Media Manipulating Your Focus: "Current Thing"

Level 1 - NGMI

Welcome Avatar! Last week we did a play by play of actual decisions made from 2020 to June of 2022. Now we’re going to walk through a lot of news events that coincidentally lined up with major decisions as well. Once again, you can decide if this was by design or if it is purely a series of strange events.

#1 George Floyd Protest (Roughly May 2020)

During the pandemic there was a huge upheaval related to George Floyd. Again. Remaining politically neutral, we don’t care if you were involved in the protests or not. The bigger issue is that this coincided with the complete lock down of the US economy. Yes. Pockets were open. However, the big picture economy was closed/locked down.

Meanwhile, interest rates dropped in May to Zero. This is actually one of the most important decisions made in 2020. When rates drop rapidly to zero, there is usually a slight lag before mortgage rates change.

As you can see, in the second chart, rates continue to go downward (after May). This is a perfect set up for institutional investors like BlackRock. They have time to research how people react, what cities they move to and simultaneously lock in lower rates since the COVID-19 pandemic allows work from home.

Financial Impact? While everyone else was worried about this case, there was *NO* vote on dropping the interest rate to zero and allowing wealthy individuals to get <3% loans. Also. The change in eviction rules made sure that anyone “close to the line” went belly up and the only people able to survive multiple months of little/no/negative income were once again major firms and wealthy individuals.

#2 Absurd Changes to Election (Q3/Q4 of 2020)

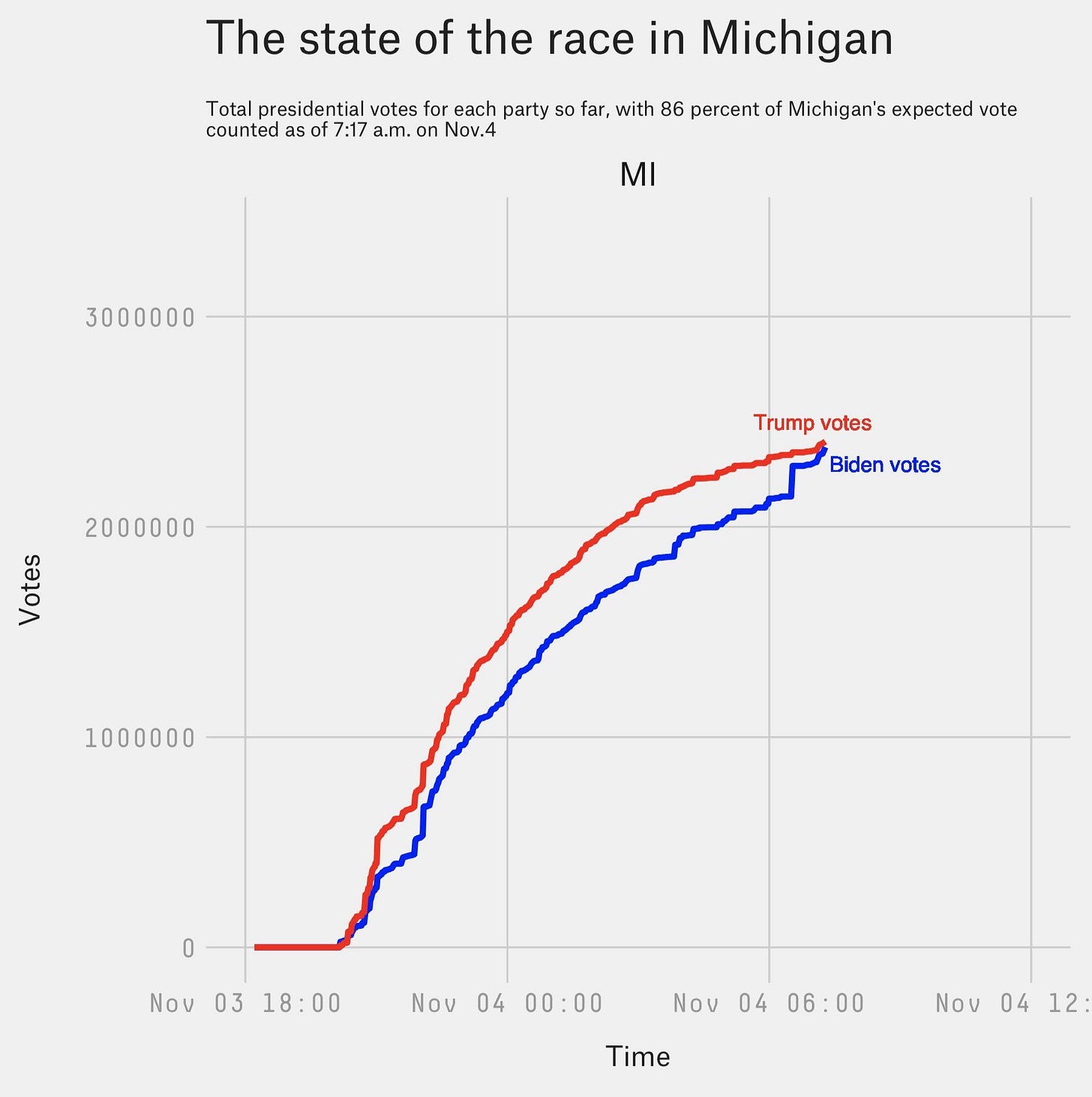

There is no way the election debacle was planned since this is a standard 4 year event. That said, using the backdrop of COVID-19, there was a huge uproar related to the new voting policies. This resulted in a sudden spike in Biden mail-in voters in the middle of the night.

People were once again glued to their computers writing about how so and so was going to save America and start the “massive comeback”. They were also fixated on the vertical blue line. Note: no president cares about you (or us) and has zero interest in ever meeting you (or us). Also. The government sent billions of dollars to dead people with stimulus checks, no way anything was done correctly even if the majority are fine with the outcome.

Meanwhile… major firms and individuals pack up their bags. They move to lower tax jurisdictions such as Texas and Florida. The writing is clearly on the wall at this point. There is no debate at all.

Once you saw major Tech companies allow for 1) remote work in Florida/Texas, 2) Elon Musk pack his bags and 3) Wall Street firms relocating to Florida… The wealthy elite and institutions started to purchase single family homes, multi-tenant homes and apartment complexes. Note: notice how the end of the year lined up with the exact bottom of mortgage rates. Incredible timing.

Financial Impact? The right is focused on the blue line jump for the next month. The left is busy celebrating. In addition! There is a new cure for COVID-19 that is being developed and ready for mass release. This creates a solid four month window where major firms can buy up as much property as they can.

Think about it. If you could buy a million dollar property at 2.5% (only $25,000 in total cost), it means the million dollar place needs to rent out for a whopping $3K a month or so. This is PEANUTS for a massive institution like BlackRock or a billionaire. $25K for an institution/billionaire is like $25 to someone who makes $100,000 a year.

#3 Roll Out the Cure

Once again remaining as neutral as possible. We can assume that everyone really believed the vaccine would work. Fair enough. The vaccine is rolled out and people begin going out (slowly but surely). In the end? This ends up being more of a “flu shot”. For the next 9-12 months we have iterations on the vaccine and once again (sticking to facts) by the end of 2021 we learn that it is not a “cure” but rather more of a flu shot type efficacy. This isn’t debatable anymore as people who had 2 or 3 injections still contracted COVID-19.

While everyone is focused on vaccine monitoring, the summer opening and returning to a partial remote/go to the office set up… Rents are going up like mad.

Meanwhile… CPI in April begins to change showing that inflation really isn’t 1-2% but closer to 4%… then 5%… then 6%… then 7%… ramping all the way up to 8%+! The worst part about this is they even changed how they define the CPI! Things you need to survive are increasing the most (food and fuel) while things like computers and TVs (naturally deflationary) make the rate look smaller. Hopefully, our readers agree that rent/food/energy is a better read of inflation which is why we focus a lot more on the annual change in median rent.

Inflation History from Statista (Source)

Financial Impact: The war against COVID rages on for 9-12 months. In the meantime, with locked in rates at 2-3% for institutions and the mega rich, they can slowly but surely increase the rents. With rents increasing by 17-18%, if they need to lower them it is unlikely ever going to get to 2-3% of the home value. Okay, be honest, next to no shot as long as they didn’t buy terrible properties.

#4 Ukraine and Russia

No doubt about it. The war that broke out is horrible and the government *did* warn us about it in advance. We’re not going to say they missed it as that would be false info easily debunked with a search.

The more interesting part of the war is how it coincided with a sudden removal of all of the COVID restrictions. Once again, these are just step by step explanations of what occurred. When the war broke out you could: 1) travel without a vaccine card, 2) go to dinners/dining without a mask, 3) go back to work if your company decided it was critical to business and 4) the only place that continued to enforce masks were medical sectors - doctor visits, hospitals etc. Note: Airplanes and Uber forced masks for a longer period of time. However other than these two regions *poof* all the issues were gone.

This major and terrible news event was a rare chance to say “nothing we did worked” without admitting it. You can’t go on stage and say no one needs the vaccine. You also can’t go on stage and say the virus is not as deadly as we thought. Both of those admit incompetence so better to be *right* on something big and major (Russia attacking Ukraine) to gain credibility while brushing the prior decisions under the rug. Can’t be an admission of bad decisions if no one remembers.

Financial Impact? That’s right. At this time they begin to raise interest rates rapidly and tell you that if you didn’t secure a mortgage by now you’re going to have to pay double. Once again, quick math is that your ability to afford a $400K place with 20% down just changed to $280K (if you had $80K to pay the downpayment maybe a bit more but the point stands). Everyone focused on War while energy prices soar and cost of purchasing a home soars.

#5 Roe v. Wade

This is the latest news that people are now focused on. Once again, we don’t get into politics and you’re entitled to your view on if you think it was good or bad decision. None of our business. Now the bigger question (to us!) is what does this line up with?

Option #1 Recession: One of the brighter people in the jungle came up with a pretty decent idea which is listed below:

Q1 was a terrible quarter and Q2 is shaking up to be down in terms of GDP unless tons of credit card/debt payments inflate the GDP number. Hint: be sure to check Real GDP versus printed GDP since printed GDP doesn’t adjust for inflation in many cases.

People in the USA post all day about the good/bad of this decision. Great. If we look at the history of major announcements or “current things” they seem to line up with a big financial change. Again. Major current thing… So what is the financial change?

Option #2 Sudden CPI Change?: Major store chains are considering the following: “Keep your returns we have too much inventory!” (yes seriously, can read here). This isn’t anything to celebrate it just means drum roll: large decline in consumption!

If this ends up being a real trend, CPI within retailers can help “reduce” printed inflation. Read that carefully. Below is the official breakdown and if food and energy goes up a lot but apparel suddenly nose dives the inflation issue can be suddenly solved! (Magic!) (Source)

Option #3 War Spending? Another item we don’t get to vote on is spending money on Wars. Recently, we’ve seen more complaints about Russia’s actions in Ukraine. The more they press this issue the easier it is to ramp up spending

To be crystal clear, the war is horrific. The question is if Roe v. Wade is another psyop to get us to spend more money on something else (without the masses noticing).

Financial Change: Jury is still out on this one. We’ll see if there is a pivot in financial policies or we announce a recession. Or nothing!

Up to You to Decide: All of the items here were historically correct (broadly, we didn’t bother looking up the exact days): 1) protests lined up with interest rate drop, 2) election coverage leads to massive stimulus checks and near zero interest loans to rich people and companies, 3) COVID-19 vaccine focus leads to rents going up 17.5% owned by - you guessed it - the wealthy, 4) Ukraine and Russia lines up with admission of inflation being bad and removal of vaccine rules and 5) now we’ve got Roe v. Wade.

People can say we’re too focused on money/finance. That’s fair enough.

Just ask yourself the following: Why can't you vote on: 1) money printing, 2) interest rates, 3) taxes, 4) school curriculum for your kids and 5) war spending? Financial literacy isn’t taught in school for a reason would be our guess.

Save yourself because no one else will. Hopefully we can all agree on that!

Till next time…

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team

One other incident of note was in the fall of 2019 when the repo market started to blow up. Seemed like the first major cracks in the system were showing and covid was a great excuse to cover up the decades of bad monetary policy

Obvious to me and most readers here but unfortunately sounds like crazy gibberish to most folks who get high-fructose information from 30 min of half-digested "evening news" telling you *how* to feel about something.

Everyone do yourself a favor and learn how to *think*. That means reading financial data (doesn't lie) and trying to figure out the story they portray. Bull is talented at this, hence why he's so right on with macro 80%+ of the time.

Meanwhile, watch out for the Midterm elections as a distraction. Republicans should win both houses big and Biden will effectively be a lame duck with no power. Right will celebrate, left will be furious, but what will actually get done?

Will we be in an stagflationary recession by that point? Regardless of who wins the election, what does that lead to...? BFF J-Pow da real prez now and even he can't control energy prices. Hmmm...