Getting Ahead by Using Time Calculations

Level 1 - NGMI

Welcome Avatar! One of the main premises of this website/group is that you’re looking for ways to improve Efficiency *without* sacrificing any results. While this sounds like it is impossible, it is not. Most of the gains in this world are related to the “80/20” rule which means that most of the value ~80% is attributed to a few items. If you take this seriously and look at every aspect of your life, you will find that you’re burning tons of valuable time.

Quick Note on Time: We can use 90 years as the baseline for life. This is higher than the average (80s), however, we assume the average reader here cares about their health. Therefore, 90 is a fair baseline.

Of the 90 years? 10 years are spent doing nothing (unless you’re an insanely talented person you don’t have enough information to drive economic value). The last 20 years should not be spent on stressful work/intensity. So. You’ve got 60 years.

Of these 60 years, 20 of them are spent sleeping. While you can survive on 6 hours of sleep (age 20-30 or so), in the end, the average works out to ~8 hours or 1/3 of the time.

Now you’ve got 40 years worth of time being awake. 40/90 years = 44.4%.

Focus on the 40 Years: The above math has been displayed by numerous famous people in the past. Why? Rich people care more about time than anything else.

Time > Money and also Health > Money

This is why rich people spend so much money on comfort items (lay flat business class, private jets, massage, hormone replacement, diet, high quality gym etc.) Therefore, we can take a look at how much damage a few "bad decisions” can make on your life.

Evaluating 40 Years of Life - Get Ahead With Avoidance

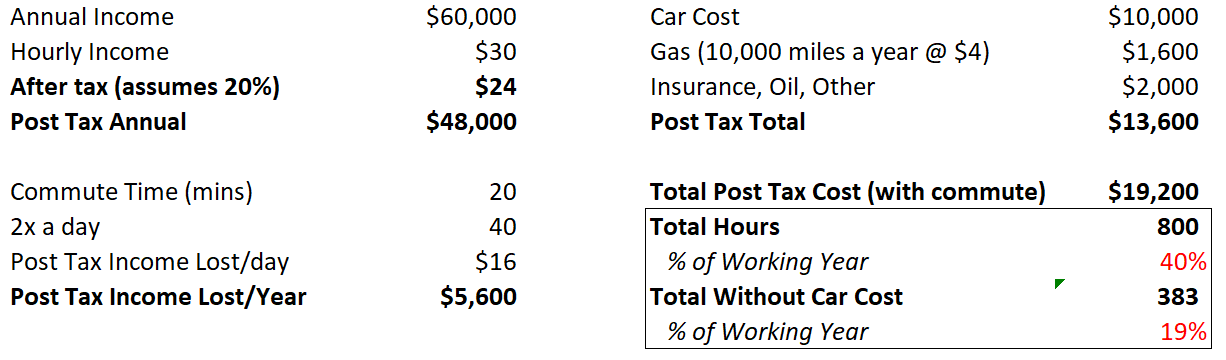

#1 Starting With Commute: Has anyone run the math on the cost of commuting. The cost of the car isn’t even the issue, it is the time lost. This should tell you with near certainty that Work From Home is here to stay. You can take a large cut to your earnings and still justify working from home with the car savings alone.

Roughly speaking, for a person earning $60,000 in gross income, the annual cost of the car is ~19% of their earnings (assumes 2,000 work hours per year).

Quick calculation for Readers: 1) ~2,000 work hours in a year assumes 2 weeks off so 50*40= 2,000 hours; 2) this would be $30/hour *pre-tax* and $24 *post-tax*; 3) your commute is opportunity cost *you should be able to do something productive but can’t*; 4) insurance, oil changes, some minor car issues (parking ticket/parking costs) and gas alone account for ~$3,600 a year which is… 19% of total annual post tax income!

If you’re a young person and you’re reading this, you should be willing to take a double digit reduction in your income for a work from home set up. It isn’t even debatable. You don’t have any real responsibilities. Move to a lower tax state.

Professions that should be “okay with this”… Every single white collar position. If you use a computer for work everyday there is no reason to show up to a cubicle. Find an employer who is smart enough to recognize this.

Nail in the Coffin: If you don’t value the money, that’s fine. What about your time? Even if we assume you only spend 40 minutes driving per day (for 40 years), you’re looking at 9,733 hours or 608 days burned or ~4% of your life wasted (remember you’re only awake 16 hours a day). No productivity. Just costs, stress and pain.

#2 Tax Evaluation! Instead of viewing taxes in terms of “dollars” start viewing it in terms of time. While everyone knows what marginal tax rates are, the point is the same. How much time are you paying out?

Keep it simple. If you have a 50% tax rate, you are likely employing people and took an incredible amount of risk. This means half of your income is sent out in taxes. This would represent TWENTY YEARS out of 40 years of high income! You already pay the majority of taxes (top 1-5% of US population pays ~58-59% of total federal taxes)

Instead of worrying about things you can’t control (we’re convinced taxes will simply go up), you should look for the right tax structure. For some of you it simply means going to no-tax states. For others it could mean DeGen Island USA/Asia or even Dubai. We don’t know. Instead we can take out the trusty calculator once again.

How much *time* do you lose by paying a high tax rate? Look out below!

We’d wager that most of you are likely in the 30-60% savings rate range. If you’re at 90% you’re either a billionaire or homeless. The point is rather simple. If you have a high effective tax rate, call it 40% and you can drop that enough to increase your savings rate by 10%… It’s a 4.2-8.7 year difference in becoming financially independent. This is quite large. (LINK)

Put that into perspective. Within the 40 years of “high effort” you can erase 10-20% of it... Just on tax savings.

Autist Note: Frugality doesn’t work because there is a floor on spending. No matter what you have to spend $X,XXX to survive (food, rent, utilities etc.). Earning income has no ceiling and if you keep a low tax structure, you can pull in multiple years of savings at once.

#3 Intangibles: There is no way to calculate the impact of all the intangibles. We will die with the following belief: Stress is the #1 health killer in the world. You can’t measure stress. However. Worrying about bills, about the next paycheck and about your physical health is certainly not going to lead to a healthy future.

Try and calculate how much time is wasted on the following: 1) news/mainstream media propaganda - around 30 minutes to an hour, 2) some TV/Movie watching, probably ~2 hours a day and 3) other unhealthy hobbies such as alcohol ~ 2 hours a day in total.

Since life is for living… which items here have the least value? The news and movies/TV. If the typical person burns 1.5 hours a day on this stuff it represents ~10% of the entire day (1.5 hours/16 hours awake = just under 10%).

Simply cut this out (keep the fun/socializing which is helpful for your sales skills) and we’re left with a grand total of 4% + 10% + 10% = 24% of your entire life saved on three life changing decisions.

You can take back ~10 years of the 40 productive years of your life by avoiding 1) cars/commute, 2) insane tax levies - likely to be raised anyway and 3) depression consumption - mainstream media.

While some of you don’t care at all about the time, look at the money and stress instead. From a money perspective you’re paying out 10 years worth of economic effort for next to zero value. Being homeless on the beach is certainly better!

Eyes on the Big Picture

Some of you aren’t interested in becoming your own boss (you should be!) and some of you love cars for one reason to another. The point remains the same. If you look at your annual expenses there are very few items that cost you high amounts of *time*. Cars, taxes and television/movies are usually the largest drains on your time - with no learning/production.

*AFTER* you make it in life you’re free to blow your time on whatever you like.

Some Jungle News: Slowly but surely we’re adding our older posts in video format. For those only interested in free content, you can check out our YouTube channel which is a video version of the old website (LINK)

A group of bankers have put together a resource for those that are interested in Wall Street (LINK). If you’re a paid subscriber and *have an interview* you can email us and we’ll send over all the Wall Street answers/overviews we had in the past.

BowTiedOx is wrapping up his fitness competition for September and his twitter account has some good examples rolling in (people have lost up to 20+ pounds in under 3 months!). Results > emotions. (LINK)

BowTiedOctopod is continuing to convert more people away from $10-15 expensive low quality fast food meals to $5 healthy meals. We’re going to work with him to find a way to make a small niche since Ox is well on his way at this point (LINK)

Finally, we’ve identified a few people to add to the island website shortly and that will be announced per usual on the free substack!

Thanks again for all of your support. Wednesday paid stack will be focused on E-commerce.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

Daily Reminder: You ARE EARLY. Too much negativity/cope. Everyone reading this is extremely early. If you stay on top of technology, there is always a new opportunity.

About 5 years ago I read every article on your blog in a week. You said to push yourself to the limits in your 20s because your body can handle the stress and energy required. Gotta say that was the best advice i've ever received. I'm nearly 30 and I cannot imagine having to work 90 hours a week on my biz again and focusing 100% of my energy on only work for the next 10 years... If anyone in their early 20s is reading this - do not fuck up this advice. Work 6/7 days a week until you get where you want financially.

Reminder: Almost all tech startups are fully remote friendly. Especially pre-IPO companies. Get in, negotiate equity upside. Big tech incumbents with large physical presences are loathe to enable full remote.