For Dummies: Wealth Inequality is *Not* the Same as Income Inequality and Inflation Theft

Level 1 - Definitely NGMI

Welcome Avatar! One of the major issues we noticed with our writing is that it assumes most people have taken statistical courses and economics courses. This is the case for the vast majority of our subscriber base (average reader being a Turbo Autist with ~$600,000 US Token net worth). Instead of using statistics we will use *basic* math to explain why the system you are in is screwing you. Yes you the person reading this. You are being screwed by *no* fault of your own.

Now that we’ve made a pretty bold claim, we’ll go ahead and explain it in a way that anyone can understand. If you make under $500,000 US Token a year in a W-2 this 100% applies to you (you’re being pushed into the slave class/grasshopper eating class at a rapid rate).

So it begins.

Part 1: You Are Being Tricked to Fight Amongst Yourselves

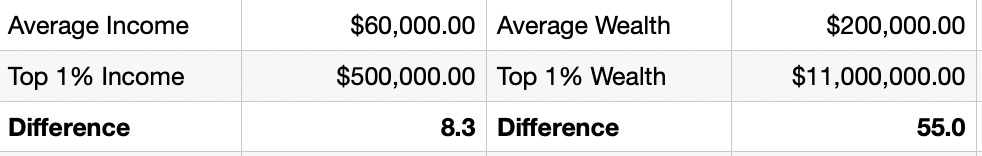

Step 1 - Current World 2020: Some basic stuff. In 2020 as a rough proxy the typical family made $60,000 pre-tax. The top 1% made about $500,000 pre-tax. Mathematically this means there is a difference of 8.3x. The 1% makes eight times more money than the average American. (Post tax it is less, but we’re keeping it simple!)

The Average Household has around $100,000 to $200,000 in *net worth*. For fun we’ll go ahead and take the *high-end* to make the comparison difficult. How about the top 1%? The *net worth* is roughly $11 million US token *POST TAX* (that’s another thing people forget - wealth is post tax money). Mathematically, this means the difference is 55x. The 1% is 55 times more wealthy than the average American.

Below is a very basic table so you can check our math and prove this is correct.

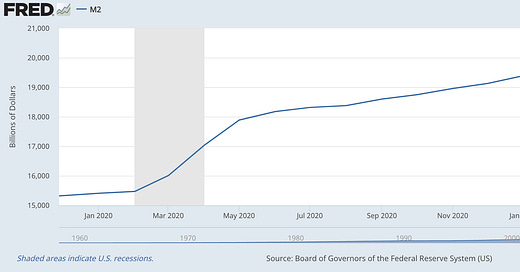

Step 2 - Increase the Amount of dollars by 40%: Okay. So we have a massive pandemic and the solution is to print money. We print 40% of all US dollars and hand it out to people. While this is not a *perfect* 1:1, it is a good proxy. If the average price of a home is $200,000 if you print 40% of the supply the average price should go to $280,000.

You can do the exact calculation here (LINK), we’re using 40% as it is easy to calculate.

Here is the problem, if the prices of assets go up by 40%, doesn’t this mean the wealth of everyone goes up by roughly 40%? Yes it does.

The S&P 500 is up ~33% over the last year and homes are up roughly 30%. Therefore the top 1% just got a lot richer. A lot. (Yes, stocks are *correlated* to money printing - LINK)

Step 3 - Return to the Spread- Sheet: Since wages did not go up by 30% (in fact many people were down/flat), we’ll just use no change as the baseline. If you look at the numbers this means when the “dust is settled” it will look like this.

$60,000 average income, Average wealth of $280,000 (40%) increase. $500,000 average 1% income and average 1% wealth of $15.4M

On paper this “looks okay” because the average wealth difference is still 55 times. The problem? How do you catch up?

Here is the final and most important part of the equation. If you look at the numbers, how does someone get into the 1% if the earnings did not go up? Run the numbers.

Say you are a star in the making and you can make it to the top 1% of *income* earners. We will even say that you can somehow avoid all taxes (likely impossible) but we’ll have some fun with it.

If you start with a $0 net worth and earn $500K per year you could catch up in 22.0 years back in 2020. Now that 40% of the money has been printed you have to work 30.8 years.

Now do you see why wealthy elites would like to raise taxes on wages? It doesn’t matter to them. If you raise the taxes on the guys/girls earning income… All this does is make the wealth disparity larger and larger and larger. Notice, we didn’t even include the fact that the person with the $15M is earning $600,000 US Token a year on assumed returns of just 4%!

In short, if you are earning $500,000 a year and someone else now has $15,400,000 and is earning $600,000 (20% more than you) how do you think you’re going to catch up? It certainly isn’t by earning money. Your only hope is equity.

Step 4 - Wake Up: We get it. If you were born lower-middle income you think $500,000 US Token a year is a lot of money. It is. However, the wealthy do not care about income. They care about *wealth* disparity.

The higher taxes go on earned income (wages) the more it separates the rich and the poor. You can raise the taxes on all earned wages to 80-90% and the wealthy will not care one bit. They don’t have earnings anyway. Which is the topic for point two.

Part 2 - Inflation as Theft/Wealth Transfer

Now you are probably asking yourself… Well cartoon bull from the future, why in the world don’t wages go up by 40%? The answer is incentives and competition.

We live in a world rife with inefficiencies. We learned with COVID-19 that a ton of jobs/tasks can be automated. Virtual meetings work perfectly well the vast majority of the time. The middle management layer isn’t needed and any repetitive task can be completed by software/new technologies.

Put Your Business Cap On: You run a business. We can call it an online T-shirt store for fun. It’s quite large and you make $10M per year in revenue and $1M per year in profit. You find out that your costs will go up by $1,000,000 next year due to inflation. Well what do you do? If you do nothing, you will receive $0 in income next year.

In the end you have to do what is best for your company and your family. You use new technology and start replacing every single inefficiency. One by one. You monitor employees output. You look for robots to manufacture your goods. You look for new people to produce your goods etc. In the end you find that you can automate a few jobs.

After a full review your costs went up by $100,000. You raise prices slightly to make sure you’re back to $1,000,000 in profit (10% increase in prices and flat income year over year).

You might say this is unfair. Unfortunately, life isn’t fair. If the T-shirt owner *didn’t* make the adjustments he is going to go broke. All of his employees are gone. His family suffers. Everyone suffers. By making these changes, his business is alive, he has some employees who get to feed their families and he can wait out the storm.

Bonus: if he simply tried to raise prices by the full amount, another competitor would make cost reductions and put him into the red (losses) within twelve months.

Do You See the Theft? By printing an enormous amount of money all you’ve done is shift more money to the business owner and away from regular workers. The business owner is flat (luckily) however, the employees he had to cut are now earning $0/year. There is absolutely nothing he could do to prevent this. Once the money printer hit and prices went up it was time to reorganize or go out of business.

In short, increasing prices just causes businesses to reduce headcount so they can remain competitive.

Part 3 - Fixing the Tax

Okay, what should we do about it? There are numerous avenues and none of these are perfect. However. We’ll highlight three that make a lot more logical sense vs. what is being done today. (Don’t worry we give this a 0% chance of happening it’s more of a fun explainer of what the real issue is)

Step 1 - No Lending to Owner: One of the biggest loopholes is as follows. You set your company up in Dubai or another tax haven. You pay yourself a fake salary of say $100,000 US Tokens. Instead of paying yourself a salary you “borrow” money from the company at 0% interest. Since you’ve taken a loan from the Company it is not taxable. Think this doesn’t happen? It happens all the time and in a big way.

Make loans taxable *if* you own the entity. One crazy loophole closed. If you loan yourself balance sheet cash from a company that is owned 100% by you… it should be considered a salary. Currently? It’s completely tax free!

Step 2 - A *Tiny* Asset Tax: This is going to make a lot of people mad. Especially the big time capitalists (most of our readers).

They need to come up with a *small* asset tax above some sort of number. Call it $1 Billion. If you own a billion dollars of a single stock you have to sell say 1% of it once a year and give that to your lowest paid *employees*

What? Nice sudden change vs bringing in the government no? This way the low paid employees participate in some of the upside from the success of the Company (if they get cut/fired they still own some of the firm).

There is just no way that Restaurant companies should have “higher” valuations in 2020 compared to 2019. It makes no sense and everyone knows it. They were *printed* into higher valuations.

An alternative is to have a small annual tax for billionaires only that is distributed in some form of universal basic living (LINK).

Important note, the Biden plan doesn’t make sense because it is *Unrealized* gains. We learned in 2020 how bad that could get. If you had unrealized gains in 2019 and suddenly your business tanks how would you pay the tax? (LINK)

Quick Note: If you have better ideas for this, please let us know. The wealth disparity is *not* due to income so no need to bother with that part. Just look at the asset disparity and decide how you would go about giving hope/opportunity to the next generation (vs. vile amounts of hedonism where you “die with zero or in debt” - ie. peak selfishness).

Step 3 - Reduce Tax Rate on Low Income and Increase Corporate Tax Rate: Assuming that no one will agree to the above, then we should simply raise the standard deduction and increase the high-end corporate tax rate. Once again, the problem is not “your buddy who makes $500,000 at XYZ Company” or “Small business that does $3 million a year in net income” it is the trillion dollar companies.

These companies cause the most wealth disparity so you have to find a way to change the tax rate here. We really doubt that Apple or Facebook will change how they operate if the tax rate goes up by 1% (yet that would be enormous in terms of dollar terms for the lower working class).

Don’t Worry We’re Still Ultra Capitalist: In the end, we don’t see any of this stuff happening. The media does a great job of getting everyone focused on “high earning families/individuals”. They purposely turn a blind eye to the real issue (which is billionaire tax shelters, loans and asset inflation). Why? The media is run by a billionaire. They are not there to tell you how it really works.

The Good News? On a final positive note, 2021 is still the greatest time to be alive. Crypto currency is solving a large chunk of these issues in real time. Intermediaries simply sit in the “flow of money” and that rent extraction is moving to digital currencies. Therefore, we don’t even care about the prior three steps! They were just there to tell you the real issue (wealth disparity *not* income disparity).

Instead of fighting all of these loopholes, remember that no one is coming to save you. Not your boss, your family or your country. Save yourself by playing the game correctly (“Don’t hate the player, hate the game")

The game is won by creating digital income (online income) and investing into high quality technology firms and crypto currencies in our opinion. This way your income can be moved to a more tax friendly state/country. This is what the wealthy are doing so you should do it too.

Best of luck anon. And please. Do not try to eat your own by going after an income tax.

They are laughing at you.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

Daily Reminder: You ARE EARLY. Too much negativity/cope. Everyone reading this is extremely early. If you stay on top of technology, there is always a new opportunity.

If we are going to taxes that have 0% of ever happening...a 100% wealth tax on every billionaire who goes on TV to say "I want you to raise my [income] tax"....aka Old Man Grifter Extraordinaire Buffet

Fantastic read.

If we are dreaming, I'll add an idea for the billionaire tax:

- Pay an annual % of wealth into a trust fund that builds and maintains beautiful private-public works, like city parks, natural parks, libraries, etc. It's actually how noblemen and the wealthy in the past will pay its dues (cannot recall how much of it was considered a cultural/religious duty vs a legal requirement) but at least it instilled a sense of belonging to one place, and of leaving an honorable reputation that would outlast the person.

Now we get absolute privacy with complete detachment from the locale they live in, privatized upside with socialized downside, reputation and honor are shunned for the ability to do what you want in private.

Anyway, I consider the main problem to come from the governments, but the incentives are out of whack at every level.

Dreaming phase off, let's put the money-making glasses back on.