Trouble at FRC: What Happened? All the Details

Level 2 - Value Investor

The societal impact of failed companies in isolation is typically muted. Take Toys R’ Us as an example. The bankruptcy of Toys R’ Us did not raise concerns about a systemic risk event. Unless you were a stakeholder (employees, shareholders, lenders) and felt a direct impact, you quickly forgot about Toys R’ Us and Geoffrey the giraffe.

“Everything must go, even Geoffrey”

- Toys R’ Us, circa 2018

Bank failures are different. When a bank collapses, the pungent scent of money going up in flames fills the air. People begin to question the safety of their own funds. Before you know it, the walking dead are lined up outside banks and ATMs (or logging into their banking apps).

We’re Cap Stack — analysts from a lesser known side of Wall Street that focus on distressed debt. If you consider early stage investors “angels”, we’re more like the undertakers. Troubled companies are an intellectual puzzle. Each case offers unique challenges. Today’s puzzles are banks, who seem to find themselves in trouble every once in a while.

Years without bank failures lulled bankers, regulators, and we, the people, into a complacent state.

Banking relies on depositors not needing all their money back at the same time. As long as everyone believes their money will be there when they need it, there’s little reason for everyone to withdraw. Upholding this belief is crucial to a bank’s survival, let alone success. Banks rely on earning a positive spread on their funding base (deposits) to make a profit.

Good banks are expert risk managers. Expert risk managers deserve more of your confidence. With your confidence, banks operate with the expectation that you and all the other depositors are not going to withdraw all your money at once. This is what we would call a symbiotic relationship.

The bank collapses of 2023 have reminded society at large that banks are in the business of confidence.

To provide confidence nationwide, deposits are federally insured up to $250,000. This insurance is provided by the Federal Deposit Insurance Corporation (FDIC) and is backed by the printing power of the Federal Reserve.

“Why not insure everything?” you might ask. If you insure every dollar deposited at every bank, you risk running into two major issues:

Mismanaged banks receive the same protections as well-managed banks, creating bad incentives

A perception of minimal risk means there is little discipline required of depositors for where they deposit

“Why insure at all?” you might then ask. Deposit insurance helps small banks survive, otherwise capital may only flow to the largest and safest of banks (those backed by the financial wherewithal of the government).

Without any deposit insurance, bank runs accelerate in times of panic and risk causing widespread financial collapse — the likes of which we haven’t seen in nearly 100 years.

100 Years of Banking Crises in 60 Seconds

From 1921-1929, there were over 6,000 bank failures in the U.S. From the stock market crash in October 1929 to March 1933, there were another 9,000 bank failures.

In the midst of the banking crisis in March 1933, President Franklin D. Roosevelt famously said "the only thing we have to fear, is fear itself.” FDR understood that confidence upheld the banking system.

The Banking Act of 1933 established the (FDIC). After the introduction of insured deposits in the year 1934, there were only 9 bank failures that year.

The Great Depression had not yet ended, however. Another 381 banks failed between 1935 and 1942.

In the 1940s, banks played a pivotal role in war financing for the government. Business activity was strong, deposit outflows were minimal, and bank assets were highly liquid. By the end of 1944, 79% of bank assets were cash and U.S. government obligations. Things began to turn around for the banking sector.

From 1943 - 1980, only 178 insured banks failed (average 4.7 per year). Most of these failed institutions were small banks that had little broader impact. Depositors felt safe.

Everything changed in the 1980s. A confluence of factors including economic, financial, and regulatory forces set the stage for another banking crisis. Regional recessions and excessive risk-taking without adequate oversight resulted in a substantial increase in bank failures in the savings and loan industry.

Overly relaxed regulatory controls in the 1980s resulted in a complete lack of risk management and rampant fraud. More than 2,300 banks failed from 1981 to 1994. Finally, the Financial Institutions Reform, Recovery and Enforcement Act of 1989 brought order back to the industry. It was not an overnight fix. It took another 5 years to resolve the remaining troubled S&Ls.

Crisis resolved, depositors and the banking system spurred on. The next banking crisis in American history is well-known and understood by now. The 2008 Global Financial Crisis is widely considered to be the most severe financial crisis since the Great Depression. Loose credit standards, a housing bubble, and (once again) excessive risk taking by banks drove the financial system into a perilous position. Nearly 500 banks failed between 2008 - 2013 including Washington Mutual Bank, the largest bank failure in history. The years following the GFC brought with a host of new regulations for banks hoping to avoid another banking crisis.

If there’s one takeaway from the last 100 years, it’s that regulations struggle to find solutions for problems that have yet to occur. Yesterday’s problems are not the problems of tomorrow.

First Republic Bank (NYSE: FRC) is the problem of the day.

The Situation at First Republic

FRC’s Q1 2023 earnings call lasted only 12 minutes and did not allow for a Q&A period. Shareholders profusely vomited up the stock throughout the week, resulting in multiple trading halts.

FRC stock fell 90% in just 3 weeks in March as the failure of Silicon Valley Bank reverberated through the financial sector. By the time of FRC’s earnings announcement, the stock had fallen 87% year-to-date.

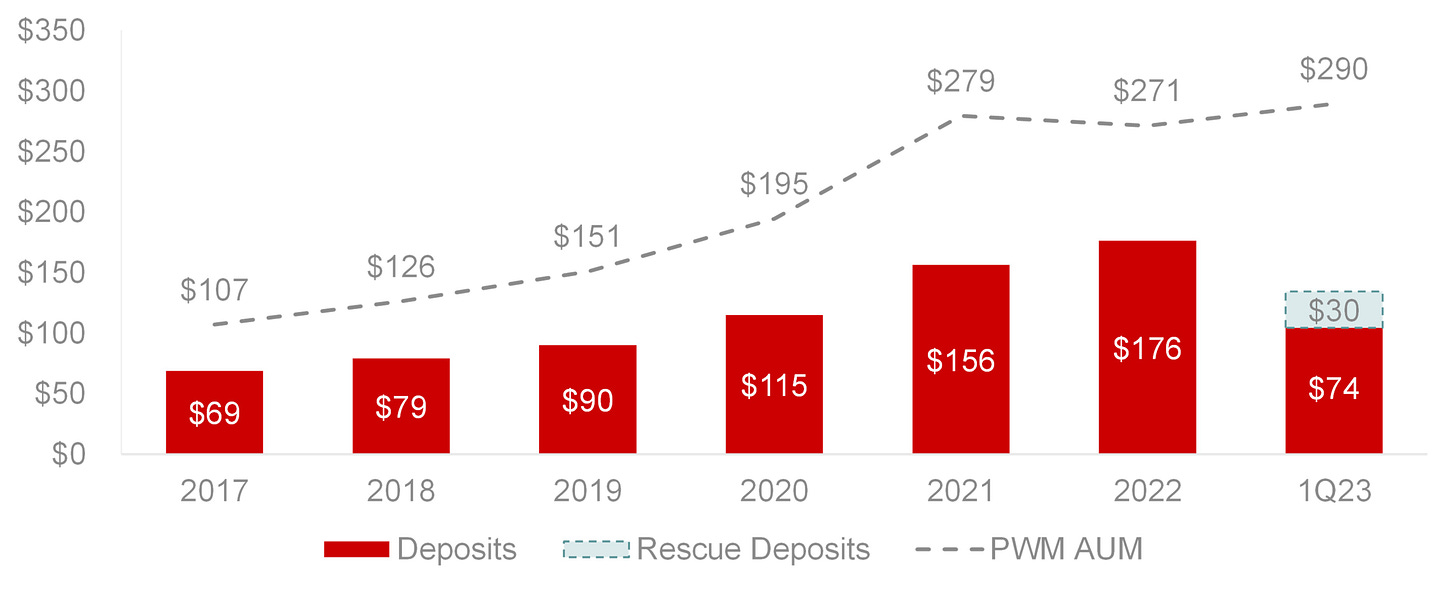

On March 9, 2023, FRC had $173.5B in deposits. By March 31, 2023, customer deposits were $104.5B, of which $30B consists of deposits from large U.S. banks intended to stabilize FRC’s operations.

FRC had lost a staggering $99B (57%) in deposits in 22 days.

FRC was in urgent need of liquidity. Hat in hand, they went to the Fed to borrow money.

FRC borrowed $80B on a short-term basis, including $63.5B from the Fed Discount Window, $13.8B from the Fed’s BTFP and $2.6B in FHLB advances. Another $25.5B came from long-term advances from the FHLB, for a total of $105.9B in borrowings from the government.

In total, FRC brought in $135.9B in outside capital to hold its pants up for a little while longer.

FRC’s liquidity (cash, cash equivalents, and borrowing availability) as of April 21 was $45.1B.

Deposits had largely stabilized by April 21, sitting at $102.7B. The 1.7% decline since March 31 was attributed to seasonality (clients paying taxes — fair enough).

Uninsured deposits fell from $119B (67% of total) to $20B (27% of total). It may appear the worst had passed, but what remained of the bank was a shell of its former self.

Causes of Distress

FRC’s long-term corporate credit ratings were A1/A- (Moody’s/S&P) at the end of 2022, signaling low credit risk from the major ratings agencies.

The bank was in compliance with its regulatory ratios (Tier 1 leverage, CET1) and even exceeded the bar for “well-capitalized” banks.

A review of the last few years of performance for FRC can be summarized in a few short words: Business Is Booming.

Net Interest Income increased at a CAGR of 18%, going from $2.1B in 2017 to $4.8B in 2022. Non-performing assets were only 6 basis points of total assets. Deposits tripled in 5 years, and the wealth management business grew along with it.

A wealthier client base meant that credit risk on its predominantly real estate-backed loan book was considered low. Unlike banks during the GFC, FRC was not holding onto a huge pile of toxic assets. FRC had no exposure to subprime loans at all!

At first glance FRC is a profitable, “well-capitalized,” creditworthy bank that almost made it to its 40th birthday. Yet here we are.

FRC’s booming business seemingly collapsed overnight. The Q1 2023 announcement blew cannonball-sized holes in the boat they spent the preceding month patching up.

FRC’s causes of distress are:

Mismanaged interest rate risk

Loss of confidence

Interest Rate Risk

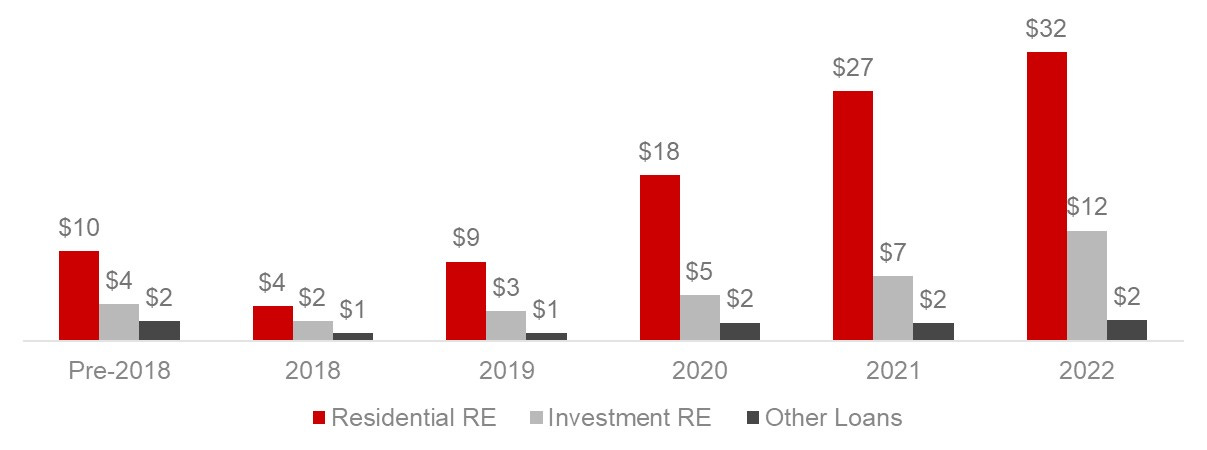

FRC made the majority of its loans at historically low interest rates. $78B of the $100B non-revolving residential real estate loans on its books were made from 2020 - 2022. Loans were made at below market terms (presumably to feed into FRC’s wealth management business).

The chart below illustrates FRC’s rapid acceleration in lending, particularly in residential real estate.

$58B of FRC’s total residential real estate loans were interest-only for the first 10 years. That means most loans have no paydown for several more years. Over 90% of residential loans held are fixed interest for at least year. Roughly one-third are fixed for the life of the loan.

Long story short: these are not the loans you want to be holding in a rising rate environment.

Interest rates cut FRC in two ways. The first is that FRC has to pay higher rates to its depositors and other creditors. With such a large portion of its assets being mortgages made at low rates with far-in-the-future repayment, the bank’s profitability and financial outlook took a big hit.

The second is that the value of these mortgages declines. FRC ran into trouble because the market value of its loan book does not cover the liabilities the bank has.

Loss of Confidence

This brings us to FRC’s second cause of distress (the deathblow): loss of confidence.

A high uninsured deposit base and a reasonably sized HTM portfolio brought FRC into the spotlight after the failure of SVB. FRC was not lending to startup founders and holding large tech company deposits at the same scale as SVB. However, the Bay Area is FRC’s largest market and over half of their loans are secured by real estate in California. Tech startup founders or not, news would have travelled fast! FRC depositors were not going to take any chances after the precipitous collapse of SVB. An average of $4.5B in deposits left FRC per day over 3 weeks.

With an accelerated deposit outflow and a portfolio of long-dated loans that would have to be monetized at a discount, FRC was caught in the proverbial rock and a hard place. Monetizing assets at market value would risk depleting the bank’s balance sheet to a point where it would not be able to repay depositors. FRC needed time to try and work out a deal with a potential acquirer. $30B from a consortium of banks and $106B in loans from federal loan programs ought to do the trick.

But what would be left of this longstanding institution?

As news broke of the at-risk bank, FRC’s wealth management business started bleeding out. 10% of its private wealth management team is confirmed to have left immediately following the events of March 2023. Recent rumors say this figure is now over 25%, with 50 of FRC’s 200+ wealth managers having departed. It would have been an easy sell. A simple “I’m moving to a bank that isn’t going under, want to come along?” would suffice.

If you’re enjoying this report, sign up here to receive a free brief on 3 companies on our distressed watchlist.

The Business (as of YE 2022)

FRC serves high net worth clientele through its banking arm and wealth management services. The bank offered low mortgage rates to customers for homes in coastal U.S. cities.

FRC’s mortgage loans had lower LTVs, higher credit quality and as a result, lower losses. 59% of loans are backed by single family residential homes. Over 80% of all loans are real estate loans, including multifamily, commercial real estate, and HELOCs.

11% of loans are business loans which consist primarily of capital call lines (also known as subscription lines) for private equity and venture capital funds.

Subscription lines are bank loans extended to funds that let funds use borrowed money instead of investor capital to make investments. This method of deferring capital calls can increase IRR and also provide availability for opportunistic investments without having to make a capital call imminently.

82% of loans are in SF, NYC, LA, and Boston. The median loan size for 2020 - 2022 was $900,000 ($1.3mm average) with a median LTV of 60% and FICO of 780.

The bank’s funding base prior to the bank run was almost entirely deposits. 63% were business deposits and 37% were consumer deposits. FRC’s proportion of uninsured deposits was the third highest after now-failed banks SVB and Silvergate.

You can start to get a picture for what FRC does. Founded in 1985, FRC provides a high-touch relationship business for HNW individuals in coastal cities.

The Balance Sheet

Let’s pop open the hood of this flaming pile of scrap metal and see what’s inside.

62%, or $104B, of the entire loan portfolio is maturing more than 15 years from December 31, 2022. This is not surprising now that we know FRC’s loan book consists primarily of residential mortgages. Loans maturing within one year total $17.7B, with most of these being subscription lines (53%) and stock secured loans (22%).

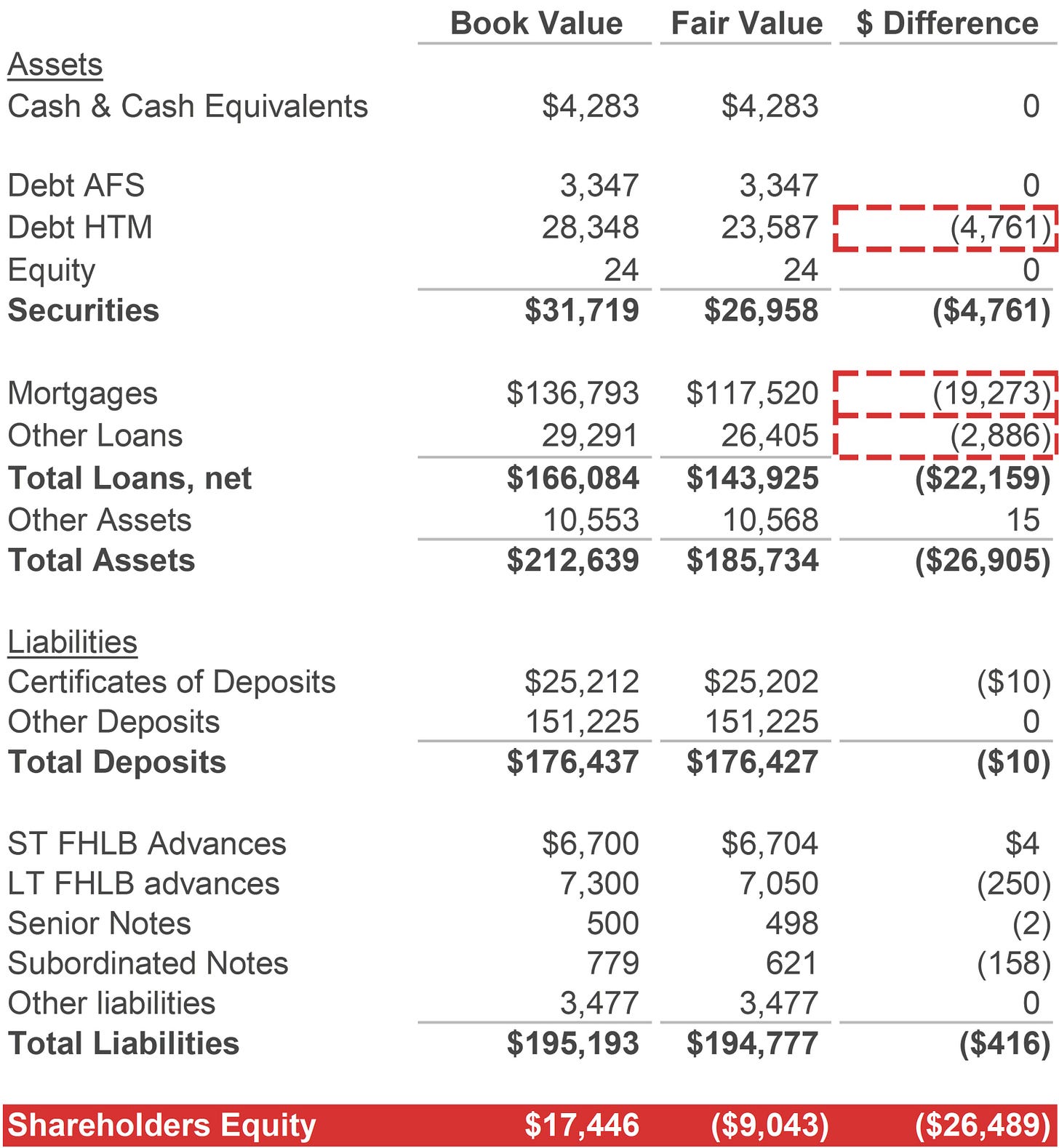

While that’s a nice tidbit of knowledge, it’s not the fun part. The fun part is looking at the company’s fair value measurements for its assets as of the end of 2022 to see where (and when) value broke.

This summary balance sheet compares the book value as reported by the company to the fair value measurements also reported by the company. In simple terms: an estimate of what the assets are actually worth today.

Based on fair value, FRC’s equity was already $9B in the hole by the end of 2022.

The bank was undercapitalized long before the run on the bank. A scan through 2022’s quarterly filings tells us that FRC could have gone belly up at any point in the last 6 to 9 months under these circumstances. There are probably more busted banks that look just like FRC hiding in plain sight (you didn’t hear it from us!).

Remember, banks must adhere to certain regulatory ratios, chief among them being the common equity tier 1 (CET1) and the Tier 1 capital ratios. Dropping below the minimum requirements (such as going negative!) means a bank can be taken over or shutdown by regulators. This is where accounting makes things murky.

If you’ve been following the SVB situation at all, you’ve heard of held-to-maturity (HTM) securities. Banks experienced surging deposits over the course of the pandemic with anemic loan demand. FRC used the opportunity to originate mortgage debt at low rates. The bank focused on credit risk, miscalculating the risk of the market value of the mortgages falling if rates were to rise.

To manage their balance sheets in the face of lower loan volumes, banks also invested in securities. These securities are either marked as HTM or available-for-sale (AFS). HTM securities are marked at book value, whereas AFS securities are marked to market.

Believe it or not, banks do try to manage these risks! Rate expectations had shifted, but the sheer speed at which rates rose in 2022 was unprecedented. Despite these HTM securities and mortgages pushing banks underwater on their equity, the situation was ignored by regulators until a major blowup. Existing regulatory ratios do not capture the market value of these securities. Had SVB or FRC sold even one HTM security in their portfolio, they would have had to mark the entire portfolio to market and all of a sudden the ratios would not look so good. By the end of 2022 FRC was sitting on losses of $4.8B on its HTM portfolio, $19.2B on its mortgage portfolio, and $2.9B on other loans.

How could regulators have missed this? Coming off the back of two years with zero bank failures, perhaps they got a little sleepy.

The rest of the post details how bank failures differ from corporate bankruptcies, how this situation concluded (Big Bank wins again!), and more on distressed situations.