One in 1,000 Year Opportunity and the Quick Math to Riches

Level 1 - NGMI

Welcome Avatar! On twitter we saw a ton of cope about the probabilities to become a millionaire. On this side of the web, we prefer a balance of 1) realistic chances and 2) avoiding the people who were not going to make it in the first place. The reality is that anyone who has an above average IQ and work ethic will become a millionaire. This is the truth.

The negative side is that many people just aren’t bright. We use a natural filtering mechanism for our own substack. If someone believes $100 a year is a lot of money it means they don’t even make 6-figures and are not our target audience. As the joke goes in major cities, if you simply go outside you end up spending $100+ on random stuff (food, drinks, random clothing you forgot you needed to grab etc.).

Before the Quick Maths: Instead of going through things like IQ scores, our view of “IQ” is making the best probability based decision (Detailed Post Here - LINK). If you are always making the correct probability based decision? Over the long-term, you get what you deserve out of life.

This means probability based decisions are key. If you continue to make the “right” risk reward decision, you’ll eventually hit your stride. A good account to follow on this belief system is actually BowTiedSalesGuy (LINK). You can tell based on his writing that his life frame work is for winners.

One of the under rated comments was “Approach the $500K deal with the same enthusiasm as you would a $500 deal”. This is because you’re teaching yourself good habits. Always sell in the best way possible and the results will follow over time after that.

Second Item, Be Hard on Yourself: Take a look at all your decisions and try to recognize when you *didn’t* make the best probability based decision. 99/100 times it is because your emotions took over. There is a time and place to be more communist/socialist (with friends/family), however, when it comes to money you have to remain rational. This website is a perfect example of an emotional/irrational decision from a business standpoint.

That said, we recognize it and decided that the rare chance it works is worth the risk since the world is a complete mess: 1) supply chains, 2) fake inflation data, 3) China dominance, 4) Geo-Political issues in the middle east and 5) complete squeeze of middle class. If we were not financially independent we wouldn’t do this. We’d go straight into E-Com (Paid Stack LINK) while balancing out doing the minimum at one of the career paths (Tech/Wall Street M&A/Sales). When you’re financially independent, you can follow any dreams you have (art, music etc.).

Onto the Maths: While data on the number of millionaires will always be skewed here are some quick rough metrics according to Spend Me Not (LINK): 1) Roughly 20.3M millionaires in the USA out of around 330M which is 6%, 2) millennial millionaires have an average of 3 properties with a RE portfolio of ~$1.4M, 3) around 43% of the world’s wealth is held by the top 1%, 4) only 20% of American millionaires inherit their wealth and 5) ~1% of millionaires are under the age of 35.

1% Under Age 35: This is the one we want to highlight here. The main reason why we’re pushing so hard on BTB? We see the next 2-3 years as the best risk reward upside for young people. In a sentence, young people have gotten screwed.

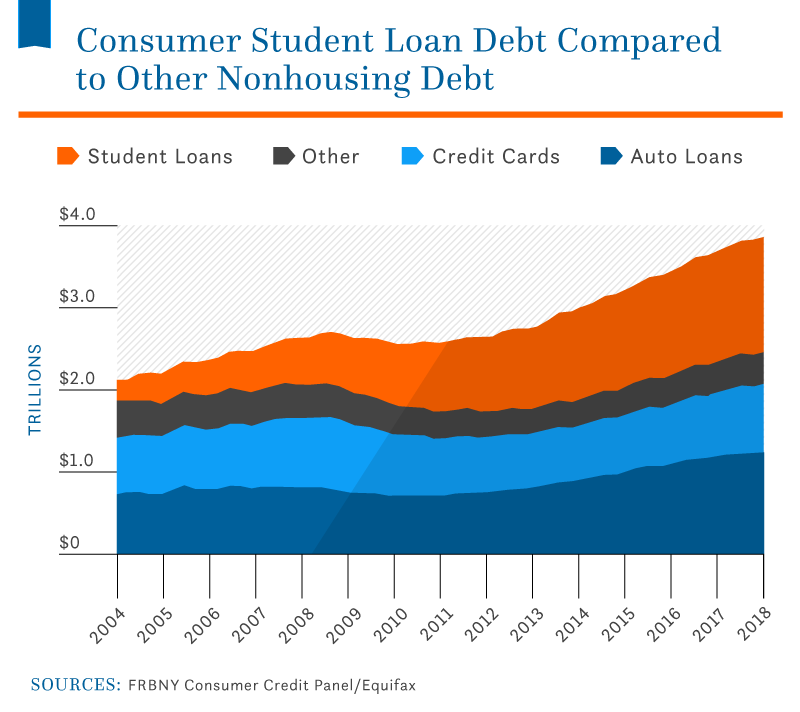

Tons of debt since their parents said to “go to college or be a failure” and a massive printing press with no signs of slowing. Student loan debt is in the trillions. While the US Debt Clock website is definitely built for fear mongering, the big picture is the same: money will be printed (LINK)

Chart from FRBNY Consumer Credit Panel / Equifax

As a fun side note, if we met a smart kid who was 20, we’d probably tell him to just start an e-commerce business and forget college entirely. You’re better off focusing on either E-com or becoming a software developer at this point. The only reason to go to college is if you can get it practically for free. In that case it is effectively a small parachute for you if you can’t get anything off the ground in four years (a copper parachute if you will)

Why Under Age 35 and Why Tech: Here is the thing. If our macro view is correct you’re currently sitting at the “knee” of the curve. In financial terms this means your standard “7-10% compounded” becomes less relevant. Take a look at how technology has been adopted (in the past).

The first part shows you that new technologies are adopted faster and faster. IE. The smartphone was picked up faster than the internet. The internet was adopted faster than cable TV. So on and so forth.

The question is, do you want to be early or late to that adoption? We think you already know the answer to that.

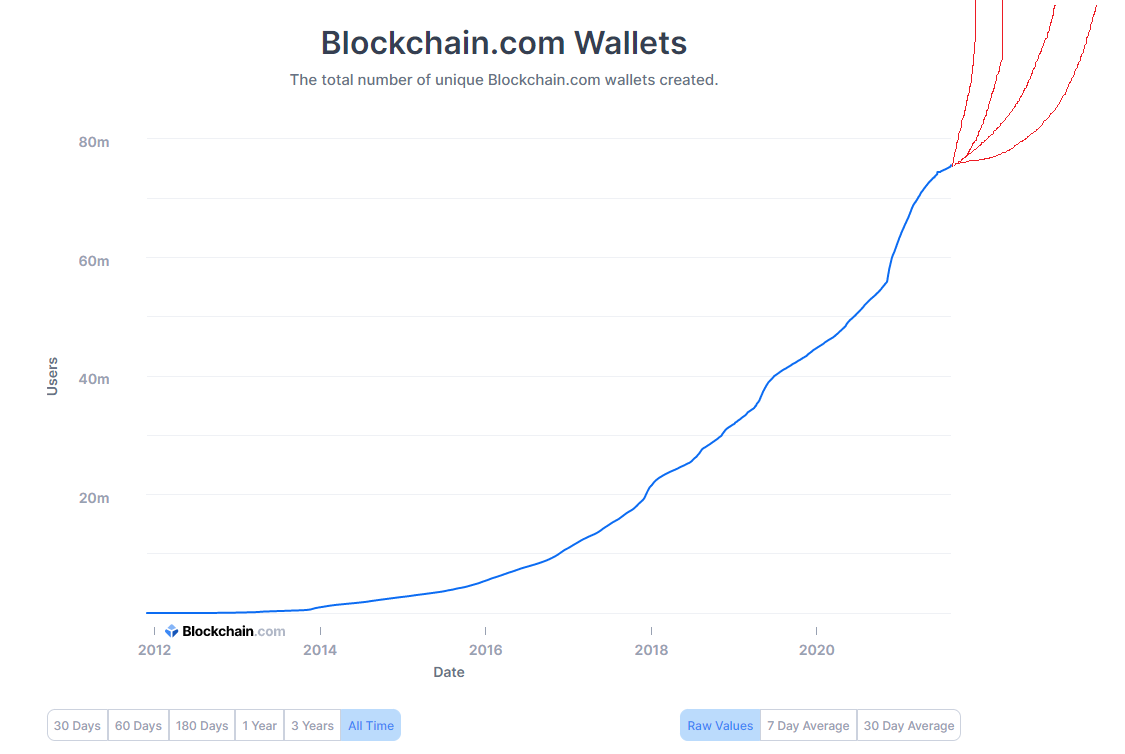

For context there are about 75 million wallets and this is increasing by ~1 million every 60 days. Now stop and think. Most people would look at that and say “okay no big deal in just 2 years it’s only going to increase 1% every 60 days”. The problem? What if it looks like first or second red line we drew? Every single person who joins the network likely brings a “friend” to the network. Hence exponential growth (not linear).

If that’s the case you’re looking at 150M+ unique wallets in short order. There is a real (although statistically unlikely) chance that you’re looking at half a billion users in just a year or two (we haven’t even included people onboarding to centralized exchanges like Coinbase).

Turning Back to You: Since we’re trying to attract the sharp people with a chance at making it, we suggest you use a simple compound interest calculator. For *fun*, type in an extremely high rate of return for just 2 years (LINK). You’ll find out that it is practically *event based* income (event is when you sell a company or have a one time windfall of income - historically we’ve pegged event based income at $500K+ US Trash Token).

Example: $50,000 USTT saved you go to $100K USTT (100%) then assume big cycle 200% return = $300K USTT. That is life changing money for many. Hint: no we don’t just talk about Bitcoin otherwise the returns would be lower, the game is to outperform Bitcoin (Bitcoin is basically the S&P 500 of the crypto space).

At the time very few people listened (look at the comments and many suddenly “deleted” their incorrect predictions). And? Those that did ended up with a ~10x. We’re here to say the potential with crypto is basically the same as it was at the time of the Tweet with a *longer* time horizon. You probably won’t see a massive move within a few months (100% move on a trillion dollar capitalization in a month is unlikely). (your average guy who bought just one coin, was able to buy a full year of living expenses if he held on for a year, that’s meaningful by any measure)

Are You Living in the Best Time in History? We’ve stated that this is a 1 in 1,000 year opportunity. We are not kidding. We also think it’s going to take a ton of work as the vast majority only know about Bitcoin (effectively, everyone on Griptoe Tweeter calling for 6-figure BTC and trying to charge hundreds to thousands of dollars a year for the same statement. IE. that BTC will hit $100-250K USTT)

Some questions for Plato.

Is it luck if you’re smart enough to run the math on compounding and live below your means for a few years? (Note we still hate frugal people we’re attempting to show you how large the opportunity is)

What is 2-3 years in the grand scheme of things anyway?

What do you really have to lose?

The answer is nothing. As Plato himself actually said “Courage is knowing what not to fear”

If you figure out how crypto is going to develop, you’ll be well positioned to benefit from the 10-15 year growth of the industry (DeFi, NFTs, Insurance, Layer 2+ scaling, video game and crypto integration etc.). During this time period as we transition into the Sovereign Individual you can flex as *much* as you want since you’ve successfully managed the transition.

Remember. If you don’t build up the right knowledge base now, you’re not going to benefit from the next layers of innovation. This is how life works. Miss one boat and you have to physically swim to catch the next one - LINK

Quick Maths Now: We write as if the reader is not financially independent. Many of the paid subs are beyond financially independent (many even at HFs/VCs with 8 figure plus net worth).

In 2010-2020, status goods, flexing etc. were not “costly”. IE. the economy was in good shape and the returns were pretty stable except for the 2 big bull runs in crypto. The reality is that the market capitalization during the 2012-2014 and 2016-2017 bull runs were just not enough to bring in mass adoption. Currently, the size of the market is big enough for the majority to participate ($2T is quite liquid)

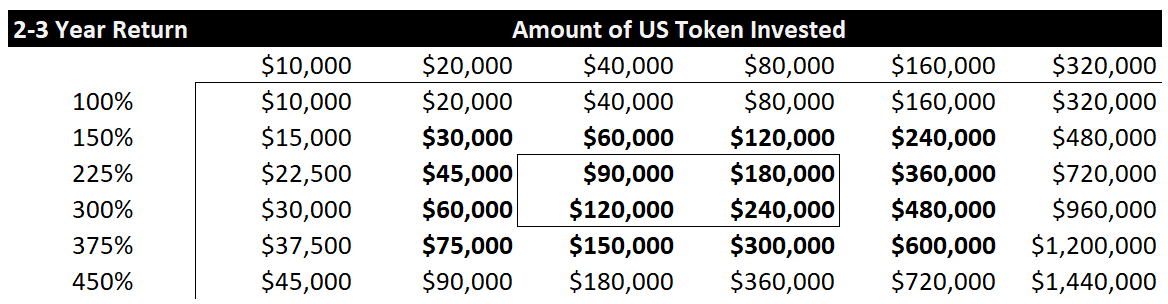

Ask yourself. If you know that people are suffering. Many are on food stamps (LINK) and you could get a 200-300% return (instead of a more standard 7-10% return) what should you be doing? Once you answer that look at the math below

Take a long and hard look at that table. If you miss the knee in the curve you miss ~75%+ of gains. That is an enormous figure. If you could have doubled your savings by living beneath your means for only 2-3 years you could have changed your returns by 100% (potentially).

These are not small numbers (right side of table or left side of table) both individuals will feel the pain if they don’t learn about this industry.

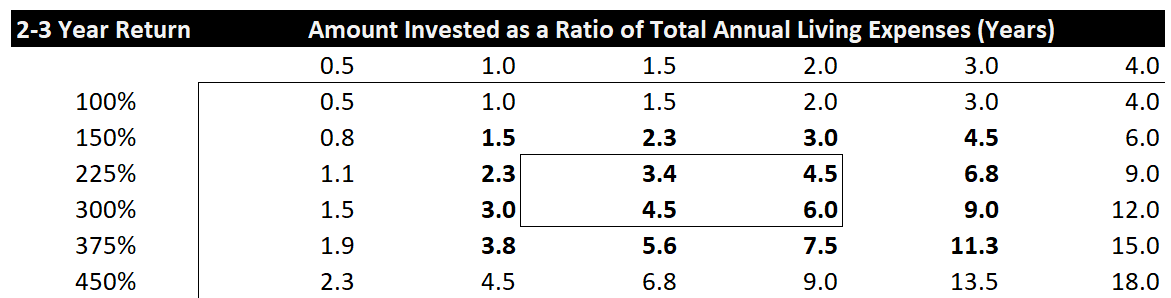

For an extra level of understanding look at the modified table below. Where you can calculate based on annual living expenses. This is by far the best metric for wealth (how many years can you live on $50K, $100K, $200K or $400K/year in after tax spending).

In this case just look at column two (labeled as 1 year). If you put one year of spending and are right, you’re looking at three years of total time purchased (300% return). That is an absurd move in the right direction. If you look at the extreme case (4 years) you’re half way to financial independence in 2-3 years.

Summary: At this point the situation should be pretty clear. We really do not know how to lay it out any more. The 2020s = the greatest opportunity we will see in our lifetimes. 80% of US Token millionaires are first generation so the odds are already in your favor.

Also.

If you don’t believe that paragraph remember what happens if you’re wrong.

Chart from Wikipedia.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.“ – Mark Twain. This quote also kicked off the Big Short.

For the love of humanity, get off zero at minimum.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. But rather opinions from an anonymous group of Ex-Wall Street workers who moved into Affiliate Marketing and E-commerce.

PS: At current rate we expect to start staking individuals and their niche online businesses by start of next year. You’ll see an example of the structure shortly (next 7 days or so).

"Why'd you move back in w/ Mom & Dad for the next 2-3 years?"

"BTB told me to 🤷♂️"

In it to win it

I've sent this to everyone in my circle. I keep encouraging them to subscribe. It's up to them to do it. I made my 1st website and am starting a 2nd. We've made a few sales so far. 1st internet money we ever made. Never would have done it had I not been following you. Don't know where it's gonna go, but got to at least try. Like u say, 99% never even start. If you're out there wondering, just start something. It begins a process that changes your thinking.

-BowTiedGarden