The Art of Keeping Your Crypto and Eating It Too

Level 2 - Value Investor

Cutting straight to the chase, we think Summ is going to work best for our audience which has complicated on chain transactions.

You can access Summ HERE and get 25% off your first year for being a BTB subscriber. Yes this also operates as a ref link. (BTB25)

Welcome Avatar! It’s tax time anon! Here is what you need to know and how to get your cryptographically secure digital assets sorted for the Tax Man. Since all transactions are recorded on an immutable blockchain that can be seen forever until you are long past being six feet under, we can assure you that it is wise to keep up with the tax rules in your jurisdiction.

There are only two things that are certain in life: rug pulls and taxes. Death should be solved by modern technology.

While you may not immediately relate crypto with taxes, you can be sure the tax office near you wants a slice of your ETH and meme coin gains. Don’t be quick to think you’ve outsmarted them by moving on-chain either (more on this later).

As Q1 is tax season for many countries around the world, this is the quarter of max stress for anons. This article will focus on the US tax rules related to crypto. However, many countries follow similar guidelines, so if you live in Europe, Canada, the UK or Australia, you should still keep reading.

Anyone who lives in a no-tax jurisdiction can stop reading here and get back to Dexscreener to find the next up-only Ponzi scheme.

Remember. Your friends and family believe you lost all your coins in FTX, LUNA, BlockFi or Celsius. Uncle Sam will continue to monitor on chain transactions and compliance picks up.

Crypto Taxes: The Basics

As many of you would know already, the key distinction between crypto and fiat is in how it is viewed by US government bodies, such as the Internal Revenue Service (IRS). While fiat is viewed as currency, crypto is viewed as a capital asset, a subset of property.

This causes a whole host of issues for crypto investors, especially if you’ve fallen a bit further down the rabbit hole than the average CEX user.

Depending on what activities you are partaking in, you could be liable for capital gains tax, income tax, or a combination of both. While there are still some gray areas, particularly around more nuanced DeFi activity, the IRS has released a set of guidelines and FAQs covering the tax treatment of many crypto activities.

Here’s a run-through of what you should know:

Capital Gains Tax (CGT)

This one is a pretty simple concept in theory, but when you apply it to the whole range of crypto activities, it gets more complex.

CGT is a tax imposed on the profit realized from the disposal of assets such as stocks, bonds, real estate or crypto, calculated as the difference between the sale price and the purchase price.

Simple, right? Yea… kinda.

Here are some common crypto activities that trigger CGT events:

Selling crypto to fiat

Swapping one crypto for another

Swapping crypto for an NFT, and vice versa

Paying gas fees in crypto

Paying for goods and services with crypto

In some cases, depositing into smart contracts (more on this below)

Crypto creates issues because the events that can trigger CGT aren’t always denominated in fiat. This means there are multiple steps required to determine the CGT payable for each event, making it unclear at the time and adding friction to reporting.

When you sell shares, it's pretty obvious what your PnL is in fiat terms, whereas when you swap meme coins to ETH, it’s not always as clear. On top of this, tracking the cost basis of assets as they travel from exchange to wallet to blockchain to protocol (and so on) quickly becomes a serious nightmare that doesn’t typically arise for other capital assets.

DeFi is also a tricky one. The IRS is not up to speed on the latest yield farming Ponzi protocols, so there is very little guidance on more nuanced transactions. However, depositing crypto into a smart contract often results in the return of a receipt or LP token that tracks the deposit.

The IRS has clearly outlined that crypto-to-crypto transactions trigger CGT. This could be a “gotcha” for many DeFi deposits and withdrawals. The devil is in the details; be careful.

Gas fees are another one that not many people think about. When you are paying $300 in ETH to swap on Uniswap during peak bull, you’re disposing of your ETH and potentially triggering a capital gain if the price of ETH has risen since you acquired it. In this instance, the value of the gas fee can get tacked onto the cost basis of the token you acquired during the swap, but the point is that this is complex and something to be aware of.

Asset holding periods also come into play when triggering CGT. In the US, and in some other countries, gains made in long-term holdings (>1 year) are taxed at a lower rate. Tips on using this to your advantage will be covered in more detail in part 2 later this month.

Income Tax

Another simple one, right? Income tax on crypto is actually even scarier than CGT because of just how wrong it can go if you don’t keep on top of it.

The key concept here is that any ‘earned’ crypto is taxed as income at the market value on the date and time it landed in your wallet.

Let’s cover a few examples:

Salary paid in crypto

Mining

Staking rewards

Yield farming

Airdrops

Referral rewards

Chain forks

Here’s an example of this in action + a situation you don’t want to find yourself in:

You staked 100 ETH. After a month, 5000 “reward tokens” have accrued, and you decide to claim them. At the time you claimed them, each token was worth $2, so the entire claim was valued at $10k when it hit your wallet.

This $10k is treated as income and taxed accordingly.

Say you decide to hang on to your “reward tokens”. The token goes down 99% over time (surprising no one), and you eventually sell them for $100.

Well, guess what? The IRS is still going to tax you on the $10k of income you made at the time you claimed them. Not their fault you diamond handed to -99%. What you can do is claim a capital loss of $9,900 on the position.

But that doesn’t help you much either. You can only use capital losses to offset up to $3000 of income per tax year, meaning you still have to pay tax on the remaining $6,900 income.

Paying tax on now-worthless tokens is not fun. Do not get into a situation where your tax bill is larger than your portfolio (it happens!).

Autist Note: Now you understand why we suggest selling the airdrops (at least half of them) because you can pay taxes in the vast majority of jurisdictions and you won’t be left with a tax bill you can’t pay because some scam airdrop went down -99% then down -99% again.

“cRyPtO iS dEcEnTrALiSeD, i’M nOt PaYiNg TaX ”

But hang on a second; crypto is decentralized and anonymous, right? If the IRS doesn’t know about it, why should I pay tax on it?

There’s a widespread myth that crypto transactions are ‘untraceable’ and beyond the reach of the IRS. But that's just what it is—a myth. The blockchain, by nature, is a transparent, permanent ledger of all transactions, accessible to anyone, anytime. When you think about it, it’s probably the least suitable place for any kind of tax evasion or illicit activities.

Remember, the IRS also collaborates with crypto exchanges, which collect KYC information on users and report trading activity. Exchanges keep detailed records, including withdrawals and withdrawal addresses, which makes tracing transactions on-chain not as difficult as you might think.

Sure, with meticulous planning from the start and perfect execution every step of the way, it is possible to keep your on-chain footprint completely unlinked to your identity. However, if you’ve KYC’d to an exchange, forgotten your VPN, used your personal email for accounts or doxxed yourself on Galxe to earn a $100 airdrop, you’re not in this category.

You also may have heard about mixers like Tornado Cash, often mistaken as tools to dodge taxes. Once again, if you are not in the category above, then this is likely going to land you in more trouble than it’s worth. The IRS deals with highly complex tax evasion cases. Throwing your ETH into a mixer is far from a foolproof method of avoiding tax.

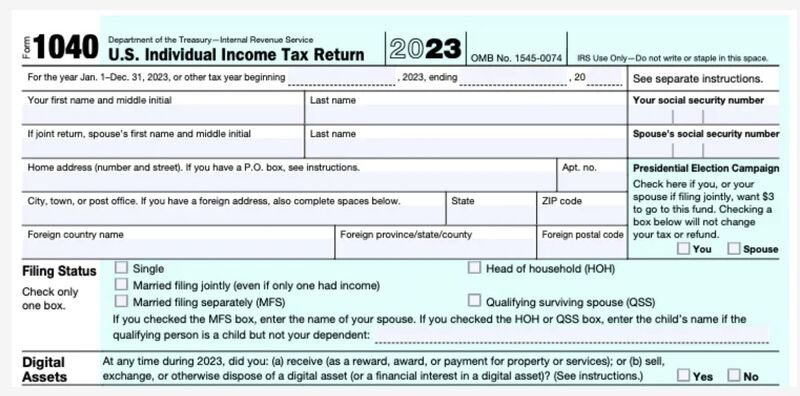

Being a slow-moving government org, the IRS is definitely behind the eight ball in terms of crypto, but it is getting up to speed. This year they have added a dedicated section to Form 1040 specifically asking about digital asset activity.

Been airdrop farming across 100s of protocols and chains? At this point, you might be thinking, “Nah, there’s no way I can figure out the taxes on this complex mess.” The IRS doesn’t care how complicated it is; it’s up to you to figure it out. Do you think the IRS gives people with multiple businesses, offshore entities and convoluted tax structures a break because of the complexity? Think again

So considering all of the above and the fact that tax season is already upon us, here are your options for getting your shit together whilst avoiding a nervous breakdown.

Your options:

Be a deranged lunatic and risk life changing returns.

Hint: Not worth it.

Do it manually

Calculating your taxes manually is a possibility, especially for those with small or very simple portfolios. If you are simply trading spot on one exchange, you can probably just download your transaction CSV and figure out the amount pretty quickly.

Anything more complex and manual calculations could end up becoming a time-consuming, error-prone disaster. If you find yourself scouring block explorers and historical Dexscreener charts to figure out your taxes, you need to move on to one of the next options.

Now, if you have something simple, such as bought BTC/ETH and then sold it later with only 1-2 transactions, it is 100% doable. More realistically, if you found this side of the web, it isn’t you.

Use tax software

If your crypto activity has gone beyond buying a bit of Bitcoin on Coinbase, this is probably the option that you need to go with. Crypto tax software allows you to import transactions automatically from both exchanges and wallets, allowing you to track the cost basis of assets, monitor income throughout the tax year, and generate tax reports when the time comes to file.

There are now stacks of options when it comes to crypto tax software; however, while most might appear the same on the surface, like everything in crypto, some claims are not backed by the reality of the product.

The majority of options were built to handle centralized exchanges only, and do a very average job handling on-chain activity. As that is where the complexity is, if you’re with a provider who can’t handle bridging, LPs or other DeFi degeneracy, you may as well go back to the manual method.

If you pick the right tax software, you’ll avoid having to waste time scouring block explorers and Dexscreener to pull your transaction history and pricing for your coins in fiat terms. No one enjoys doing tax, so you may as well automate the process and be done with it.

Onto the Tax Software - Summ

As mentioned above, there are a bunch of different tax software options out there for you to choose from. We recommend and have partnered with Summ. At a high level, Summ differs from other crypto tax competitors for a few significant reasons.

Mainly, you’re plugging in on-chain transactions, and it is approved by Coinbase, which is where the vast majority of you likely get your CEX crypto. Here are some points that we like about it:

Built from the ground up to handle on-chain activity: Most crypto tax software struggles with anything beyond basic sends and receives on-chain. Summ supports the full spectrum of degeneracy, including LPs, bridging, staking, on-chain derivatives, etc.

Broad integration coverage: They have support for 1000+ chains, wallets and exchanges. They have recently added a bunch of new chains like Celestia, Manta Pacific, Scroll, zkSync, etc, to keep the airdrop farmers happy.

Smart-contract level support: Summ integrates to the dApp or even smart contract level, so when you import your on-chain activity, you’ll notice that a lot of smart contract interactions are automatically tagged correctly. In other tax software, smart contract activity often shows as ‘unknown’.

Transparent, CPA-approved reports: The platform provides automated steps to help you reach an accurate report (and save on tax $$). When you download the reports, you can see the breakdown of the calculations, and you have the option to file directly with TurboTax using their integration.

Nothing in crypto is perfect, but the team at Summ is very receptive to feedback and moves fast to improve, which we like.

For The Anons

We’re all about remaining anon, so if you don’t want to provide your name, you can use Summ without any personal info. This is important as you won’t be at risk of being a target for phishing in the future, and you can still use the Tax Software.

You can access Summ here and get 25% off your first year for being a BTB subscriber. Yes this is a combination ref link and discount code. (BTB25)

4. Use an Accountant/CPA

The final option is the most expensive option, and sometimes, it isn’t as hands-off as you may think. Going to an accountant with your crypto activity is definitely an option, but make sure you go to one that understands crypto. Giving your average accountant a stack of blockchain explorer CSVs will not only result in your accountant hating you, but it will also lead to a lot of back-and-forth explaining your degeneracy; plus, you’ll end up overpaying for their services as they up-sell themselves on your dime.

If you go this route, be sure to go with an accountant specializing in crypto. There are many of these available now across the US and the rest of the world. Most are using Summ anyway, so unless money doesn’t matter to you, you can achieve a similar result using it yourself.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

As a guy who runs a crypto tax accounting firm, I have to say this is one of the best crypto tax guides I've seen.

We use CTC and just a few tips for the anons who plan to use it to DIY:

1)Sort your transactions chronologically - it's easier to see them in context than haphazardly in the "review" page.

2)If you are overwhelmed by the sheer number of transactions, start by adding "incoming" and "outgoing" as filters. This will show you ONLY the transactions CTC didn't algorithmically categorize. Use the "view in context" feature to find the transactions around it that might be related.

3)There are often "missing purchase history" transactions which contribute to overstated cap gains in CTC. Usually this comes from data import errors or an uncategorized cross chain bridge/swap. You can usually find these by going to "view balance" for the transaction with the missing purchase history, selecting "view ledger" and then finding where the balance first goes negative.

You may need to import data via csv if using exchanges like Kucoin/Binance which have incomplete APIs. You may need to "hard sync" the data source again to call the API again and hopefully pull the data off chain.

This process overall will probably take you about 1hr/100 transactions reviewed so plan accordingly. At this point if that sounds overwhelming just file an extension and keep farming airdrops while chipping away.

Also BTB - would be more than happy to give jungle a discount on accounting services and kick back to treasury.

Thanks for the article, it got me thinking about something that should be in the back of all our minds.

Quick open question to everyone here (this must be on some of your minds). This was just a random idea of mine.

In the US, there is a HUGE difference between taxes on short term capital gains (up to 37%) and on long-term capital gains. (up to 20%).

I've just been buying ETH and accumulating. However, I will likely want to sell some ETH if say it reaches my price target (say +$8k for a random number)

Is there anyway that once ETH reaches our price target of $8k, we could short the same amount of ETH in our portfolio in a trade, and then we're essentially market neutral, not making or losing anything if ETH price goes up or down. If we could do that and we only sell our ETH and close out the short position once our holding period is +1 year (so it counts as a long term capital gains, versus short-term capital gains?)

One of the concerns I have is the rehypothecation of ETH, and what exchanges would be stable enough to put our ETH in and also to hold the trade, as that would be a big risk in itself. I would be open to paying someone to help me through that if it's needed bc the tax implications are big.

Would appreciate any feedback you guys have, and if you have any ideas of your own.

Thanks in advance and #WAGMI.