Synapse Bridged & Some Token Winners

Level 2 - Value Investor

Welcome Avatar! BTB, the DeFi team and members of the BowTied Jungle have been working with Synapse for the last two months as part of the BTB advisory engagement (standard disclosure). As you recall, we disclosed if you add value to the project you can earn SYN tokens without purchasing a single one. This is part of our way of finding other avenues to earn money if you have talent/skill. Resident owl and Ceasar (an ape), have identified two winners.

We covered our high level thoughts on Synapse in the announcement post of our partnership. Some of the main strengths we highlighted included: 1) Speed; 2) Reliability; 3) User experience; 4) Now sixteen chains, with new chains added fast; 5) Arbs and 6) Superior Non-custodial design

Plenty of you made good money with arbs on Synapse. Equal Opportunity, Unequal Results.

Today, we’ll go one level deeper and explain how the mechanics and security model behind Synapse work.

But first, an update on the partnership!

It’s been two months since the BowTied bull advisory partnership with Synapse. Since then, the Synapse team has been busy. On their end:

Launched bridge partnership with Terra

Launched the Avalanche Subnet DeFi Kingdoms as the exclusive bridge partner

Max Bronstein, former Coinbase Ventures lead, appointed COO

Added support for the Metis blockchain

SYN token listed on Coinbase and Huobi

Deal with market making firm Amber to increase SYN token liquidity on CEX

Made infrastructure improvements to reduce user fees

Added VSTA bridging for Arbitrum <> Ethereum

DeFi team has working in the background to assist with operational items, testing, etc. and will continue to do so.

Two Jungle anons have helped the Synapse team out.

BowTiedShrike has been helping the Synapse team on the business development front and will be receiving 1000 SYN tokens. Will Be Paid out on April 30.

BowTiedCrocodile helped the team out with UI work over the course of a few weeks and will be receiving 300 SYN tokens. Will Be Paid out on April 30.

While the 1/3 to jungle is set at 1,000 tokens, BTB will be covering the spread here out of pocket. (IE. 300 SYN out of own allocation due to some confusion on how to structure these payments/thank you notes).

As a reminder, jungle contributors can earn up to 1,000 SYN tokens per month for valuable contributions to Synapse as part of the BowTiedBull x Synapse advisory partnership. If nothing is done, the 1,000 SYN goes into the treasury. Therefore April Month = paid to shrike/crocodile.

Now, let’s dive into Synapse. We’ll be covering how it all works, the bridge structure, and a small peak into some of the things they’re working on.

What is Synapse?

Synapse is a decentralized bridge that lets you move assets between blockchains with its own cross-chain Automated Market Maker (AMM). The majority of value bridged is USD stablecoins and Ethereum. Synapse issues pegged assets nUSD and nETH to facilitate swaps through its AMM.

Autist note: Synapse's AMM is optimized for swaps between stable assets. It uses the StableSwap algorithm developed by Curve (as re-implemented / forked by Saddle)

How Does Synapse Work?

First, a user initiates bridge of token X on Chain A to token Y on Chain B

If token X is an AMM collateral asset (USDC, USDT, DAI, or ETH currently), then

X is sent to the Synapse smart contract on Chain A

The Synapse validator set confirms the transaction

A Synapse validator pokes a smart contract on Chain B with the destination wallet address and desired asset

The Synapse smart contract on Chain B mints nUSD or nETH, swaps for the desired asset, and transfers the asset to the destination wallet along with some gas to the destination wallet

The proportion of assets in the destination chain AMM shifts to contain more nAssets and less collateral assets, the impact of which depends on trade size vs quantity of liquidity in pool. The StableSwap design incentivizes an opposite trade by adjusting prices if asset proportions are outside of an ideal equilibrium

In periods of high activity and chain congestion, there are pool imbalances which create opportunities for arbitrage by bridging between chains

Synapse vs. Other Bridge Models

A common bridge model is lock & mint: a user deposits native tokens to the bridge and the bridge mints a voucher token on the destination chain which is backed by the collateral the user locked in the bridge.

This means that every holder of the voucher depends on the safety of the bridge to be able to redeem the underlying asset. If the bridge is hacked and collateral is stolen, the vouchers (also known as wrapped tokens) are no longer backed, meaning their holders will suffer loss.

In the AMM model used by Synapse, the process is slightly different.

Synapse generates a voucher (nETH or nUSD) which represents the deposited collateral (ETH or a top 3 stablecoin). Then the voucher is immediately swapped on the destination chain to the desired asset. This means that the risk of holding a voucher token collateralized by the bridge passes from bridge users to the AMM LPs.

In comparing the models, note that liquidity providers are in the business of managing risk and receive compensation in the from of transaction fees, the opportunity to arbitrage imbalanced stableswap pools and SYN tokens. Users do not want risk and the Synapse model ensures that their risk is minimized.

Below is an example of a user moving USDC to a sidechain.

With a competitor lock & mint type bridge: USDC is swapped for fooUSDC, a wrapped / voucher token on the destination chain. fooUSDC can’t be used directly in DeFi applications and depends on the security of the bridge for its value since fooUSDC needs to be redeemable for USDC.

With Synapse AMM bridge: USDC is locked to mint nUSD which is immediately swapped for USDC and transferred to the user on the destination chain. This USDC is a native token, can be redeemed directly with Circle, and so does not depend on the bridge for its value. The user can then use USDC in DeFi immediately.

Autist note: Synapse also uses the lock and mint model for tokens which are not swappable through AMMs yet. In certain cases, they use a pure mint and burn model (for the SYN token) or a lock, mint and burn model for tokens that are not easily assigned minting privileges.

Synapse Performance

Synapse has expanded to support sixteen chains and averages $1.65b per month bridged volume year to date. Growth is extremely strong. Most recently, growth has been driven by key partnerships with DeFi Kingdoms and the Terra ecosystem.

Breaking out volumes by chain highlights the diversity of bridge sources. It’s worth noting the DFK partnership accounts for 6% of all time bridging volume even though it just commenced at the end of Q1.

Note that we’re focused on bridge volume. TVL is cute and all, but bridge TVL beyond what’s necessary is a vanity metric. Too much TVL is actually inefficient. There should only be enough liquidity locked to service user demand - any excess is dilutive where liquidity is incentivized with token rewards.

What Are They Building?

Unlike a lot of other teams you see in the crypto space, the Synapse team prefers to show people what they can build by actually building and shipping instead of hyping things up and not delivering. A few things we can highlight today:

Message passing: allowing for app on one chain to trigger an action on another chain

Synchain: Proof of Stake blockchain

[Redacted]: We’ll be providing another update soon on a project the team can’t announce just yet. Stay tuned

Synapse Software Development Kit

The Synapse SDK allows protocol teams to integrate bridging features directly into their app frontend. Synapse provide example code which adds the wireframe below into a dApp. Developers can choose which buttons to include and can format the interface to match their dApp’s look and feel. Users can then use Synapse without having to leave the host app, using ordinary wallet transactions. This means users don’t need to understand how a bridge works or choose among competing services.

High quality documentation helps developers build on Synapse quickly. Protocols who want to integrate their token with Synapse may review this 1-page then complete this form - the first rollout takes about one week.

Don’t underestimate the importance of intergrations - remember the DFK partnership contributed 6% of *all time* volume.

We think the SDK - if well marketed - will be a key pillar in Synapse growth.

Bridge Security

People in the cryptoverse seem to be stuck on the idea of “bridges are high risk.” We are not downplaying the risks of many bridges. However, there’s a bad take going around that bridges will become the focus of hackers because they contain a large quantity of assets. Any protocol with a high TVL can be a lucrative target for hackers - bridges happen to have a somewhat high TVL, but many DeFi apps dwarf bridges.

It isn’t just about TVL. Designing a secure bridge is a harder engineering problem than writing a secure smart contract for a single chain. The attack surface is larger. And. There are few experts (such as Caesar and Aurelius) who deeply understand bridges.

How do bridges fail?

There were 3 high profile bridge hacks in Q1 2022: Wormhole, Qubit, and Meter.io. In each case, attackers were able to inject spoofed data, bypass verification, and withdraw funds on the destination chain despite not having provided equivalent value on the source chain.

Synapse Security

Out of an abundance of caution, Synapse engineers have built additional checks on both the source and destination chains. Individual transactions are checked to prevent double spends and other attack vectors. There is a small additional gas cost for these extra safety checks, but the result is collateral cannot be sent to chain B unless it was actually first deposited on chain A according to discussions with the core devs.

Conclusion: the chance of Synapse being exploited *while your bridge transaction is pending* are vanishingly small. If you send stables (this uses nUSD through the cross chain AMM) you receive native tokens on the destination chain so you are not at risk even if Synapse somehow gets exploited a minute after your transaction confirms.

Part of the reason we wanted to work with Synapse is because they have a strong user first mentality, exhibited in not just the security but also best-in-class UX among bridges (don’t just take it from us - ask anyone that’s used the bridge).

Concluding Thoughts

The Synapse team is building the future of bridging infrastructure with a long-term, customer first approach. Despite already dominating bridging volumes, the team tells us they are still in the very early innings of the Synapse protocol.

We’ll be sure to provide you with updates on the product, our partnership and further contributions from members of the BowTied Jungle.

In the meantime, make sure to follow @AureliusBTC, @caesar0x, and @Max_Bronstein.

Until next time, anon.

As you know, we’re building out what we hope becomes the first ever internet country. We fund anons, look for alpha to help you navigate the changes coming and continuously look for new projects to either 1) invest in or 2) become a part of and earn the tokens yourself! (Hint to Shrike/Crocodile you should take a swing at the Synapse job opening if it makes sense for you economically and you are a good fit)

Equal Opportunity, Unequal Results

Disclaimer: None of this is to be deemed legal or financial advice of any kind and the information is provided by a group of anonymous cartoon animals with backgrounds in Wall Street and Software.

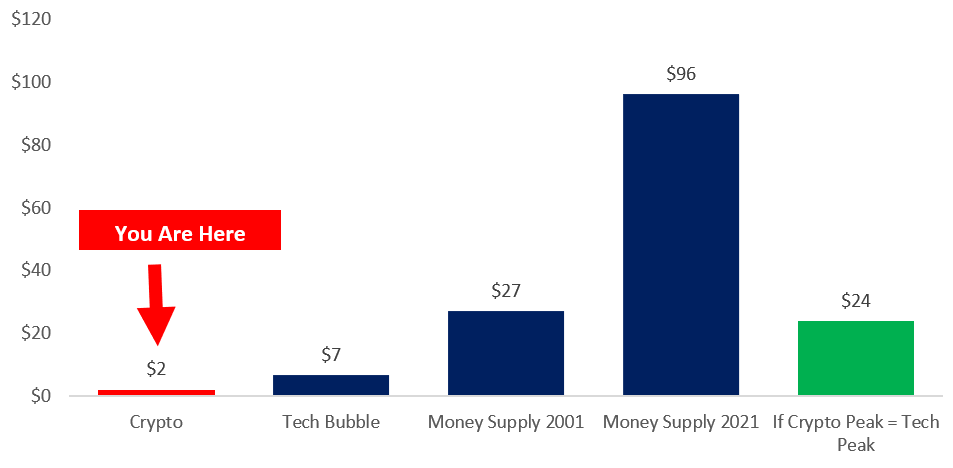

You’re Early: Remember that you’re early. If you need to zoom out see our post here on Crypto versus the Tech bubble (which was only the US stock market).

Below Chart in $Trillions of US Tokens

Thank you to Bull and the SYN team for the opportunity! I’ve enjoyed working with the SYN squad and they definitely have the talent to do big things.

Insightful update/breakdown. recently applied to the Marketing role so let’s see where it goes.