Scaling Bitcoin: The Opportunity for Stacks

Level 2 - Value Investor

This is a Guest Post from Product Lead at Stacks Andre Serrano

Imagine this. The year is 2035 and Bitcoin is $1M. What if you could take a loan against your BTC — without using any intermediary — to fund your startup, buy a house, or obtain your plane ticket to Degen Island? This is made possible by Stacks, which enables decentralized apps and smart contracts on Bitcoin.

2023 was a renaissance year for Bitcoin, which benefited from a perfect storm of rising institutional demand and surging developer activity. This has led to new growth in the Stacks ecosystem.

This post will explore the vision of Bitcoin and Stacks, while highlighting the upcoming catalysts for the Stacks ecosystem.

The takeaway: building on Bitcoin is back.

Bitcoin: The Base Layer for the Digital Economy

Bitcoin is the world’s most valuable digital currency and secure settlement layer. In 2023, Bitcoin settled nearly $10T in transaction volume, achieving its tenth consecutive year of 100% uptime. This, combined with its predictable monetary policy, makes Bitcoin the perfect foundation upon which to build a decentralized digital economy.

Yet, today Bitcoin has a small onchain economy. As of this writing, Bitcoin’s TVL is just $297M, a mere 0.04% of its market value. Compare this to Ethereum, which commands a TVL of $62B – more than 20% of its market value! Bitcoin's small TVL means only a small fraction of its circulating supply is being used for onchain borrowing, lending, stablecoins, and other capabilities proven in high demand in other ecosystems like Ethereum and Solana. This is the market opportunity for Stacks.

The Problem: Building on Bitcoin is hard (for now)

Despite the characteristics that make Bitcoin an ideal store of value and settlement network, it is limited in its scalability and programmability for a few primary reasons.

Lack of Expressivity: By design, Bitcoin is simple; its simplicity is one of its greatest strengths. However, its limited expressiveness makes it unsuitable for building decentralized applications. Over the years, this left users with limited options to use BTC without entrusting it to centralized entities. This exposes users to counterparty risk, which has resulted in lost funds as seen during FTX and BlockFi in 2022. Ultimately, this means that layers must be built on top of Bitcoin to enable DeFi applications like trading, lending and borrowing.

High Fees: Bitcoin’s transaction fees have skyrocketed more than 100x YoY. The following chart shows the impact Ordinals have had on the Bitcoin fee market. Prior to 2023, average transaction costs were 1-2 sats/vByte, but they have increased to more than 200-300 sats/vByte in 2024.

High fees are a double-edged sword for Bitcoin. Bitcoin’s security model actually depends on sustained transaction fees due to its declining coinbase rewards. This has been a vocal concern among both Bitcoin skeptics and within the community, so this type of activity is indeed healthy. However, it has the consequence of making various activities on Bitcoin more expensive, pricing out smaller holders, and pushing more of Bitcoin’s activity to L2s.

Slow Transaction Times: Bitcoin transactions take 10-30 mins on average. As crypto matures, so have expectations for transaction speed and settlement. For the newest crop of crypto users that are used to Solana speeds, this feels like an eternity. It also makes most DeFi activity impractical on the Bitcoin L1.

Scaling Bitcoin on Layer 2

Bitcoin’s simplicity is a feature not a bug. It was built with a limited design to optimize for security and decentralization at the base layer. Now that the protocol secures nearly $1T in protocol value, making upgrades to Bitcoin is like trying to change directions on a warship in the middle of the ocean. It’s a slow and arduous process that requires careful planning, patience, and coordinated effort.

This is for good reason – since the standard for changing Bitcoin is so high, it provides a more reliable foundation to build on. And since changing the Bitcoin base layer is nearly impossible, building layers on top of Bitcoin is the only path toward unlocking the Bitcoin economy

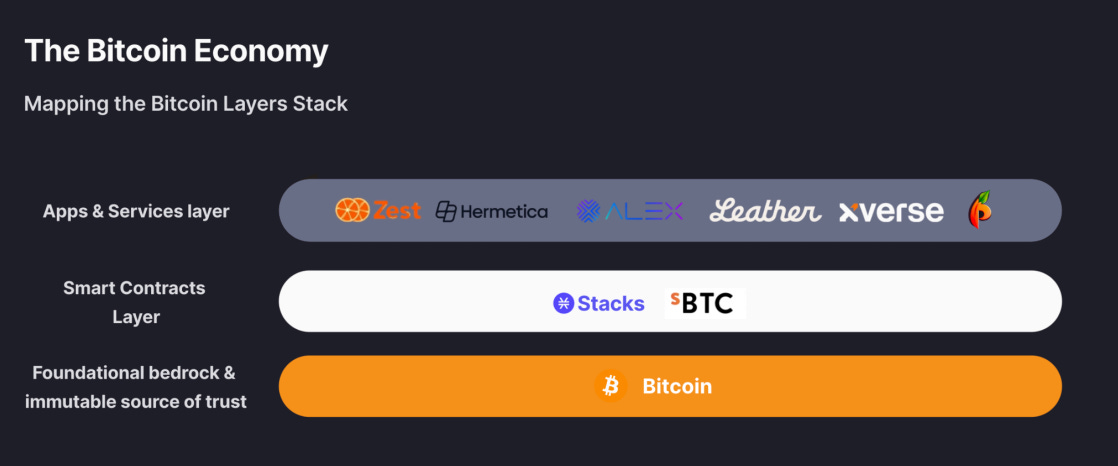

Stacks is a Bitcoin Layer 2 protocol that enables fast, cheap transfers and new use cases for BTC. Stacks addresses the limitations of Bitcoin script and provides users with a secure and decentralized solution for utilizing Bitcoin in various applications. It achieves this without requiring any changes to the Bitcoin base layer.

Stacks has been in development since 2015, launched in 2021, and was the first project to gain SEC approval to sell its native token $STX.

The Nakamoto upgrade is the next evolution of the Stacks blockchain. It combines changes to Stacks consensus with a native asset, sBTC, that will enable BTC to be used on Stacks in a decentralized way

The Nakamoto Upgrade Enables Fast, Secure BTC Applications: The Nakamoto upgrade is a proposed consensus change to the Stacks network. Its primary purpose is to improve the speed, security, and efficiency of the Stacks Blockchain. The main changes can be described as follows:

Fast Blocks - brings the transaction times down an order of magnitude to 5 seconds on average

Bitcoin Finality - Stacks will receive 100% of Bitcoin’s security budget. Reversing a Stacks transaction will be as hard as reversing a Bitcoin transaction on Layer 1

Bitcoin Miner MEV Resistance - ensures that miners must spend competitive amounts of BTC to win new Stacks blocks.

Bitcoin miners will no longer have an advantage over other Stacks miners.

Stacks is unique in that it is the only Bitcoin L2, or any L2 for that matter, that offers native Bitcoin yield for users who lock up or "stack" STX. In addition to the changes above, moving forward, users who stack STX must also validate new Stacks blocks in order to earn BTC rewards. This change is necessary to enable sBTC, the missing piece of Bitcoin DeFi.

sBTC: The Future of Bitcoin DeFi: sBTC is a protocol that enables BTC holders to participate in DeFi without relying on trusted third parties. The system is backed 1:1 with BTC secured by an open and decentralized network of validators who stake STX. For performing this service, STX stakers earn native BTC rewards, currently 6% APY

There is large, unmet demand to use BTC across financial applications like lending, borrowing, derivatives trading, and crowdfunding. We are in the early stages of a thriving DeFi ecosystem on Bitcoin and we are starting to see the fundamental building blocks come together.

Here are a few examples of the types of applications sBTC will power:

ALEX - Platform to trade BTC, BRC20 assets, crowdfunding and more.

Hermetica Finance - BTC options vaults using sBTC as collateral.

Bitflow - Stableswap protocol allowing users to earn yield on sBTC without incurring impermanent loss.

StackingDAO - A liquid staking service that allows users to earn yield while maintaining liquidity by minting stSTX

Stacks DeFi TVL is currently $72.2M, up 961% year-over-year. Yet, this represents just a small fraction of Bitcoin’s market cap. If sBTC can unlock just 1% of Bitcoin’s market cap, it would represent a significant increase in onchain BTC activity.

Conclusion: The resurgence of Bitcoin has not only solidified its status as the cornerstone of the digital economy, it also highlights the potential of Bitcoin layers like Stacks to enable greater scalability and expressivity for BTC. With the upcoming Nakamoto Release and integration of sBTC, Stacks is poised to unlock Bitcoin’s true potential as a productive asset, which can be used in a wide range of decentralized applications.

There’s never been a better time to start building on Bitcoin. If you’re interested in following along on Stacks development, check out my newsletter Bitcoin Writes.

You can also follow him for update on Twitter here (Source)

See you all at Degen Island 2035.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

The best part is that yields on STX DeFi are high and we have at least 3 airdrops to look forward to in the near future between Zest, Bitflow and StackingDAO. Not to mention the Stacks ordinals and the ability to manage ordinals through the same wallet interface with ease. No doubt the BTC whales of this cycle that have interest in DeFi will be here this cycle. It's set to moon.

Seems silly not to be in STX in the current cycle

Pissed I sold STX at $0.70, at least still early