Free LOOKS Token and The Greatest Rug Pull - Trad Fi.

Level 2 - Value Investor

Welcome Avatar! Now that everyone is in full panic mode (again) with little data science to back it up, the good news is that the NFT DeGens just got some free tokens. If you spent more than ~3 ETH on Opensea in 2H2021 you’re looking at some free computer coins.

Part 1 - LooksRare Air Drop ($LOOKS)

We’re putting this in the free post just to make sure no one misses it. It’s free money and there is a *time* constraint here. A big one. You only have a few days to claim it so make sure you do by going to this website: https://looksrare.org/

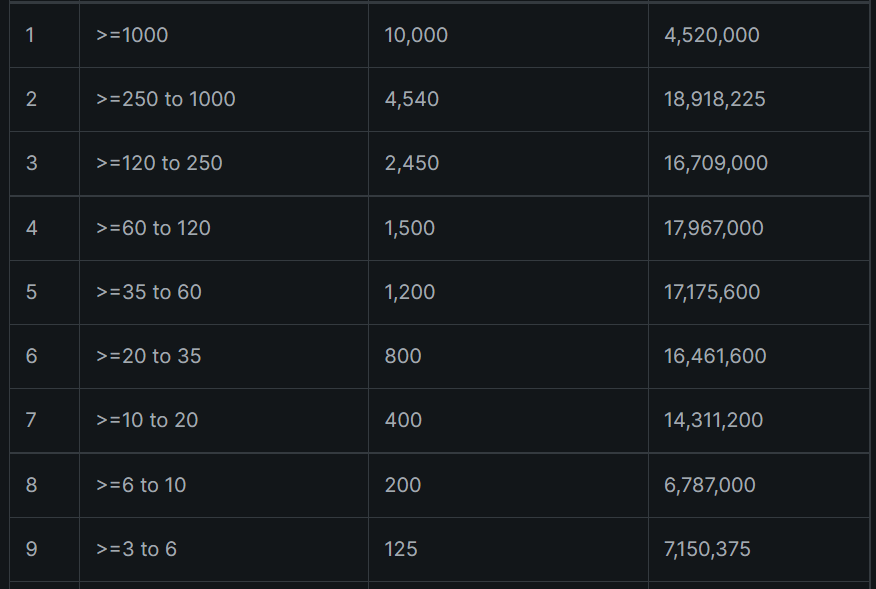

There are 9 tiers: 1) you link your address; 2) you have to list an NFT on their market place - anything works; 3) you then claim your airdrop. It is that simple and for more information you can read the document here

IMPORTANT: You’ll only be able to claim LOOKS from the airdrop during a short window of 7-10 days (exact time TBD but it’s live already!).

The token is trading at just over a couple of bucks so even at the low end of 3ETH total volume you’re looking at $250. For anyone involved in more significant NFTs (Apes, toadz during the big run etc.) you’re probably looking at 1500+ at minimum (or ~$3K/1ETH). Autist Note: since this airdrop is not a significant amount of money, it isn’t life changing if you keep it, stake it at their ~900% APY or simply sell it all. No need to fret over it as your NFT exposure is likely pennies compared to what you have in your total net worth. Just making sure you guys get the free computer coins!

Individualism Side Note: For those that recall the last free post, in a crazy turn of events Logan Paul and KSI are launching a drink company (came out the next day!). If we were to bet, we’d say it succeeds. Individuals replacing companies is the future. While it won’t happen overnight (you can dream about selling to a company), the future is the sovereign individual. Best to team up and support individuals over the long-run. Hence the existence of the BowTiedJungle.

Part 2 - The Greatest Rug Pull in History

This section is a guest post by BowTiedHomosapien with limited edits from us. We’d like to say that he’s a pretty good example of how far someone can come reading our stuff. We won’t disclose too much since it’s personal but lets just say he went from 100% NGMI with under $50K in *gross income* to now making enough that he’s moving to DeGen provinces to *legally* pay the least amount of tax. This has all happened in under a few short years (somehow his life trajectory outperformed computer coins the last 5-6 years or so). Also as a big thank you he is helping with some of our troll efforts so we hope and pray that all his real life activities to go full degen work out! Win and help win.

If you read this Substack, it will be clear that Banks are Zeros. The United States has printed 40% more dollars in the past year alone. Yet computer coins (BTC) have a fixed inflation rate and will eventually cap out at 21 million. Holding “Fiat” USD (USTT) is a guaranteed loss, while BTC is a bet on the future.

Many of the subscribers here do not have a background in finance. This post is intended to give a bottom-up overview of why banks exist and why they are zeros.

Firstly, a definition: Banks are Zeros. There are different types of banks. Scotiabank, Citi, Goldman Sachs are “every day” banks, and then there is the Federal Reserve (Fed), the Central Bank of the US.

Every day Banks are Zeros because they are middlemen. Crypto and technology, in general, enable people to interact increasingly without the need for these intermediates. Banks and other middlemen like insurance companies have huge salaries, buildings, and HR departments, and code has none. Over time, this makes it harder for these businesses to compete.

Yet crypto doesn’t just disrupt the entities themselves; it disrupts the very networks our society is built upon. If you have not read this short tweetstorm from Naval, please do so now.

That is what we are working towards, and that’s what the world can become. The Federal Reserve Bank is also a zero, abet in a slightly different way. By printing unlimited US dollars, it is turning the value of the world’s reserve currency to zero. This is the largest Ponzi scheme in the world.

The US Dollar (US Trash token): The USD, along with every other currency in the world, is a “Fiat currency.” “Fiat” is Latin for “Let” or “So be it .”In other words, a currency in use today only because the Government says so.

In the past, you could take your dollar bills, walk into a bank and receive gold in exchange for your paper. Gold, historically, is generally accepted by people to be a good “store of value .”Yet, anything can be used. People have used many things in the past, including huge rocks, tobacco, and seashells.

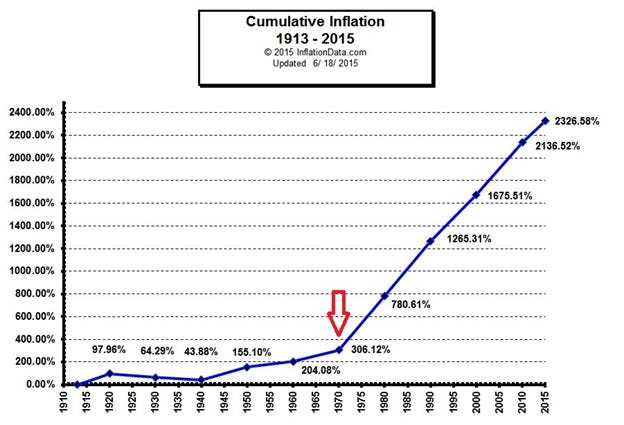

Under the old system, because people could trade dollars for gold, if the US government wanted to create more dollar bills, they would need to hold on to more gold. However, the Government printed more dollars anyway. So, by 1971, the Government only had 1/3 of the gold needed to convert all the dollars back to gold. So, in the end, on August 15th, 1971. The US government gave up trying.

On that date, President Richard Nixon ended the convertibility of dollars to gold. This was the collapse of the “Breton Woods” system. At this time, the US replaced the gold standard with the US Dollar as the global currency. From then on, Fiat (“so be it”) has been used for day-to-day transactions, and its value is now based on the relative value of other fiat currencies.

Where are we today? Without a fixed link to gold, to limit printing, the Fed can print and spend unlimited amounts of USD. Gone are the days where the dollar needs to be physically printed. Now that the financial system is electronic, it is as simple as changing a digit on a screen.

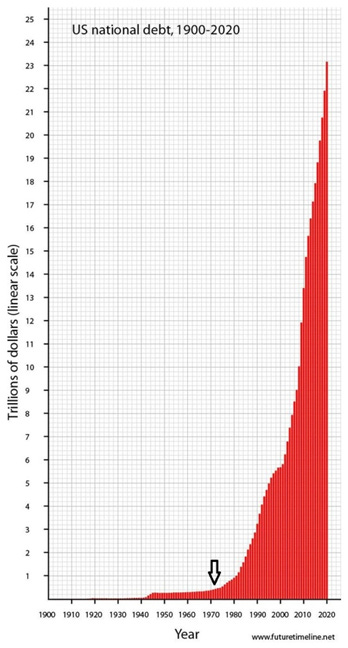

When the Government (elected officials) needs money, it takes out a loan (government bond) from the Fed (appointed by the president). The Fed creates money for this loan out of thin air by printing USD, printing dollars, and giving it to the Government.

This is what it means when you hear that the US government is over $30T in debt. Government spending and the interest owed on the previous debt continues to grow. Thus, congress consistently votes to raise the debt ceiling.

Foreign central banks, pension funds, and other investors will buy these loans from the Fed. They do this because a loan to the US government is generally considered a low-risk investment.

What is happening now is that the amount of debt is so high that the US government now needs to take out loans to pay off the interest on their previous loans.

Imagine you have a maxed-out credit card. At the end of the month, the credit card company expects payment. You don’t have any savings, so you beg the company to increase your credit limit so that you can make your minimum payment with more debt.

So what happens now? If the Government is forced to raise the debt ceiling each time and take out more debt to pay off the previous debt, they must print more and more money to pay the ever-growing interest rates. The debt will never be paid off.

The crash in 2007/2008 was simply a symptom of the disease. The economy has “recovered,” but nothing was done to address the underlying problem.

Covid, too, has only increased this. By closing the country, the Government needed to print more and more to keep the Ponzi scheme afloat. And it is a Ponzi scheme.

The “solution” to the debt problem is to make the debt worthless. By printing more money, each dollar has less and less value. Such that the $30T in debt has less and less real value - “risk-free losses” a BTB Saying

Who loses? All the foreign governments and investors who have purchased US debt lose because the value of their investment goes down. Everyone that uses US dollars – thinks about inflation as a hidden tax.

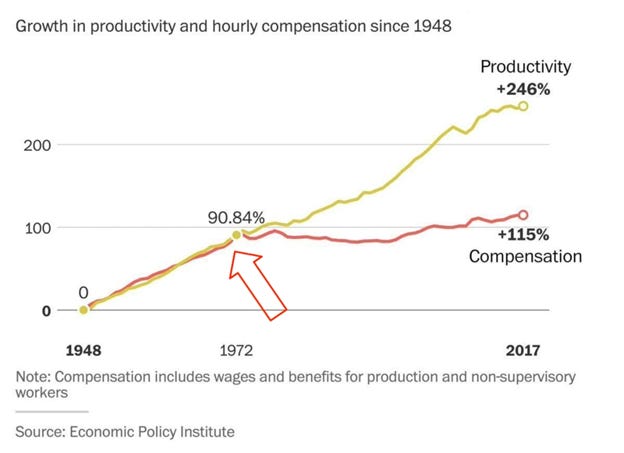

Without money printing, increases in efficiency and productivity should have a deflationary impact. Goods get cheaper and cheaper to produce. Thus, the value of the dollar goes up. Historically, inflation is attempted to be kept at ~2-3%; however, if, due to increased efficiency, there is a 3% deflationary impact. That means that it’s even worse. Typical inflation is closer to 5%, increasing productivity “stolen” through this process.

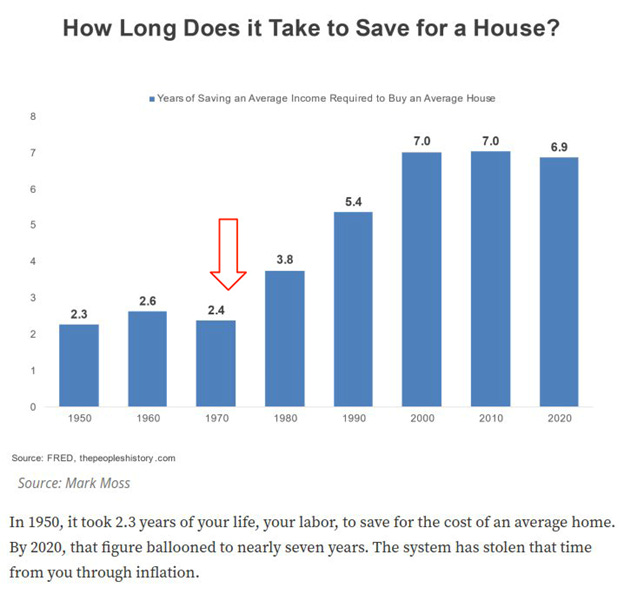

What is the cost of inflation? In the past, a single parent working an average job such as a mailman could afford to support a house, a wife, and kids. Today? LOL. No chance!

Relationship to Society

Take an honest look at all the problems we face in society today. Racial disputes, increased mental illness, poverty, growing income inequality, infighting, the list goes on and on.

These are complex issues with many reasons, yet all of these problems are fundamentally rooted in, and exacerbated by, the rotting economic system.

This is in no way a grand conspiracy, and there is no Illuminati. These policies were made by people like you and me, and people who generally do care about improving their country. However, they got lost along the way. They traded ivy league educations for thinking that they could control a complex, chaotic system.

If you look at any complex system, the weather, for example. We can make as many models as we want. Use all the supercomputers in the world and still will not accurately predict the weather even a few days in the future. It’s the same with the economy.

Keynesian economics is based on this. The idea is that if the economy is slow, print money to stimulate it back again. Then, this causes what’s known as the “boom and bust” cycle. Where the economy inevitably overshoots and crashes down again. Hypergrowth and depression instead of slower but steady growth with reasonable interest rates over time.

What has happened is people got greedy. Does anyone remember Occupy Wall Street several years ago? It was a great movement but misdirected. Yes, banks absolutely will bribe government officials (not directly, they just get good jobs at the banks afterward), yet it isis ultimately the Government that the attention needs to be directed to.

A while ago, who posted on Twitter about inflation caused by greedy businesses? Price fixing? As if those are anything new. Businesses seek to maximize profits. Banks, of course, are middlemen and will fail, with or without the Fed printing money. The grand experiment is failing, and the Ponzi is collapsing.

Economic Policies – Keynesian vs. Austrian

Debt – spending money you don’t have with the expectation to pay it back in the future. Yet when you take on more and more debt, eventually, you cannot pay it back.

Inflation – reduces the value.

Adjusted for inflation, the average wage today is less than the average wage in the 1930s

Wealth redistribution

Historically – wealth redistribution events can be non-violent or violent. We are getting into speculation territory, and Bull has already talked about several items here in the past with UBI and higher taxes. Yet, aside from RE, it is increasingly easy for the rich to flee with wealth, and the only solution is to stack computer coins and ride the wave.

What can you do?

Nothing. The Fed is an independent entity. As a US citizen, you have no vote or say as to what decisions they make. And like any other institution, they are perpetuating the problems they were initially created to solve. Their duties expanded over the years to have more and more control. You can’t even vote, and even if you could, the collapse can’t be stopped. Infighting between political parties is a distraction.

Save yourself. Get a career, start a second income stream, buy crypto.

Then? You can save your family. Friends. It’s clear as day that the world is caught up in a scam. The deeper you go, the more scams you find. The more injustice and hate are revealed. And so what? You can spend your life fighting the system. Finding article after article to get angry about. The value of honor and truth are losing their hold. Ye, that doesn’t mean you have to sink down. Find other people to build long-term relationships with. Protect yourself from short-sighted people. Be aggressive and cut out the toxicity from your life. Be a lighthouse in the dark sea that the world is devolving into. Your light will save the few who choose to listen and help themselves. Your light will allow you to find other lighthouses. The rest will crash their ships on the rocks of Degen island.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.” – F.A. Hayek 1984

Resources

This article was oversimplified. For example, The Fed also provides many other functions – yet see graphs) Also note that the Fed is an independent entity – as a Us citizen, you have no vote or say as to what decisions they make. And like any other institution, they are perpetuating the problems they were initially created to solve. Their duties expanding over the years to have more and more control.

Some Resources: WTF Happened In 1971?

Read about Keynesian vs Austrian economic systems. The ideas are nothing new. Just replace BTC with Gold.

This doc came out at the end of 2012…

Amazon How Economies Grow and Crash

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

Daily Reminder: You ARE EARLY. Too much negativity/cope. Everyone reading this is extremely early. If you stay on top of technology, there is always a new opportunity

As BTB mentions, this article is OVERSIMPLIFIED. Two more ideas come to mind which I think should be shared w/ readers to keep them sane:

1. Lower wages are caused by globalization, and to a smaller degree women entering the workforce, NOT money printing. Basic supply & demand dictates that when labor supply is increased many fold w/o increased demand that wages are going to go down. It's not the government's fault because of money printing if you're broke.

2. Most housing & education cost inflation is due to gov't backed lending, not money printing. Gov't backing these loans and aiming to make them available to anyone has greatly increased the demand for these products while not changing the supply. In this situation people can now buy their houses for much more than they otherwise could have, and pay much more for education than they could without these loans. Sellers are happy to accept the higher prices.

All this to say, the problems with money printing are real but it's not to blame for everything. Lower wages are a natural consequence of globalization and the only thing people can do to help themselves is make themselves more valuable in the labor market or create their own business. Similarly, high housing and education costs is caused by misguided liberal ideals for everyone to own their own house and be educated - good in theory but comes with very painful unintended consequences.

There is no Illuminati but there is a jungle. #2035