Unnecessary Risk, Broken Business Models, Troll Tuesday Update and Short Jungle Update

Level 1 - NGMI

Welcome Avatar! For those that have read us for a decade you already know the "escape" plan for Shawshank.

The most viable path is always the same: 1) Wall St. M&A/Enterprise Sales/Tech, 2) Internet business and 3) invest any extra money into stocks+crypto+RE.

At this point, there is an interesting phenomenon where *some* people did make generational wealth. This is the exact same thing that happened in 2017 by the way.

What ends up happening? They end up gambling it all away in the end (same story time after time).

Part 1 - Unnecessary Risk Isn't a Skill

During the bull market in 2021, anyone who was de-risking on the way up was seen as an "fool". Yes really. People thought that if they put $50,000 into some coin they would get rich, since some people did experience that (early to the right NFTs, early to DeFi etc.).

The problem? This creates bad habits.

If you want examples of this we suggest going through crypto twitter and looking for people who lost 7 figures, 8-figures or even 9-figures which represented their entire net worth (FTX/CEL/BlockFi etc.).

Then go back to their history and you'll see a common theme. They run it up on extremely dangerous bets and never sell. Or. They lever up and never sell.

The complicated part related to hyper exuberance is that the majority do not have an exit plan. They only have an "enter plan". If you bought BTC at the bottom say $3-5K in 2020, did you write down a "sell X% at $ number"? Most don't.

Then they continue to build on this same habit over and over and over again. Long-term it results in total loss.

This is why you *must* start a business at some point. If you're always investing money you don't need, it is a lot easier to stay rational and avoid total loss. Anyone who has been in the online game for more than 5-10 years knows that you get some banner years and some really bad down years. During those up years you learn to diversify or put away a "never touch" rainy day fund.

Taking risks is great. It can lead to outsized returns.

Just remember that unnecessary risk = life long bad habits: 1) investing into ponzis, 2) trusting exchanges, 3) investing in hedge funds - stocks - that practically never beat the S&P 500 and 4) believing that you'll "outsmart people" to wealth vs. *Build* for wealth.

Part 2: Broken Business Models CeDeFi

The BlockFi numbers are out and it is a blackhole. No way this gets filled especially after the lawyers get their fees in the process. Don’t believe the hype with BlockFi suing SBF, it is just for “show” to make it seem like they are making an effort to help customers. They don’t care about customers because if they did this “business” wouldn’t have existed in the first place.

Autist Note: If you were involved with BlockFi, you can try the same thing people did with Celsius. If you have a small claim you can try to sue for it and if they don’t respond you win by default. Could result in recouping some money if you had a small amount in there. Doubt any of our readers had a dime in there since we’ve been preaching that this is a zero since 2021.

Nexo Still At It! Below is an extremely long tweet thread that explains their business model. It is long so give it a read here.

Now that you’ve read it (or didn’t). We can summarize it in a couple of words: It’s a hedge fund.

We’re not going to go through each line item. All you have to understand is the yields are being generated by other investments/taking risk (that is the TL;DR). As usual, if a firm is able to generate yields *ahead* of the interest rate, then it is good to go. If they fail to do so (extremely high failure rate long-term) then the business goes under just like Celsius.

Simple Example: When you put money into a bank they give you say 3% interest. They take your $100,000 in deposits and help Joe in Montana buy a property (with your $100,000). Now they collect 7% from Joe, you get 3% on your deposits and this is *somewhat* sustainable since there is limited volatility and the government back stops the banks as we saw in 2008-2009 (if things get real ugly it seems that bail-outs are now normalized)

This Example: You deposit your BTC into a “yield” product. They take that money and start investing it (scam coins, other projects, arbitrage, etc.). If they can continue to do 10% returns while paying out customers 5% they make money! Everyone wins.

Now if things go bad and the fund has a “bad year” and the investments are down 50%… watch out below since the compounding gets ugly.

$100K at 5% = $5K per year owed to customer, the fund failed and only had $50K… Now they have to generate a 10%+ return just to make interest payments! If they want to make a reasonable amount of money they need 15%+ returns *and* they can’t have a bank run (redemptions) otherwise they go to zero since the money isn’t there to pay them out.

Conclusion: As stated for years, just hold your coins in cold storage. If you must be a degenerate gambler do things on-chain.

Limit exchange activity to an absolute bare minimum.

Part 3: Troll Tuesday Adjustment to Avoid Scams

Not going to go into details but first of all thank you to the $400 scammer! Despite having public proof the scammer was a liar, we ended up having our best 2 days of sales from the free engagement and traffic. So.

Thank You and Welcome to New Readers!

The Downside: We’re going to change Troll Tuesday to expand outside of the Jungle. This means that *we won’t choose the winners anymore*. Even though this is *our* website and *our* operation, the bar has been raised. Even though it is 100% our right to choose finalists for polls, people will complain about everything!

New Set Up: Here is how it will work. 1) we will find businesses that accept crypto, 2) we will pay the business and 3) the *business* will run the competition and choose the winner.

Read that carefully. 1) we will send them the money in advance and 2) we will have nothing to do with the winner or the voting process. Not sure how much more fair it can possibly get than that. The only downside here is we have to do some manual checking to see if the business is a fake or not.

The Upside: We will avoid 100% of all scammers and liars at this point. This is good for everyone here as you might not be in the Jungle and you might have different skills versus memes/videos etc. We’ll see what each company wants to do for the giveaway but it will be public and each item will be valued at the same rough range we do $200-300 or so (give or take) depending on our mood and what company wants to participate.

Suggestions/Comments: If you have a business or know of a business that would like to participate have them reach out to us on twitter. This will make it easier for us to look at the profiles and do some basic checks on the validity of the business. Will we get scammed in the future? Maybe.

It is possible to get scammed by some fake business, but at least this way we don’t have to deal with blatant liars and low quality sub human individuals on a consistent basis.

Note we’ll skip this Tuesday and have one for you December 6. We’ve already found one legitimate business, just need to make sure it runs properly. That’s it! Moving fast to get away from the dregs of society.

Final Note: please don’t mention the scammers in the comments it just gives them free traffic.

Part 4 - Short Jungle Update

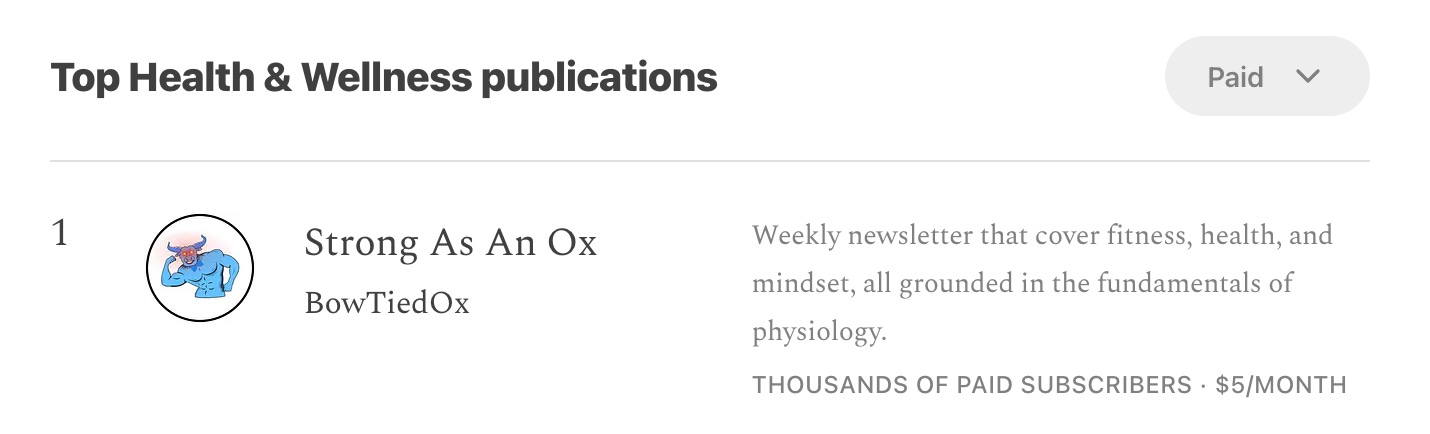

In good news, the Jungle is still going strong. Congrats to BowTiedOx for now being the #1 top paid content creator for Health and Wellness. Would say we’re surprised but that would be a lie as we told him publicly he’d eventually make more than what we’re doing due to the larger audience base for his niche!

You can follow him here if you’re looking to level up your fitness! (Link)

More Winners Emerging: It seems like every three months we get a new winner in here in some brand new niche. Right now as a quick roll call (beyond what we’re doing) there is: 1) DeFi team for high-risk crypto, 2) Devil is doing coding, 3) Fawn is doing well in skin care, 4) Octopod is doing great in cooking, 5) Sales is an entire sub division with sales guy, cocoon and systems all in different sectors, 6) DDS is running dentistry, 7) Opossum and tetra doing wifi niche items, 8) cuda doing what appears to be a focus on online dating, 9) Ranger doing politics and 10) 5-10 other ones that we’ve lost track of - (handyman and farmer as other examples of extreme niches)

As usual, if you’re good at something we want to hear from you as we’re happy to help audience build *if* you’re elite at what you do. If you’re not elite at what you’re doing, it unlikely works anyway.

Equal Opportunity, Unequal Results.

One Big Issue: If you’re on Twitter, right now the jungle is far too reliant on that social media app. Don’t really care if you need help getting an inital audience boost but if you’re still only getting traffic from twitter consider your income stream to have *MASSIVE* risk.

There is a battle on Twitter after Elon’s takeover and anything can happen: 1) iOS ban, 2) business failure/bankruptcy and 3) lower quality platform that leads to massive user churn. The list goes on and on.

We’re so concerned/cognizant of this we’ve started building out an Instagram targeted to high-end (homeless) advice. It covers art, cities and offers free Q&A for lifestyle/dating related questions (for now). Until it hits at least 10,000+ we’ll continue to add significant value there to de-risk getting blown apart by Twitter.

Final Note!

Promote or ignore. Promote or ignore. Promote or ignore.

Remember this when operating online. There is always going to be drama so only defend yourself against blatant lies. People have realized how large we are now so the honey pot is big enough that people will try to “get an audience” by engagement farming. Don’t participate! With the new Troll Tuesday set up we’re officially insulated from all future scammers (the best we can).

Best of luck out there and be kind to everyone, financial pain is here for the vast majority. Keep grinding through year end and into Q1 if you’re still a W-2 worker!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team. Currently homeless.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money. At 20,000+ instagram follows we will publish some city guides ranking each region we’ve been to.

A quick tip on suing BlockFi, CEL, etc. (or any business for that matter) in small claims court. In order for your judgment to be good, you need to properly serve the entities. That means figuring out the appropriate name for the entity, addressing the Small Claims Complaint to the appropriate entity/person, and serving that entity/person

States require a business to have a designated agent for service of process for the stater where you are suing. Most times, this information is kept with the secretary of state for your state. You'll want to navigate to the SOS website and look for "business entity records" or "agent of process" search. That's the person/entity you will want to address the Complaint to effectuate service.

Pro Tip: every document after the Complaint must be served on the opposing party.

Small claims lawsuits are important. Getting a judgment against a soon to be insolvent entity (or anyone) is important to preserving your place in line in the event of bankruptcy. You likely will not be first in line, but you will have a place in line above a non-secured creditor (example: a credit card company).

Great post today boys 🤝