Mainstream Advice Guarantees a Life Not Worth Living

Level 1 - NGMI

Welcome Avatar! If you’ve stumbled onto this side of the internet, you’re well aware that most of the education system doesn’t teach you anything meaningful. You go through classes all the way up to advanced calculus and yet there are zero classes on how to: 1) lower your taxes, 2) invest at various wealth stages and 3) how the credit/debt system works. This is probably by design. That said it gets worse. Even after you start working (and learning about saving/investing) all the advice makes little sense. Starting with the 10% rule.

Part 1 - Save 10% - Guarantee a Poor Financial Future

You can use the linked calculator in the source line to make your own adjustments. While this looks okay at first “work for 50 years and you retire” it is actually 100x worse than that!

$5K is only 10%: Start with this part. It assumes you will spend $45,000 or so per year for the rest of your life. Now that makes sense until you realize that your earnings likely go up over time. If you earn $50,000 now, peak earnings go to $100,000 and then back down to say $70,000… The entire model is already broken. If you have lifestyle inflation (say spend $90,000 a year), it means your standard of living needs to *decline*. Doubt anyone wants that.

Inflation a Stable 2%??? If you look at the assumptions it’s basically 5% excluding a built in 2% inflation buffer. Anyone who has seen food and energy prices this year is likely laughing at this assumption at this point. Yet it is exactly what mainstream financial education talks about. There are periods where stocks don’t even go up for an entire decade! There are periods where inflation can be as high as 5-15% (as we’re seeing now). A single price hike like this and you’re blown to bits.

Crabs in Buckets Created: If your strategy is to scrape a few pennies together every year, it simply won’t work. You’ll create a “crabs in a bucket mentality” trying to pinch pennies and get ahead by reducing spending. Doesn’t work. You have to create income/revenue and scale otherwise there is no chance that being in a bucket full of penny pinchers will result in a healthy financial future.

Part 2 - Ignore Quality of Life and Health

The second part of this entire game is that we ignore quality of life. If you want a glimpse of this go work/volunteer in a hospital/end-of-life services industry. This will allow you to make smarter decisions about how you are spending your time. Imagine a scenario where everyone gets 10 years to do no work. You can choose ages 60-70 or ages 30-40. It would be much smarter to keep the “good decade”.

To be clear, this is not feasible given compounding skills and growth of your biz. However. The point is the same. The quality of life you have after age 60 isn’t even remotely close to age 20-50 (even with advanced drugs etc.). Note: “give them the bad years” is a saying that has a lot of truth to it. The probability of pulling this off is low though.

Quality of Life is Better if You Work: That’s right. Rewind to when you were a kid and had summer vacations. Unless you were from a rich family you got quite bored as there was nothing to do except play sports all day (These days? Video games if you are not a good athlete).

Most people in their 60s who are rich and well off do some work. They just enjoy what they are doing and typically clock in around 15-25 hours a week (this is our observation). You don’t want to be working 40-80 hour weeks and you certainly don’t want to hang out with Karen from HR every quarter for your “review”.

Wasting the Good Years: Another common one is that the typical person in their 20s blows 20+ hours a week watching sports, getting drunk at bars and memorizing random stats while losing year after year in sports gambling.

This is what “everyone else is doing” and is “normal”. Going back in time, it would be smart to actually master a few things: 1) a sport that will last until you’re 70+ such as tennis (pickle-ball when extremely old), golf, lifting weights and biking/hiking, 2) starting an internet business the *first* month after starting a career/job and 3) setting up one internet business for an exit in your 30s as you may change priorities - kids, supporting your parents etc.

By Getting the Bag Early You Will Prevent the Steep Decline in Functional Capabilities.

Part 3 - Setting the Bar Low and Fudging the Stats

Of the three major things you’re taught this is probably the worst. If you look at “business stats” they say that somewhere around 90% of businesses fail. When you look under the hood though, the numbers begin to look at a lot better.

Example One - LLC for Homes: Many wealthy people buy properties under an LLC to disguise the buyer. Bill Gates is well known for this. Buying farmland under a myraid number of LLCs to hide that he’s the buyer.

The second example is the upper middle class types. They buy properties under an LLC as well and have various “expenses” to make sure it shows a zero income. The more aggressive types actually show a loss to help offset their W-2 income from the tax man. Is it wrong? Yes. Does it happen since no one bothers to check a random LLC posting $20-30K losses? Also yes.

Example Two - Focusing on Income: This was mentioned three times in the past here but the obsession with income is beyond comical. Many CEOs get $1 salaries so their income is below the poverty line. Income doesn’t matter. Also. The income “shown” by a top 1% earner doesn’t make a lot of sense. Here is an example:

Joe works at Morgan Stanley - He clears $300K after taxes or around $500-550K gross income. Good for joe! Since he is $500K+ he’s in the 1%.

John the self employed maverick - He clears $60K after taxes since he pays himself a $100K salary. The Company he owns (100% of it) generates $5M a year in net income. On paper John is not part of the 1%.

Now it doesn’t take a lot of mathematics to realize John is 10x+ more valuable than Joe. Even if he doesn’t register as a “top 1% earner”.

Example Three - Bombarding You With Negativity: This is the main job of the news. It’s all bad news. So and so failed. 90%+ of businesses “don’t make a profit” and are “failing” by that definition. XYZ person quit his job to go and start a business based on a great idea (never works! Since you only quit *after* making 2x from the biz vs. your career). And. Constantly highlighting all the major companies that fall off the map (just look at AirBNB coverage during the pandemic - they survived).

As a rule of thumb the goal is to make you risk averse. While risk management is important, avoiding all risk guarantees you fall down this “life path” which ensures a life that isn’t worth living.

Negative News is Better for Clicks if Targeting Mainstream

Part 4 - Draw Out Your Own Map

Everyone has a different vision of what they want their lives to look like. Also. Everyone has a different set of skills. We even have pure blue collar workers like BowTiedHandyMan who gives info on how to make good money outside of the standard we preach here (Tech/M&A/Sales → Online biz). The key is taking your time and using it wisely. The jungle is useful as you’re able to troll and make some money. A lot better than being a random account ranting about sports/politics/insert topic of the month and making $0 for it. Much better to do all of that and spend 50% of the time working so you can make $100, $1,000, $10,000 or more.

Assumed Map: The map that we *assume* most of our readers fall into is this. They want to be financially independent at a reasonable age (40 as a line in the sand). They want to *choose* what they do for work at that point. And. They don’t want to end up a “millionaire” at age 65 with no life experiences and 9-5 wage slaving the entire time.

If that’s the general idea of what you’re trying to accomplish then you’re forced to go against the mainstream talking points. Sure it *is* true that having a mortgage is forced savings for the “average person”. It *is* true that you can retire at 65. It *is* true that a ROTH IRA and a 401K can “help you save” since it is automatic. So on and so forth. The problem is… do you even want that life? Or is it better to just take the company match (guaranteed 100% return) and spend the rest of your time trying to generate more revenue with an online business. Anyone serious about the assumed map here knows that option two is 100x better from a probability perspective.

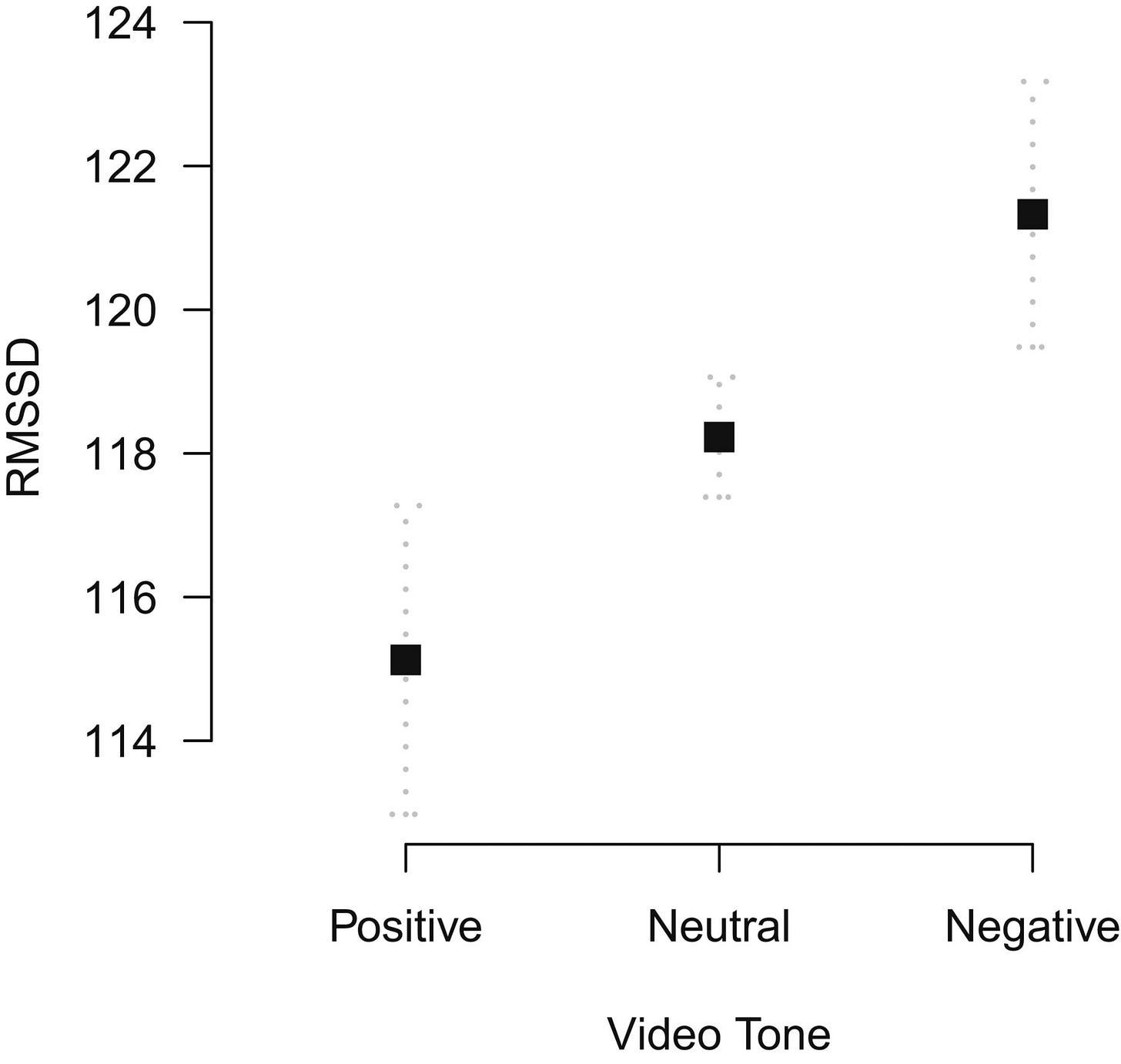

The Most Depressing Dot Chart - Somehow Encouraged!

On that note, hopefully you don’t have any interest in the dot chart and map laid out above. If you do have an interest in it, enjoy hanging out with Dave Ramsey and Yahoo News! We’re confident this part of the interwebz is not for you. To each his own!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Security: Our official views on how to store Crypto correctly (Click Here)

The education in this substack would've been so valuable to me at age 20. There's definitely a reason this isn't taught. I share the stack with my adult kids; the writing here teaches them things I never could.

Great update on the basics!

I am basic and not as high speed as the rest of the jungle due to earlier life choices. Very thankful to have this community and improve all I can!