Synapse and BTB Advisory Announcement

Level 2 - Value Investor

Welcome Avatar! We’ll be working with Synapse as an advisor to their project: us being team BTB and the DeFi Team. We will help provide: 1) protocol improvement propositions, 2) business development efforts and 3) security help due to the honey pot nature of bridges. The structure will actually benefit *you* as well. This will be a 24 month agreement and individuals who read our website can earn up to a maximum of 1,000 SYN in a month if they provide helpful advice or connect the project with other tokens (it is a bridge after all).

Structure/Overview

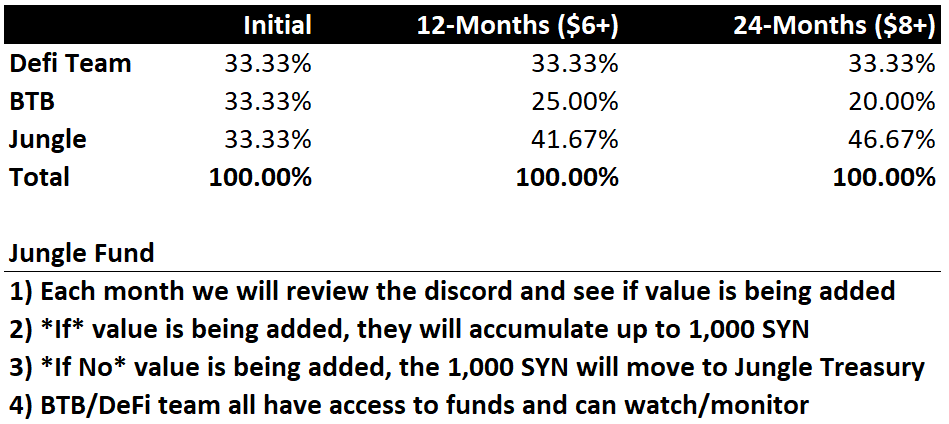

Over the next 2 years we will accumulate a total of 72,000 SYN (3,000 SYN vested each month). This will be distributed as follows: 1/3 to the DeFi team, 1/3 to BTB team and 1/3 to the “Jungle” which includes anyone who is a BowTied animal and any paid subscribers to BTB.

Note: *separate* to this agreement we’ve purchased approximately $100,000 US token worth of SYN (not related to the 72,000 SYN over 2 years for the advisory role).

Defi Team consists of: Brain, Duck, NightOwl and Iguana. They will *not* be eligible for the “Jungle” 1/3 allocation. The DeFi team will help look for technical issues, provide updates on the project/protocol, look for biz dev opportunities and Iguana will look for security issues.

BTB allocation: This will be HODL’d for a minimum of a year. We will take an active role in helping Synapse look for engineers and their marketing efforts. If the Jungle and DeFi team succeed in helping the project we will search for new opportunities similar to this and create a DAO for everyone contributing to projects/protocols. It is unclear what projects we will work with in the future, however, we will create a similar structure to fund a DAO + anyone who contributes to the project.

Jungle Allocation: Equal Opportunity, Unequal Results. Anyone who is a BowTied anon or paid stack reader can receive up to 1,000 SYN in a month by helping improve the project. If nothing is done outside of BTB/DeFi team the 1,000 tokens will be sent to a Jungle DAO fund. (more art than science to determine who is adding value, however, if no one outside BTB/DeFi is contributing we will put the funds into a treasury for a future DAO).

Bonus: Since this is a long-term agreement we’ll evaluate success on a 12 month and 24 month timeframe. In 12 months if the price of SYN is above $6 for more than 30 trading days we will allocate more to the Jungle. In 24 months, if the price of SYN is above $8 for more than 30 trading days, we’ll allocate a higher percentage. Note: this assumes individuals outside the DeFi Team and BTB are contributing. Once again, this is more art than science but over time it will be clear if people are adding value or not (we’ve already seen it with the growth of SalesGuy, DgenFren, BowTiedOx and more.

Note: emphasis on this being more art than science and a trial run of things to come. If someone adds a ton of value they get the entire 1,000 SYN. Example - If they add something small we agree to send them 250 or 300 SYN while the rest goes to the future use fund. Our guess is that a few people will end up driving the majority of the value (always happens like that!)

Incentives Aligned? This is an advisory role but we think the set up is fairly aligned. BTB and the DeFi team will be working on the project (ie. need a salary/income of some sort) and there is opportunity for other anons to earn an income (open ended). If the entire value is driven by BTB/DeFi then we will put all the coins aside for a treasury. To reiterate, the 3,000 SYN vests *monthly*. The most important part of this set up is that anyone can *earn* SYN with their ideas and intelligence. Since crypto is an emotional sector many worry about being able to get in and out fast, this creates an alternative as your cost basis would be zero if you provide value to the project. (as you all know long-term investors win)

Synapse Overview

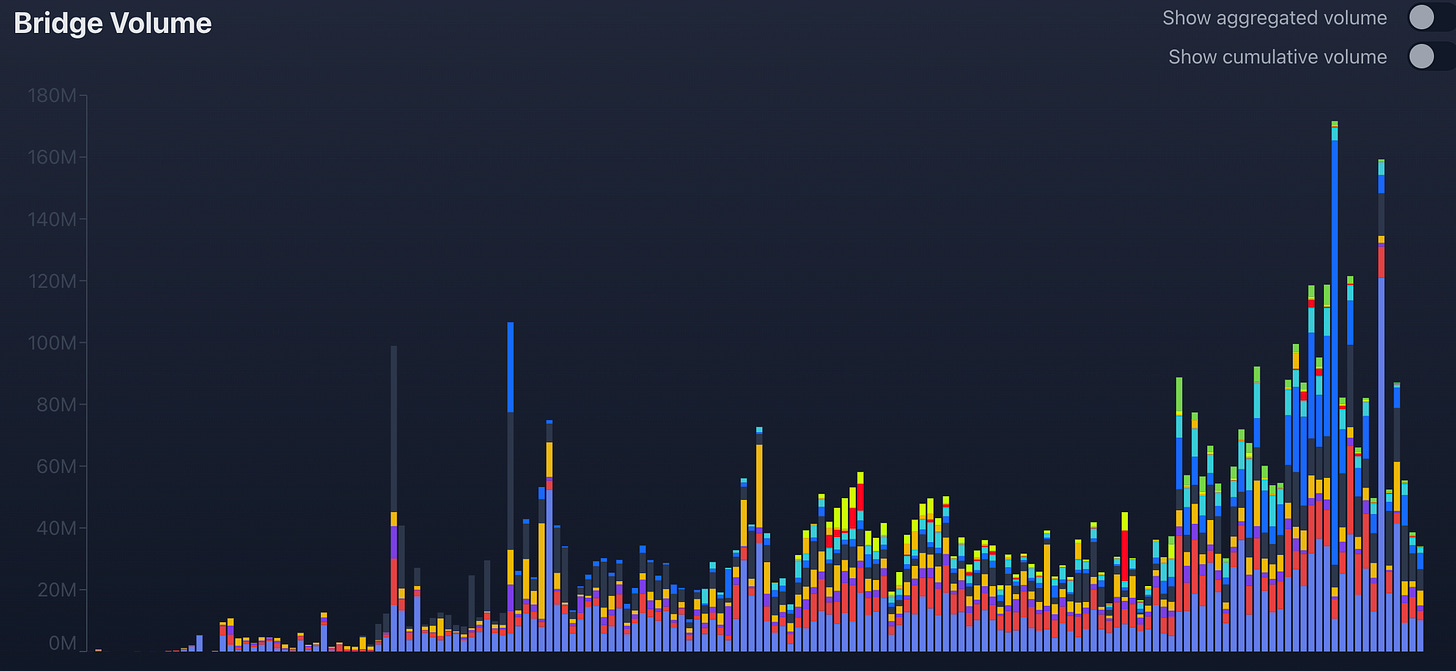

Why Synapse: While there are several reasons we think incentives align since: 1) we can help spot arb opportunities & flag them to the community and 2) SYN is by far the fastest bridge in the space. If we think this through it means that we can help find arbs/snap plays for the community (during volatile times) and if you end up capturing an arb, speed is of utmost importance. Everyone who has read this website for six months remembers the arb opportunity to acquire free ETH by clicking two buttons on a screen (26% annualized ETH returns for crossing a bridge!). Note: the craziest part is the arb lasted about a month and people didn’t bother checking it beyond one day, many of our paid subs made five figures from two button clicks (Simply Incredible!)

Synapse is a decentralized bridging solution that lets you move assets from L1s, sidechains or L2s to another (e.g. Ethereum —> Avalanche, Avalanche —> Arbitrum, etc.). Synapse has its own cross-chain Automated Market Maker (AMM) for asset swaps on native chains. The AMM uses a stableswap function to optimize for swaps between stablecoin assets.

SYN is the governance token for Synapse, giving holders rights over DAO governance. Protocol fees earned from the Synapse bridge are split between the DAO and liquidity providers. In the future, validators that secure the Synapse network will be required to stake SYN and will earn a portion of protocol fees for operating within the network. SYN tokens give voting rights over supply and emissions, meaning these parameters can be managed dynamically at different stages of Synapse’s growth.

The Synapse Value Proposition

Speed and reliability: Synapse is the fastest bridge at scale we’ve used with cross-chain transfers being completed within minutes. Yes, that means it is time to stop waiting 7 days to transfer your assets from Arbitrum to Ethereum. Furthermore, when chains become clogged and slow, oracle based bridges and most other traditional bridges become unusable while Synapse remains fast and available.

User friendly: almost all applications in crypto suffer from unnecessary complexity which frustrates users and limits their adoption. Synapse is very simple and intuitive for users and this shows in their growth numbers.

Availability of different chains: twelve different chains are available today. The team ships quickly and new chains are added when needed. You can see how everything fits together when markets are hot - you have a fast bridge that is simple to understand and enables bridging across cheaper chains. Potential for Anychain —> Anychain.

Arb opportunities: opportunities for arbitrageurs (and BTB paid readers!) to benefit from risk-free arbitrage trades resulting from pool imbalances

Non-custodial design: unlike some other bridges which store your funds in a smart contract on the source chain and mint backed tokens on the destination chain, Synapse works with native assets on both chains. To bridge USDC Synapse makes a sequence of transactions for the user in 1 click: 1) swaps USDC for nUSD on source chain; 2) mints nUSD on destination chain; 3) immediately swaps nUSD for USDC on destination chain; 4) sends USDC to your wallet… This means you always have normal USDC tokens, not a synthetic asset backed by funds in a bridge smart contract. We think this gives Synapse an improved security model relative to other types of bridge.

Synapse has a ton of exciting developments in the pipeline. As part of our partnership with the Synapse community, we’ll be sure to provide key updates to our readers and community as they arise. Stay tuned as there is a lot coming in the weeks and months ahead.

If you’re new to Synapse, head over to the website here to check it out. We think it’s quite intuitive to use but you can also check out their how-to-bridge guide for step by step instructions.

Synapse Improvement Points and Risks

Improvement Points: Unlike other projects the team is willing to listen to our suggestions which include: 1) batching transactions a few times per day, 2) having a cascading fee schedule to incentivize whale usage, 3) beefing up security efforts due to honey pot nature of the business and 4) the obvious - getting more items to bridge.

Risks: There are a couple of clear ones. Any bridge is naturally a honey pot for hackers. The more synapse is used… the more incentive there is to find a bug in the code (one of the massive risks as we’ve seen with numerous hacks particularly if centralized). Also. As funds get co-mingled, any stolen funds would certainly prefer a fast bridge vs. a slow one that takes days to clear.

Example: Co-mingled funds are potentially at risk should there be a stablecoin crackdown (Synapse used as exit bridge). Therefore a pool could be considered “tainted”.

Competitive Risks: Other projects such as Anyswap can compete on fees (however they operate at a loss). The competitive advantage is certainly speed and user experience since arbs cannot wait hours as the opportunity can close quickly (as we’ve already seen for paid stack members).

Concluding Remarks

Synapse: As a reminder if you want to help us improve the synapse protocol we suggest joining their discord and keeping up to date with product announcements on their Twitter.

Crypto Tag Giveaway: As a second reminder, we have a free CryptoTag meme giveaway today as well, this is open to *literally anyone* even guys who can’t afford $0.27 a day to grow the Jungle. CryptoTag will choose the winners of the contest so be sure to @ them to have your meme seen.

Pretty simple rules and is *not* limited to just BowTied individuals, anyone reading this can make a simple meme: 1) have to be following both BowTiedBull and CryptoTag on Twitter and 2) have to make a meme with the following concept “Keys lost forever due to paper storage”.

Over the coming months we’ll be offering small to medium sized opportunities to people on the paid stack (whopping $0.27 a day cost) and any member of the BowTiedJungle (free). As usual, Equal Opportunity, Unequal Results.

We suggest subscribing to link up with other future multi-millionaires. Twas’ Written in the Stars.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

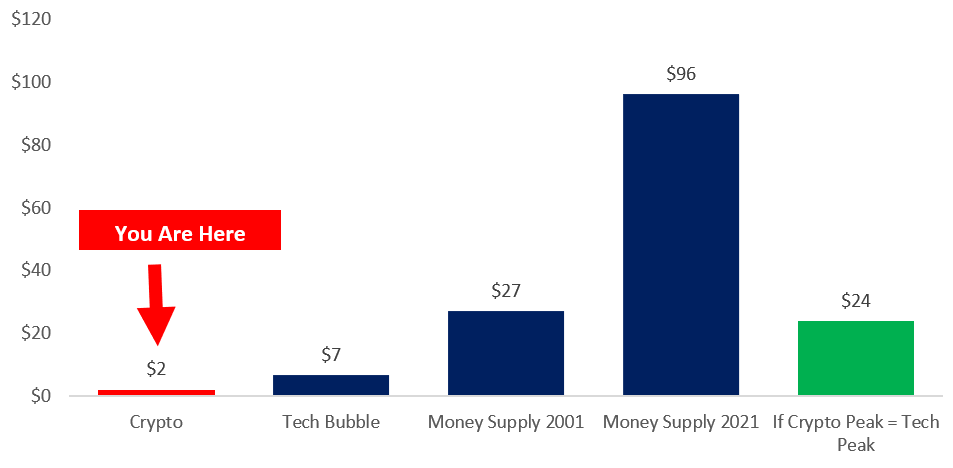

You’re Early: Remember that you’re early. If you need to zoom out see our post here on Crypto versus the Tech bubble (which was only the US stock market).

Below Chart in $Trillions of US Tokens

Synapse discord or BowTiedJungle discord? Can I get an invite to the latter? I'll just dump everything here for now.

I did a read of their docs and a quick security assessment is that their "cross-chain multi-party computation (MPC) validators" are by far the weakest link.

It's basically structured like an m of n multisig. m validators agree on a cross-chain transaction and then they generate the signature that unlocks funds. Who owns access to those n validators? Is it like the same guy with the root password on all n servers? None of that is clear from the current docs. The validator code is unaudited, but it's the most sensitive piece. They have a roadmap to change this to a distributed proof of stake blockchain with SYN staking, rather than MPC. That needs to be a top priority. Bridging is incredibly risky because it requires relying on the trustworthiness of something that isn't your blockchain. Ownership of the current validators needs to be transparent.

See Vitamin Butane on "the future will be *multi-chain*, but it will not be *cross-chain*". Better address that directly. Buterin talks about the risks of backed or wrapped tokens. I think Synapse addresses this by having liquidity providers in a wrapped_token<=>native_token liquidity pool take on most of that risk. Bridge users get the native token after a swap in the pool, but the liquidity providers in that pool keep holding the wrapped_token. Makes sense if fees earned from swaps on the pool compensates for the risk of being exposed to wrapped_token. If that's the case, it should be made clear to liquidity providers.

Wonderful project! Looking forward to contributing, especially with data science/software engineering.