Personal Finance and College/Education for the 2020s

Level 1 - NGMI

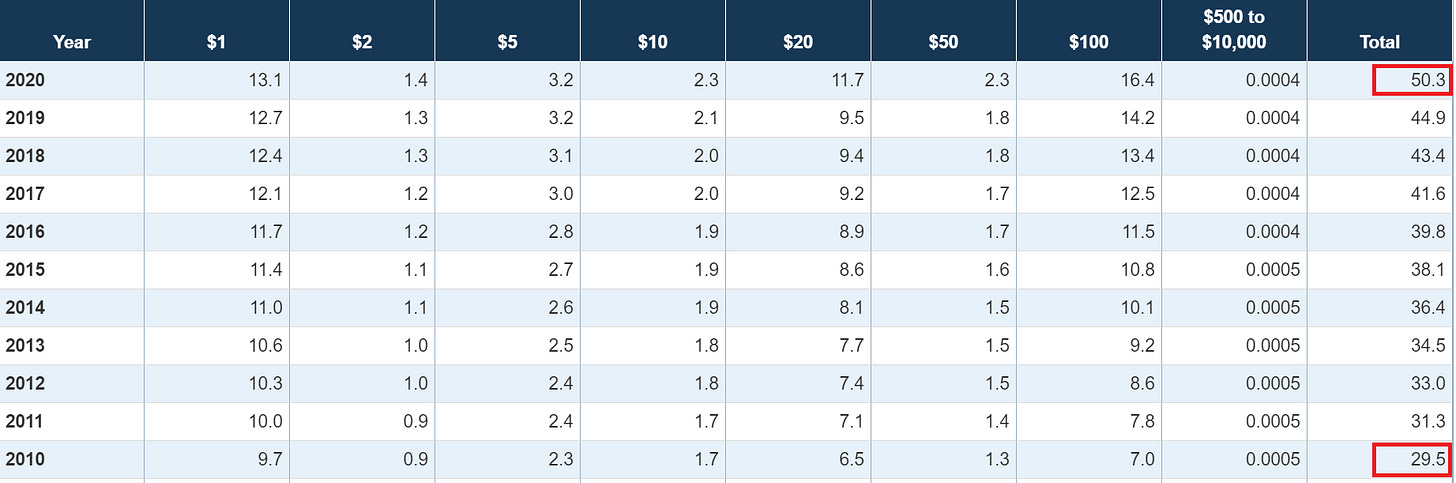

Welcome Avatar! Based on the past few interactions we had on Twitter, it’s a good time to update everyone on two topics: 1) basic personal finance decisions and 2) how to remain educated in the evolving world/economy. Some of the stuff has not changed from about five years ago. That said, the future is certainly different now that the government has printed trillions of dollars. For some perspective, since 2010 (only ~10 years ago), the amount of physical dollars in circulation is up 66%. Link.

Also. If you use other metrics M2, M3 etc. it is possible to suggest that ~90% of dollars have been printed since around the year 2000. Since we don’t like cutting data and try to keep it simple, you can easily see that over half of the dollars created has occurred since 2008-2009 (use M3 in this case to avoid change in reporting issues)

Part 1 - Saving and Investing Flow Chart

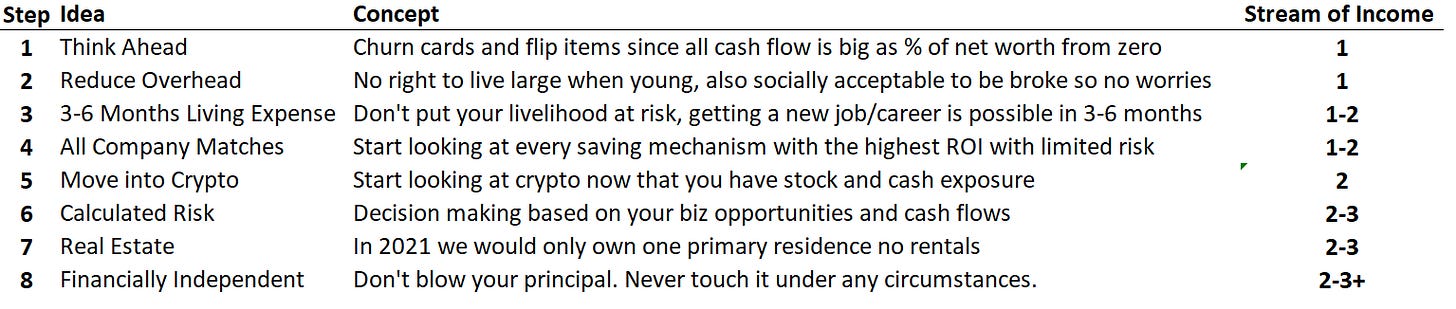

Before jumping into the flow chart. Remember. The goal is to create multiple streams of income. Your focus should not be on “cutting costs” but generating more money somehow/someway. Even if it’s a time for money exchange for a few months/years, that is fine. The chances that you can make $40-50/hour clipping coupons is practically nothing.

As a warning, this section starts at the low end and assumes that you have nothing (completely broke).

#1 Think Ahead: If you have no money, you have to plan ahead. This means you can look into the following: 1) credit card reward churning, 2) gift card discount purchasing, 3) bank account opening churning and 4) quick resells of holiday goods - such as Xbox/Playstation consoles and other popular products. These four things alone are *not* going to make you rich. What they will do is add a few thousand US tokens for you per year. A simple example is stacking the rewards: 1) get one that requires $1500 in spending, 2) use it to buy discounted gift cards online for places you need anyway - food, clothes etc 3) use that to purchase a popular holiday good for reselling. You can easily create $1,000 worth of rewards + 10% return on a resell. By the time you start your secondary income source this stuff doesn’t matter. And. Yes. We did do this when we had nothing.

#2 Reduce Overhead on Day One: On day one, with nothing, you want to keep the overhead as low as possible. You’re going to work 60-80 hours a week anyway. So this means reduce rent expense to as low as humanly possible. Don’t buy anything high-end in terms of clothing (no one will care if you’re broke and 20 years old). Even as you begin to scale up (and get richer) we’d try to keep rent/mortgage expense to a minimum. Well below 20% of after tax income should be spent on rent/mortgage. This is the exact opposite of what you’re told to do (33% is insanely high).

#3 Gather 3-6 Months Living Expense: We’re using a rough range here as it depends on your financial situation. Living Expenses = monthly rent payment + food + utilities + healthcare cost. If you have a job/career and have accrued some vacation days that will pay out, you can be at the lower end. If you will have zero dollars coming in (assumes you get fired/laid off), then you shouldn’t be at the low end.

There is really no situation where you want to have less than 3-6 months in emergency money. Anything can happen. You could have a sudden medical expense. The Company you work for could go under or be acquired (assumes you have no equity). So on and so forth.

If you’re aggressive about your expenses you should be able to get to this level in 3-6 months. You should be able to save around 50% of your take-home pay because you’re not going to focus on going out or “flexing” for your first 2-3 years anyway. Oh and by the way. Any girl you’re dating who cares if you live with roommates at age 20-23 or so… is not someone you want to deal with long-term. Dating life is not a good excuse to spend money living alone in your early 20s.

#4 All Company Matches: This one should be obvious but you should take the Company match (practically no exceptions). This has nothing to do with crypto or stocks or bonds. It has to do with math. If you get a company match that is a 100% return on day one! There is no way to beat that.

The math behind it is pretty straight forward. If you contribute $5,000 *pre-tax* US Token and buy the S&P 500, the Company will match you and also buy $5,000 US Token worth of the S&P 500. Now some will argue that you have to “pay penalties and taxes” if you remove it early from your 401K. That doesn’t matter though. If you were to pull the money out it would get you $10,000 * (1-tax rate -10% early withdrawal penalty). Even if you you had a 40% tax rate and a 10% penalty that is 50%. Which means that you get $5,000 US Token worth which is *post tax*. Again. There is no logical reason to avoid the Company match. You could take the money in and basically get part of your earnings post tax instead of pre-tax.

#5 Move into Crypto: At this point this would be the third investment idea (our opinion). If you already have 3-6 months of living expenses and are maxing out your Company match at the firm, you should have no problem buying some *large-cap* crypto. Don’t buy high risk small caps (most are ponzis so you have to be smart and correctly get into them early to lock in any sort of return).

As a note here, this third level assumes the following: 1) you’re already working on a secondary form of income and 2) you do not have any upcoming liabilities to take care of. If your goal is to have one form of income and suddenly become a “trader/investor’ to get rich… It’s not going to work. Only 1/1,000,000 will succeed with some high risk gambling strategy. Unfortunately, a lot of people have learned the wrong habits due to all the craziness that occurred in 2020. The good news is that these people will lose their money over the long-term and creators/producers will win (as they always do, just look at the richest people in the world - all of them are producers/creators)

#6 Calculated Risk: At this point you should have various directions. You should be flooded with options. Unlike “Jugglers” people who work on 10-15 projects at the same time (none of them work), you have 2-3 income streams and know that there are options for you: 1) go with product A, 2) sell company go with idea B or 3) continue to scale current income streams and invest into crypto/stocks/buy your first residence.

There is no way that we can make this decision for you. The one thing we would say is that you probably need to add ~$50,000 US Token or ~1.5 BTC (current rates) to your savings account. This is because a new product/biz idea usually costs $50,000. If you have 2-3 successful income streams, you don’t want to be forced to sell them. Instead by saving intelligently you can start the other idea immediately.

#7 Real Estate: Pretty big change. Before we had real estate as a wealth creation vehicle but that has changed. You’re free to do whatever you like. In our opinion, you’re better off just having one place to live (home/apartment) and no other real estate exposure. The problem is as follows: 1) internet sites sell for lower P/E ratios and are easier to fix and 2) taxing a home and rental income is a lot easier. The tax set up has changed to a point where you can live in Puerto Rico or Singapore and get much better tax treatment when compared to real estate. Where else can you get 0-7% tax rates?

The second issue with rental properties is the inability to to move. If you start buying in a particular area you need to be there to manage, otherwise you lose even more returns to a property management firm. Real estate compared to Internet sites just isn’t comparable anymore. Unless you have expertise in the area, we’d stick with internet sites and other forms of mobile passive income.

The final item is clarity on the ownership structure and adjustments. If tax changes come in, you can do a ton of different things with internet based businesses. Sell part of it and maintain minority ownership. Have various LLCs to spread out the ownership. You can move to a better location. You can adjust the business model (if they change rules on shipping/manufacturing). So on and so forth. Your options are better since the income is not tied to a physical location.

#8 Financially Independent: Once all of your passive income is generating more than your living expenses, you’re free. There isn’t much advice to give at this point. You simply don’t touch the passive income savings/nugget. This prevents you from taking too much risk and allows you to do whatever you like with all of your future earnings. No one is going to get to financial independence and suddenly “quit” the business. It doesn’t work like that.

What does happen? After you grind it out for a few more years, you begin to prioritize things differently. For people with kids it usually shifts in that direction. For people who make tons of money there are two paths: 1) become ultra competitive and want to be #1 in the space and 2) become more lifestyle focused and interested in something fun/less stressful that does pay the bills. We’re in camp #2 if it wasn’t obvious.

For fun, the general framework we’ve seen? Most people hit financial independence and then grind it out another five years. This is a rough proxy. After five more years of grind they make a decisive decision to scale hard or prioritize other things. Who knows where you end up on this spectrum it isn’t any of our business. As long as you’re financially independent it’s your call!

Part 2 - College and Education

Ah yes. College is in fact a scam. No way to say it nicely. The whole scam is as follows: 1) you need to get a degree to prove you are smart, 2) they make sure it is easier for rich people to get accepted in to the colleges that matter, 3) they make sure everyone has to take on debt to pay for this “education” if they can’t afford it and 4) you have to pay back the debt even if the education doesn’t help you make any money in the future.

The low IQ people always come in here and say “But without the degree you wouldn’t get a job at Goldman Sachs/Google etc.”. This is horrendous logic. All you’re saying is that the system is in fact a scam. If you didn’t actually learn anything useful at the college then why was the degree required in the first place?!?! Requiring a degree from an “elite college” does nothing but perpetuate the scam. If you can sell/generate revenue for the firm, it shouldn’t matter if you went to college in the first place.

#1 Play The Game: With that aside, instead of complaining about the rules of the game, you want to maximize it in your favor. This means you should write your admissions essays to fit the narratives - if you’re writing for a liberal school just make up a bunch of progressive talking points. It means you should apply to majors that are easier to get into and switch (if possible) such as Ethnic Studies (then declare for something real within that school system after being admitted). So on and so forth. Look into all the rules and make sure you’re putting yourself in the best possible position to gain admission.

#2 Choosing the System: If you have 3-4 options, go to the career website. Do not ask your friends for “opinions”. Go onto the career website for each school or ask for the info on who recruits at the university. If there is no difference in employment options choose the one with the lowest cost. For example if you have to choose between NYU and Cornell, but your cost difference is $60K… Go to NYU. If you have to choose between NYU and Harvard and your cost difference is $10K, probably better to go to Harvard. It is a gradient so be smart about your decision making.

#3 Maximize the System: Once in the system, your goal is to get an A- average or so. The general cutoff for most good paying positions is a 3.5 GPA. This is a mix of B+ 3.333 and A- 3.666. A good way to boost your GPA is by taking community college classes during the summer of your freshman year or into your sophomore year. If you have 3-4 classes that are taken at a community college no recruiter is going to be upset. It looks like a smart decision and doesn’t inflate your GPA much. Choose two classes that would be hard at your university (like physics) and two classes that would be easy (history) so it looks like you really just wanted to get a slight head start.

#4 Get Into Your Field ASAP: Anyone who works for a living will choose the guy with a 3.5 GPA and 3-4 internships over the guy with a 4.0 and zero work experience. This is because anyone who works for a living knows that college doesn’t teach you anything useful for on the job performance. On the job performance is much more predicated on sucking up to the right people and making sure your work quality is “good enough”.

#5 Take The Easiest Professors: No recruiter is going to take the time to look at all the professors you have. Every college has some sort of system to rank each professor. Choose the ones with the most lenient grading averages and the easiest content. As long as the class says “Accounting 101, Grade: A-“ you’re good to go.

#6 Begin the Side Hustles: We didn’t do this, big mistake. You can go ahead and learn copywriting/online sales during your spare time. If you’ve done the prior items correctly, it means that you should be able to reduce your studying without impacting your grades. What you learn is that smart people don’t need to study hard (because they are smart). If someone is studying all day and can barely muster a C/B grade, it is not a good decision to pursue that career/job.

Since you’re efficient with your time, you should spend at least part of it learning the basics of online sales. It could be anything from copywriting to learning basic website design in the future. You could even start an online tutoring business for a few extra bucks just to learn how to build the website and get some customers.

#7 Don’t Blow All of Your Time Partying: You can go ahead and party here and there just don’t let College be the “peak” of your life. When you become successful you’ll find that every single year after age 25 or so is pretty much a new peak. You’ll have a few bad years due to bad luck etc. However. Every year after 25 is going to be great. The reason we don’t say 21 is that the first 3 years of grind is absolutely awful. When you have nothing and are building from scratch, working 60-80 hours a week with minimal sleep isn’t “fun”. We’re not here to sell fairy tales where you get to do nothing and somehow get rich. You have to put in about 3 years to build a good foundation of skills. After that you have good habits and your hours stabilize closer to 60 than 80.

#8 Skip it All: Another fun idea is to simply skip all of this stuff. You can go to Hack Reactor or other coding schools and side step the college system if you’re a savvy tech person. If you can go straight to a top company without the four year degree process or start a business without college you’re good to go. No doubt about it.

As a final note. The major issue with the future is decentralization. Due to crypto, institutions including college are losing slowly. Why would someone pay for a $9,000 class on History/Humanities when they can pay a few dollars a month to learn about the future of technology. Why would someone choose to learn about gender/race privileges when they could actually learn how to make money yield farming? Why would someone pay $5,000 a semester for classes on economics when they could take a class on sales for a few hundred dollars with a 100% ROI. It just doesn’t add up. The only thing that institutions have left is their signaling mechanism which is losing its power as more and more people graduate with nothing to show for their effort (job/career prospects unchanged).

Concluding Remark: During a Twitter interaction (just an hour ago) a few people argued you can get to $1M US Token without a business. While this is mathematically true it still misses the big picture: 1) significant upside comes from a business and 2) you are taking *more* risk by relying on just your career. The last part is confusing as every nay sayer will suggest that 90%+ of businesses fail.

Well, even if that is true, nothing prevents you from starting a basic online business that makes even $30-50K US Token per year. You could do something low risk like reselling products or becoming a copy writer. You could even attempt to scale out something on Fiverr.

In the end, you should become more optimistic. In your 20s and even 30s, you have a ton of energy. There is no need to take your foot off the gas as you can use it to build a bigger base/foundation. The future is brighter than it has ever been before and you can de-risk your future while simultaneously increasing your income. It is a no brainer!

Part 3 - Conclusion and Preparing for the Future

It is quite difficult to stay on top of future trends. Over time as you get older you simply fall behind due to attrition. We’ve never used TikTok for example and that is an extremely popular video/media outlet. For older people, they are probably confused (rightfully so) as to why their kids are having a tough time getting higher paying jobs after college (globalization, secular decline in high paying industries and huge companies getting even bigger).

We’ll have to update posts like these in the future but right now the above still works and we’d add the following adjustments for the future.

Creativity: You need to become a creator. It really doesn’t matter what it is. Creators stand the test of time as they have a brand/aura/mantra. Things like Marvell Comics have been around for decades. Things like the Simpsons will have revenue for the foreseeable future. So on and so forth.

The second issue with creativity is that you need to become more extreme. This is just the name of the game. People have short attention spans so you have to grab attention by doing extreme things. As people use more recreational drugs, people become desensitized. This means it will only get worse from here. You need to have some sort of edginess otherwise secular decline is coming soon.

Crypto: Obviously we are biased. But this is the future. Largest advances in computer science, security and speed are occurring right before our eyes. Also it is new enough where people don’t even understand valuation. And. You can even make money on obvious ponzi’s since the ponzi’s even offer fair launches at times. Once the launch is done you simply get rid of your principal. Don’t hate the game, play the game correctly.

The odd thing about crypto is that people get upset when the market doesn’t reflect the underlying performance. We are long-term investors so we actually love this. Imagine if Amazon was trading at a lower P/E ratio when compared to something like Macy’s stock. Why in the world would you be upset. It means there is a massive dislocation and you have time to invest before people catch on.

Tax Planning: No way to really convince us otherwise. Taxes are likely going up particularly for the well off/rich. Think about what assets are easiest to confiscate/tax. What assets are easiest to protect and what assets are easiest to pass on to the future generation (if you have kids).

On the same line of thinking, anyone who is well off should think about their tax strategy over the next 5-10 years. If you run a business there are ways to reduce your taxes before the sale by changing your residence/company location. If you are in multiple jurisdictions (say you have real estate in various states), it is a *lot* smarter to clean this up and simplify. The more streamlined you are the easier it is to adapt to the rules thrown your way.

Disclaimer: Nothing in these articles are to be deemed as legal or financial advice of any kind.

Great stuff. I'm 30, but it's good to revisit the basics every now and then to keep your foundation strong.

I agree with almost everything you said, but I'd like to challenge one belief or assumption that keeps coming up in your writings: the idea that you should focus on building wealth in your 20s and then wait to focus on health until your 30s and beyond.

I think this is based on the idea that output increases linearly in proportion to hours worked. E.g. 60 hours of work per week yield 50% more output than 40, 80 hours yield 33% more output than 60, etc.

I think that the real equation for work output is something like this: output = time spent working x energy x focused % of time.

Y'all talk about "working 60-80 hours a week with minimal sleep." If I'm right about the above equation, "minimal sleep" gives you more hours in which to work, but it can also reduce your output per hour by sapping your energy and impairing your focus.

You CAN work 60-80 hours a week and still get plenty of sleep, though, if you have no kids, no romantic partner, and no social life (which y'all would advise for someone who is trying to build wealth). That's what I'd recommend.

Other things I would add to help optimize the equation are healthy eating and meditation. Healthy eating improves energy and doesn't take much time if you just go to Chipotle, Sweetgreen, or wherever and order all vegetables and meats and no grains or dairy.

Meditation has really helped me improve my focus. You don't need to be a monk and meditate all day, but adding just a little bit to the morning can help you stay on track.

I do think that people in the wealth-building phase should engage in minimal exercise, though. A clean diet can make up for a lack of exercise, but the reverse isn't often true. 20-year-olds (myself included) are also prone to lifting like idiots and hurting themselves.

Thanks Bull. Well said. Been doing all of these things except the company match.

The thickheaded bighorn did it this morning. No need to avoid on principal.

Don't hate the game.... free money.