Spying on Competitors - Ecom

Level 2 - Value Investor

Welcome Avatar! Usually, we reserve E-com important updates for the paid stack but today we’re bringing in Opossum to talk about spying on competitors. Our goal of driving 10x more value than all competitors, remains on track!

For anyone who has worked in the space for a long time, you are used to clicking on ads and following the sales funnel to figure out if a successful strategy can be replicated. With that we can jump in!

BowTiedOpossum here. Do you want to spy on your competitors to try to replicate their growth? Maybe you’re out of ideas on how to grow your digital business even further. A large percent of people aren’t seeing growth because they’re not doing the fundamentals *correctly* or they’re not creating enough content (not moving fast enough).

Once the fundamentals are mastered, many people don’t know what to do to take their business to the next level.

Either way, you should be looking at what your competitors are doing to learn best practices.

Today I’m going to talk about different ways to stalk your competitors. Going through this process will give you an idea of what the successful players in your industry are doing and give you ideas on what you should execute on.

Since this analysis is going to be different for different business models, I’ll try to stick to high level tactics that are universal.

Let’s start at the beginning assuming you know nothing about your competitor’s business.

Traffic

It doesn’t matter if your competition is affiliate, ecommerce, or selling a digital product. They ultimately always sell on a domain. This domain is where you’re going to start.

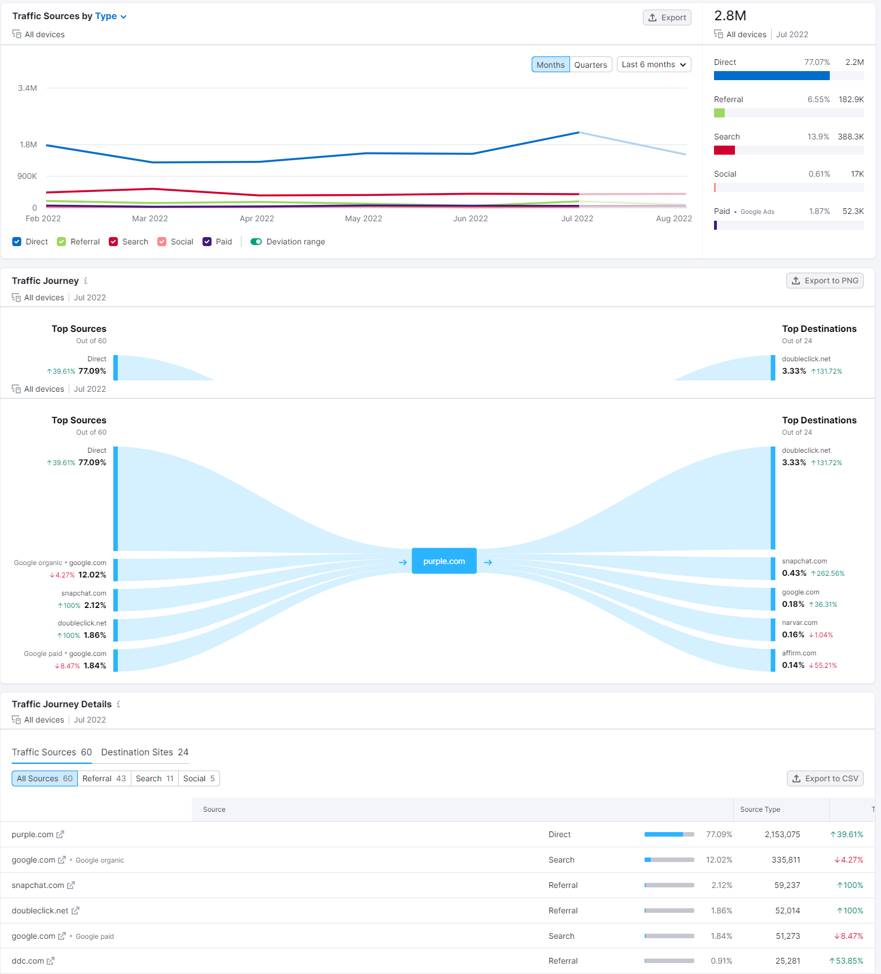

For most of this article, we’re going to be using purple.com as an example. To get a good idea of what traffic they have coming to their site, we’re going to pay for a SEMRush account. Use SEMRush or Ahrefs. Do not use Similiarweb or other tools.

While nothing is completely accurate, SEMRush and Ahrefs are going to be the two most accurate tools.

Won’t dive into every metric available, but as you can see, you can get an idea of the amount of traffic the site is getting and where it’s coming from.

Once you have a list of where the traffic is coming from, you can use the sections below to see how they’re getting so much traffic.

Note: When you see “Direct” in the tool, that just means that SEMRush can’t track the source of the traffic. Sometimes this could be direct but a lot of times it’s from email, an ad network that can’t be tracked, or a referral from the website’s subdomain.

Note #2: You can track a subdomain or a subfolder using this method. You’re not out of luck if your competitor’s top level domain isn’t unique. I’m looking at you Gumroad, Substack, Podia, etc.

Paid Ads

If a company is running ads on a platform, there’s a good chance those ads convert. It’s not always the case that all of the ads convert well but it’s a great place to start when testing your ads out.

Google

If your target competitor is running ads on Google, SEMRush is tracking and categorizing all of them.

In this section, you can see what KW they’re targeting, how long they’ve been targeting them, what their copy is, what page they’re driving the traffic to, cost metrics, and who else is bidding on those KWs.

TikTok

You can find a company’s TikTok and look at their videos and ads but that’s not real helpful. A better way to do this is to see what ads are working on the platform for your industry, not just for that one competitor.

Go to TikTok’s Ad Library and find your niche. From there you can rank the ads via reach, CTR, or view rate. Find an add and you can see how well it does compared to the industry average.

Now all that’s left to do is to study the videos and figure out why. There’s a few metrics that will help you analyze why the ad works and how you can replicate.

Twitter

Unfortunately, Twitter took down their ad transparency center in Jan 2021. Previously you could look up a handle and see all of their ads in the last week.

I’m sure there’s tools out there that are tracking Twitter ads but I haven’t had a need to look when the organic data is readily available below.

Instagram & FB

Meta has made this really simple. Just go to their ad library and search for your competitors.

Organic Social

Unless you already have scale or are running a physical product ecommerce business, you’re probably going to stick to organic social in the beginning.

TikTok

It’s easy enough to spy on individual competitors just by looking at their profile and seeing which videos got the most engagement. Study the style, tags, and copy then try to replicate their success.

A better way to do this is to look at what’s working in your niche. Look at the tags that your competitors are using and search for those tags on the platform. Filter by “most liked” and start studying the videos.

Figure out what framework and visuals they’re using to hook the audience. Try to replicate the frameworks with your own brand.

Twitter

Twitter makes it easy. You can see everything except for reach and engagement metrics.

Unfortunately, you don’t have the time to scroll through thousands of tweets and count the likes and retweets to figure out what that audience likes.

There’s a lot of tools out there to help you analyze other accounts on Twitter. Since I already have a SEMRush license, it’s what I use. The goal here is to see what tweets get the highest engagement and study the writing style.

You can even do this with your own account to see what resonates with your audience.

With many of these tools, you can analyze the data in 100 different ways. You can use these to figure out:

What text, topics, copy structure resonates.

What larger accounts engage with the account providing them exposure.

Audience growth by day and track back which Tweets caused the growth.

Instagram & FB

Most of the value in spying on Instagram and Facebook is on the paid side. If you’re interested in analyzing the organic side, SEMRush has the same functionality for these platforms.

If you don’t want to pay for SEMRush just for the social analysis functionality, a good runner up is getting a premium SocialBlade account. This will run you anywhere from $4-$100 a month.

If you also need a tool for SEO and website traffic, I’d just bite the bullet and pay for SEMRush. You can do most all of your research in a month and cancel the subscription.

Referrals & Affiliate

Finding the referral traffic is easy. You just need to use SEMRush’s traffic analytics tool. The time consuming part is figuring out whether the traffic is a referral from ads, referral from affiliate, referral from “natural” links, or a referral from ad networks.

In the case of ad networks or affiliates that run through a 3rd party network, it’s really difficult to track that back. The traffic is bouncing off of multiple domains and losing the actual source of the traffic.

In the case of the Forbes traffic, that’s easier to track to see if it’s affiliate or natural links. Just go to backlink analytics and search for the domain. From there, go to the URL and look at the links pointing back at Purple.

hy should you care whether the traffic is coming in via actual referral or affiliate?

If the traffic is coming from a “natural” link, you can put that website on your link building list. Forbes is an obvious example given their size, but you should get the point.

If the brand is running affiliate, you can then signup for their affiliate program to see what they’re offering their affiliates. If you can beat what they’re paying their affiliates, you have an opportunity to steal a large percentage of their affiliates and jump start your traffic. It only takes an analysis like this to find their big affiliates. Then start cold emailing them about how much more money you can make them.

SEO

The 3 biggest factors for SEO are going to be links, content, and technical. Since you can easily see and study their content with your own eyes, I won’t be covering that here. You should be able to figure out the content differences.

Technical Audit

A good resource for this is my post on doing a site audit. A quicker way is to just quickly run a site audit in SEMRush for your own site and your competitors. Compare the two to see if your site has any major red flags.

The major technical factors is easy. Structured data and other things are important but if Google can’t crawl or find your content, it can’t rank it.

Links

I used to think that doing a backlink analysis on my competitors would just tell me how screwed I was in trying to compete with them. You always need to build more links…

There are however, a few benefits to studying their link profile in SEMRush or Ahrefs.

You don’t know all of the sites in your niche. The internet is a big place. If you’re doing link building outreach, this is a great place to start. If a website is ranking, it means that many of its links are relevant to your niche. Relevancy of links is very important.

Analyze 5-10 of your competitors and you now have a large list of websites to reach out to. You’re (or your VA) going to have to do some manual work and look at these sites. Many of them are spam sites. If a site is linking to a domain 34k times, you can ignore it immediately.Trying to rank for the map pack or anything local requires more links that are focused on local. Local organizations, local directories, etc. The easiest way to find these is by analyzing your competitor’s backlink profile.

There are a number of “best of” directories that Google views as legitimate. They have taken over the SERPs and sometimes make up over 50% of of the organic text ads. You need to know what websites are in your niche and be on them.

They’re generally free and just take time to fill out. Search “accountants in [your city]” and see sites like Upcity, Expertise, Clutch, Thumbtack, Builtin, GoodFirms, and DesignRush flooding the SERPs. There’s more and many of them are niche specific.

Conversion & Retention

Acquisition is easy to spy on. Conversion is much more difficult. This is where you have to get creative. While it’s impossible to know what your competitors true conversion is, you can look to try to find things that are driving conversion.

Retention, like conversion, is more difficult if not impossible. There are some things you can learn from your competitors though. Much of it outside of what you can see by analyzing their funnel goes in the “really expensive” category.

Post Purchase Page

This is the only way that you can estimate what their conversion is without having to pay a lot of money. If you’ve read my writing, I mention multiple times that tools like SEMRush use sampling to get their data. Data that’s sampled has inaccuracies leading to large variations compared to the actual data.

To get an estimate though, look at the top pages section in SEMRush and try to find their order confirmation page. Some stores will block all data collection (for obvious reasons) in the checkout process so you may not be able to find it.

If that’s the case, look at the last page in their shopping funnel that you can find that’s being tracked.

Now that you have the users visiting this page, you can estimate the AOV and estimate their revenue and conversion.

Credit Card Data

Arguably, this isn’t possible for most people unless you have some real money to spend. This is usually reserved for the big players. Here’s a few use cases when this is feasible.

You’re looking to break into a market and need to know what the LTV of a customer is for said industry.

You’re a hedge fund looking to trade on the data.

You’re a PE company looking to get more insight into the industry to find companies to acquire and flip.

If you have 5-6 or even 7 figures to waste, you can either buy credit card data or have the broker company run the analysis for you.

If you’re in the first group, you can get a rough idea into what the customer retention looks like and compare it to your own numbers. This will also work for conversion estimates.

Interviews

This is done by PE firms but if you play your cards right, you can gather a lot of information about your competitors.

Note: The following may be crossing some ethical lines.

There’s an entire industry of companies that act as matchmakers for PE companies and industry experts. These experts get interviewed for an hour on software or some other topic and get compensated for their time. The PE firms get information from customers of the companies they’re likely targeting.

If you were to change this interview structure slightly and target vendors of your competitor, you might be able to draw some information out.

It’s a lot more complicated than the above sentences suggests but if there’s a lot of money on the line, this might be an avenue you should go down. Tegus, Guidepoint, and GLG are some of the bigger players in the space.

Everything Else

The everything else bucket is the UX/UI bucket. What customers experience when they get into the brand’s ecosystem. While not unimportant, it’s something that you should be looking at with no special knowledge of how to acquire the information.

I’ll touch on the high level things you should be looking at when scoping your competitors.

Email - Sign up for your competitor’s emails. Period. First, sign up for their free email list to see what their sales funnel looks like. Then, purchase something from them to see their post purchase experience along with their reactivation process looks like.

It’s also a good idea to study how they collect their emails. By doing this, I realized that popups are so normalized now that they’re ignored. I’ve found better success in signup rates using an embedded form in the page as opposed to a popup.

Copy - Study every aspect of the copy.

Find their ads when a user first gets introduced to the brand.

Look at their value props, how they address pain points, urgency through scarcity, storytelling, testimonials, product reviews, ratings, CTA’s, etc.

Design - Study their design and how they move people through their funnel. The contrasting colors of their CTA, their visuals, the simplicity of the User Journey, the steps in their checkout funnel, the navigation and site architecture, etc.

Wrapping Up

If you own a digital business, running through the above exercise should give you a ton of ideas on what your next moves are for growth. If you haven’t started your first second income stream yet and want to learn how to start, checkout my Substack here.

Lastly, I’d like to thank BowTiedBull for giving this opportunity to do this guest post and for the opportunity that the jungle provides. If you’re sitting on the fence on whether to join the jungle or start your WiFi money, the answer is pretty simple.

You’re already late. Join and get started today.

While the media continues to push us into a bug eating propaganda world, the BowTied Community continues to grow even in a macroeconomic bear market driven by President Powell. We suggest you join and connect with niche individuals before it is too late. Find the people who can help you in your niche and save yourself.

We’ll be expecting you

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team

started first ecom biz and making first 200 something $, looking to optimize and scale ads and sailing blue seas from there

Thanks!

Actually just built my first SaaS product/website for a farming niche using Opossums guidance. Will launch this week. Can’t thank you enough for this information.