Lifestyle Inflation and Retirement Calculation Scams

Level 1 - NGMI

Welcome Avatar! For those that are un-initiated, prices are going up. Wages are lagging the price increase and of course, you are not getting any younger. The third part (age) is where a ton of the financial advice you see doesn’t pan out (once again, the mainstream is wrong).

In the traditional world (even after COVID-19!) you’re told to save “10% of your salary and retire at age 62”. Roughly speaking. This sounds good because you can plug in a 10% savings rate and you get there pretty easily. (See Below!)

Part 1 - Work Backward Not in Linear “10%” Moves

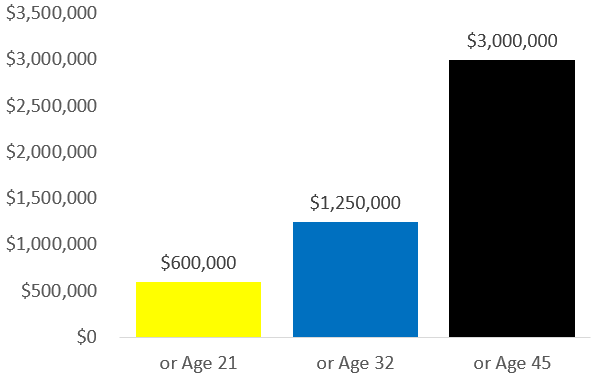

Calculation is 10% savings rate, 7% returns and 4% withdrawal rate.

Now the problem that they don’t explain to you is this… are you going to spend the exact same amount of money at age 25 as you will at age 35? 45? 55? Absolutely not. Generally speaking, you *have* to spend more in your 30s/40s if you intend on improving your standard of living, supporting a family or enjoying life a bit more (unless you plan on living with roommates for life)

In short, if you follow the standard plan and save exactly 10% of what you make each year, it is unlikely that you can afford your lifestyle upon "retirement”. You’re unlikely living the same standard as you were just out of college (we hope!).

Retirement is a Scam: In the end, long-term readers of this side of the internet know that retirement is a dream sold to the masses. No one successful enjoys doing nothing all day (billionaires continue to work/do something well past retirement age). Instead, we should focus on a point at which *you* don’t have to work on anything you dislike! You’re still going to work doing something.

Maybe you become a scuba drive instructor. Maybe you become a cartoon bull that attempts to build the first digital country with a bunch of anonymous turbo autists (oddly specific). Maybe you open a basic bar since you enjoy talking to people. We don’t know. The point is that you should have an *exit number* to remove all the excuses for doing a job/career/business you hate. To be clear. Until you make it, you absolutely need to do things you hate/loathe as you haven’t made it yet.

Better Way to Calculate It: Since it is unlikely that you will spend the same amount at 25 and the same amount at 55, it is a lot easier to calculate based on an assumed number. In this case that number will be exactly $120,000 US Tokens per year (or $10,000 a month after taxes).

While the ultra rich will say it’s too little, its pretty difficult to claim you’re struggling on $10,000 in monthly spending outside of the major cities which are becoming more crime filled by the day.

With that out of the way you now know the exact number you need which is $3,000,000 US Tokens. If you get there and generate 4% returns, you’re at $120,000 US Token per year. All set!

Not PG-13 Language Corporate Guys Reading (NSFW!). Oddly they use $2.5M but you get the point (ignore the interest rate stuff since that doesn’t exist anymore).

Part 2 - Starting from Three Sticks

Going back to the original “FIRE” advice we can see it just doesn’t work. How do people save $12,000 a year after tax at age 21 when they have: 1) living expenses, 2) likely student loans and 3) unlikely make more than $5,000-6,000 per month? It is actually painfully demoralizing.

To avoid going into the valley of despair the smarter way to think about it is with a liquidity event and by “gaming the system”. The system is designed with tons of flaws from performance reviews to underpriced assets (cough practically every private online business cough).

Calculate Back: “I Need Three Sticks”. Sounds gargantuan. The number is really a lot lower. Remember. If you want your *exit number* at age 45 (pretty reasonable) it means that you need *less* than $3M by age thirty or so. How much less? Try 5 times less if you’re 21 years old (1.07^24 = about 5.0x)! Okay so now we have a starting point.

*You* need $600,000 US Tokens at age 21 or you need $3,000,000 US Tokens at age 45. both of these seem pretty difficult since you have no time in the first scenario and in the second scenario the number is big (mentally).

Set a Timer Around Age 32: This sounds pretty reasonable. You underestimate how much you can do in 10 years and people overestimate how much you can do in 1-3 years (this applies to all humans). Therefore we’ll use that metric. You need about $1,250,000 US Tokens (reasonable! As 1.07^13 is about 2.4x).

Autist Note: Some of you may have a later start. That’s entirely fine. You probably made a good amount of tokens from JPEGs/PNGs and airdrops of random coins (at least paid subs did!). There is no reason to look backward and just take a look at the logic below.

Okay We’re looking for $1.25M US Tokens: If you work a high paying career or take on a couple work from home gigs (multiple) you can probably save mid 5-figures. This is a start! This means you can now practically ensure you hit your number by retirement age (worst case scenario).

What they don’t tell you is an *event* based income which is becoming easier and easier to come by. Every week we get a new email from someone who either made their first $1-3K online or sold their business from anywhere from $30K to $3M!

Several Options: 1) Standard grind pattern: WFH take 2-3 slots and be a mediocre performer. Mediocrity is rewarded in Corporate America since the pay differential is maybe 25% at max for each level (you can do the math on having 2-3 similar roles); 2) The Better Path: The one we recommend is you work a regular career and play the politics game (get rain-makers to like you), now you can slowly win those promotions and spend *all* of your free time starting an internet based business. No excuses here as you can put the entity under the name a friend/family member or you could use a VPN/work off a slim portable laptop with a separate WiFi connection. Being more realistic here, the vast majority of smart employees will let you work from home anyway making this 100x easier than it was even 3-5 years ago! and 3) All in Business: This is when you’re making 2x your net income from an online venture when compared to your net income on W-2. Usually people quit too early and then the business goes down in flames (extremely common).

Rough Exhibit

As you can see, all these options should allow you to accumulate US Tokens rapidly. The difference is really leverage in the equity you build. If you’re not that interested in working for yourself (it is not “easy” and you have no support system), you can still make it by grinding it out. However. You won’t be as rich as a successful person in Option 3 any time soon!

That said, for those that want to really see how far they can push it, there is no limit with Option 3. The question is if you have the time, talent and pain tolerance to keep pressing on the gas until you hit 2x income and scale up from there.

Part 3 - The Ole’ Curve Ball

Now there is just one big problem here. We’ve assumed that the purchasing power will be about the same. If you’ve seen your grocery bills, you know that this is a real issue. Cost of gas, meat and anything you need to live is rising by 20-30% or at a minimum of 13% by our own conservative calculation

In Short, if inflation is around 15% it means you lost *two* years of compounding! Or 1.8 months worth of work in an entire year (0.15*12)!

Back in the day there was nothing you could do. Good Ole’ Jerome hits the printing press, prices go up and the middle class is flattened out. Currently, you’re seeing this today as prices go up, your savings are eroded and you didn’t even get to vote on it.

Fortunately, you can entrust your savings into an alien (Vitamin Butane) and an anon (Satoshi) who is one of the richest individuals on the planet.

Make no mistake, you can continue to follow the standard path and make it. We have no doubts about that (stocks, real estate and traditional items will be around in one way or another). The question is if you think you can make that path a little bit better, more exciting and befriend a bunch of cartoons in the process.

This choice is yours anon. And. Don’t let the people who stole your future from you tell you the path to riches is “10% savings per year”. The future is WFH, WiFi, Computer Coins and of course some basic necessities like meat which will become rare in 2035.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

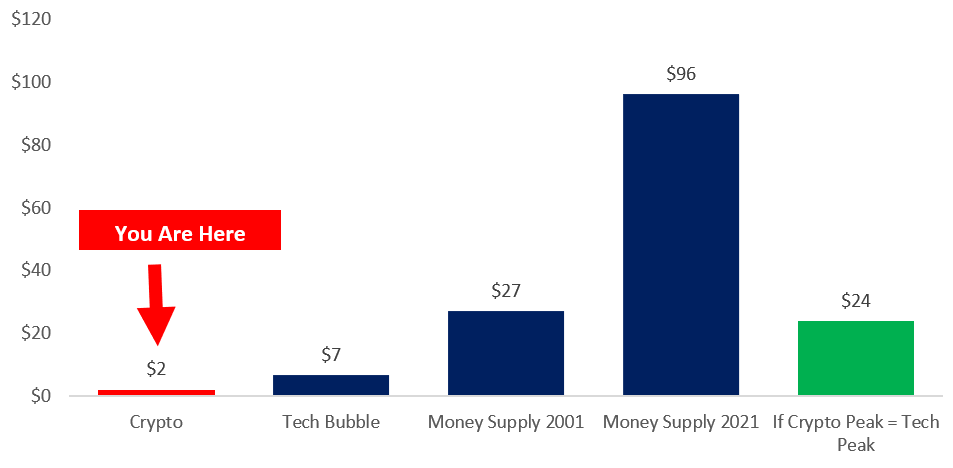

You’re Early: Remember that you’re early. If you need to zoom out see our post here on Crypto versus the Tech bubble (which was only the US stock market).

Below Chart in $Trillions of US Tokens

Advice for anons with kids - if your goal is to build generational wealth, your "exit number" should take into account what you need to live off of AND how you want your children set up.

This changes the math, changes how you approach wealth preservation (slightly), and requires you to do some process work that a lot of people might not be thinking of (ex: life insurance, trust).

Happy to share what I'm doing if there's interest in the Jungle. I've dealt with or am currently dealing a bunch of this stuff (mid-30s, high NW with kids).

Read this FIRE blog, Early Retirement Extreme. Physicist who couldn't get a real job, so he spent his time sewing up the holes in his socks to save money. From the I-shit-you-not department. Let's just say I read BTB now and I never learned to sew.