Understanding Relative Wealth and Incentives!

Level 3 - Virgin DeFi Analyst

Welcome Avatar! After touching on this topic briefly last week, we realized that the relative wealth concept is not really understood. The biggest barrier appears to be the concept of elites versus your average joe. Being realistic you can beat the average joe by following the free stuff here but most of our audience is upper middle class turbo autists (millionaires who are bored and looking for a way to level up).

Now before we get into it, a word from our Sponsor for this post!

Just kidding. Don’t have any.

Part 1 - Wealth Is Relative in Any Economy

The human brain has a hard time understanding relative metrics when using US Tokens since the brain goes “omg $1M is enough or $5M is enough or $100M is enough!”. Instead we will use a new unit of account “DeGen Tokens”.

Welcome to DeGen Island: Here on DeGen Island the only acceptable form of payment is DeGen Tokens. Nothing else works. You can only pay for goods, services (wink), assets and anything else with DeGen Tokens. Instead of worrying about acceptance of other computer coins, simply assume the island only takes DeGen Tokens.

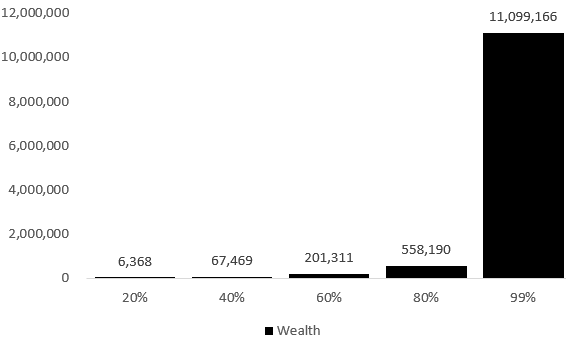

Island Economy: Since the island has a saying “Equal Opportunity, Unequal Results”, the wealth of individuals has a wide range. In fact, for this example we will assume the wealth inequality is similar to a place called “The United States of America”. The richest 1% of residents have 11.1 million DeGen Tokens

Exact Same Wealth Difference! (Source)

Since this is tough to visualize, we have a simple chart below which shows only five categories: 1) bottom 20%, 2) bottom 40%, 3) top 60%, 4) top 80%, 5) top 99%.

DeGen Residents Consider an Income Tax! Well as you can see from the above an income tax is not going to solve much. The rich will in fact just get *richer* on a relative basis. If you are wealthy the income derived from your wealth is already more than the top 80% of the residents.

Quick Math: 11M DeGen tokens times 5% = 550,000 DeGen Tokens a year. This is equivalent the entire *wealth* of anyone in the top quintile and below!

In simple terms, the top 80% is not earning 550,000 DeGen Tokens per year otherwise they would have more than that for their *entire* net worth.

Scratch that idea.

DeGen Island Considers a 10M distribution to all residents! This also doesn’t work since it means there is *no* incentive to work hard. If a massive redistribution effort is done it means that the bottom 20% will have as much as someone who worked for 20 years slaving away as a nurse, dentist, doctor etc.

Scratch that idea. This is even worse than the income tax idea since the talented people will leave.

Something In the Middle? Perhaps a change to inheritance taxes. This could *actually* work if there was a way to discern the productivity of the kids/children. You really don’t want to hand a bunch of teenagers with no skills 10M and “see what happens”. What happens is a lot of drug/alcohol abuse and wasted spending

Much more likely to pass some sort of ultra high-end wealth transfer tax. Since there is *no* relationship between the value brought by the parent vs. the child. Also. We doubt this actually happens just pointing out that being born rich doesn’t mean any economic value was created.

Part 2 - The Solution? Create Value in New Ways

Ah yes. So now you’re probably a bit frustrated. You don’t want to tax ultra wealthy people who are alive today because they are bright, talented and will likely leave (jobs are gone, wealth leaves and brain drain).

This means the only way to compete with a system that is tilted heavily against the bottom 80% or so is through *innovation*. You can see the power of innovation by asking a simple question…

What Do The Wealthy Do? This is an odd one. Most people don’t even bother to look it up! If you look it up we can pick up some clues. Note: you can also call Wealth Management firms and catfish as a potential client. Take the time to ask a few questions about typical client wealth accumulation and they will spill the beans if you don’t believe the graphic below. (they give broad strokes to avoid breaking confidentiality agreements)

Take a close look at this chart. It tells you that the people who are in the *middle* have the majority of their wealth tied up in the primary residence! Now you know why everyone says “go into real estate!” it’s because the majority of people have their net worth parked in their home. And. They are not actually all that rich.

What is this Business Equity? What most people don’t tell you is that this is the fastest way to get rich. You start a Company and grow it from zero to X million and your return is nearly infinite (in-calculable!). The second part is that a large sum of money slowly but surely finds itself placed into: 1) stocks/trusts, 2) rental properties and 3) other assets.

Solution #1: Since the goal is to grow the economic pie (not play zero sum games) it means that DeGen Island will focus primarily on finding ways to fund entrepreneurs which allows for potential business equity. Will every resident succeed? Nah. That’s not how life works. However, it’s the fastest way to create large amounts of wealth without risking millions of DeGen Tokens.

Part 3 - 2022 New Investment Issue

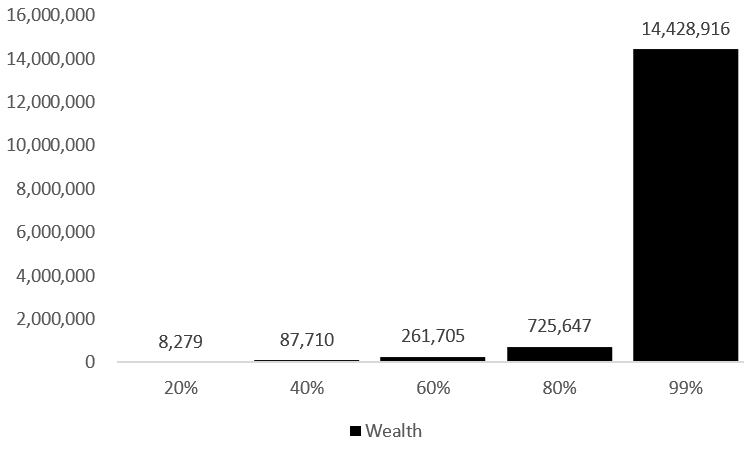

At this point we have a pretty good picture of what is happening and what the issues are: 1) the majority of rich people are rich because they killed themselves and took a lot of risk - sorry won’t see us hating there! and 2) the bigger issue is that the divide has *accelerated* due to terrible policy. We return back to the simple bar chart. What happened is that printing money (30% asset inflation makes the net worth difference look like this!)

Well now we have big problems. When this occurs, the people who were in the 20-80% range are no longer able to save fast enough to even afford a down-payment on a home. Don’t believe it? Check out the maths.

As you can see, we know that the price of a *median* home is up about 15% (we avoided using the average because the average is higher! ~375K→500K). After this we used a *higher* than median income and have costs going up in-line with the price change of the median home.

What you get is a 7 year hole. Before, your typical DeGen Resident could work for 4-8 years or so and buy a decent place. Now? You have to work and save diligently with no errors for 10 years before being able to pull this off.

Conclusion: If your goal is to catch up, trying to play this game is unlikely going to work. The wealthy people who already own the real estate can get better rates and use their income to buy hundreds of properties.

Part 4 - Ok No Homes, No Old School Stocks

Well you’re not left with much. The answer is right in front of you which is right tail of the risk curve. There really is no other option. If you’re scared of building a business or investing in the unknown? Well… You will slowly be pushed down the socioeconomic ladder. Does not sound fun.

Here are some simple steps for you:

Invest more into start ups and of course try your own niche mini start up. We have 20-40 people or so already earning WiFi money and you don’t even need a name. You do need legitimate talent though. As an example, BowTiedFawn is a skin care expert who is hopefully a female based on the avatar

Become an expert in market-cap products (computer coins or stocks) that are below $10B. To be clear this is with your *free time*. If you’re spending your time becoming an expert in Bitcoin or Google and Amazon, we’re sorry to tell you that the vast majority already understand it

Bite the big bullet. Mathematically, it is difficult if not impossible to really grow wealth in a career anymore. While the best careers are still the ones we recommend: tech, enterprise sales and M&A investment banking… even those numbers are under pressure due to consolidation to the top!

Note: For the record, paid subscribers know we recommend owning your own home (primary residence) outright or with some obscenely low interest rate <3%. The message we’re relaying with “no homes” is that you’re unlikely going to get rich from real estate anymore as the years it takes to accumulate enough wealth… is long.

Part 5 - Putting It All Together

While the sections appears to be a bit dystopian, we view it as a big opportunity. From what we’ve seen over the last decade of writing, less than 1% of people will even follow the plan listed above (the three bullets). They will simply “agree” and then forget about it as they turn on Netflix.

This means your competition is already small.

The writing is on the wall. Prices have gone up due to massive money printing. Your income is being drained on a relative basis as asset inflation only helps people who are already rich. You can’t afford *not* to take risk.

This flies against conventional wisdom of “just save 10% of take home pay and buy homes/stocks” since that’s not going to be all that easy with high inflation and automation. Better to pivot now and put the pain up front.

Addendum - Relative Wealth and How a *Young* Rich Person Thinks

If your goal is to just be a bit better than average, our content is honestly not for you. You will probably be better off in the fringe frugal crowd known as “FIRE” (financial independence retire early). If you understand the prior sections it means that “being above average” will slowly become “average” on a relative wealth scale over time.

Therefore, we really cater to people who are trying to grow over the long-term. If you’re just starting out we sporadically have ultra high risk ventures with a good *historical* hit rate (mints/small caps) and if you’re already rich? There are various arbs and higher risk ventures you can go into.

Concept - Wealth is a Gradient: Assume you have $5M US Tokens (a large nest egg). Lucky for you, you’re still working/growing your business. Would you ever invest additional savings into an asset with “10-15%” return potential? No. You work for a year and save another $100K.. .that’s 2% to your net worth

Is your life going to change if you’re worth $5.1M vs $5.0M…. You know the answer. It won’t. Now if you could continue researching and investing into the bleeding edge it is certainly possible to turn $100K into another $2M which means you’d be worth $7M! Instead of $5M.

That *does* make a difference (40%) as you can upgrade your residence or begin flying private from time to time without touching your “financial independence” money.

To avoid sounding elitist, we realize these are *BIG* numbers. It is simply an attempt to help people see the “other side of the table” and how they think.

Few people will become multi-millionaires under the age of 40 (although our comments section has a *ton* of them by “coincidence”).

That’s it for now, it was a lot harder to describe all of the moving parts hence the longer free post. That said, we’re pretty confident in our views as asset inflation and cost of living increases = push down everyone from the lower class to the upper middle class… You know it’s getting bad when mainstream media is talking about it!

Best of luck anon! We hope you make it and end up homeless on a beach one day.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

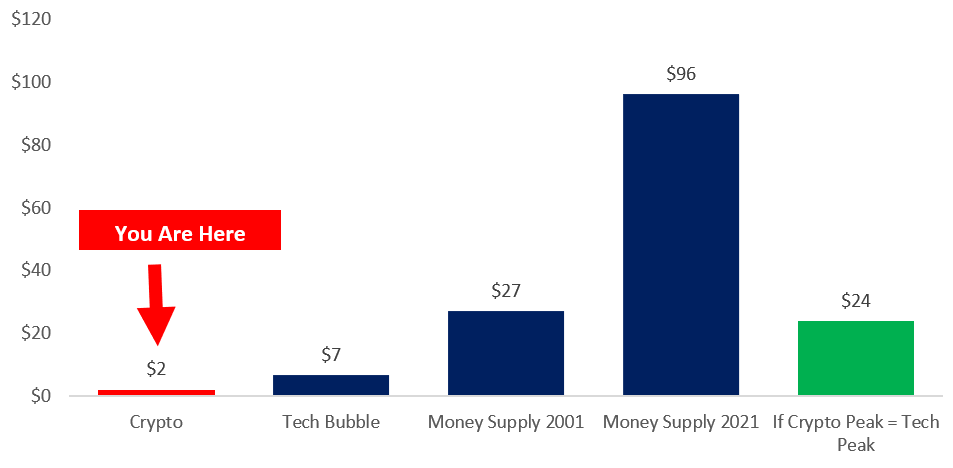

You’re Early: Remember that you’re early. If you need to zoom out see our post here on Crypto versus the Tech bubble (which was only the US stock market).

Below Chart in $Trillions of US Tokens

Not rich, yet? Read and act on How to get rich + BTB..."Theres a floor to saving and no ceiling(s) to earning" ... "You can sell your business, you can't sell your job" ..."don't be the boring rich guy"

It’s like you talk to me 1:1 with these posts. Thanks.