Ordinals & The Opportunity for Stacks

Level 2: Value Investor

Welcome Avatar! Some of you wanted an update on STX after the Ordinals hype. As many of you are aware that is a long-ago project we looked at. Given our stance of “de-risking and leaving a moon-bag” we usually lose sight of these projects since we spend our time looking at other markets (Real Estate to Crypto and anything inbetween).

That said, we have (aravindgee) here to provide an update.

Part 1: Introduction

Greetings! If you're a regular in these parts, you're probably aware of the buzz surrounding BTC ordinals that's created a major shift in the recent weeks. Among other things, it has attracted folks from other chains (eg. ETH) to reconsider BTC, has renewed criticism from BTC maxis (typical) and amped up the energy on STX. In this post, we will explore what the rise of ordinals means for BTC and Stacks.

Before we dive into it, first things first - this is not financial advice. While I work for one of the entities in the Stacks ecosystem, this post is based on my personal opinions only - it does not necessarily reflect those of my employer or the general sentiment in the Stacks space. I cannot predict the price of STX but I firmly believe that Stacks is a solid platform, here to stay and will continue to grow in the long run. NFA, DYOR.

The Rise of Ordinals & Inscriptions

Ordinal Theory: In late January, Casey Rodarmor's ordinal theory started receiving widespread attention. While the name sounds very academic, the idea can be distilled into the following:

Ordinal theory assigns a unique number to each satoshi (1 BTC = 100MM sats).

This uniqueness is tracked through the life of the blockchain, including any transactions the sat may be used in.

No sidechain or code changes are necessary on Bitcoin to enable Ordinals.

(Tech note: Ordinals operate as an additional layer, accessible through a specialized app like an ordinal wallet)

If you're interested in learning more, you can read the docs for the finer details.

This leads to a fascinating implication. Sats are now non-fungible and possess certain traits, making them a collector's item depending on their rarity. For example, the first sat of the first block of each halving (when the mining reward is halved) is rarer than the first sat of any Bitcoin block.

Consequently, sats are trackable, making them more suitable to store complex bits of information that aren't easily lost in the density of the chain. This has resulted in the explosion of inscriptions - "NFTs" written directly on the BTC chain.

"NFTs" on Bitcoin

Inscriptions are artifacts inscribed on Bitcoin sats, meaning that they are permanently recorded on the blockchain through bitcoin transactions. They are made possible through Ordinals and the Taproot upgrade from 2021 which permits the storage of large amounts of data on-chain.

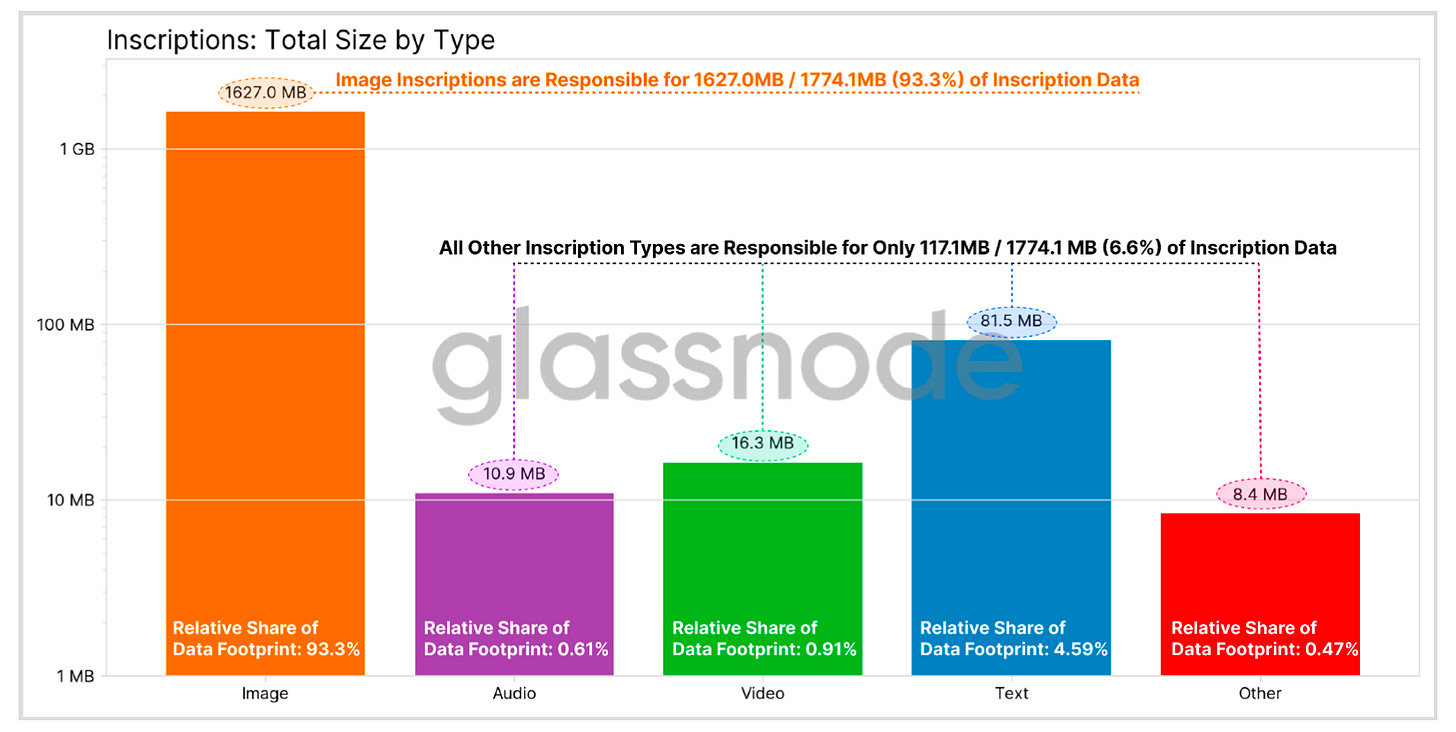

These inscriptions aren't restricted to images; they can also be text, audio/video, pdf or pretty much anything else (Someone even inscribed this game of DOOM!).

(Snapshot of size by inscription type - Source)

Image inscriptions are the most popular, for which NFT collections have already started to take shape. For instance there's OrdinalPunks, inspired by the original CryptoPunks. YugaLabs (BAYC) has also entered the fray with its own inscription collection.

The ability to store arbitrary data has even led to domains being ported to BTC - sats.id is a project to standardize writing of domains on-chain which now accounts for >15% of inscriptions. It leans on the security and finality of Bitcoin to hold the ultimate authority in mapping addresses to domains.

To explore inscriptions, the original Ordinals.com is a good starting point. Some other options (including trading platforms) would be Ordinals Directory, OpenOrdex, Ordsea and Ordswap (in no particular order, use at your own risk). This is a fast evolving space; more sophisticated tools are being actively built.

This is Good for Bitcoin (Seriously)

The Bitcoin blockchain uses Proof of Work as a consensus mechanism, where miners with serious computation power need to solve cryptographic puzzles, earning block rewards (as well as transaction fees) and ensuring that the blockchain state is reliably recorded. This is essential to maintain a high degree of decentralization on the network.

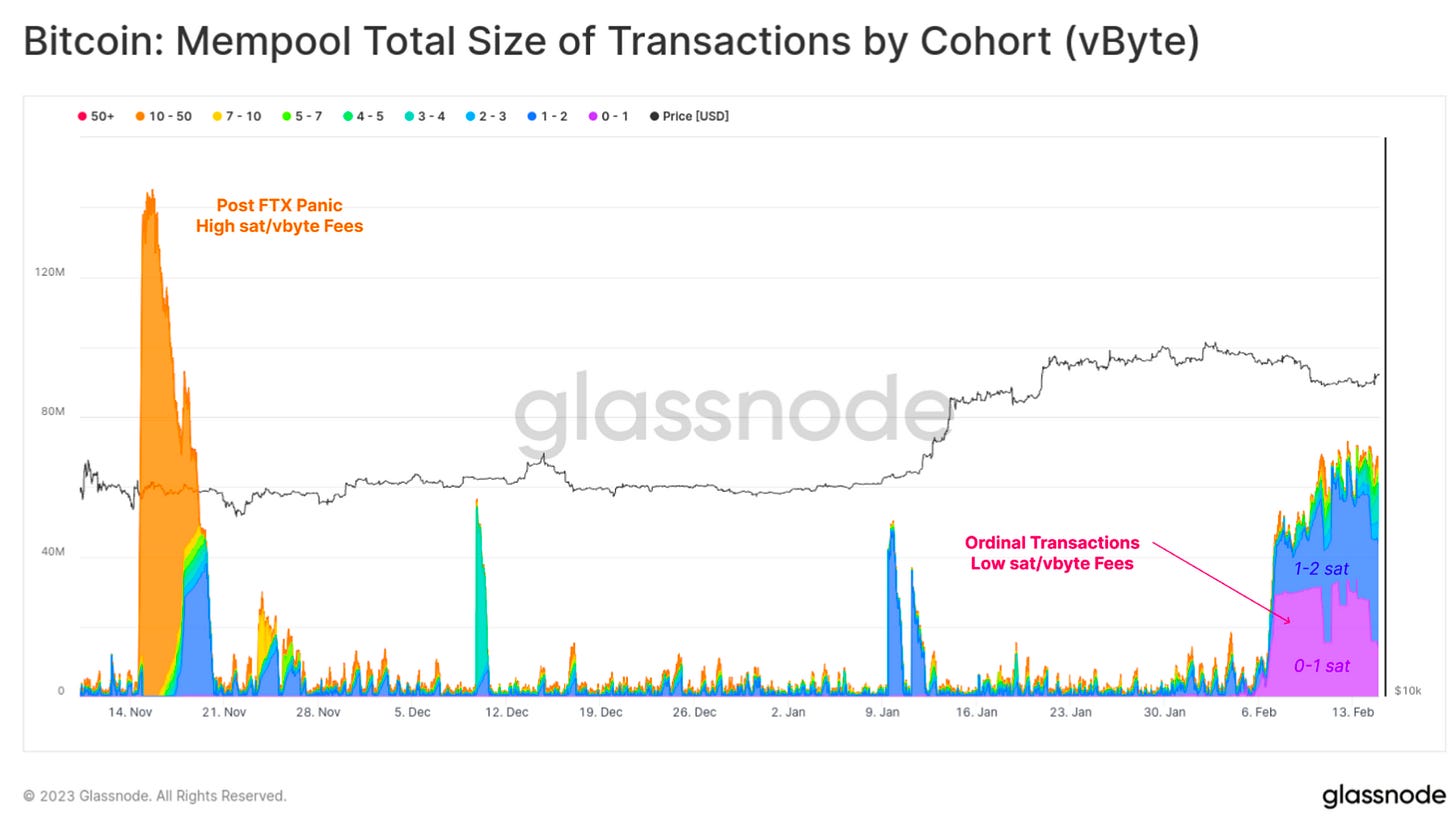

In early February, there was a large uptick in the size of the mempool (the list of valid transactions awaiting confirmation). This correlates with the flurry of activity from ordinals and has increased the baseline of fees awarded to miners. In other words, the incentive for miners has improved, thereby potentially enhancing the security of the network.

(Source)

In the long term, fresh use cases implemented on the Bitcoin chain are essential to its survival. More applications begets more users and elevated levels of activity. As the block reward keeps halving every few years and becomes insignificant, higher transaction fees will motivate miners to carry on with their role. Ordinals are already proving to be a driver of this change.

The Challenges

Inscribing ordinals has not been an easy task - especially for very early adopters who did not have access to any of the tools built in the recent weeks. The "vanilla" method of creating an inscription involves setting up a Bitcoin node, syncing it to the blockchain, creating wallets and sending/receiving transactions. This is a far cry from a more typical NFT experience, like minting from a browser with just a few clicks.

In addition the collecting and trading of ordinals required advanced configuration of wallets and a lot of caution - imagine if the user accidentally spends an inscribed sat or sends it to the wrong address! A tutorial can be found here for the more tech savvy and curious readers. Finally, each inscription is sent as a separate transaction and has varying fees, depending on current mempool conditions and how fast it needs to be finalized. Speed matters in certain time-sensitive use cases (eg. sats.id considers only the first name on the chain to discard duplicates).

Bottomline is that the user experience certainly needs a lot of work. Nonetheless, this can be interpreted either as a challenge or as an opportunity for developers to acquire scores of users with little competition.

On a side note, inscribing all sorts of data on the Bitcoin blockchain has opened up the possibility of attacks with malicious code. Here's an example of a suspicious-looking PDF inscription and the ensuing panic. Theoretically, the Bitcoin chain is agnostic to the contents of the inscription. Therefore the onus is on the applications that build on Ordinals to promote good security hygiene, which should be a key part of UX.

Enter Stacks

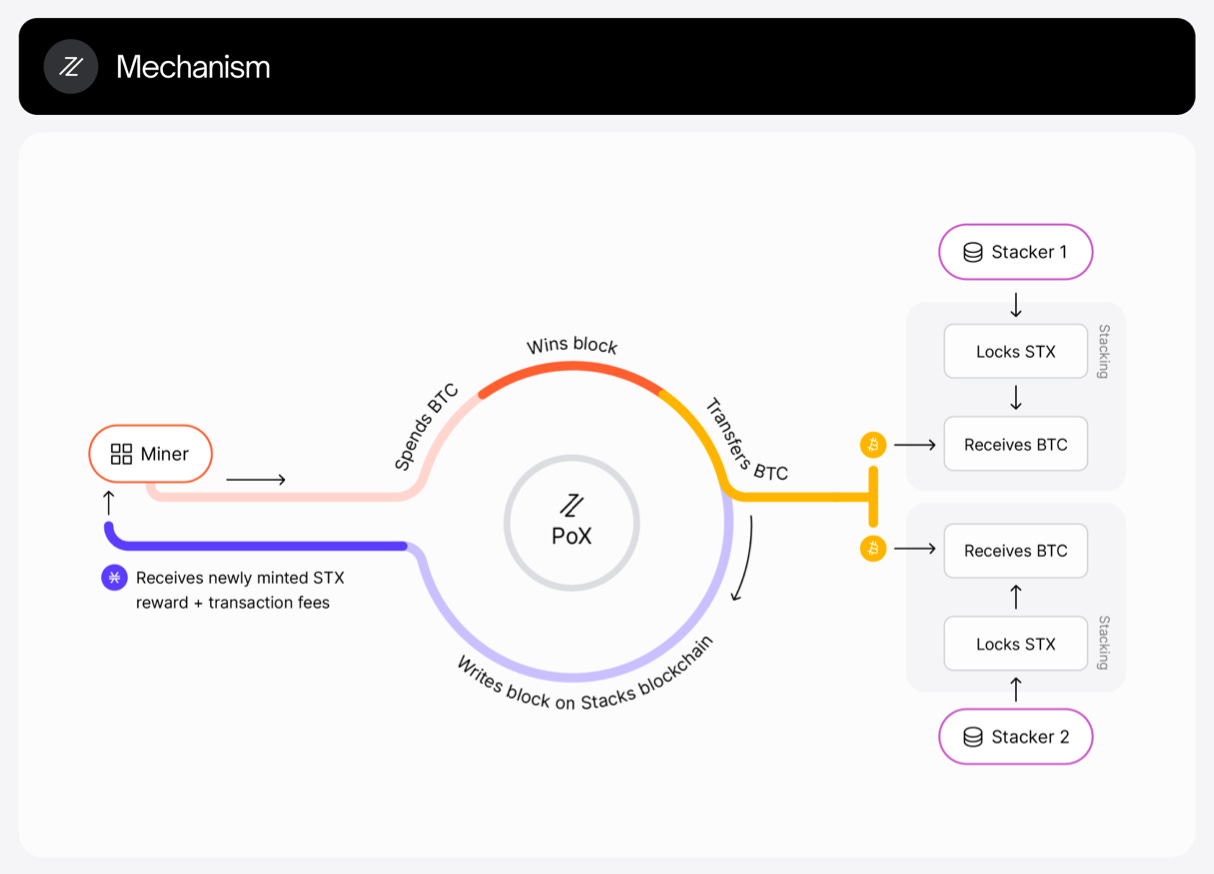

The Stacks blockchain was designed to be tightly coupled with Bitcoin and inherit its security. Its main goal is to serve as a smart contract layer for BTC, and operates on the PoX (Proof of Transfer) consensus mechanism. This involves holders of Stacks locking up their tokens (called Stacking) and miners, who spend BTC and receive STX tokens as reward. The BTC is distributed among the stackers as a thank-you for helping secure the network.

Additionally, Stacks uses Bitcoin as the layer of settlement in finalizing transactions. While Stacks transactions execute and scale independently, they are anchored to Bitcoin blocks, storing their state on the Bitcoin chain and also improving its mining incentives in the process.

The Stacks Advantage

The past month has been incredible for the Stacks token. It has more than doubled in value over just 2 weeks, as well as a similar steep increase in daily trading volume.

While Stacks does not have a direct connection to Ordinals, the market behavior can be correlated with the latter's creation. Stacks' placement as a "Layer 2" solution for Bitcoin has given birth to a strong narrative. In any case, developers in the ecosystem have been leading the charge on enhancing the utility of ordinals and grabbing users:

Gamma.io, popular Stacks NFT marketplace has built a point-and-click solution to create new inscriptions (no code or tech wrangling required).

Hiro Wallet and XVerse, popular STX wallets now support ordinals also.

bns.xyz, to inscribe .btc names (Stack's equivalent of ENS domains) on ordinals.

Changes to the Stacks protocol itself are indicative of its commitment to Bitcoin. The recently released Stacks 2.1 Upgrade increases the probability of lower transaction fees on BTC, as well as the ability to send STX assets directly to a BTC address. Also worth mentioning is the Subnets functionality, which is designed to increase the overall throughput of the Stacks chain for high-performance applications.

More importantly, coming up is sBTC, a trustless two-way peg for Bitcoin. This will be a major leap in terms of the interoperability with BTC and unlocking its financial value. Currently Stacks can read the state of the Bitcoin chain and react to changes; sBTC will close the loop and permit Stacks to write to the Bitcoin chain. Use cases include, but not limited to:

Borrowing and lending (s)BTC

Purchases and payments

DAO treasuries - powered by (s)BTC

And of course, Ordinals. sBTC can potentially support the peg-in/peg-out of ordinals, making it easier to create inscriptions or deploy smart contracts based on them

Conclusion

Ordinals and inscriptions have brought in an unexpected wave of innovation to Bitcoin (and subsequently Stacks). Stacks has endured the years and cycles, supported by a growing community of builders. With ordinals, it has the perfect opportunity to break the next barrier in adoption and growth. While Ordinal developers and users have a long way to go in terms of building & adoption, the potential is immense and will be exciting to watch play out.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money. At 10,000+ Instagram follows we will publish some city guides ranking each region we’ve been to.

it's been a while... so, STX to $100

great narrative work