How Early Are We? We is Real Early, Anon.

Level 1 - Definitely NGMI

Welcome Avatar! We highlighted our macro view of how early we are in a prior *Free* post which you can read here. This was more numerical in nature. Many of you are in Sales or other “socially aware” industries (minimal Turbo Autists, surprising we know!) and wanted social cues to prove our thesis out. No problem. Starting from the top.

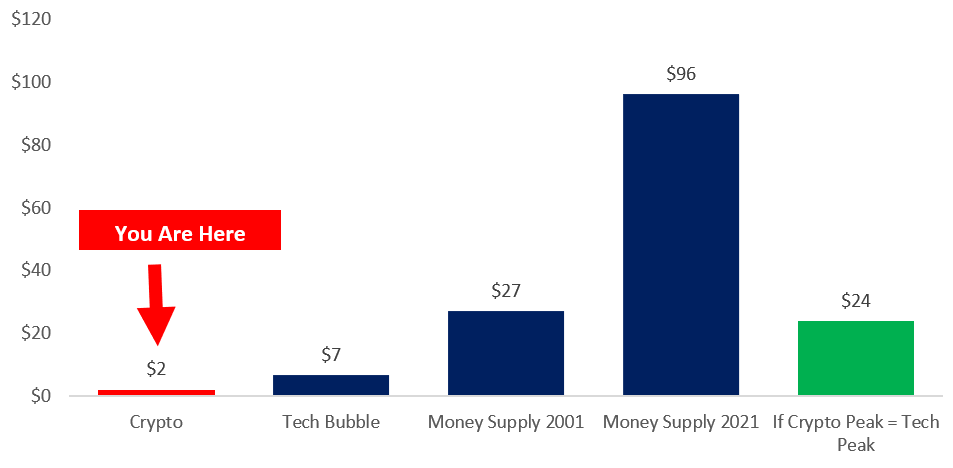

Quick Review of our prior article: 1) Crypto Market Cap - Total around $2.1 Trillion, 2) Tech Bubble was $6.7T at peak and 3) Money Supply was $27T and is currently at $96T (we will ignore the barriers to invest in some tech stocks on a global scale to keep it simple). This results in the following maths. *Note we realize the market cap is now $3T, going from $2T to $24T or $3T to $24T is still massive… also money printer is still on*

US Tokens in Trillions

Two Steps: Step 1: In 2001 the Tech bubble hit $6.7T and the global money supply was $27T. This means it reached peak mania of ~25% of total global money supply. Step 2: Take this 25% and multiply by the current total global money supply of $96T. This gets you to a crypto market cap of $24T.

Now Onto the Program - Look at the Competition

Lightweight to Say the Least: We’re still at a point where most have no idea what is coming. The largest generational wealth transfer in human history over the next ~14 years (cartoon opinion. How do we know? Follow the herd and do the opposite (sounds familiar, anon).

The herd is currently reading stuff like “investing for 13%” returns which doesn’t even beat inflation and Bitcoin Maxi newsletters. While we love BTC and we do think you should be invested in a diversified set of assets just in case there are a few years of volatility… people are behind.

How behind? As stated, we’re sub 10K *free* subscribers (paid much, much lower) and yet our YTD returns from April (not even from January) are 300%+ all time stamped on the paid substack for a whopping $100 US Trash Token per year.

What are people reading then? Apparently stuff like the below…

Record scratch. Music pauses. No we are not “hating” we are laughing and *cheering*.

Why? >they don’t know.

This means that people are really paying $365 US Token a year to underperform inflation and basic stuff like “tech”. Lights out cartoons, we’re that early.

What About BTC and Other Crypto Broadly?

This one is quite fascinating, the masses have finally woken up to BTC. This means they are aware of what it is. Most still think that this computer coin is vaporware, however, they are starting to admit a bit of defeat (unless you’re Peter Schiff who is certainly a BDSM submissive at this point). That is neither here nor there.

It means that BTC is considered a “safe haven” it is an “institutional grade” investment asset. The conversation around BTC being worth zero is essentially gone. Therefore, you’re seeing a lot of *stability* in news coverage around orange computer coin.

Below is search interest over the past 5-years for Bitcoin on Google Trends

As you can see we still haven’t hit peak interest from 2017 (got close) and you’re seeing a bit of a “trading range” in terms of search interest.

We do expect the interest in BTC to pop again (when it hits new all time highs). However. 2017 vs. 2021 when the price is 3x higher tells you people are *still* asleep at the wheel.

Final Check Ethereum: Properly pronounced as Efferiums, you can see that there is still limited interest. While it did spike when the new all time high was hit, it was still short lived and interest “crashed” 50% shortly after.

Below is Search Interest Over the Past 5-years for Ethereum on Google Trends

Conclusion: We know that search interest is still low. Bitcoin is seen as “safe” and people have finally started figuring out Ethereum. This is all basic data that is free. Also. If you want to spot check this, go ahead and type SHIB into google trends, you’ll see an outrageous spike and a massive fall anticipated due to the decline (no we don’t own any SHIB or dog coins, just using it to make a point).

Retail that’s for Beautiful Females - How About the Big $$$

From the prior section you can make an argument that “retail doesn’t matter”. This means institutions are most important. Fair enough… The relative size of retail versus institutions is massive to say the least

Pause. Have you seen the “research coverage” of crypto. It is abysmal. PayPal is not a Wallet. TopShot is not a decentralized NFT platform. And. They couldn’t even spell decentralized… spelled it as “decntralized” missed the e. These people “are expected to earn your trust”. Won’t work out well!

CNN/Wall Street Crypto Coverage: We’re watching from afar. While we have no interest in CNN we’re waiting for analysts to show up. Right now you got venture capitalists running around calling for $250K-$1M bitcoin, you got the crypto exchange guys saying similar stuff and once in a while you get an actual crypto person on the tube.

*crickets* notice… no real Wall Street presence. You don’t have guys with their sweater vests, vertical striped shirts and ill-fitting suits recommending computer coins. This is good.

Wall Street research analysts are primarily paid for two things: 1) helping raise money - even though their job description says they “can’t get paid for it” and 2) pumping their clients books - if they want to buy something they pay for them to go on TV and say “sell” (giving them a lower entry)… It means the institutions are not invested in SIZE. When they are you’ll see more market manipulation tactics.

The Ole’ Bubble Concern and 4 Year Cycle Thesis

While we’ve covered the 4-year cycle thesis and our opinion on that, the big item that people are missing is the current inflation flywheel that is occurring. Back at the beginning of the year we warned of $5+ gas and were laughed at on Twitter (by mid-wits of course). This has occurred in many states and we’re seeing real inflationary pressures.

You may be wondering, what does this have to do with computer coins? Good question. If you’re looking at what is happening, they are forcing people up the risk curve.

In simple terms, if you see the cost of food, rent, housing, utilities, gas etc. rising by 20-30% (please don’t tell us it is 5%, our honest number is 30% for total inflation by year-end)… it means you have to beat 20-30%.

The sentence above is significant even if it reads like a run on sentence. If inflation is 20% you must find assets that appreciate 20%+.

You are not gonna get that by buying Macy’s/Restaurant stocks. Instead you have to look to higher volatility. This means tech, biotech, some medical and of course good ole’ computer tokens.

Economic Inflation Flywheel: Many of our free subscribers have asked why the inflation rate appears to be accelerating. While we don’t answer questions for free subs, we will address this one as it is important to understand the flow of funds and cost initiatives related to Q4.

If we know that Gas and Transportation costs are going up, this will flow through to all of the other industries. Just like the money printing it does take some time to impact the economy. Therefore… what happens?

1) gas price go up, 2) transportation cost go up, 3) supply chains packed means more costs go up, 4) we enter into winter season usage of *utilities* will spike and 5) as demand spikes…. prices will go up significantly.

Chart is pretty ugly, but just look at the markers for January which represent peak consumption.

Will Utility Cost Inflation Begin? We think so. 1) you can see we are in the month of November, we estimated this with a *green rectangle*; 2) you can see that it’s about 1/4 of the year and we know the chart ends at January; 3) January is the peak; 4) conclusion number go up for utility costs since we’re at the beginning of the ramp!

Conclusions: If you’re ultra smart you will understand our view of the “4-year” cycle thesis from this chart alone. We’ve explained it in detail in the paid substack but hopefully the picture is clear. Inflation for utilities will accelerate into year end. That is our bet. This means you have to have even better returns for Q4.

Save Yourself

In the end no one can give you the execution. Sure we can give you the blueprint and tell you step-by-step what we are doing. However. Most don’t even want to put in the work. For those that do… get ready to lock in. Take a stim pack (double entendre video game - IYKYK) and get ready to read from start to finish on this Substack.

Here is some music to get you through faster. We hope you make it to DeGen island… Anon.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

Daily Reminder: You ARE EARLY. Too much negativity/cope. Everyone reading this is extremely early. If you stay on top of technology, there is always a new opportunity.

"Most still think that this computer coin is vaporware, however, they are starting to admit a bit of defeat (unless you’re Peter Schiff who is certainly a BDSM submissive at this point). That is neither here nor there."

I'm still wheezing from this after finishing the article.

Appreciate you as always bull.

AMD over $150 today.

AMD and Meta teaming up to build Metaverse.

Yuge.

Xilinx merger around the corner...