How Your Future is Being Stolen From You: Inflation, Rates and Fiat

Level 2 - Value Investor

Welcome Avatar! We’ve started a *free* PDF to answer all newbie questions on crypto. And. We have to do one more high-level post that will explain why you should care. We realize that many people have limited experience with institutional investor so this should help you get to the “aha!” moment where you realize the game is rigged. In simple terms, large asset owners (stocks, real estate etc.) get preferential treatment while the average person (middle class) gets treated much worse.

Part 1 - Inflation Solidifies the Wealthy Elite

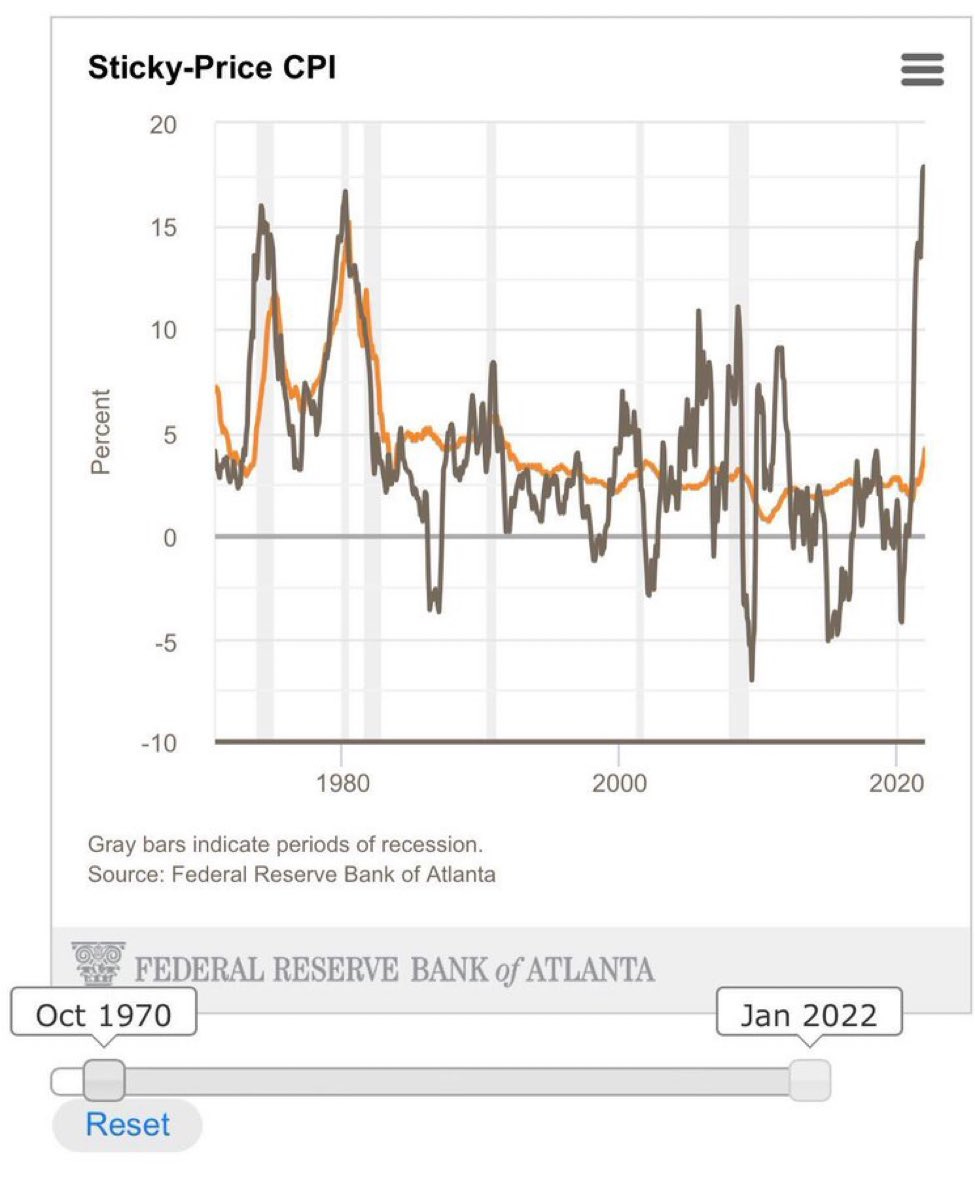

Inflation: We’ve stated since early last year that the numbers are cooked and even-though they are saying it is 7.5% it is easily closer to 20%. For a better view of inflation we suggest looking at the chart below which would represent inflation numbers if we used the *same* basket of items from the 1970s (before *significant* tech products were added that are naturally deflationary since the entire job of tech is to reduce costs).

Source: Federal Reserve Bank of Atlanta posted on Twitter by PA_P3RRY

We’ll take an aggressive stance and say that anyone who believes 7.5% is simply not living life. Food, utilities and housing costs are all up much more than 7.5% for anyone who pays their own bills. That said, we want to keep the example easy so a newbie will understand how the big scam works.

Inflation at 7.5%: In simple terms, inflation means the rising cost of anything you buy. If you used to spend $100 a month on something, it will now cost you $107.5 in the following year. Scale this up and if you spend $100,000 a year in total expenses, it means next year you will be paying $107,500. All of these numbers are *after* taxes which means if you want to live the exact same life next year, you need to pull in 7.5% more money after taxes.

Doesn’t That Impact Everyone the Same? Nope! That’s the entire scam. While many may read the prior paragraph and say “well everyone rich and poor has to make 7.5% more!” it simply isn’t true. The reason for this is low interest rate debt.

Simple Maths: You get the chance to borrow money at 3%. This means you can borrow say $100,000 at 3% for the next 30 years and lock in the interest rate. Sure you have to pay $3,000 a year, however, you can take that $100,000 and invest in anything that goes up with inflation over a 30 year timeframe (such as a home or even the stock market)

Inflation is 7.5% and your payments are 3.0% so if you simply buy an inflation hedge you *made* 4.5%. While you are borrowing money, the interest rate is so low that inflation gives you a bigger and bigger valuation. IE. You buy a home worth $1M US Token and it is now worth $1,075,000 while you paid only $30,000 in interest (probably less!)

Below is a clear graphic of how a rich *asset* person gets further and further ahead.

Crushing the Middle Class: As you can see each year asset owners get wealthier relative to the middle class (even if you are a high earning person) since wealth is not the same as income. If you’re a rich institution like Blackrock you can borrow more money and get a lower rate as well (how the game works). While the rich guy feels like he’s getting ahead, the mega corporations are getting even *further* ahead.

Shrugs “That’s the Game”: Before Bitcoin, there was no solution to part one. Your only choice was to play in the same rigged economic game where the rich get richer with both assets and low interest rates. This actually explains why corporate politics is so prolific. If you can manipulate a wealthy person’s *emotions* you got the promotion and had a better chance at closing the gap. This is why politics always wins over performance in mega legacy companies (fantastic example is investment banking). Autist Note: if you’re in investment banking (our old focus from an old career!) this is good for you since you can get the top bucket rating without doing much work. Just get the highest paid MD to like you since he’ll be loved politically and ignore the underperformers.

Part 2 - Need for a New Financial System

Until the creation of Bitcoin (post housing crisis) there has been no alternative to the current financial system. The ideal store of value would purchase the same amount of goods and services this year as it will in 10 years. While this is practically impossible as demand for goods and services go up and down (trendy products etc.) it should be a possibility for necessities: food, water, electricity and rent.

New Economic System: If you tried to exit the current financial system… there was no alternative. In fact, if you try to protest or crowd source money in Canada they will even block you with no civil penalties!

Now? There is no excuse. You can use crypto currencies as an insurance policy against the constant money printing. If you think that governments will continue to print money and potentially take you out of the financial system, you need at least some insurance against that. If protecting your hard earned money is not important to you then we don’t have time to convince you.

Graphical Depiction of Potential: You don’t even need to believe in crypto to invest in it. Simply take a step back and look at how many users the industry has and ask yourself “Are users going to go up or down?” If you answered “up” then you’re forced to buy since the supply is capped. If you believe users of crypto will go *down* then you shouldn’t buy them (enjoy ze bugs!)

Potential Explained: 1) 4.6% of total assets are held by millennials - about 25-40 y/o rough age band; 2) 53% of assets are held by boomers and 3) 94% of crypto buyers are Gen Z/Millennials. Current USA Wealth? Around $120 trillion. Important note, the move from $60T to $120T was not actually “wealth” but simple money printing. The amount of dollars printed has doubled since 2008

Source for Chart. Green is top 1%, Black 1-10% and red 50-90%.

Now for the quick math and why you should care even if you don’t believe in it “that much”. If we assume the Boomer generation passes on their wealth to millennials that’s 53% of the $120 Trillion which is $63.60 Trillion

As you can see if we know that 94% of all crypto buyers are Gen Z/Millennials, the question is “how much” since we know that it will be more than zero. For fun, even if 10% of the money goes to crypto you’re looking at a 159% return. Note: yes we’re aware that this is not perfect math as people will sell if prices go up/down like any market. It is simply to provide an example. Where will the $63.6 trillion (not billion) end up?

Part 3 - Keeping It Simple

Take a step back and ask yourself what the guiding principal was for every single good investment. It wasn’t “P/E ratio” it wasn’t “Value Investing it was the following: will more people use this?

When Google purchased YouTube they were laughed at. Now it does around $20B in annual revenue (SEC filing page 33) and they don’t even make the videos. They guessed correctly that more and more people would be watching videos and created a monopoly around it.

Back when Facebook bought whatsapp and instagram they were also laughed at. Once again, the herd was wrong. User growth exploded and the deals were a steal.

Up To You! We know the following: 1) inflation is higher than the interest rate that rich people pay; 2) we know that more restrictions are coming - see Canada - which means your account could be locked; 3) we know that the 94% of crypto buyers are the younger generation and the boomers currently control 53% of the wealth and 4) we know that governments are printing tons of money with no way to repay it and you don’t even get to vote on it!

Should you buy financial insurance? Your call anon.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

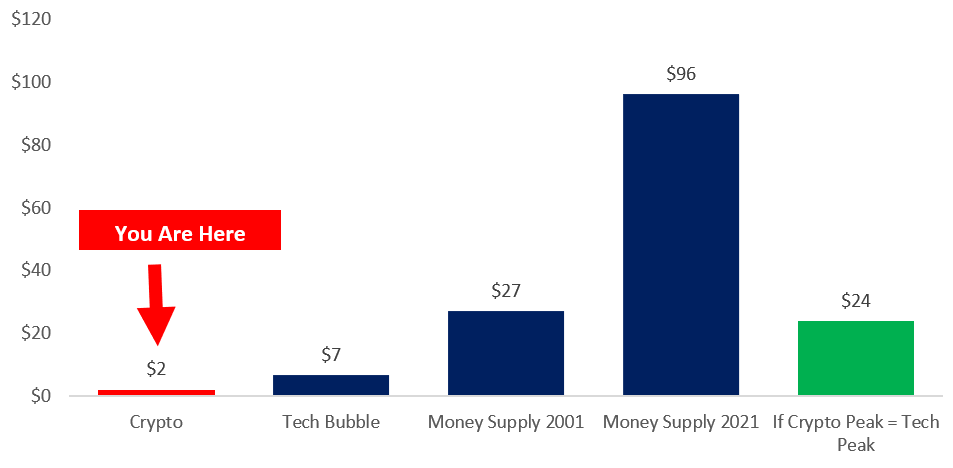

You’re Early: Remember that you’re early. If you need to zoom out see our post here on Crypto versus the Tech bubble (which was only the US stock market).

Below Chart in $Trillions of US Tokens

This post should be compulsory reading for 10 year olds and over

Hi Bull - At this point is it just advisable to go and buy a house and take a mortgage out in a high demand tax free state(Dallas, Nashville, Miami) vs continuing to Rent?