Inflation and CPI will Be Adjusted - Play FETCH

Level 1 - NGMI

Welcome Avatar! On Twitter we stated that the real inflation rate should really just be Food, Energy, Transportation, Clothing and Housing. After some back and forth with someone it resulted in the phrase FETCH. Fitting since the goal is to turn the human population into puppies fixated on the “current thing”. While this calculation of inflation is less important in economic booms, it becomes *extremely* important in economic downturns. This is because stagflation or a deep recession leads to the same thing: wealth inequality.

In order to survive you need: Food, Energy, Transportation, Clothing and Housing (FETCH). Everything else is actually discretionary. While we’re not saying people will move to the stone age and delete the internet. The real cost of living is well… what you need to live!

Why Are We Talking About This? Well now for the fun part. We’re arguing that CPI *must* be manipulated going forward. For those that have older parents or grand parents, you know that social security is tied to “CPI”. Ie. Reported inflation. If inflation continues to be this high, it means the government will have to increase the payout significantly *and* do this while collecting minimal tax revenue (no capital gains taxes to collect in 2022!).

Therefore manipulation of CPI is all but guaranteed in our opinion. The goal is to try and prevent a massive hike in social security payouts and do this in a way that people don’t “see” the underlying inflation.

How Can They do this? Glad you asked! Take a look below and we can make it pretty easy to understand (Source).

CPI says 8.6%: 1) Food says 10% inflation, 2) Energy 35% and 3) Other is 6%. Time to do some quick math. If we know that CPI is reading “8.6%” it means that CPI is heavily favoring the other category.

Step 1) We know that energy is about 8% of household budget multiple that by 35% inflation = 2.8% to the CPI

Step 2) We know that food spending is about 8% as well multiply that by 10% = 0.8% to the CPI (food and energy at 3.6%)

Step 3) The other ***84%*** is in an obscure bucket of other that includes everything from clothing to cars to commodities. Multiply by 6% and you get 5%. That means 3.6% + 5.0% = 8.6%! Magical, we’ve roughly hit the CPI.

CPI in the Future: Now if food prices, energy prices and housing prices continue to go up, there is only one way to prevent CPI from going up even more… reduce the other 84% data!

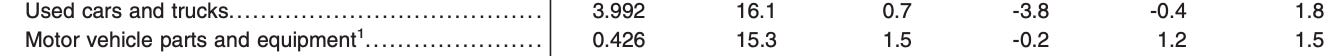

Example 1 - Page 12 on the PDF: We know that there were crazy price hikes for cars back in 2021. Now that sales have begun to slow (consumer contraction), they can claim that automobile prices are down say 10-20% to help understate CPI. If used cars go from +40% y/y increase to -20% that reduces CPI in a big way. Also. They can make it a bigger weight in the index.

Example 2 - Computers Televisions (Page 12).: Since the price of TVs go down over the long-term, they can use products like this to help claim lower CPI. Increase the weight of things you don’t need (televisions, electronics, toys etc.). This helps drag the CPI number down.

Example 3 - Rent (Page 13): Now that rate hikes have taken place if rent begins to stabilize they can claim that inflation is improving. If you’re smart you will look at the below screen grab and realize how insane it is. The claim is that rents are only up 0.6% from last year to today. Think. Ask around. Is anyone seeing a rent increase of only 0.6% from last year? Doubt it.

Pay Close Attention to CPI: There is no easy out here. We can’t have inflation reported at 8-10% because it will bring immense pain to social security especially in a year of limited tax revenue (no way that we see “record capital gains taxes” in a market where every asset class is down). This is an extremely tight rope to walk. They have to put a CPI number up that is “believable” but not so low that people say “we’re being scammed” like Japan which claims no inflation.

Recession, Stagflation… It doesn’t matter

Both of these lead to the exact same outcome: wealth inequality.

Recession? This means job loss, cutting spending and moving down the socioeconomic ladder for a chunk of the population.

Stagflation? This means inflation and job loss which leads to cutting spending and moving down the socioeconomic ladder for a chunk of the population.

No matter how you slice it the USA is flattening out the middle and creating “tails” which means there will be wealthy people and then a large lower/middle class. What industry you enter is more important than ever. Try to make it to the right side of curve.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team