Retire with Fire and Guarantee a Life of Suffering - Also Welcome Bogleheads!

Level 1 - NGMI

Welcome Avatar! Before beginning, there is nothing wrong with being mediocre. Some people legitimately don’t mind being in the middle. In fact, the majority enjoy it since they prefer being part of a large herd or group and don’t have the risk tolerance to stand out or go counter consensus.

One of the major trends over the past 10 years has been “extreme early retirement” where you live on lentils, beans and rice to try and guarantee that you retire with the ability to live on… lentils beans and rice.

Part 1: The Wrong Belief System

You only live once. This does not mean you should blow all of your income and guarantee that you work forever. Instead, the right way to think about “YOLO” is if you’re maximizing your potential.

If you want proof that practically no one does, just go to a middle class suburban area and you’ll hear people say “I could have done xxx” or “I was XXX back in the day”

What they are really saying is that they are not *currently* successful and don’t even believe in their future. Otherwise they wouldn’t hinge their entire personal identity on their past would they?

Frugality and Penny Pinching: Time and time again, people make the same mistake. No matter what you do you cannot take your spending to zero. In the end you have to pay for housing, food, internet, water and all the basic necessities in life. Also. If you’re truly working as hard as you can, you know that it is much easier to increase your income by $1,000 a month vs. decrease your basic necessities by $1,000 a month. In fact, it isn’t even close.

Not Even Worth Living: An old phrase from Ben Franklin was “Most people die by 25 but aren’t buried until 75” - paraphrased.

This is effectively what most people are doing. They go down this path of extreme cheapness and end up living a boring life year after year after year. There is no real logic behind it. The amount of time and stress finding the best coupons or deals on every single item could have been spent earning money instead. If you spend 5 hours a week looking for deals, even at $50/hour ($100,000 a year assumed earnings), you would collect $250 vs. find $75 worth of bargain deals.

Scale It Up: For the laughs, we saw people suggest that credit cards are not for rich people. This also makes little sense. If you run a company and spend $1M in ads, why wouldn’t you take the $20,000 a year in benefits. It makes no sense at all. You can get 5-star vacations on that system alone. Once again, if you learn to *spend to earn* you will make a return that is 10, 20 or even 100x better than the frugality crowd.

In short, do you actually want to live a boring life forever? If so, what was the point in being alive in the first place?

Part 2: Then You Blow Up

You think you got it done. You’ve somehow calculated a way to live on $40,000 a year. This means you need to accumulate $1,000,000 and you are set using the proverbial 4% rule.

You retire on December 31, 2021. Ruh Roh.

Suddenly it doesn’t work: Your portfolio goes down about 25% and now you’re at $750,000. This means you’re generating $30,000 in income vs. the assumed $40,000 in income!

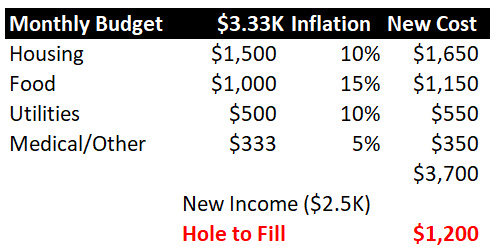

Unless you find a way to cut cost on food which is up double digits, electricity or gas - also up double digits or housing… also up double digits. You’re in a tough spot.

Not Looking Good: As you can see, if you have one bad year (inflation of double digits) for necessary spending, you’re looking at a pretty enormous hole to fill with the spread being your entire food budget. Not likely you can substitute goods if you were already living on lentils, beans and rice.

Part 3: Confusing Passive and Frugal

Lately, Bogleheads has somehow found this side of the web. They have a much better understanding of what it takes to retire and a lot of their information is much better than this useless exercise of cutting all costs to prison level living standards.

The major thing the Boglehead people miss? They are typically high earning white collar people who *refuse* to ever start a business. They know the ins and outs of investing and understand P/E ratios yet they don’t think they can muster up even $50,000 a year in an online business (which would be worth $150,000+ on a 3x P/E).

To us this is surprising. But. That’s how the world is.

Passive Investing: This is a GREAT strategy for people who are either 1) terrible risk managers or 2) scaling a business. It is a *terrible* strategy once you’re financially independent and wealthy.

Who It is Good For? You are working 80 hours a week (for real). Hard career + side income. Or insane work hours in a career. Or. Insane work hours with your latest business success.

The common thread? No Time. If you don’t have time you can go ahead and do basic stuff like index funds, bonds and some risk on with 5-10% of your remaining funds

Who is it Bad For? Someone who is *already* financially set. At this point it means you should have niche information to take advantage of. If you can’t figure out a way to generate more than 4% returns and you’ve started a successful business already, you’re either lying or you are not trying anymore.

If you are already financially set for life, the only thing that is going to move the needle for you is a higher return investment or another event.

Example: Joe is worth $10M after selling his Football Jersey Company. He knows everything about selling to sports fanatics. He needs $300,000 to live a great life and puts $7.5M into Boglehead type investments. The remaining $2.5M? Well… an extra $100,000 a year isn’t going to move the needle all that much in terms of lifestyle change.

That is either one expensive family vacation or it is a sports car. Not going to change much. So. The solution? Use that *excess* money to chase higher returns or even buy up internet companies you can fix.

Conclusion: We’d be a lot more likely to align with the “Fat FIRE” camp which is really just a fancy way of saying “truly financially independent”. In our *opinion* you can’t claim to be independent if you’re worried about adding Guacamole to your Burrito. Instead, if you can live an upper middle class lifestyle forever, that would be a good level to claim financial independence.

Part 4: Some Conclusions

The major things that should be highlighted are as follows: 1) there is no way you should try to retire in a bull market. This typically over-states your net-worth, 2) you should not try to cheap your way to the top since it creates a lifetime of stress, 3) most people severely underestimate how much they can earn as an entrepreneur *IF* they have a successful career based income stream and 4) within the blogosphere, FAT Fire is probably the most respectable as it doesn’t force you to live a boring life forever.

On that note, back to the tent.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money. At 10,000+ Instagram follows we will publish some city guides ranking each region we’ve been to.

A long time ago, a French philosopher (Blaise Pascal) was weighing the pros and cons of religion and he realized that the devoutly religious were making a bet with unseen odds.

If you were not religious, you would definitely end up in hell. If you were religious you could still end up in hell despite living a devout life simply because you prayed to the wrong God. Some, like modern Bostonian philosopher Patrice O'Neal, claimed better to not risk it at all and at leaat go to hell for something cool like hookers, and cocaine.

The FIRE crowd are praying to the wrong God. Living an ascetic life in the hopes of achieving freedom. But they may end up in the same hell as their coworkers who insisted on always pushing a car note to the edge of what they could afford and living on credit.

The right God is the God of scalable income. Its the only altar worth making sacrifices on, but it requires a touch of bravery as it presents obvious short term risk. While the God of frugality presents a risk that isn't really obvious until you're much further down the line.

Better to be in hell having had a nice car, than being in hell after squandering your youth trying to penny pinch for no goal other than an early retirement. We retire through income generation, not from saving.

Amen.

People underestimate how pervasive and harmful scarcity mentality is to your success but also your overall well-being. Maybe I just intuitively get this from years of being on both sides of winning and losing but: playing to not lose, scarcity just eats at your soul.

The FIRE crowd just seems like it's making scarcity the be all. That's really the link between why they can't see the possibility of success in entrepreneurship and instead go low cost. Total asymmetry and it's obvious.

Thank You Based BowTied Bull. Show them the light.