GBTC and ETHE - Terrible Financial Products

Level 1 - NGMI

Welcome Avatar! Even during the bull market in 2021, we wrote hundreds of times to avoid investing into these two products. The incentives are all wrong and figured this would be a good time to capture any retail person on the fence about the “bigger discount”.

Since most people have only seen a low interest rate environment, it means that they don’t have a lot of experience dealing with high-interest rates. In fact, anyone born after 1988 or so (2010 graduation date) has NEVER seen a recession during their working years. Read that again! Anyone born after 2010 has never once experienced a recession and on top of that they are used to a sudden bailout of trillions being printed (COVID-19 plan).

If paid on fees why do they care about the discount?

Part 1 - Simple Discount Rate

As all of you know, a dollar today is worth more than a dollar tomorrow. That’s basic logic as prices go up *over the long-term*. While prices may go down due to new innovations (Tech killing costs), the long-term general trend is that food, homes, S&P 500, water, etc. go up.

Now if we pause and look at what is happening today, you have a rising interest rate environment. This means there is a *bigger* opportunity cost on your money.

Since 2010 or so there was absolutely no reason to have a high amount of money in bonds/CDs/savings accounts. Getting a 0-1% return doesn’t mean much.

Would you rather have $100 today or $101 tomorrow? The difference is pretty irrelevant so no one cared about having a savings account. You were better off just investing. There were “risk free losses” in having money in your savings account (inflation of 2% guaranteed you’d lose purchasing power with a return of 1%).

Tech Example: Now with the basics out of the way you can see why tech companies did so well. If you have a company that is going to make no money for 9 years then in year 10 it makes $100M, the discount rate is small. You take $100M/(1.01^10) and this means it should be worth $90.52M

Now that game is over. If we have 2-year bonds and 10-year bonds in the 4-5% range (rough math) then you’re looking at a massive decrease in value. Since interest rates will continue to go up this year (seems obvious to us), then we’ll use 5% as the number to keep it simple.

The same tech company is now worth $100M/(1.05^10) = $61.39M. This means the valuation of the Company needs to drop nearly one-third (61.39/90.52-1 = 32.1% decline)

Part 2 - GBTC/ETHE Craziness

GBTC and ETHE are marketed as “crypto in your brokerage account”. For anyone who has read anything online about crypto, you know that having any coins on an exchange or in a brokerage account defeats the entire purpose of the industry entirely. No real debate there. The whole point of crypto is to take ownership of your digital assets.

Before the complainers come in, we realize a lot of people need to be able to sell it. So if you have some small amount of money on an exchange that is fine. Every personal financial situation is different. That said, you don’t “own” those coins on the exchange.

Exchange > GBTC/ETHE: Starting here, there is absolutely no reason why you should ever own any GBTC/ETHE. If you hold your BTC and ETH on an exchange (while you are taking some risk) at least you are not being charged a fee to hold onto the assets. If you buy 1BTC on the exchange (pay the fee) and simply let it sit there, you don’t lose any money. It just sits.

Compared this to GBTC/ETHE. If you buy $10,000 worth of either and do nothing (price doesn’t move) you will be left with $9,800!!!! You lose $200 by simply doing nothing. This is like buying a car, driving it off the lot and just letting it sit there for years and years. It makes no sense.

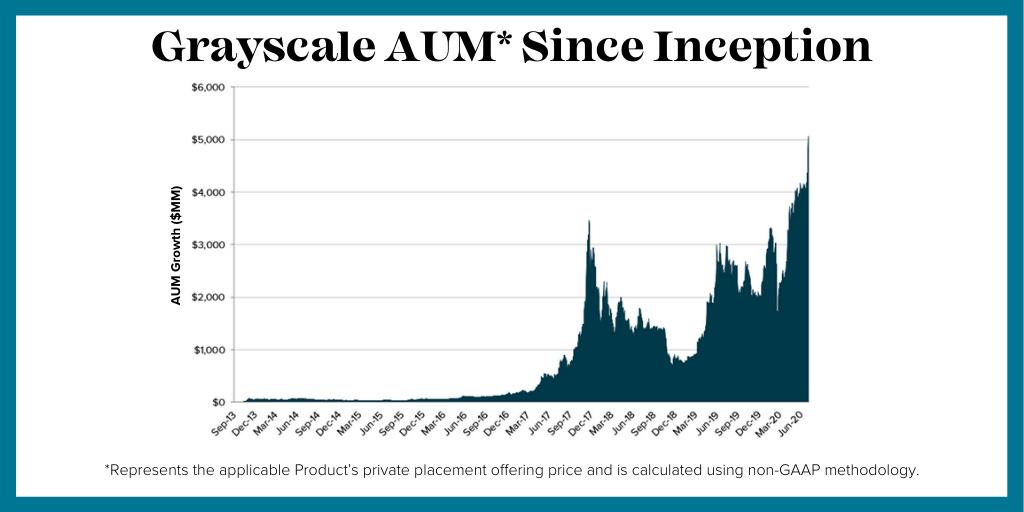

GBTC/ETHE - Terrible Incentives: Now you’re wondering, why don’t they just lower the fees to be competitive. There is no incentive. Why would you lower fees if people are still buying this terrible product? You wouldn’t. Your goal is to just get people to buy it and collect your 2% on billions of dollars. At $10B you’re making $200M a year on fees alone while doing nothing. Not trading it, not staking it, nothing.

Also. If you were to buy something like ETHE, you can’t even stake the ETH. ETH staking offers a small return of single digits percentages. With ETHE you don’t have this option.

Part 3 - GBTC/ETHE Won’t get Better

Put it all together. If you now have the option to get a 4-5% return, you have to discount the product even more. If you leave your “investment” in GBTC, it means that the value you put in is not only the 2% fee but the opportunity cost of leaving it there! If you wanted to invest $10,000 it means you could have had $10,400 to $10,500 instead of $9,800 (assumes price is flat).

Now run the math on how long this will happen. Say it happens for the next 5 years.

$10,000/(1.07^5) = $7,142. Now assume its 10 years… $10,000/(1.06^10) = $5,584. Even if we lower the discount rate by a percentage point (4% instead of 5% - plus the 2% fee) you can easily see how the discount can be 50%+ in the future.

Autist Note: It doesn’t make sense that the discount rate on GBTC is higher than ETHE. If anything it should be reversed since ETH has staking potential. That said the market is the market.

Part 4 - Does Grayscale Care?

If Grayscale cared they could lower the fees. Of course they don’t. Instead they are doing the dog and pony show with “suing the SEC”.

They are taking the profits they are making off you (the fees) and using the money to sue the government. In the middle of a downturn where governments realize crypto is a non-fiat option. You can decide if that’s a good use of resources vs. simply lowering the fee to 1%.

Hopefully this was simple and helpful for newbies. If you want to avoid buying scams like this, Celsius, Voyager etc. You should consider joining our community and news letter for a whopping 27c a day

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Security: Our official views on how to store Crypto correctly (Click Here)