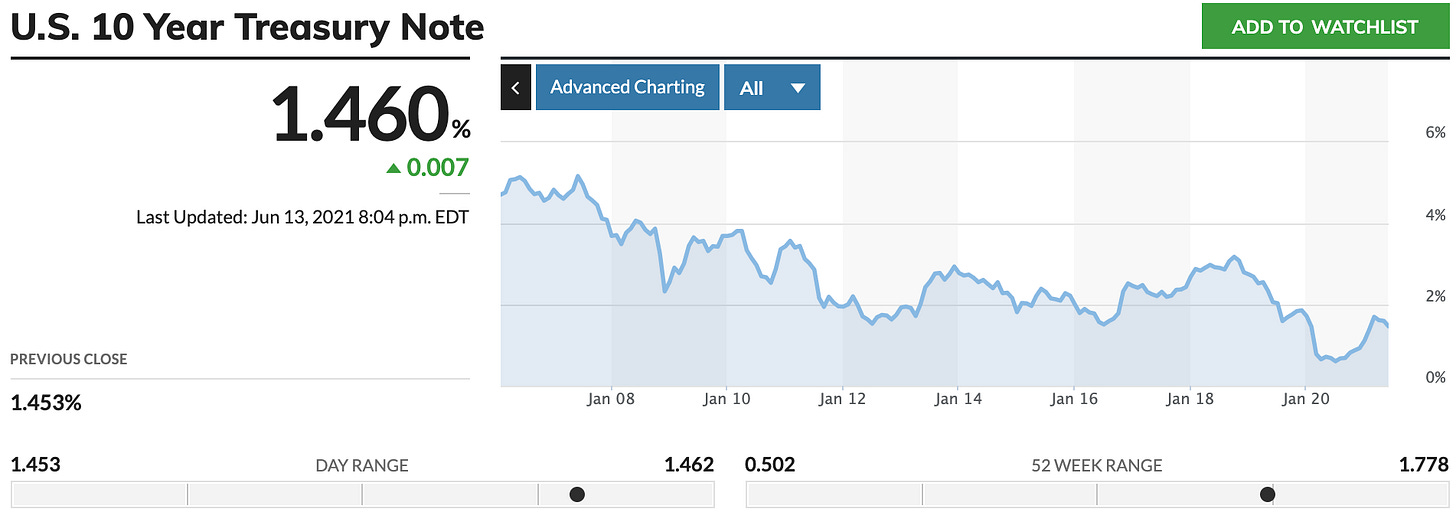

Lie #3 - Safety of Financial Investments Like Bonds: The idea of “safety” is a myth. Everything has risk. Even the US tokens you own. What you have to ask yourself is “what is my time frame?”. At this point bonds are no longer investable assets due to inflation alone. Some complainers claim we’re pushing a narrative but we’re not. 4-5% inflation in the USA is a lot of money unless you grew up upper middle class and don’t know what life is like for normal people. If you were making $48,000 after taxes and suddenly you have to pay a $2,285 bill that is a big issue ($48,000/1.05 = $45,715 - $48,000 = $2,285)

For some perspective (for those born wealthy), $2,285 would be equivalent to 1.5 rent payments (average rent in USA is around $1,500). If you are only saving 5-10% of your income and you have to blow 5% on a sudden cost that would take you to a zero savings rate. Or. It would cut your savings rate by 50% from 10% to 5%. This is a huge spread if you understand compounding.

Now look at the options to “fight off” this tax. Inflation is nothing more than a tax as you have to pay for food, shelter and water no matter where you live. So. If you’re looking at bonds you’re guaranteeing a loss. Currently the 10-year bond yields 1.4-1.5% and your inflation rate is 4-5%. This means you’re looking at a loss of 2.5-3.6% per year.

That means if you don’t increase your net worth (after taxes) by at least 2.5-3.6% you’re getting poorer every single year. Again. Your *Net Worth* has to go up by a minimum of 5% not just your after tax earnings.

Inflation Rates January —> December since 2008 (LINK)

We’re unsure if people are either unaware (grew up well off) or simply lack empathy. These numbers haven’t been hit since 2008 and the 2008-2009 recession generated one of the largest wealth inequality gaps. A 5% inflation rate for roughly 4.5 years means a 25% change ($50K is needed to buy $40K of products). That is a significant adjustment.

We can go ahead and scratch that off as an investment vehicle. Now you have stocks, commodities, crypto and real estate. Of those there are different issues with each one. Stocks = industry matters a lot and returns are volatile. Commodities = historically a good store of value but difficult to know the right basket - Gold has been a poor store of value as it is barely up since 2012. Crypto = high risk bet on societal improvement of legacy financial infrastructure. Real Estate = illiquid asset that can generate cash flows but is tied to a specific region with rules/regulation.

Value of Gold Per Ounce from Goldprice.Org

The point here? There is no such thing as 100% hands off investing. You have to look at the rules/regulations and make your own assumptions on what will/will not change in the future. If we’re betting on the sovereign individual it means that governments will begin to compete for your citizenship. This means you should favor a more mobile investment portfolio. If you do not believe in the sovereign individual, then you could invest in more illiquid assets.

How This Can Ruin Your Future: What worked in the past may not work in the future. In the past bonds had yields of 12%+ so you could have made a killing. At this point we’re at a near zero environment with large amounts of money printing. Who knows what will happen in 20 years but don’t believe the hype. Something that worked for 20 years or even 100 years may not work in the future. Even companies like Coca-Cola could go under over a long enough time frame. You just never know. It is your responsibility to stay up on the trends and trust your gut instincts.

Lie #4 - Never Quit! Stay Hyped! This is by far the best marketing tactic for the masses. You send them to a Tony Robbins seminar where they pay thousands of dollars to walk over hot coals. Or you send them to a commencement speech from a CEO (Steve Jobs had a popular one at Stanford). They leave with bright eyes and hopes that all of their dreams will come true.

Then reality hits. The real skill you need to learn is *quitting* and *un-learning*. When you go into the real world after college you have to solve problems by yourself. If you simply try to be the best at what you love, we can all but guarantee failure is in the future. What you need to do is *quit* everything that won’t scale.

Just because you love to play soccer does not mean you’re actually good enough to play at a professional level or even become a college coach. Just because you love to learn languages does not mean you should become an English teacher or XYZ language teacher. Just because you love to paint does not mean you have to become a painter when you see NFTs selling for tens of thousands or even millions of dollars.

What you should care about? Being the best and figuring out a way for it to make money for you. If you can become a top 10% person in a particular field then you find 4-5 of these skills and blend them into a product. We don’t work in art (have never drawn anything meaningful) but we can go ahead and assume you have graphic skills.

Here are some good options: 1) help make ads, 2) help create NFTs, 3) help create video games, 4) help create user interfaces and 5) help design products for major companies. As you can see, none of these have you in Italy painting on the Street selling items for $50 US Token. If you want to do something you enjoy, you have to find a way to make it livable as well.

The term “never quit” really applies to all the awful stuff you have to do. Using the same example, if you’re an elite designer and you end up making User Interfaces… you get to enjoy customer service problems! This is the worst.

Imagine you spend thousands of hours perfecting a design and then have to make edit after edit after edit. This will happen to you. Never quitting means that you should be willing to do all the garbage tasks that are involved with making your skills valuable. If you have to print and ship millions of posters. You stay up all night manually printing stuff and checking every single item off the line. If you started a diet pill company and there is an issue bottling the products, you get to manually drive over there and physically help if you’re forced to. No excuses, No quitting.

Before moving on here, there are a few things that you cannot skip: 1) health, 2) sales/copywriting, 3) new technology/innovations and 4) customer service. No matter what you start and where you end up you need to learn all four. (Hint: we just gave you the four most important things to take care of in your life if you don’t know where to start!)

How This Can Ruin Your Future: Just because you love something doesn’t mean that you’ll be the best at it. It doesn’t necessarily mean its a bad skill. You have to spend more time asking yourself “what is the best way to monetize this skill”. If you don’t do this and become laser focused on something where you won’t even be in the top 10%, you won’t get rich. Even if you love making digital art, you might make more money making digital ads. We don’t make the rules. The economy does.

Lie 5 - Work Alone or in a Team/Company: General rule of thumb: you are underpaid. In order for you to make $100,000 US Token a year the company you work for must generate more than $100,000 a year otherwise they would be losing money and go out of business soon. As you move up, if you’re a team player, you’re really capturing the same old percentage return. While you may make $200,000 US Token per year, chances are you’re making the firm 5-10x that amount. No matter where you sit within a large organization, no revenue generator is getting a 100% cut of what they pull in. More likely in the 10-20% range with those numbers reserved for solid performers (the revenue generators also pay for loss leadership like marketing expenses etc… The head of HR making $1,000,000 US Token per year needs to get paid too!)

Now with that aside, there are times when you should go it alone and there are times when working with someone else can help. While we think every single person should have *one* revenue stream tied entirely to themselves (no partner, no nothing), you have to be smart about working alone or working with a person/company.

Starting with partnerships… we can help with that one. Never do a 50/50 partnership. There is no way that two people enter into a biz together and have equal value creation. It just isn’t possible. Even if you had one person who was an elite coder and the other person was an elite sales person, they should not be in a 50/50 partnership.

Why? As the business becomes more successful, the sales person is much more replaceable than the producer of the platform. Don’t do 50/50 partnerships. Be honest about your value. If that means more it means more, if that means less it means less.

As a final note on partnerships, In the USA most people are short term and opportunistic. A good check for this is to help someone make money and see what they do. If they offer no real value within a few months, simply cut them off with no response. No need to tell them why, just move on and pretend it never happened. You learned a lesson right there. You misjudged a person’s skills or character. Neither is a good answer. You also dodged a massive long-term bullet. They will blow up (have seen this hundreds of times).

Once you have a good filtering system and have helped say 10 people or so, you can then widdle down the list by talent/skill they have. At that point you can hire and offer revenue/salary etc. On the other side? If you have a specific skill but don’t have a platform then you should reach out and get into a revenue generating role. In this role, you have something specific to add but don’t have the audience or platform. This is why many companies are eventually sold to Google or other major tech companies (access to sudden revenue growth). Autist Note: this is actually a great way to get into e-commerce. Learn to sell. Reach out to companies with products you know you can sell, take a cut of the revenue. When you learn the business model of many products you can already sell… Hundreds of options open immediately.

If this is a bit hard to decipher in your particular situation we have an easy answer once again. Do it yourself. In terms of getting rich, being a team player for a massive organization is generally a bad move (Hat Tip - Felix Dennis). *After* you hit a wall and need someone, then you can go ahead and expand.

How This Can Ruin Your Future: If you drink the Kool-Aid early and never bet on yourself, you become a “team” player with a big “stable” paycheck. This is a huge problem. The longer you’re inside the system, the harder it is to get out. On Wall Street they call these “Golden Handcuffs” but nowadays they are looking more like Silver/Copper handcuffs as the industry is in secular decline. Also. Your stable team player job will go down the drain quickly if you’re unprofitable. Just like a standalone business, if you are not making money you’ll be gone soon enough.

Important Reminder

Steve Jobs took a trip to India after dropping out of college seeking enlightenment. He came back disappointed and said:

"Thomas Edison did a lot more to improve the world than Karl Marx and Neem Karoli Baba (the guru he was seeking, who died before they could meet) put together"

Great post. Unfortunately I wasted my early 20s completely. Well no point in thinking about it. Going to give up 5 years (instead of 3) of working 70-80 hour weeks to compensate