Importance of Being Liquid and Anon

Level 3 - Virgin Defi Analyst

Welcome Avatar! Usually our free posts are slated for Monday, however, a lot of things have started to move in favor of the sovereign individual. While Crypto Twitter views the space as: NFT vs. DeFi vs. L1 vs. Gaming markets we think it’s a lot easier to split as follows: Anons and the Masses vs. Institutional Investors and Public Figures.

Do you think it is wise to hold a large amount of assets on a single address? Do you think it is wise to use your IP and tie it to Tornado Cash over and over again? Do you think it is wise to flex your net worth with increasing wealth inequality and the dismantling of the middle class? Probably not.

While things like real estate and interest rates appear to be unrelated to the crypto economy, they certainly *are* related. As more people become frustrated with the current financial system (which is without a doubt a scam) they will look for an alternative and Crypto is the only thing that we’ve got. Crypto is without a doubt the future and the smartest people in the world are already on the train. Say what you will about personalities, however, betting against Musk, Saylor, GoldmanSachs (now), El Salvador, Square and more… is probably not the right move.

Part 1 :What Does This Have to Do With Real Estate

Real Estate and Inequality: For many who are reading this, you are probably in our “average audience” which is $600,000 net worth and $200-400K annual income. This means you likely grew up middle to upper middle class and went to a good college and played the “rules” (not a negative or positive comment just statistically likely).

This means you grew up learning that “the only way to get rich is levering up with a house!”. If you don’t lever up and buy Real Estate you’re shunned from the Real Estate Religion. This has worked for a long time as the financial system is designed to inflate asset prices so everyone feels richer! There is just one big problem… We hit a point where massive institutions bought with extremely low rates locked in at 2% or so (last couple of years).

Raise The Rates Lower Home Prices? The old timers will say “Look back in history interest rates have to go up!!! Also. They reduce home purchases!” We’re going to go ahead and disagree with that. The reason why rates are low is because they cannot go up high or else defaults will cascade through the system.

Excluding the massive volatility in 1980 we’ve seen a pretty clear trend. We don’t get to the next peak! Once you lower rates for a long enough time people have locked in “free money” and simply wait out the storm (Thanks BlackRock).

This means that it’s going to be difficult if not impossible to raise rates to 5%+. For those that lived through the 2008-2009 recession this was actually a massive debate post the recession. “Will rates ever go to 5% again” - It appears we have our answer: No.

Beyond this, even if you do think that rates will go to 5% again… Does it matter when inflation is 7%? How about a more realistic 13% as inflation is manipulated? You know the answer, it doesn’t.

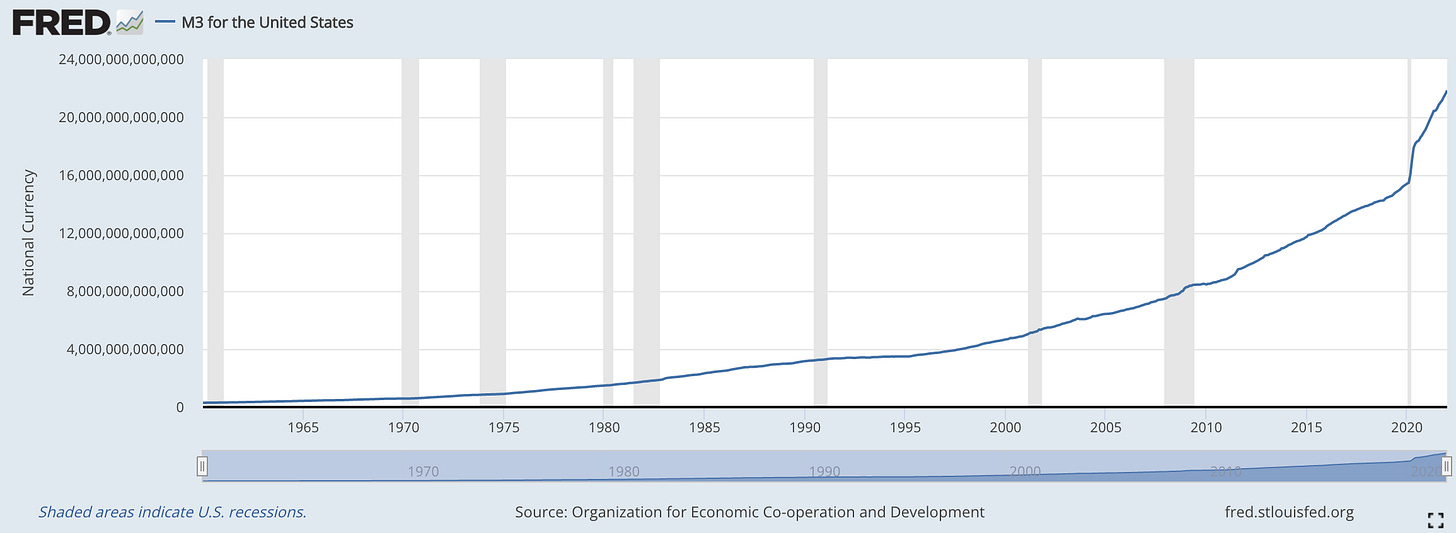

We’ve printed around $10T over the last couple of years and this means that inflation has to add up to 30% (even with basic math and no real change to the velocity of money).

Conclusion: Can’t raise rates that high and anyone who has locked in 2% debt during the ZIRP time frames can just take cash flows from rentals and buy more and more assets… with Cash (no financing)

Circling Back to the Typical Reader: If you’re feeling like you’ve done well (if you have $500,000 US Tokens you are doing well), just remember that BlackRock is borrowing at 2% and buying Billions in assets. Since wealth is relative the gap is widening.

Nail in the Coffin: Since Real Estate is now firmly in the hands of the elite, you really only have one option. Which is fight with liquidity and primary residency (at most). You’re not going to beat BlackRock or XYZ Trillion dollar mutual fund when it comes to acquiring property. Therefore if you go down that path, you’re never going to “gain ground” against the elites. For every 10 units you acquire, BlackRock is picking up 10,000 units. Yes. Really.

Part 2 : Sounds Terrible How to Compete

If you’ve noticed, the large institutions are *behind* when it comes to understanding anything tech oriented. This is why new tech creates the largest wealth transfers (happened with computers, the internet and now computer coins).

Once you acquire niche knowledge you can now invest in things that people don’t understand.

The above sentence is critical. If large institutions “understand it” the opportunity is gone.

Back in 2008 if you understood smartphones you could invest in Apple and get rich. Back then a screen based phone was seen as risky and new. That would have led to life changing money. This also worked with Social Media companies such as WhatsApp and Instagram where Facebook was laughed at for purchasing them for high valuations (Facebook was correct). Now? We’re in Web 3.0 where we can make an argument the institutions don’t get it. Why? They are public about it.

Why Be a Public Figure? At this point, the bigger names in crypto and in the VC world have split. There are wealthy anons and there are wealthy public individuals/entities. Knowing that regulation is coming and that more and more scrutiny will be done do you believe it is wise to have your wallets known?

Chain of Events: 1) wealth inequality goes up, 2) this leads to more crime and regulation, 3) this leads to loss of tax revenue - both legal and illegal as rich individuals flee to tax havens and 4) a CBDC is created to undo the mess made with the current Fiat US Token standard.

Critical Thinking: If you own a bunch of real estate and don’t pay taxes on it who owns the property? We all know the answer there and you’re absolutely insane to try and avoid paying taxes.

Option 1: Stay anon, go into the deep end with tech and remain liquid: computer coins, some stocks, some cash and some long-term high value physical assets

Option 2: Become a public figure or work at a VC fund. This leads to immediate knowledge of all your wallets and addresses (easy to track).

The End Game Says Option 1: If you’re able to remain anon while paying the least legal tax, you have the best chance to *fight* illegal asset seizure. Think it through. If the Bitcoin Maxis or the ETH Maxis are correct, what does that mean for governments? It means they have to compete for the best citizens and find a way to back their currency with BTC or ETH (insert any coin).

If the biggest and most dangerous powerhouses in the world know where everything you have sits… Do you think they will allow you to simply leave and live your life as a king? Or. Do you think they will do exactly what they have done in the past and confiscate similar to the gold standard confiscation.

Wikipedia Summary

Part 3 : Understand the Jungle/Digital Country Now Anon?

Pause for a second and ask yourself. If you build a quality reputation as an anon online and know 2-3 people in 10-20 countries around the world and all of you “accept” crypto as a form of payment… Who is safer from a world of “Hyper Bitcoinization”. The public billionaire with a walking target on his back or someone with worldwide contacts and 1/100 of the net worth (yet anon).

Leave the lambos to the VCs.

Part 4: Conclusion

To us, the Real Estate game will now create even more inequality as the people with 2% rates can now take cash flows and buy whatever they like cash or with higher down-payments.

This means more inequality = more crime/looking for new financial system

As usual, all of you are able to come to your own conclusion. If you have a particular talent that can *help people* we’re more than happy to help you build an audience. We’ve proven it with 20+ people in less than a year and as always…

Equal Opportunity, Unequal Results

Join our community of winners and help create online income streams for others. Also continue to accumulate computer tokens and ask us questions any time you like (always here to help). That said we do need to fund each new person and the price tag is a whopping 8 chicken nuggets per month ($0.27 a day!). We don’t cater to the pinky up tea sipping cup types like your typical institutional newsletter.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

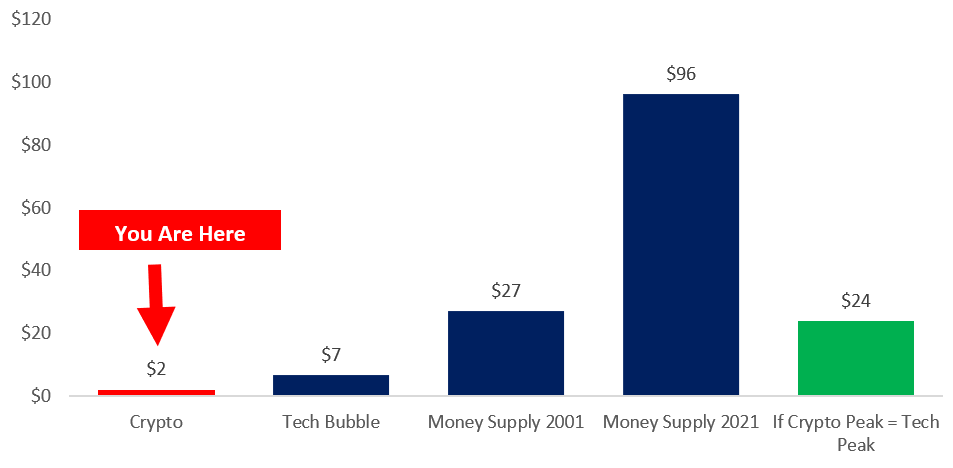

You’re Early: Remember that you’re early. If you need to zoom out see our post here on Crypto versus the Tech bubble (which was only the US stock market).

Below Chart in $Trillions of US Tokens

Sun Tzu says: When stuck between BlackRock and hard place; be like liquid

Excellent advice about staying anon. Only reason not to be anon (unless your incomes comes from being a public figure, and even then you can be semi-anon if you set it up right) is ego. Like you say elsewhere, avoid at all costs.

One other point: Thinking about "competing" with Blackrock is silly. You can't "compete" with billionaires/institutions and you don't need to. If you're a wildebeest, you don't have to be faster than the cheetah, you just have to be faster than most of the other wildebeest. If you can cobble together 10 rental properties that cash flow in your 20's, you're doing great. It doesn't matter that Blackrock bought 10,000 in the same time period. Same goes with computer coins. Nobody is going to "compete" with Winklevii, but that doesn't mean we can't all get rich. As you say, we're still way ahead of 95% of people.