The Coming Decades and the Solo PE Agent

Level 1 - NGMi

Welcome Avatar! After the absurd bull market in 2020-2021, the vast majority are now addicted to fast money. This is why you’re seeing a constant move to scams, grifts and fast money offerings. If you offer someone a large number for a 12 month period in exchange for giving up everything they built up in terms of Long Term Value of the customer they will sign the dotted line. This is an interesting development because the USA has always had this issue.

Now? It is much worse. You have people addicted to TikTok thinking they are going to live to 150 years old, become trillionaires and the latest and greatest celebrity (or old celebrity like Charles Barkley) will somehow make them rich.

In the end, this is going to push the divide between the rich and poor up. It will be apparent by the end of this decade if we were to place a wager. Someone in their 20s is falling down one rabbit hole while a small percentage find the correct answer, since the correct answer rarely comes from some celebrity who hates you and thinks you’re a loser already.

Part 1: General Decade Planning

Generally speaking, unless you were born into money your life should look something like this: 1) learn and grind making millions of mistakes in your 20s, 2) in your 30s you should be printing cash and have a high time value and 3) in your 40s that part of your life should largely be done and either you’re on an extended adolescence or you decided to have kids [to be clear none of our biz which you choose], 4) then your 50s come where health issues ramp up massively and you definitely don’t “got it anymore” and 5) by your 60s you’re probably in some chill town like Santa Barbara surrounded by other people who made it and simply have no interest in being bothered anymore.

As usual, you’re free to believe you’re going to be President of the United States and live a life of international mystery for 70+ years. The number of people who can pull this off is lower than probably 10,000-20,000, so, we’ll take the under on that bet.

As a point of emphasis, this was an outline for guys and for women it’s pretty similar except that most need to make a decision related to kids by their late 20s vs. 30s for men. Again. You’re free to disagree this is just based on general probabilities related to health and the time it takes to find a decent person. No one smart is going to pray that “mr right” or “mrs right” just shows up right when you want them too. You’d be an absolutely clown to risk everything you worked for on some 6 month relationship 99/100 times.

Knowing the Framework

Assuming you agree even slightly with the above summary, we can now prove that the competition level is going to collapse at the middle to upper middle while the talented will take MASSIVE share in the future. With that we can simply look at the data and figure out how many people will be well positioned to maximize their quality of life.

Part 2: The Data Suggests Mass Failure

As you anons know, we’re really not interested in debates around facts. People still message us claiming you can get rich with a 401K since they refuse to run math backward (source), they fall for the trap that your time is worth more later in life vs early in life (also false) and they are addicted to short term dopamine hits.

How do we know most people are not trying to figure it out? They can’t even tell real traffic from fake traffic. They look at stuff like views, likes etc. which don’t mean anything. Again. They mean nothing.

The claim is that the number would be higher if it was a large account but that just means there are more bots (lol!). Every post on Instagram shouldn’t be a massive banger unless the person has bots! Either way we’ve given up on this topic since we know for sure now that the vast majority will just give away their time for free.

Exhibit A - TikTok has blockbuster numbers. On TikTok people take advice from 25 year olds who don’t know what vesting is and have never even owned a rental property. They think this is better for them because they are the same age. Sadly, this is how it “works” in society.

Humans were evolved to follow “group stink” and end up in the same sinking ship 10 years later. After the ship sinks their excuse was “everyone else was doing it”. Well of course it wouldn’t work if everyone else is doing it. That would be the definition of the average decision which provides average results.

If you want more certainty (that there is no competition out there), just look at the analytics for p*rn, Only Fans and even sports betting like FanDuel.

The analytics tell the true story at all times. Unfortunately, the game on social media (to get big) is to play the same scam with bots/Philippine followers because the average person is just not smart to realize not all posts should be good posts due to algorithms alone.

We’re definitely not going to go down that path since it would attract the left side of the bell curve (who likely has 5th grader reading comprehension anyway).

That said, if you’re trying to sell anything mass market: supplements, T-boosters, make-up etc. Know that you must play this game to get more sales. People legitimately have no idea and are too lazy to pay $10 for basic tools but they will pay $100K for a worthless Humanities Degree.

How This Will Create Rich and Poor Divide

With that back drop out of the way we’re going to see intense pareto principal scaling. Especially post COVID-19 where all of you are being tracked closer than ever with absurd KPIs and analytics.

As a reminder of Pareto Principal it means 20% of people generate 80% of the revenue/profit.

What they leave out? This ***SCALES***. That means within that 20%, 4% of the people generate 64% of the value.

Then the last step which is that within the 4% the top 0.8% generate 51.2% of the value. That is right. The top 1% of the organization are responsible for more than half the value. They leave that part out when going on and on about “inequality”. If you’re generating half of the entire value, you should be paid substantially more than someone generating only 0.00001% of the value.

Why This Matters

CEOs have figured this out (at least the smart ones have!). You’re better off giving all the bells and whistles (software tools) to the top people and letting them run fast.

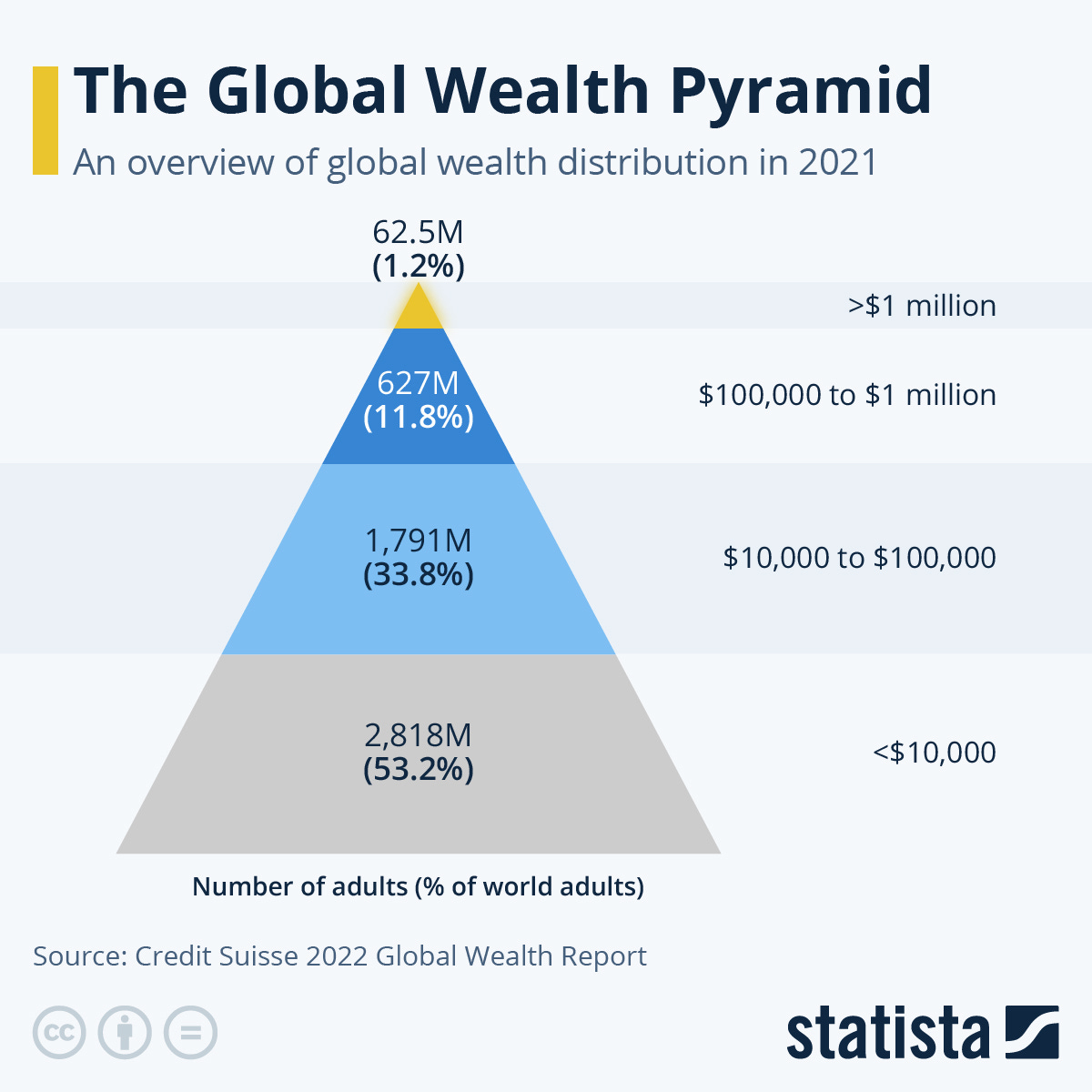

Credit Suisse Wealth Report (Rest in Peace - source)

“47.8 percent of global household wealth is in the hands of just 1.2 percent of the world's population” - CS Wealth Report

Wait a Second: We just ran the basic math and 0.8% should control 51.2% of the wealth but here we’re seeing the top 1% (25% more people included) control 47.8%. Guess what that means?

Right now the top performers are underpaid.

That is a wild wild realization and certainly don’t mention that statement during your “general education classes” you’re forced to take in college. The tweed sweater guys definitely don’t like to learn they are actually overpaid in their tenured professions teaching sociology.

Conclusion Better Not Mess Up

Now that you have the numbers in front of you, it’s pretty clear that you’ve got less time than you think. While we still recommend going into the same high paying professions and scaling out on the side over time, just don’t expect the same significant wage growth seen over the past decade or so.

It just doesn’t make sense.

Right now you’re seeing this happen (even on Wall Street, notorious for hating change). The top firms are paying up big, the small firms are becoming “unappetizing” since many of them can’t offer competitive compensation anymore. If you’re in tech just ask around about the step down in total compensation taken when you go from one of the mega firms like META to a more middle tier company (it is ugly and can represent a -40% draw down). Don’t be foolish in thinking Tech companies haven’t taken notice! Despite firing a ton of people META is back to nearly $300. All of those employees were truly “non-essential”. Ouch.

Part 3: The Good News!

As usual you’re on the hyper competitive side of the internet so there is an obvious good side to this long-term trend. If you put in the work the reward will be 50%+ greater than in the past.

That is simply amazing.

To put this in perspective you could look at a typical Managing Director where comp would typically be in the $1M average/median and that would turn into $1.5M as less VPs and Directors are around. With more automation, you don’t need “execution” VPs anyway since they are just loss leaders on the P&L of any Investment bank.

Similarly on the Tech Sales side if you’re a top performer, you could manage 50%+ more accounts in the future. KPIs will prove that it is better to lean out and only hire “A” talent and get rid of all the “C-B level” talent.

It Gets Better: While most will focus on the career side, since they are unlikely to take action, it also means that all of those E-commerce businesses you see are trading at horrendously low valuations. You should be salivating at this.

To be clear we’re *not* saying to buy this business or to even bother looking at it. It is quite literally one of the first ones we saw when we clicked over to empire flippers.

Run some numbers:

Revenue is $32K and Profit is $10K

This means there is somehow $22K in operating costs? 68.7%

Valuation is about 3.75x *annual* earnings (45 times $10,218 = $459,765).

If you are an expert in tools/automation and can cut the opex by $10K, you’re now buying it for 22.7x monthly earnings or just 1.89x annual earnings

This is the future.

Unlimited Opportunities: Typically competitive advantages stem from people, process or product. Since it is unlikely that the typical reader will be able to create the next iPhone or Microsoft, we’re guessing your best bet is competing with people or process.

Within that? The answer is now staring right at you. Process.

Opportunities in Process

If we were to start over again, we would start by learning new processes for the next decade or so. In the industrial age it was all about people management and scaling human labor (see middle management). Then we moved to new products that were so addictive everyone jumped on them (computers, cell phones etc.).

Now? We’re entering into the process competitive advantage age.

If the typical person who is college educated can’t even figure out what traffic is real. Can’t even figure out how to measure KPIs. Can’t even figure out where the “margin leak” is, this means you should be able to make an absolute killing by learning how to streamline poorly run assets (e-com has far too much overhead with some companies generating $10M with a crazy high employee number of 20!).

This is to say? The dawn of the “Solo PE Agent” is here. If you’re able to build anything by yourself you can now replicate it without even going through the hardest part of the process (audience building).

You just buy the assets that are behind the times. Rip out the margin leak, replace with basic software tools and you’re done. No impact to top-line.

Read that part 10 times if you have to! In the past PE firms would buy companies sacrifice 5% top line declines for say 10-20% profit margin expansion. At small scales it will now be possible to see 0% impact to top-line and 20%+ margin expansion.

The question is if you’re going to take the time to recognize that’s where we’re heading. Streamlined processes and significant upticks in efficiency. Or. You can bank on everyone going “back to the office” and things go back to the ways they were in 2015. You can guess how that ends.

Part 4: Conclusion - Seems Unrelated?

You’re probably wondering why we started the post talking about decade planning. Well it means your quality of life can sky rocket. If we know that the upside of learning scalable skills is now 50% higher, it means you can reach benchmarks *faster*. Gone are the days of needing say 10 years to make it and that becomes 6-7 years. If you want to be ultra rich (historically that took 20 years), it means 13-15 is more likely in the future.

Sound extreme? Not really it is just math. If you were to compound your $50K initial E-com biz at say 10% over a decade you’d only be moving the needle to ~$130K. If you became a master of process and could take that return to 30% it would be $689K. If you’re a real killer and can improve net income consistently by 50% and generate a 50% return over 10 years, you’re looking at $2.9M.

Anyway. This is the beauty of tech tools and staying ahead of the curve. Once you see it you simply can’t un-see it.

Become a master of new process tools (see getting rid of human capital) and you’re going to be able to enjoy an extra decade (perhaps more) in the prime of your life.

Don’t be fooled. The value of your time is always higher at age 20-40 vs. age 60+. This is why they say “youth is wasted on the young”

On that note, back to the tent.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

"you’ve got less time than you think". im fucked. onwards to unfucking myself

This was a banger 🎯