Tucker/Lemon and Get Ready MainStreet Layoffs

Level 1 - NGMI

Welcome Avatar! As many of you know, we don’t care much for politics. The Tucker and Lemon news hit and honestly they are both probably better off. We’re entering into the age of the Sovereign Individual which means more and more people will support individuals over mega corporations. While we realize a single individual cannot build a home or manufacture washing machines at scale, the point is the same.

The future is direct line of access to individuals.

This actually lines up perfectly with something we stated earlier. Pareto principal scales and the Tucker/Lemon layoffs are actually related to future layoffs.

Part 1: Tucker and Lemon

This has nothing to do with politics. If you’re left winged or right winged that’s fine. This has to do with scale and opportunities.

Scale: Prior to mass adoption of the internet, going on CNBC/FOX/CNN was a status symbol in many cases. It meant you were a “somebody”. Today? That signal has turned into noise particularly as you see a large chunk of “30 under 30” winners charged with fraud (much more than a single case!).

Why has it all changed? Scale changed everything. Now that people spend more time in front of their computers you get easier direct access to people you like. You get information directly from the source. And. You don’t even need to watch the news since a video of the event is loaded faster on the internet anyway.

Tucker and Lemon: Say what you will about both of them. They are household names. If you like one and hate the other that’s fine. It would be similar to saying Biden and Trump are household names. They are.

How someone “feels” about this is irrelevant.

Household name defined? This means you have outrageous scale. You have mainstream appeal. Your audience is so large that you are a walking business since people will pay to speak in public. That is huge.

Autist Note: this is not the same as localized fame. Localized fame would be something like David Shaw. For the finance people it is blasphemy to call him “local” since he’s a legend on Wall Street and computer science. Reality?

This is localized since you can go to a bar in any place outside NYC and no one would tell you what he does. To be honest they’d be more likely to recognize Tommy Shaw from the band Styx than David Shaw.

Short Term Pain Long-Term Gain

Prediction time. Both Lemon and Tucker likely make more money. The only issue we see here is *speed*. If they don’t do anything for a year or two? Interest dies. Life does not reward slackers.

The biggest high-profile case of quitting at the top is probably Dave Chapelle. Arguably one of the most well known comedians in the past 20-30 years or so (yes we think his skits are gold mines especially from the Chapelle show days).

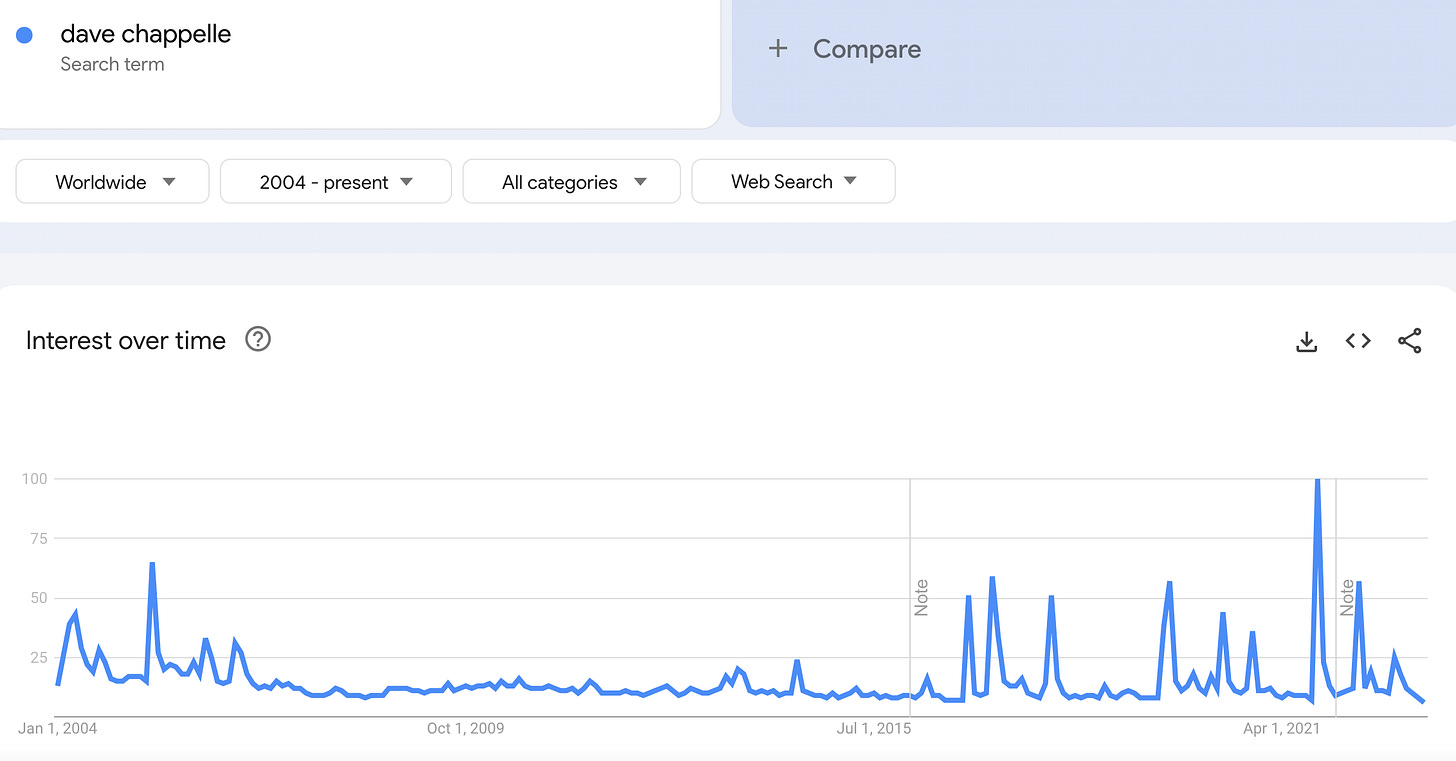

That said, he quit and quite literally disappeared. His total attention didn’t really recover until 2021. Again. This is not meant to be emotional you can just tell by the numbers below.

Once you quit it is hard to get back to the same level of relevance (source google trends).

Just a Number in Excel

This is yet another reminder that you’re just a number in excel according to your employer. The reality is that they were likely *underpaid* since they command so much attention. The problem is that P&L hurts when writing those large checks to the rain makers.

Funny enough we were writing about this concept on April 22! Yet here we are.

Conclusion: No need to feel bad for these two guys. While it is a massive headache to re-start, chances are they will make more money by starting their own organizations.

Read that carefully though!

Chances does not mean guarantee. We live in an attention economy where marketing is the new software engineering.

If they move fast and take advantage of the attention? They make more. If they shy away from the spotlight and don’t absorb the kinetic energy? They could lose in a big way. Speed is king. Attention in motion stays in motion (physics applies to marketing anon!)

Part 2: Main Street Pain

All the guys celebrating the Tech layoffs and Wall Street layoffs (or even Tucker/Lemon layoffs). Your time has come.

Before Beginning: Yes, there are likely *some* layoffs left in Tech/Wall Street. That said, they will unlikely reach the level we saw in March. If you utilize the search bar you can see we’ve stated consistently that Q4 would be round one and Q1 would be round 2.

The only thing that changed was a bank failure which pushed some of the tech layoffs into April and messed up payroll/restructuring systems temporarily.

Outside of companies struggling to survive (like what happened to Bed Bath and Beyond), the *majority* of cuts are likely complete on the white collar side. We’ll see how much worse it gets but it unlikely hits these levels.

Areas that are still going to struggle: mortgage bankers, fund raising (ECM for example), tech companies that have no profits + debt and commercial real estate.

What is Main Street

This is practically everything else. That said you guys come here and support us (we love all of our clinically insane readers!) and deserve some specifics.

The easiest way to go about this is a top-down approach.

Top: What benefitted from Covid in 2020-2021. Start there and you’ll get a good list of places that likely get hit:

Domestic Travel. Since restrictions are lifted the numbers there are going to be lower as it competes with international

Moving: This was actually elevated for 2020-2022. As people get called back into the office it means that these companies saw about 3 years of inflated revenue. Second half of 2023 and 2024 likely won’t be good.

Online Retail: While there will still be demand, the consumer is weaker as money printing has faded.

Leisure: Who goes to bars, clubs, hotels and vacations? That’s right, high earning white collar employees!

Furniture and Appliances: How many times do you buy a new fridge or couch? That’s right rarely. It’s a long sales cycle so these won’t be replaced quickly. Not really surprising bed bath and beyond went under with that backdrop.

Middle: After that you’re going to look at the following:

Auto: As you can see this is starting to happen (source). To be clear repair companies are fine because people will hold onto their cars for a longer duration. The sales of new + used vehicles will not do as well going forward

Home Construction: In-line with high rates, the demand for this will dwindle, people will need to try to hold on for dear life (to avoid default) especially if they are over leveraged and are carrying negative equity. You are already seeing DR Horton offer discounts (so it seems) to get rid of inventory (hitting their gross margin line). Going from ~33% gross margin to ~25% isn’t great. Note we didn’t look at this in great detail we’re just reading between the tea leaves given their mortgage discount offering (source)

Tail End: Once that set is done you’ll see the finalizing of cuts. This will be items that people don’t want to cut. But. They are forced to cut. You’ll see some eliminations/reductions in things like restaurants/fast food that are typically resistant. Remember. Resistant doesn’t mean immune!

As a small note, if you see cheap food companies reducing staff it means you’re basically at the end of the pain train. As a rule of thumb though since no one can cut back on food/water, you won’t see anything major. Just keep your eyes peeled for any small reductions.

On that note, we are immune… since we’re homeless.

Back to the Tent.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money. At 10,000+ Instagram follows we will publish some city guides ranking each region we’ve been to.

On the note about cars, it’s definitely happening. Last month the dealership tried to say the lease price of an F-150 was $800 (current lease was $300). Today I called back and they said Ford had released new rebates and payment would be $350.

As a PR agency for mainly tech companies, I’ve lost quite a few clients. PR and marketing are the first to get whacked when times are bad. I have picked up new clients but the monthly retainers are lower by about 20% or more. I’m also picking up smaller one time gigs I wouldn’t have touched before to simply maximize cash flow until we come out the other side.