NFTs for Beginners - Overview and Glossary of Terms to Ramp Up

Level 1 - Definitely NGMI

Welcome Avatar! While everyone is aware of the NFT craze at this point, this is meant to be a guide for complete newbies. Most people think “NFTs” have no value and don’t believe in the “community aspect” of the industry. They will be proven wrong in a massive scale and this post will likely convert you into understanding why.

NFT Use Cases

The first use case for NFTs is a simple “flex”, you are richer than them. Anyone can rent or lease a super car. Anyone can rent an expensive mansion for the day/weekend. None of this is remotely impressive as it only costs a few thousand dollars.

In the crypto landscape, you can’t pull this off. If you rent an NFT, people know you rented it (blockchain data) and on top of that, it is practically impossible to “fake” owning a $400,000+ Crypto Punk or $1M+ Artblock.

While there are a lot of people who scam it in a different way (have 10 people chip in 12 ETH each to acquire one Crypto Punk), the end result it still the same. They only have one and the group identity is forced into 10 hands instead of one. Over the long-term, people will find out that the punk owner doesn’t actually own the punk (this is happening already if you’re deep in the space).

In short, first initial use case is insecurity/flexing which has been around since the dawn of time. At this point a JPEG is likely a bigger flex than a Lambo because it is 100x harder to fake and more importantly it gives you access to powerful people you’d never meet without it.

Key Point: it isn’t possible to duplicate so if you “right click save” you’re not adding anything. You’re highlighting the rarity.

Powerful People and Community: For the people who claim that they will never own an NFT, we cannot help but laugh. There are really two major types right now: 1) the real substantial projects and 2) the scammers who are dumping on their fan base - see celebrity NFT drops of 1/10,000 units that quickly move to zero. If you see an NFT being sold with no community backing it (just a celebrity), you should run.

Run as fast as you can away from the project. The only way you should be involved is if you know people will “push the price up” for a couple of days. Then. Immediately liquidate.

Community: This is where the real value is. If you were to ask someone “what is the net worth of a Crypto Punk Owner” they know it’s in the millions (practically guaranteed). This is powerful in itself as you can jump into the Punk discord and immediately know you’re not talking to a LARP.

This is enormous. Even if you go to high-end bars/clubs/restaurants? Tons and tons of people are simply LARPs. Again. It isn’t hard to buy bottle service for a day or even pop some champagne. The real value is finding people who are heavy hitters in their industry.

Access: In the near future, if you want to raise money, do you want to go and raise it from Punk owners or do you want to try and raise money from a random newly minted NFT? The answer of course is Punk Owners. This is powerful in itself as well. You’ve created an access point to get rid of the “riff raff” and target internet rich individuals/entities.

Access Part 2… If the Celebrities wise up (they will), the NFTs they sell will eventually give you real access to something new. So far, “experience NFTs” have been a flop but they will likely work in the future. Instead of buying a random 1/100 mint from a celebrity, the ownership of it will allow you to meet them or do something specific with them. NFTs can also be used to sell your time. Auction off an NFT that gives you access to a one hour call/meeting. So on and so forth.

A lighter form of this would be advertising. Say you wanted to do a sponsored post. Instead of collecting US Trash Token, you could collect via an NFT which would represent a certain amount of minutes for a podcast or advertising space/paid content.

Streaming Money: NFTs can also be used to collect royalties or the concept of streaming money. You send your “employees” an NFT and you link that to a token issuance. This way you can fill their account without the need for constant manual sending of tokens.

Gaming: NFTs are already entering the gaming sphere. The first “NFTs” were really skins in digital games (just without any real outside use). Back in the day, gold in specific video games ended up having more value than some currencies (like the Venezuelan bolivar).

Quick Conclusions: At this point you should come to a few conclusions: 1) if you can “flex” online, do you reach more people? The answer is yes. The rented lambos/mansions won’t work anymore; 2) there is no reason for a 9-5 payment system, it can be streaming money or one time instant payments and 3) access becomes more relevant and this could range from the right network to special areas in a built VR video game.

Okay How to Get Involved

Assuming that you have some interest now and understand that NFTs will not go away any time soon (in the future every single person will be forced to own an NFT just like they use the internet), it’s time to look at your purchasing options.

1) OpenSea: This is the most common and will likely be displaced long-term if they do not compete on pricing. They charge a 2.5% fee but for now it’s the main way to acquire an NFT.

Source (Pitchbook)

2) Rarible/SuperRare: Rarible / SuperRare is similar to OpenSea and there are pricing differences at times for the same item. Some people do try to buy on one and sell on the other.

3) Nifty Gateway: is also a semi popular marketplace in NFTs, although more for those who are on ramping from fiat and may not have ETH in a hot wallet ready to go, as credit cards are accepted as a form of payment.

Some Security Notes: Many scammers attempt to sell fake versions of Art Blocks and other high valued NFTs. You have to check the item to make sure it is verified on OpenSea.

Valuation/Concept Today

At this point you’re in inning one. This means that NFTs will fluctuate at a significantly higher rate relative to the underlying asset. IE. if a NFT project is collapsing you won’t see it since the liquidity dries up. On the other side, if a project is doing well you’ll see hundreds of alerts over and over again.

Key to NFT Success: Community and Marketing. If the plan is to invest in a project and let it "run” the project is going to be worth nothing. Since you’re in the early stages of NFT adoption, the winner is going to be the one with the best marketing.

Here is a great example: Corona. If you do a blind taste study of Corona beers they rank poorly. That’s right. They are not considered to be good tasting if the test is run blind.

Why do they sell well? You guessed it MARKETING. If a team doesn’t have good marketing it’s best to avoid.

Want to know why we’re using Corona as an example? Snoop Dogg runs their commercials. The same guy who owns a punk and uses it as his avatar. (10) Snoop Dogg (@SnoopDogg) / Twitter. He understands marketing.

To really drive home the point, the beer tastes so bad that they consistently use a “lime on top” to market it. That’s right. The beer is so awful you have to improve the flavor with a lime before consumption. In the end, the best marketing and mediocre product will crush the best product with bad marketing. This has been the case since the beginning of time.

Cultural Relevancy: Once you understand that community and marketing are important (just means diamond hands + marketing), the last item remaining is relevancy. Punks will likely stand the test of time as the first OG product. The other ones have to carve out a niche in another way. We won’t disclose much more than that given that paid subs have our NFT portfolio.

If you’re on the fence about a project a good filter is strong diamond handed community + a reason to be culturally relevant in 5-10 years (no one thinks out that far hence the FOMO hype cycle we’re seeing).

For the Newbies!

Below is a glossary of terms created by: CryptoMouse (@The_CryptoMouse) / Twitter

1/1 of x: a framework for thinking about an NFT collection. For example, CryptoPunks are 1/1 of 10,000. Each NFT is unique, but they belong to a coherent whole collection in contrast to 1:1 art.

1:1 Art: Art where each piece is unique (1 of 1), usually in contrast to PFP and Generative Art where collections can range from 100s of pieces to 10,000 pieces.

AB: ArtBlocks, currently the largest platform for generative art in the world, that has three collections: "Curated" (often referred to as “ABC”), "Playground" and "Factory", although competition has entered via Gen.Art.

Alpha (alfa): anyone from a hedge fund background knows this one, a term for any outperformance generated (beware anyone “dropping alpha/alfa” on Twitter though, usually just “beta”).

Aped: From Crypto Twitter, and not be confused with ape projects like Bored Ape Yacht Club, it means committing a large size of your portfolio to a particular project.

But it’s money laundering: like the criticisms of those who are not crypto natives, this is usually just used as a form of massive cope by those unable or unwilling to invest the time to learn.

COPE: opposite of FOMO. Making yourself feel better about a poor decision. Also people unwilling to chase projects that are doing well since “it can’t go any higher”

Ded: dead or deceased.

Delist: remove your listings from marketplaces (like OpenSea) because prices are rising and your listings may get snagged at a low valuation if the trend continues.

Derivative: Projects derived from the original project. An example would be PFP copy projects of CryptoPunks both on Solana, Tron and Tezos. Many rail against these as stolen art, which they are. But if you zoom out anon, you’ll see it underscores the value of the originals. This has become very true of punks, as they are considered blue chip NFTs, with many long-term investors in the space citing the Fat CryptoPunks Thesis.

Discord: a messaging platform heavily used by NFT project communities. It is both extremely useful, if one dedicates many hours each day to reading the reams of ever expanding content generated ad infinitum, and a breeding ground for scammers, looking to compromise your seed phrases for hot wallets by impersonating NFT Twitter personalities and/or marketplace/hot wallet help desks. Word to the wise: turn notifications off unless you want to annoy yourself and everyone around you with constant pings 24/7 and use the block function liberally.

DYOR: Do Your Own Research.

Few: “Few will understand”, similar to “probably nothing” and is considered a polite version of FOMO.

Floor Price: lowest possible asking price, either for a particular collection or a subset, and often easily manipulated by large buyers.

FOMO: Fear of Missing Out.

Fren: Friend.

Gas: Cost of completing a transaction on the Ethereum blockchain, measured in gwei. Also can lead to “Gas Wars” depending on who has paid a miner bribe or who is using a flashbot to front run. Gas often spikes when a large project is minting, leading to many stalled and ultimately failed transactions.

Generative Art: Art that is algorithmically generated, ideally in real-time when minted, although this is not always the case.

GM: Good morning.

GMI/WAGMI: Likely already know this one, "Gonna Make It" and "We All Gonna Make It"

GN: Good night. (You’ll notice in a bull market there is often very little time between a “GN” and a “GM”.)

HEN: a marketplace for art issued on the Tezos blockchain that many use first as a cheaper alternative to ETH.

HENI: platform where Damien Hirst did his “Currency” NFT project.

Hot wallet: a digital wallet tied to your browser, most commonly MetaMask, commonly referred to as “MM”.

IRL: In Real Life. Fortunately, digital and IRL are merging as we spend more and more time on a computer vs. outside in the “real world”

IYKYK: If You Know You Know. Also considered a polite version of FOMO.

JPGs (or Jpegs): Another name for “NFTs” which can range from image files for art and collectibles, to audio files in the case of Deafbeef, to video games like Axie Infinity.

LFG: Let's F____ing Go. Used to express excitement, often accompanied with rocket ship emojis.

Liquidity: In this context, it usually means available ETH to buy jpgs. NFT buyers in general are a very illiquid bunch who usually are overly invested in various projects at any given time in the hopes of avoiding FOMO.

LL: Larva Labs, the creators of CryptoPunks, Autoglyphs and Meebits.

Looks Rare: Often used ironically, as rarity is often a driver of value in the space.

McDonalds: Back up career in case NGMI does indeed come to pass.

Meatspace: Another way of saying IRL.

Mint: Issuance of a piece on the blockchain, either by the artist or a collector.

NFA: Like DYOR, NFA means Not Financial Advice. AKA due diligence is up to you.

NGMI: Similar to the above, "Not Going To Make It".

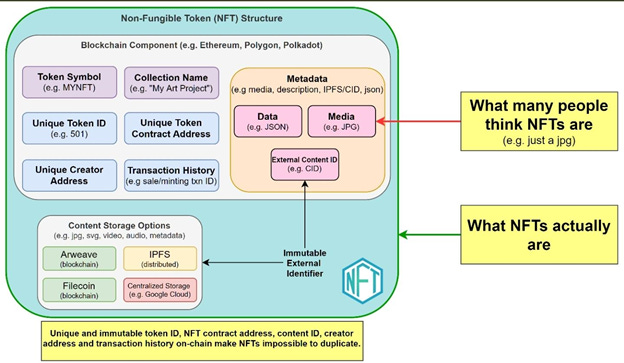

NFT: Non-Fungible Token.

Noob/Pleb: Newbie and Plebeian, respectively. Commoners or the opposite of OGs.

OG: Dating back to ‘90’s hip hop, original gangster, meaning anyone who was early to the community and earned respect for staying engaged through multiple cycles.

PFP: Profile Picture.

PND: Pump and Dump. Often in the context of a bad PFP copy project that an influencer shills to dump on his or her followers after holding a big bag from the jump.

Probably Nothing: a BTB-ism the wider Crypto Twitter space has adopted for broad use to mean the inverse or “Probably Something”. Started in early 2020s with BTC announcements that was adopted by the NFT space shortly after.

Right-Click-Save-As: What literally everyone who is not a crypto native, although even some deep into “boomer coins” say, demonstrating their ability to download any image online. The community’s typical response is “Go for it. Then try to sell it.”

Roadmap: The list of activities a project will plan to do to add value to a community if a PFP, wildly considered as inappropriate to ask for within the context of an art project. One must learn to differentiate between the two.

Rug: Short for rug pulled or scam. A rite of passage for anyone entering the space. Chalk it up to stupid tax as one learns the landscape. It will happen, just a matter of when. Even Mark Cuban, for all his “billionaire investor chops” was rug pulled rather publicly on Titan.

Schelling Point: A term in game theory made famous by Thomas Schelling in his book, The Strategy of Conflict, which many think applies in NFTs. In this context, the idea is jpegs will become stores of value, and with more time passing, become even more valuable as the value stored increases.

Secondary: When either you missed a project mint, or gas wars were just too high for a particular project, and you buy off of a marketplace like OpenSea (OS). More terminology from finance world – both on the public and the private side.

Seems legit: AKA a project looks like it is serious and could have good prospects. Can be used both in a normal voice but also ironically.

Ser: Sir, used often when voicing a counterpoint.

Solanart: a marketplace for art issued on the Solana blockchain, like HEN on Tezos, but widely believed to be a better user experience.

Szn: Season, which means market cycle, which are often very accelerated in NFTs even when compared to the rest of crypto, sometimes only lasting one to a few weeks.

This is the way: From The Mandalorian, referencing moral conduct or other positive behavior that is to be commended.

Tx(n): Transaction.

Wen Moon: Often used in Crypto Twitter or (CT), and often used ironically, referring to the price of your jpegs rising to the moon.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

Daily Reminder: You ARE EARLY. Too much negativity/cope. Everyone reading this is extremely early. If you stay on top of technology, there is always a new opportunity.

GM / GN everyone! Long Live The Bull

Don’t hate on corona my guy! :)