The Banking Model and Wall Street is Broken.

Level 3 - Virgin DeFi Investor

Welcome Avatar! At this point you’re now familiar with the macro backdrop. Governments are printing money like mad men. Roughly speaking, the number of US dollars increased by 30% over the last year with zero signs of slowing down. Mathematically speaking, if you *did not* grow your net worth by *more* than 30% you became poorer. This is about as unfair as it gets.

Recap of Macro Picture

If someone ran a brick and mortar business they lost profits to the tune of 60%+ (rough estimate) and the vast majority were in the red. Compare this to a mediocre “portfolio manager” who lucked out and covers the technology sector. By sitting around and simply owning technology stocks (QQQ technology index is up ~40% over the last 12 months, the S&P 500 is up 38% and the Dow Jones is up 34%), he technically outperformed!

Think this through. Did the portfolio manager really add 40% of economic value to society by simply being involved in technology stocks? How about the portfolio manager who is *forced* to invest in Restaurant stocks… is he “dumb” since the sector is up 32% y/y - under performing the S&P 500 and the NASDAQ?

Sadly this is how the world of Wall Street works. They force people to specialize in sectors and completely ignore the bigger picture. They are too busy collecting their 1-2% management fees and 20% “outperformance fees” relative to the S&P 500 which always includes a lot of bad sub-sectors of the economy.

So there you have it. The printing of 30% of money did not benefit anyone in the real economy. It just pumped up asset prices. Anyone who was already rich got richer (without any real work).

Pretty difficult to argue against this as there is no way you wanted to own a bunch of restaurants and be a private company in say New York City, San Francisco or Boston. You could have worked double or triple time and you would still lose money (due to restrictions) while the guy sitting on public company restaurant stocks sees his net worth go up by 30% while doing nothing…. makes no sense.

Autist Note: Someone is going to jump in and say “well private restaurant company valuations should also be up!”. The problem is that is illiquid. Ask yourself, would you buy a private restaurant right now at a 40% higher price when compared to 2019? Not to mention all the headaches you would incur with rising food prices/cost of goods.

Part 1: How This Impacts the Banks

Now for the fun part. Putting Wall Street and Banking business models into an easy to understand example. We’ll start with banking since that can be explained in simple terms.

Bank “Business”: It isn’t so much as a business as it is a cartel. Essentially, you need to pass through a ton of regulations/red tape before you even become a bank. After this is all settled, you open up your bank business and here is what you try to do.

You convince customers to deposit money at your bank. The bank then takes this money and they *lend* it out at a higher interest rate. For example. If you are getting a whopping 0.1% on your savings account… They are lending out a portion of *your* money to collect say 3% interest on a mortgage.

Step 1: you put $200,000 US Trash Token into a bank, Step 2: Bank takes this $200K US Trash Token and gives it to someone else as a loan to buy a home, Step 3) They collect 3% interest on the $200K while paying you a whopping 0.1%. This results in 2.9%*$200K or $5,800 per year in income.

Here is the problem (for the customer!). As soon as you put your money in the bank it isn’t really your money anymore (Not Your Keys, Not Your US Trash Tokens). Since you do not have access to the $200K, you have to go through hoops just to get access to it again!

Any time you use more than $10,000 US Token you have to explain what it is for. And. It gets worse. Since the banks do not have millions in physical cash lying around at every single retail outlet, they don’t actually hold the full amount of US Tokens. If everyone went to the bank today and said “I want to withdraw all of my money” the system would collapse. This is known as a bank run.

Now, Now… What About Bad Loans? Looking at this, it sounds like the money is risk free until a smart person realizes “if the banks make bad loans, they go under… right?”. Well that is how it “should” work. However. After 2008 and 2020 we learned that there are situations where institutions are “too big to fail”.

In a situation that is deemed “too big to fail”, the government steps in and bails out the banks or they give interest free money to people with bad debt (pick your poison, the result is the same, printing money!)

From the above you can see that by having the money printer go brrrrr, you end up being forced into a tough situation… raise taxes or somehow drive up GDP/revenue in a big way. In short, the “business model” is to take money from customers/citizens and loan it out at a higher interest rate. If they make mistakes the big ones get bailed out to prevent systematic financial instability/collapse.

Summary: Now that you understand the banking business model, you can take a look at the below image from BusinessModelGeneration.com. Take a good long look at it.

Think about the *costs* of doing business. Yes. For the first time in our 10 year history of writing… we are asking you to think about costs instead of making more money. Ask yourself, how much it costs to run all of this stuff: 1) all the regulatory tape, 2) all the physical offices/infrastructure, 3) all of the employees, 4) all of the computer/security equipment, 5) all the errors/mistakes made - lost wires, stolen funds and 6) standard bad debt expenses. So on and so forth.

Part 2: The Death of This Business Model

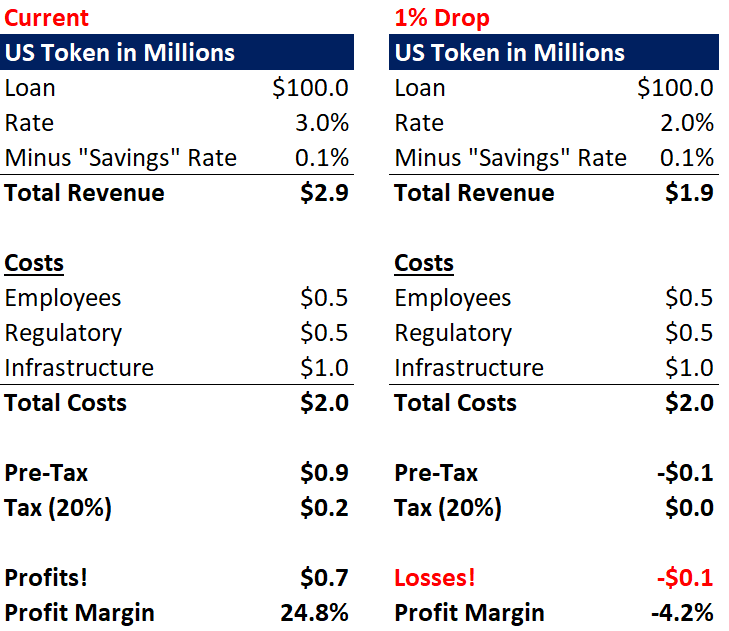

From the above you can see the cost of doing business is quite high. You have interest rates at nearly 0%. You have mortgage rates that are extremely low. You have massive overhead. We can do a quick P&L for retail banking. Instead of doing something complex we’ll make it simple for even a high school student to understand.

Autist Note: for a real example of how a bank shows its revenue and profits you can check out Wells Fargo as they have a wide range of products (LINK). If you want to go for a major firm that is more broad based and less retail check out JP Morgan (LINK). JP Morgan has *much* more investment banking when compared to Wells Fargo.

Step by Step: 1) You get $100M US Token as deposits, 2) you loan this money out at 3%, 3) you give the customers 0.1%, 4) this spread is now 2.9%, 5) 2.9% multiplied by $100M and you’re sitting at $2.9M.

Now the Ugly Part: You have to pay for all the expenses. In a standard public bank it’ll be called “non-interest expense”. We’re simplifying this a lot but basically you have to capture all the costs of running a bank: 1) real estate/infrastructure/computers, 2) employees and 3) all the regulatory stuff. We get to about $0.9M US Token in pre-tax profits. For simplicity we use a 20% tax rate and you’re left with about $0.7M US Token in profits.

Sounds Good! … Until Spread Shrinks! Now interest rates have been low for quite some time. For fun… say this bank sees a 100bps drop in their rate to 2% (from 3%). This is quite incredible. It means that the firm would officially be losing money!

They have to fire people, cut down on infrastructure spending and lower interest rates paid on the savings accounts (customer accounts) to remain profitable.

At This Point the Issue is Crystal Clear: If interest rates go up dramatically and we’re living in a debt fueled system through Trillions of printed dollars, it means that payments would be missed! No longer able to survive with the debt burden.

On the other hand… If printing money continues and rates stay low, you get to a slow bleed over time.

The revenue line shrinks as: (loan return minus savings rate paid to customers) gets smaller and smaller or goes negative.

This is why some countries have gone fully insane with negative yielding bonds (paying to lose money!).

Final Blow: In addition to all of these pressures, technology is eating at the ease of sending money: PayPal, Venmo, Cash app and of course crypto currencies. The cost of acquiring a customer is much lower (download app in mobile wallet) which costs nothing. Or. You have to go through all these loop holes to get approved for a new bank account! Take a guess which one is cheaper, faster and more efficient!

Also. If you think about digital dollars and CBDCs they also have massive issues. The issue is that the “supply” of the US Trash Tokens will be readily available online. You will get to decide. Do I want to hold a currency that is printed at 20% per year or own a currency with a fixed supply? The choice is yours of course.

Part 3: Alright Alright, Banks Are In Trouble What About Wall Street?

Ah yes. We get that most people don’t understand how Wall Street makes money (100% understandable). So. In three points it’s really this: 1) by raising money for companies, 2) making pennies on trading fees for securities and 3) giving “advice” or advisory fees - after you read this part you’ll see why our substack is an absolute steal as advisors charge 1% of net assets for advice (honestly LOL, insanity).

Raising Money: This is basically dead long-term. Usually companies go to a bank. That bank then helps them raise money via a debt offering or a stock offering. For their “work” they collect a fee of 3-7% (IPO fee usually 7%, 2-3% for bonds *and* these fees are coming down due to new options/pressures such as direct listings).

In the new world, with the internet, you can essentially raise money without a bank. If you are a well known company trying to go public, there is no need to “sell” your story as everyone already knows what you do! Also. When crypto really ramps up, you can simply set clauses in the offering to incentivize long-term holdings.

In short, this is a structural problem.

The only benefit of being in this sub-segment of Wall Street which is called: ECM (Equity Capital Markets) or DCM (Debt Capital Markets)? We have no idea! Honestly it is that bad. Perhaps you are of the belief that the Titanic will not sink in the next 10 years.

People say you “get relationships” but this is simply a lie. No analyst or associate develops deep relationships in ECM/DCM at that level. They are just making power point presentations and excel sheets (while expensing the maximum meal allowance and eating awful dry sandwiches/cookies in meetings). The relationship value really shows up at the Vice President level and if you’re there for that long… you haven’t been following this Substack correctly!

Trading Fees: Back in the day spreads were insane. You could charge $0.125 per transaction on a stock (1/8). Way back in the day, newspapers would quote prices of stocks with 1/8, 1/4 as the actual price per share. For example 40 1/4 means $40.25 per share.

Eventually tech came in and compressed these fees to pennies and fractions of pennies. High frequency trading etc. Now? You can basically trade nearly for free. This is why we laugh when people place trades with brokers. It is basically a dying business.

The only people who make money from this have deep relationships and their clients simply love them. They give them a few pennies per share to make sure they get paid. They are only getting paid because they probably provide some advice/information in the first place. If they had no trust/relationship it would go straight to electronic.

There actually is one piece of good news here. The one way to go into trading (and make money) is if you’re a software/math person. Since that’s where the world is heading (quant) you can still have a fine career (although stressful). Long-term? Also problematic as stocks/bonds get listed into decentralized finance pools and are traded peer to peer.

In short, trading is a dying business being replaced by technology. There are *currently* S&T positions that *do* pay well. Just recognize it is a dying business as clicking buttons on a screen generates no economic value.

Advisory Fees: One type is asset management. You give all your money to a guy who gives advice for an account that has more than $500K US Token or so. The problem? Fee structure is crazy high for blanket/simple advice. Many charge 1% which would be $5K a year!

We know that several asset managers read us and we likely made them upset with that comment. And. They know that this is happening right now. Fee compression, robo advisors etc.

You could ask a question here once a month for $10 and you’d get the same or better information (just with the disclaimer that it is *not* legal or financial advice). Hint: the Series 7 and other such “Series” examinations have basically no standards. You could pass them if you studied as a high school senior.

Therefore, the outlook is weak. The only way to compete here is to differentiate. For example, if we were in the asset management business we would learn crypto and provide tons of information on it with the caveat that it is “not” part of the job.

See a trend here? You have to essentially build a relationship with the client that is *different*. If you’re just charging 1% to manage money with no “edge” as they call it on Wall Street… You’re dead in the water.

Now the final one M&A Advisory. Here is the one sector that should be around for a long time. The way it works? You see all those deals where Google buys XYZ company or Coca-Cola acquires XYZ brand. For those transactions you have to pay a banker a fee.

There is *actual* value here. The banker goes out and finds the best bid for you. If you’re selling your technology company and you’re not choosing Qatalyst (if you can get them!) you’re basically insane. They have a history of getting the best valuations and focus *primarily* on Sell-Side M&A (advice to people selling their companies). For this service they charge a 1% fee. A bit more variable here but just call it 0.5-2.0% to be safe.

This is BIG money. A 1% fee on a $1 Billion US Token deal is $10M US Token. And? The total costs are pretty low. A ton of paper work, a ton of presentations but nothing expensive. High profit margin revenue. You’re paying for negotiating skills and for a rolodex of every single potential buyer in the world. Conclusion, M&A is here to stay.

If you’re interested in a quick thread on how to get into Banking just read this below, we’ll have our old Banking step by step guide up before recruiting season (for free) so no worries there (stay tuned!)

Autist Note: Banking is just a temporary position for you. You must create a real secondary income stream and get out ASAP. The industry is in decline and as ECM/DCM decline, major banks will even compress fees on M&A over time! When you’re in a declining industry eventually the knives come out in every sub-segment of the market. If you follow our long-term plans you’ll be better off.

Part 4: Big Picture Conclusion - Financial Services Are Being Replaced by Code

This is the big picture. Why do we have to wait for specific time periods to send a wire transfer? Why are the fees so high? Why does someone pay 1% of total assets (a huge amount) unless there is real differentiation in the advice? Why do firms pay up to 7% to raise funds in a world where transaction costs are lower and people can connect via the internet rapidly? Why should governments cover the costs of bad loans?

Lots of questions here. In the end we know the long-term answer.

Banks and Wall Street are going away. The talent is leaving to new industries and the firms will struggle to hire anyone with an understanding of technology. And. They didn’t move fast enough to adapt to the new world.

Q&A: Any questions related to investment banking and how the business generally operates are accepted. Please note all of our writing is simplified to make it easy to understand and avoid jargon. PS: yes you must be subscribed to ask questions get access to Q&A for the cost of less than you spend partying once a week!

Disclaimer: None of this is to be deemed legal or financial advice as opinions are written by an anonymous group of Ex-Tech bankers who moved onto affiliate marketing and e-commerce.

I'm a bank regulator, this post resonates so hard. The irony is that these trends are obvious to anybody with a brain who pretends to be even remotely rational, which excludes basically every banker I've met (C-suite or not). When the industry is surviving almost solely bc of non-interest income (service charges, fees, etc), that's an industry that is ripe for tech disruption and deserves to be replaced.

CEOS and CCOs scramble to find yield on loans anywhere they can, but at the end of the day they can't see the forest for the trees. Layoffs are happening in huge numbers as they realize their days of profitability are dwindling.

Never knew this. Easy to see the big picture of technology replacing most of it. Great lesson I learned in college was about tech related to television sets and the related peripherals. Over time, more consumers would want tvs integrated with everything and not want separate devices. Made sense then and it makes sense now.