MSTR, Celsius and Fake GDP Numbers

Level 1 - NGMI

Welcome Avatar! Absolutely thrilled that we were able to convince well over 20+ people to pull funds out of $CEL. The range of money saved was as low as $10K and as high as $150K (about 7 BTC). That aside, we’re going to mention a few short items before moving onto the GDP fake numbers that will show up.

Part 1 - MicroStrategy

Since we’re not going to put all the proof in the free substack, all you need to do is check out this link to prove that the $21K liquidation price is not real.

So there is no confusion, there is a zero percent shot that MSTR gets margin called at $21K and there is no way Saylor loses his company. Cannot get any clearer than that.

The current price where there would be issues is about $3,562. Unlike DeGens levering up on BitMex or other platforms, that is not how the debt is structured. If you’re being fooled by people on Twitter we would suggest reading our basic (free posts) on financial statement analysis and understanding how to read filings.

Other Notes: Once again not going to post all the proof available to paid stack members but we went through all the filings: 1) Saylor cannot be voted out as CEO, 2) Board cannot push him out and change things and 3) debt holders also can’t do anything there are no covenants - went through all the bond offerings. The only thing they can do is complain (which they will) however they have no legal recourse. For those interested, look up the ownership structure in MSTR annual filing. Note: probably clear as to why we don’t answer questions for free anymore since people refuse to look up basic SEC documents or don’t know how to read them!

Part 2 - Celsius

To add some humor, we posted the proof of this but the original “head of lending” was actually a sex film worker. You think that would have been a red flag but apparently it wasn’t and people really believed this would work. Simply look up the name below and google it yourself. Autist Note: we would have left the tweet up but Twitter is cracking down on its algo for that type of content and we’d be put in a bigger Twitter jail (already don’t show up on search!)

Some woke person will say we shouldn’t judge based on history, however, how do you expect someone with no financial knowledge, no tech knowledge and no investment knowledge to run a complicated DeFi protocol. Also. Why would you trust someone who makes this hiring decision. No matter how you cut it. Not good.

If she had a background in software development or something relevant perhaps it could have become the Kim Kardashian of Computer Coins.

Now we get to see how good on-chain data is. Before we make a comment here we *don’t* think it is possible to track every single transaction they have made. It is likely extremely messy. However, we do know that Celsius forced a stoppage of withdrawls. This means they are seeing solvency issues. Note: some are saying the liquidation price is now $16K or so due to addition of collateral so watch it closely.

Impact to CEL: For those interested in the pain ahead, if CEL goes under it means that retail gets dismantled. According to the terms and conditions they are considered “creditors” and if it goes under they can end up with zero.

“Upside Case”: The only way out of this is by securing a ton more collateral. Big risk there as additional collateral may be wiped out anyway. To be balanced on this, if someone big comes in and posts say 10,000 BTC in collateral, the liquidation price would drop significantly and the biz may be salvageable. Trying to guess here, most likely that someone who already invested a ton into it would be the only one willing to take on this risk

Centralized DeFi: No matter how this ends up (salvaged or not), there is no way people will use these products any time in the near future. Also. As soon as CEL allows customers to withdraw we’d wager that there will be a flood of people.

CEO Decision.. within 2 days no one can take a penny out!

Part 3 - Recession, Stagflation etc.

The results are in! Everything is up!

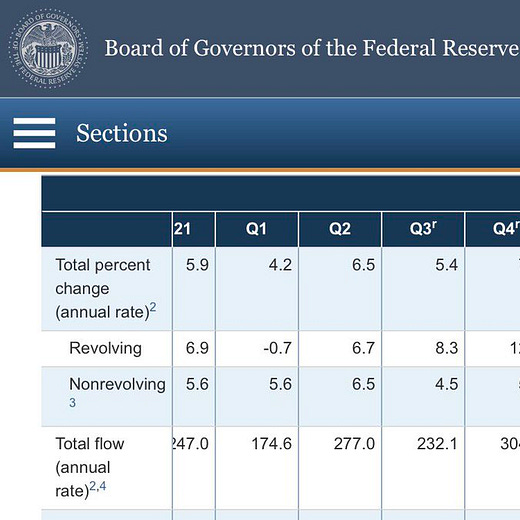

At this point, if you believe the GDP numbers that will be posted in Q2 we have a new product to sell you led by Bernie Madoff, Do Kwon, Bill Hwang and the Enron Executive team. Effectively, the only way for GDP to even register a 0.X% positive return (not even 1%) is through leverage. The below from this twitter account explains well with fed data. In short, people are depleting savings to lever up on credit/debt to pay for stuff. Not good.

Recession or Stagflation: Quick reminder that a recession is 2 quarters of negative y/y GDP growth and stagflation is when unemployment goes up and so do prices (This hurts the middle class the most and is a real possibility). For those of you that think this is where we’re heading there are really two simple options (big picture). At the low end of wealth spectrum: take savings and buy up non-perishables like a cartoon mink (yes even wealthy people stock up) and 2) if you have a bunch of money you buckle down and own a home outright. Rates are no longer low but if you own a home outright your costs plummet (hard to go broke with no rental payments!)

Conclusion: Unless you’re worth $500M+ and can step in and shake things up, these big collateral issues are out of bounds (only institutions can decide what happens next). At least no one reading this has any money in centralized DeFi project… we hope.

Note: going to have comments off for this post since it will inevitably lead to paid content being leaked related to MSTR and other items. Back to normal next monday.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We may or may not be homeless. We’re an advisor for Synapse Protocol and on the JPEG team.