Running Out of Time?

Level 1: NGMI

Welcome Avatar! At this point you now know where the world is heading. If you’ve followed this side of the web you’re probably in good shape. High 6-digit US token net worth, an online income stream and some exposure to computer coins (typical reader of the paid stack hits those metrics, roughly). Unsurprisingly, the rich continue to get richer and we are effectively nearing the last chance “to make it”.

Time Erosion: Much like an options contract, the time value of money is really painful if you’re asset light or cash flow light. It is even more painful when the money supply goes up 50%+ and you’re left with higher bills: 1) inflation, 2) returning back to the office and 3) dealing with energy/utility costs outpacing inflation as well.

At this point the numbers are cooked (the way we see it). If the recent rate hikes were able to erase this much market cap out of stocks/bonds/crypto, it means that everyone is levered up to the gills. This is called the “everything bubble” that has been talked about for years now.

Everything Bubble: In order for this to be true, you need to have the average middle class America priced out of everything from housing to stocks to even crypto! (yes crypto counts). The reasoning is simple. If retail is still priced in for crypto (barely) there is a way for them to move up the socioeconomic ladder.

Currently, the coins on exchange are being *sold* by retail and picked up by institutions/whales. Not looking good and set up for an everything bubble sooner than later.

Looking across the board, we’d wager that housing is out of reach for retail at this point (no way they can close any sort of gap on the upper middle class) and stocks are nearly priced out since inflation has killed the ability to save.

Savings Rate on the decline as Economy Opens Up

Oh and by the way, now that big tech firms are missing numbers, the ability to land an amazing “dream career” is on the decline as long as this trend continues.

The Current Global Set Up

Covid-19 picked the winners and losers. Tech, E-com, Marijuana and *any* high end sales person with a built in rolodex made a killing. Yes investment bankers *of course* had a great year last year (why wouldn’t they?! Free money printing, no travel and everyone desperate to raise money or sell at massive valuations).

Now the repercussions of those decisions will be felt. Initial Public Offerings down significantly (estimate 70%), Amazon having issues with growth (paid stack members will hear more on this Wednesday - important!) and savings rates are going down due to higher debt costs and of course the “return to office” mandate which ratchets up cost for workers!

Here are the Scenarios: 1) rates go up, asset prices continue to go down, 2) rates stabilize and assets stabilize which leads to solidification of the new upper class and lower class - “United States of Asia”, 3) rates go up but inflation continues to be high which separates the rich and poor (even more) and 4) rates stabilize and assets go back to growth separating the rich and poor (even more)

While this is a simplistic scenario, the only situation in which you’re better served in low risk ideas = perfect Fed policy. Since we’ve seen (over the past 2 years) that competence is not something the general population is good at… we can wager it’s one of the three other choices.

Stagflation

Inflation

Recession - but wait - everyone is levered up. “American household debt hit a record $14.6 trillion in the spring of 2021, according to the Federal Reserve. If you had to write that check it would read $14,600,000,000,000.”

Currently, going into a recession appears to be the most logical. If money printing stops, assets prices are going down (causing less hiring) this would typically lead to a recession. After enough people are suffering go back to point #2 where money printing begins again.

Global Change: In 2009 and beyond, many people got ultra rich off of real estate. After the housing market went bust and “we” decided to suddenly bailout the banking industry, the money printer was turned on and (in hindsight) it was clear that housing prices would go up over time (just like the stock market)

Now we’re in a similar “point in time”. We’re now facing the consequences of TRILLIONS of dollars being printed (the bailout was a “mere” trillion or so) while all of our production of goods has been outsourced to Asia (Alibaba in particular).

At this point you have to make a decision on what to do with your future, ask yourself the following questions: 1) will taking 2 years off impact the USA as a super power?, 2) will the USA lose reserve currency status?, 3) in any scenario - stagflation, inflation or recession… will people gain or lose faith in central government authorities and 4) what are the incentives of *OTHER* countries outside the USA (something us Americans rarely think about as we’re stuck in an echo chamber).

To us the answer is clear: 1) automation and 2) new technology based financial system.

China: Say what you will about them… they do not have any regard for human rights. They only care about results/production. Nine, Nine, Six means 9am to 9pm six days a week. Meanwhile in the USA we are moving towards “remote work life balance”. This means that over the long-term (as hiring restrictions are removed) the USA will become more like Europe in terms of effort the average individual is willing to put up.

Enjoy the moment as the change is imminent.

Small Countries: Famously dissed as “third world dumps”, you have to ask. Do you believe they enjoy being pinned down by the dollar? Would they prefer to have a different currency not tied to central agencies since many of their currencies have failed a million times (see Argentina). Unlike Western Countries, the majority of the world population (yes shocking!), is not used to having a stable currency and doesn’t trust government officials or government data.

Betting On Freedom: This is a pretty painful paragraph to write, however, it is something we’ve started to believe over the last couple of years. If you look at the USA and China, it seems that we’re moving towards more authoritarianism and less freedom.

We know. Private companies and public companies have to do what is best for them. That said, we’ve reached pretty questionable levels when people can be fired for tweets and actions based on their private lives (unrelated to the company) that gets pulled up due to some weird guy with no life living in a basement somewhere.

What does this mean? It means that as inflation goes up (and likely taxes as well), people will be too *scared* to do anything and more and more rights will be taken away over the long-term. People are even getting fired for saying there are two genders (example)

The Current Action Step

If you want to “make it” you’re going to have to make an extreme bet over the next 3-5 years (assuming you’re not where you want to be). If you’re already one of the “chosen ones” due to COVID you can probably relax a bit.

If you’re reading this and have no real hope, you’re forced to take action and begin building in the following direction: 1) lowest tax basis country - USA no longer necessary - sad to say it, 2) least likely to adopt authoritarian ideals - evade China and the current powerhouses such as Australia and 3) make a sizable bet on what assets people flee towards.

You already know ours!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We may or may not be homeless and set for life. We’re an advisor for Synapse Protocol and on the JPEG team.

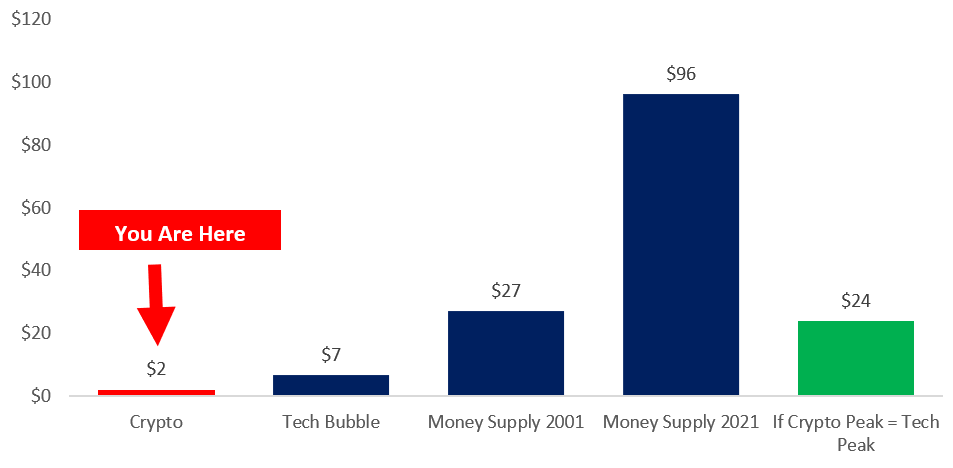

You’re Early: Remember that you’re early. If you need to zoom out, see our post here on Crypto versus the Tech bubble (which was only the US stock market).

Below Chart in $Trillions of US Tokens

Too many dudes going into panic state or feeling shitty about themselves. Doesn't help.

First and foremost you die anyways. This is just a huge ass game going on, first things first dont take it seriously.

Our ancestors fought wars and famine and you are sitting there whinging that you didn't buy bitcoin at $5. Dumb ass.

BTB posts are simply frameworks and guidelines to live a decent enough life while you are alive. Take the essence of what is being expressed and apply to your own situation.

If you think going back and reading all the posts are going to solve your life problems, its highly probable that you are an idiot. Things take time. If you go from e.g 50K NW in 2022 to 75K NW in 2023. Still progress.

The biggest thing I have taken from being a BTB reader is not financial success. It is actually controlling my emotions and being ok with eating shit. Happy Days.

I'm very curious to see how the talent exodus plays out in the states with WFH becoming mainstream. Beyond even savings on talent, we can cut bait with an engineer overseas that isnt working out, but to do so locally is a precarious legal situation to deal with.

My recommendation for US based readers: Get into positions where you're directly responsible for revenue in some fashion. You'll need to be able to point to the bottom line to survive.