Total Incompetence or Extreme Evil 2020-2022

Level 3 - Value Investor

Welcome Avatar! We got an extremely viral tweet out and the reaction was rather interesting. Some claimed that the past 3 years were entirely planned while others claim that this is proof of incompetency on a global scale. We’re not going to make that decision for you, instead what we’re going to do is write a brief history of the last three years. The one thing you know for sure is that this time period will be written about for hundreds of years to come.

The Year 2020

In 2020, we hear of a strange new virus circulating in China due to a Bat/Lab Leak/Chemical etc. No one really knows the answer and we’re not sure we’ll ever figure out exactly what happened. Conspiracy theorists will say it was planned while others will say it was simply bad luck. Either way this virus begins to cause *worse* than normal damage to humans when compared to the common flu.

Step 1: Since people fear death from the virus, the plan of attack is to shut everything down. That’s right. No one is allowed to be within 6 feet or so of each other. You must wear a mask to prevent the spread of the virus and avoid being in contact with other humans (limit as much as you can)

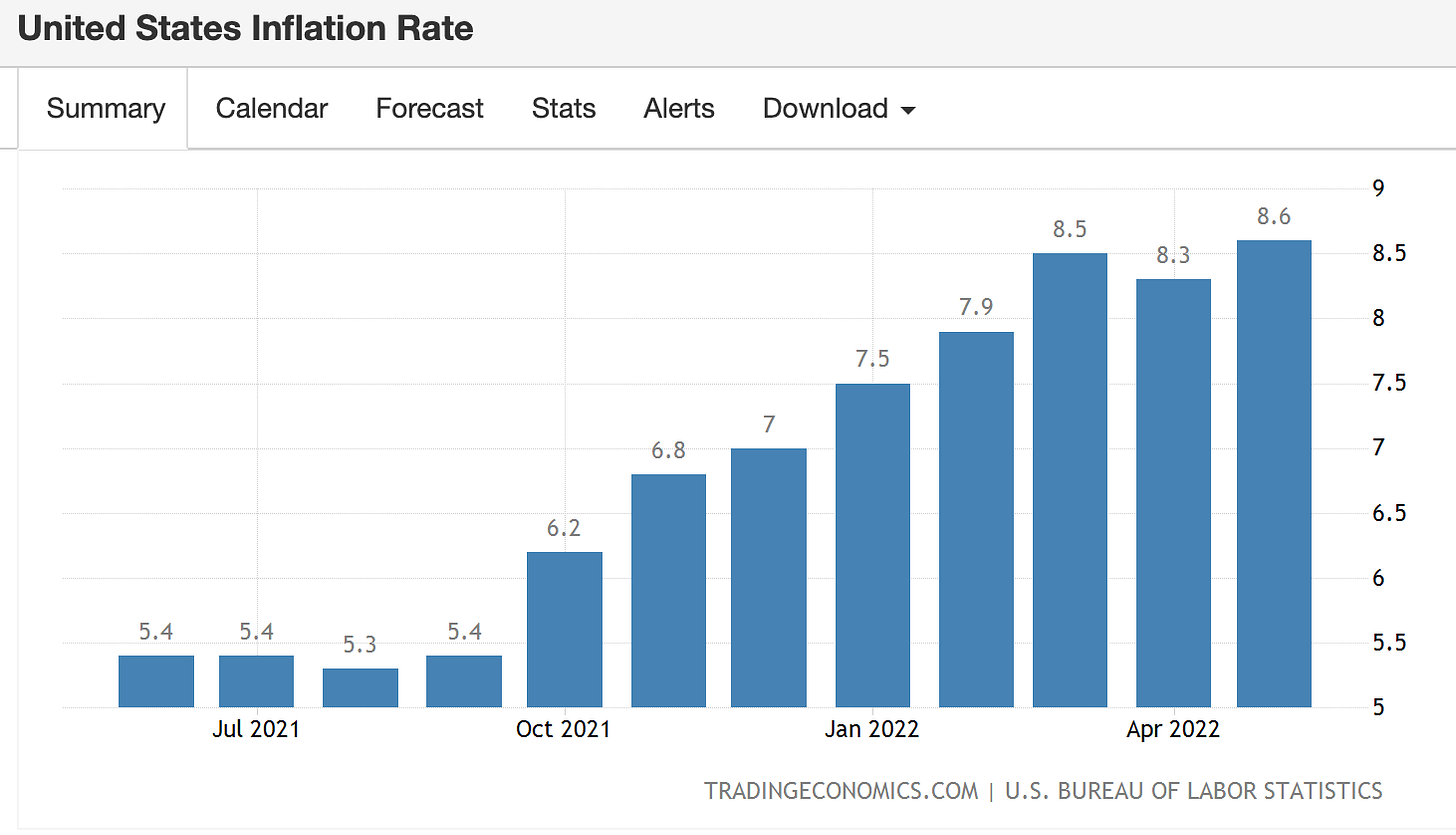

Step 2: Now that various businesses cannot legally operate, something needs to be done to make sure 1) rents are paid to avoid default and 2) the people who were forced to shut down need a way to survive. Solution? Print about $6T US Tokens over the next three years. Resulting in the below chart, you can grab from public data.

Step 3: Since the systems we have to distribute money are difficult there is a two prong approach: 1) send out $1,400 in checks to people with low income and 2) send out hundreds of thousands in 0% loans in the 6-digit range to tons of businesses.

Results in cheap loans for businesses at 0% (larger you are the better) and $1,400 for a large number of people.

Step 4: Make borrowing money as easy as possible by dropping interest rates to 0%. This way anyone who needs money can simply borrow borrow borrow to make ends meet. Lever up!

Step 5: End result is massive wealth transfer to any goods/services that can be consumed at home. This ranged from at home gym equipment to software/streaming and entertainment services. If you were able to operate from home in a virtual way, you not only made more money, your costs dropped like a rock.

The Year 2021

Once again, we’re simply writing about what actually happened and it’s up to you to decide if this was a plan or extreme incompetence. By the time 2021 rolls out, we’re hearing rumblings of a vaccine that may stop the virus. No one knows if it will work (at the beginning of the year) we just know that a vaccine is being rolled out.

Step 1: As the vaccine rolls out people are still forced to wear masks but you’re allowed to do certain activities with proof of a vaccine. This means you can go out a little bit more if you have a piece of paper that says you got the vaccine. Unfortunately, it is legitimately a piece of paper that can be lost, stolen and forged extremely easily. It is over-sized doesn’t fit in a wallet and the material is extremely easy to print from home. Many people begin creating fake ones just to have it on hand as well.

Step 2: During this time, companies are too scared to go back to normal and the “remote work” initiative gains significant steam. Blackrock and *other* financial institutions decide to borrow BILLIONS of dollars to buy properties in low tax areas that will likely see more remote work for the next several years. Once technology companies allowed people to work from home (they save on office costs anyway), the massive financial firms knew that there was even less risk to purchasing these homes/apartments. Also. Rates are at 0% still so they can borrow at 2-3% and as long as they can rent the home to someone for more than 2-3%, they can make money for the next 30+ years on BILLIONS of dollars. (as a note even 1% return on $100B is $1B)

Step 3: Since we printed a bunch of money, by the time we get to the middle of 2021 inflation begins to ramp up. This was a clear and obvious consequence from money printing. If you give everyone in the USA $1M US tokens, then $1M US tokens isn’t going to be worth much since there is an oversupply of money. Just like how produce prices drop when they are in season.

Step 4: Since inflation hurts the middle class the most, they begin to see pain. While they get a $1,400 check, a 10% increase in prices means ~$5,000 in expenses per year on a $50,000 income (rough maths). People no longer believe the inflation numbers being reported in July of 2021. They believe the numbers are much higher (they end up being correct as there appears to be a lag in the rate of change).

Step 5: Now that inflation is causing a significant headwind for businesses worldwide (gross margins down). Companies being to hire less and don’t raise wages in-line with inflation. This causes even more pain as real wages go down (real wages means income increase as a percent minus inflation percent which is negative. Example 3% raise - 8% inflation = -5% purchasing power)

Step 6: At the very end of the year, we get another wave of the virus from early 2020. We learn that it has morphed and is no longer deadly enough to take seriously. People are allowed to go back to “normal” as long as they wear masks on planes/ubers/taxis.

The Year 2022 - First Half

This is being written in June and it feels like it has been a year already! That said we can go back to the beginning of the year and see what happens.

Step 1: The world realizes inflation is a huge issue so interest rates need to go up. That is the message and rates begin to rise over time and as of this writing, the last rate hike was 75bps despite the Fed saying that 75bps wasn’t being discussed in May of 2022.

As rates go up all asset prices crash (see step 4 in 2020 where everyone decided to lever up) and anyone without proper collateral goes to zero. Major institutions are fine since they have rates set at 2% with an ability to rent the home out for more than 2% ($500K home would need to be rented out for a couple thousand a month, easy hurdle!)

Step 2: We hear of a potential war in Russia and the US president says Russia will attack Ukraine. This prediction turns out to be correct and we have a massive spike in gasoline prices.

We go from $1.961 gas to $4.545 gas from 2020-2022. That is right. A 182% increase in 2 years. (Source)

Step 3: After the war starts, daily life begins to go to normal. You can do everything without a mask and are “allowed to drive to work now with 2x gas prices and no wage increase!”. (Note: only masked area is medical facilities which appears to be phasing out).

Step 4: Rumblings of unsustainable costs keep rising from the population. People are seeing double digit price hikes in all important basic needs from beef to chicken to gas to rent. Since rent is usually close to 30% of a person’s expenses. Raising this by 10% is a big hit and can push someone with a 5% savings rate into debt.

To try and “destroy demand” and “reduce home costs” interest rates go up significantly for mortgages and now sit closer to 6%. (source)

The problem? If you raise rates this much it means that someone who could afford a $400,000 home on 20% down, can only afford a $280,000 home due to the near doubling of interest rates. There is no inventory at $280K. This also assumes that the person finds a seller willing to drop price by 30% immediately - housing has a multi-month sales cycle.

Step 5: There are no votes/voting system for interest rates or for money printing. Despite this fact republicans and democrats all fight each other online and in public. Crime begins to rise and layoffs begin. Again. The entire history written is largely due to decision you were not allowed to vote on. Please read that again. These decisions were primarily made without any of your input.

The Year 2022 - Second Half

Prediction for the second half you ask?

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team.

It's both but not often presented like this, keep this quote in mind:

“Of all tyrannies, a tyranny sincerely exercised for the good of its victims may be the most oppressive. It would be better to live under robber barons than under omnipotent moral busybodies. The robber baron's cruelty may sometimes sleep, his cupidity may at some point be satiated; but those who torment us for our own good will torment us without end for they do so with the approval of their own conscience.”

― C.S. Lewis

The busybody Lewis describes is optimizing around some moral outcome. The outcomes are bad, it's intentional so we think of it as evil but it's not quite. Take Germany and energy, their policy is suicidal, it will wreck the third world (which can't compete for energy except coal, can't compete for fertilizer (derived from natural gas), and can't compete for food). Germany's under investment and killing of morally incorrect energy (nuclear, fossil fuels) aside from being impossible, is counter productive to their own aims (carbon free/neutral energy) because now they need to retreat to COAL which is worse than natural gas from a carbon perspective.

It's evil in the sense they have ignored every other variable (including feasibility) which has had predictably bad out comes, not just for Germany but the rest of the world. The myopia of having such a narrow goal, without consideration to other considerations is a derangement, which looks like incompetence but it isn't. The people in charge very competently marched towards their ill-fated goals.

The problem is people avoiding or otherwise unable to see reality, which is orthogonal to competency or malevolence. Competently moving towards wrong goal under wrong/false beliefs to the exclusion of other factors is z coordinate here. In so far as it is evil lies in not acknowledging/accepting/dealing with reality or being unwilling to course correct from bad policy. It's kinda of like my tweet here (https://twitter.com/BowTiedIT/status/1538693830496616449).

What's worse is there is a lot money to keep people focused on the wrong areas that Are dead ends. I think a tight monetary environment will force bad ideas to fall away. Renewables (and evs) simply can't replace the energy sector, we don't have the ore(s), supply chains, manufacturing, ect to do it. Worse, compared to nuclear and fossil fuels they loose on efficiency, further their usefulness is very localized (they don't make sense in MOST places on earth). The only way they made any sense is in a low cost of capital environment where you could arb the difference with low interest rate loans. Solar panels have a useful life of like 20 years which they get less efficient over time, from an energy perspective they have a 5 to 1 pay back ratio, meaning they take the energy it takes to make them is 5 x what they will produce in 1 year. Add in a loan to pay for it which will be like 7 years, and the true roi is like 10 years or half its useful life. Thats in a low cost of capital environment, what about when a consumer loan for them is 8 or 12%? Leasing? why bother that's break even at best. (DoombergT on twitter/substack has done great work showing why green tech is a loser at scale, so has peter ziehan.)

The list of derangements goes on, and no one here needs the list any way. Eventually pain will force change, as it Always does. (NFA) If you see a structural sector of the economy counter positioned to reality, go long on reality winning eventually.

My personal belief is that this is a result of Rahm Emmanuel’s phrase: “never let a crisis go to waste”. They didn’t specifically plan the events as they played out. But their goal of a Great Reset was why they implemented all their policies. Rising gas prices are a feature, not a bug, for example.