Watching a Country Fail in Real Time Due to Inflation - BowTiedMara

Level 2 - Value Investor

Welcome Avatar! For those that are unaware, BowTiedMara is personally responsible for increasing the tourism to Argentina by 179,78,277,382%. This number mirrors the inflation rate of the scam coin the Argentinian Peso.

Since his entrance into the limelight this year, we’ve taken an interest in what happens during eras of hyper inflation. He lives in the country and the Jungle’s reach is certainly global! No need for introduction, handing it over to BowTiedMara!

Part 1: How a Currency Dies

As you might remember from my previous guest posts on BTB here and here, it is impossible to get bored in Argentina.

This year and 2024 are ramping up to be some of the most “exciting” years in recent Argentine history: not just because of accomplishing the highest inflation print in 32 years, but also because there are actual chances of a libertarian candidate making it to the presidency. Let’s dig in.

Inflation: the gift that keeps on giving

Argentina’s government is doing all in its might to print higher inflation numbers. So far, accumulated inflation since this presidency started in 2019 is closing in on four digits: 621%.

You might think central bankers in Argentina are crying saltier tears than Powell with these CPI prints, but nothing could be further from the truth. In Argentina’s Central Bank (BCRA) mandate (Article 3), it specifically says that:

“It is the primary and fundamental mission of the Central Bank of the Argentine Republic to preserve the value of the currency.”

The reaction to that phrase when locals read it or hear it, is usually unanimous:

While everyone else stresses over Powell raising rates a few basis points, the BCRA folks bump it all the way up to 11: current peso ponzi rates are at 118% YoY and 209% APR.

Whenever you see those rates in DeFi, you run the other way. Argentines are doing the same thing, hoarding more dollars than ever. Pesos literally burn in their hands, and only a select few still dare to play the Russian roulette of locking up their pesos for the minimum interest period of 30 days. Everyone knows that a devaluation could always be right around the corner.

Minting pesos to infinity, and beyond

The main reason for the accelerating inflation besides the obvious things like funding the eternal fiscal deficit, is the ticking time-bomb called Leliqs. These local peso treasury bills are mainly held by banks (and their customers), purring along at those insanely high rates.

You can understand that from any return above 100%, things start picking up pace exponentially, and now, the BCRA is printing an additional monetary base every 1.8 months just to fund the interest payments on its peso debt:

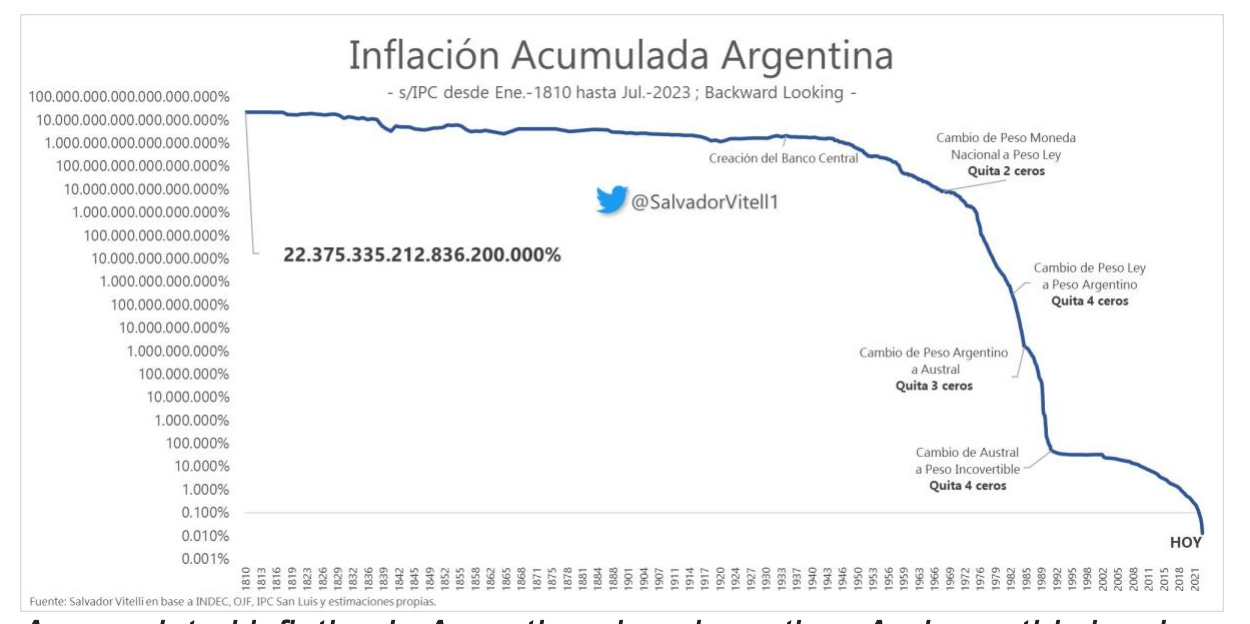

We are getting close to Weimar territory now, which means the peso could soon be a relic of the past. Either zeros will have to be slashed (13 zeros were slashed in the past), or the BCRA introduces a new currency (happened 5 times before). Those two outcomes are the most common ones.

Since the country’s independence in 1810, accumulated inflation in Argentina has been 22.3 trillion percent:

Accumulated inflation in Argentina since inception. And yes, this is a log scale. Source.

Autist note: If you’re interested in learning how Argentina went from one of the richest nations to one of the poorest in terms of GDP per capita, I wrote about Argentina’s Century-Long Decline here.

“Wars” on Inflation

CPI is currently at 122% YoY, but as usual CPI is a fake rate that doesn’t tell the whole story. Real inflation on the ground tends to follow the locked-up peso farm APR rate, which is now 209%. That corresponds more with reality.

The government declared the war on inflation in March 2022 when YoY inflation was at 52%, lol. Who would’ve thought that printing an additional monetary base every 2 months wouldn’t reduce inflation? It’s a mystery

According to many government officials, greedy businessmen are to blame since printing doesn’t cause inflation.

In a previous administration when inflation really started to pick up steam -- we are still only talking about 25%, an inflation for ants compared to what we have now --, the Secretary of Commerce Guillermo Moreno was well versed in waging war against inflation (and particularly, against businessmen).

Moreno took on the task of reaching price agreements with businessmen seriously: during negotiations, he often put a 9mm on the table to make sure that vile entrepreneurs wouldn’t raise their prices too much.

At the same time, he placed the National Institute of Statistics and Census (INDEC) under his guidance. He began a campaign of harassment against private consulting companies that measured inflation, and basically converted the Statistics Bureau into an inflation La La Land, with numbers that could not be trusted at all.

Argentina even received a €1.33 Billion fine for manipulating GDP in order to avoid having to pay certain bond holders a conditional premium tied to GDP growth. This is one of the reasons why you can’t run any good reports on Argentina’s mainstream inflation or GDP data from most of the 2005 to 2015 period.

Moreno converted into an evergreen meme by saying “we can Peronize the world”

Besides this great legacy, Guillermo Moreno will always be remembered for saying that Argentina “can Peronize the world”. In hindsight, he was right: the rest of the world is just getting started. Inflation too high? Just take out the CPI items that increase the most and replace them with something else.

Sadly, it is clear by now that the current government can’t get away with a full-blown Moreno-style manipulation: the IMF is auditing their every move. They are losing the war against inflation, and bigly.

But just to play pretend that they are committed to bringing down inflation, the Secretary of Commerce started publishing a weekly inflation chart in 2023, so that at least the bars don’t show double digits:

The official Secretary of Commerce account on X indicated that inflation was decreasing, just look at the last 3 weekly bars!

There are multiple ways this story can end, and if history is any indicator, it won’t be pretty

Reserves – What reserves?

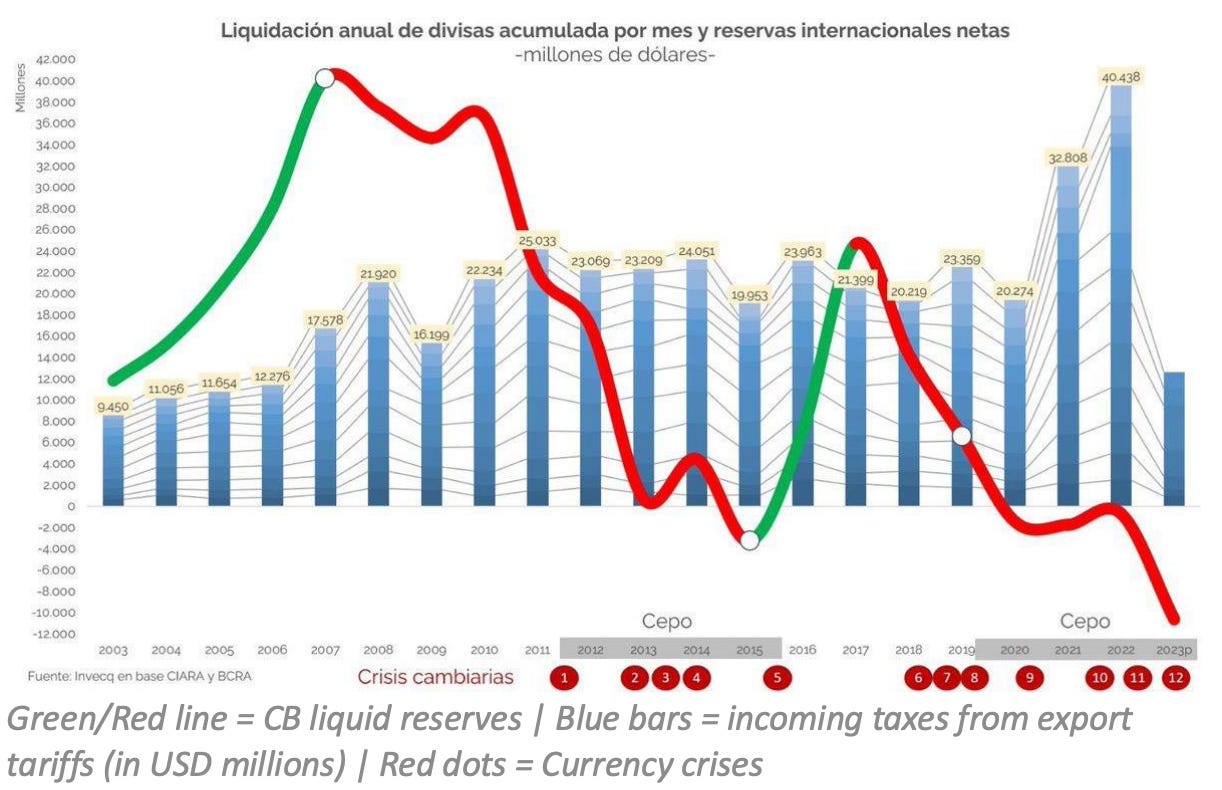

Despite some record dollars coming into the country in 2022 thanks to insanely high export tariffs that force producers pick up the soap bar without vaseline, liquid Central Bank reserves are running deep into the red:

Money is just pouring out through all the different deficit and debt holes possible, and this will continue throughout 2024, so the end is not yet in sight.

About $100 billion USD is due next year, and the peso debt death spiral makes up the biggest chunk of that: close to $75 billion. This could be refinanced, but it has to be unwound at a certain point or it will simply destroy everything.

Even though on a percentage basis the IMF loan to Argentina might seem like a decent chunk and local progressives keep blaming the IMF for all Argentina’s woes, it is not (yet) the cause of the current lack of reserves.

Old IMF agreement on maturities (red) and new IMF agreement on maturities (blue)

Argentina will only start paying back those loans starting 2026 and is only paying interest up until then. So far, that doesn’t even amount to $2 billion, so that is a drop in the bucket and not the core reason for Argentina’s lack of reserves. It just really sucks that handing out money by printing ad infinitum and going on a spending spree doesn’t increase foreign exchange reserves.

Dollarization?

People living in Argentina laugh whenever finance bros on Fintwit start posting screenshots from their Bloomberg terminal (with all the wrong official exchange rates that don’t even exist in reality), saying Argentina should not dollarize, or predicting the fall of the dollar due to “dedollarization” and BRICS taking over.

Historically, Argentina has always been dollarized, and real estate, cars and other expensive items have been priced in US tokens forever. Nowadays, the base price for many smaller products is also in USD, and merchants just directly convert that to pesos at the unofficial/blue rate.

If you see this chart of salaries adjusted for inflation in dollars, you understand why you’d have to be a full blown degen or financially illiterate to hold anything other than USD versus pesos:

Average salary in dollars from 1970 to today.

Most people are sick of this rollercoaster, and indeed the Central Bank has done everything BUT preserve the value of the currency.

If one thing is never happening, it’s “dedollarization” in Argentina. No one has ever seen a Yuan bill in their life, and they would never swap their Benjies for Mao.

Everyone with half a brain here understands that a currency with capital controls like the Yuan could never be a store of value versus a currency that can be used without any of those restrictions.

Libertarian economist and presidential candidate Javier Milei is proposing a full dollarization by shutting down the BCRA and adopting the dollar. Tucker Carlson’s interview with Milei earlier this month was a smash hit on X reaching more than 400M impressions. If you want to learn a bit more about his platform and why he is the next man with the mustache for mainstream media, it’s a recommended watch.

The dollarization Milei proposes would not be the same as the 1:1 peg Argentina implemented in the 1990s, where they pegged the peso to the dollar. The peso printer was still there, and after 10 years of close to zero inflation, they started funding the deficit with the printer again, breaking the peg in 2002.

This is why from a historical standpoint it makes sense to take away the drug from the emission junkies and go full cold turkey. Milei wants to close the Central Bank completely

We will have to see if this can be done in practice, so far no one besides Milei’s party wants to go through with this. In a way you can’t blame them: if the printer is no longer there, the personal finances of these Cantillionaires will take a severe hit.

Autist note: Fun fact is that Milei has also been raffling off his deputy salary since he started, as a gesture that he doesn’t want to live off the state. The first deputy salary that Milei raffled was $205,000 pesos ($1,000 USD) in January 2022. This month he gave away $1,312,859 pesos ($1,786 USD). In other words, in little over a year and a half, the salaries of the deputies increased by 540%. Those salaries are way ahead of inflation and almost double in dollar terms. If Milei didn't donate his salary, no one would know or care how much a deputy makes. Currently well over 1 million persons register for these raffles on a monthly basis.

Elections: Massa making it rain with the Peso Helicopter

This brings us to the elections. Argentina is never boring, and this intensifies in election years. Every day there are at least two or three clown car moments to post about on X, and on some days, it is almost too much to keep track of.

The current Minister of Economy, Sergio Massa, is also running for president! A great opportunity to run that peso printer hot while he’s actually right there to press the button. And pressing that button he does: Massa is converted the peso printer into a slot machine to see if handing out pesos can also land him more votes.

One of the first measures was to cancel income taxes for employees who earn less than $1.7M pesos ($2,350 USD). He also decided to give back the VAT paid on groceries with a debit card, and consumers who enroll for this return are automatically included in a raffle for multiple cars, motorcycles, and homes. Massa going wild with the airdrops.

Guess how this will be funded? You guessed it: by printing more pesos. Since only 80,000 employees in the country make more than $1.7M pesos/month, that shortage of tax collection will have to be corrected by printing the difference.

Final Thoughts

We will see a lot more clown car insanity in Argentina as we approach the final elections on October 22. The way the elections are set up really makes you wonder if the timeline was intentional or not.

The primaries are held in August, then the final election is at the end of October (2 months later), and then 2 months later, on the 10th of December, a new government starts.

This gives a sitting government 4+ months to burn it to the ground in case they lose. In Argentina, a week can feel like a lifetime.

As Lenin once famously said: “There are decades where nothing happens; there are weeks where decades happen, and there are days where Argentina happens.”

In case you want to travel to Buenos Aires to get a front row seat to yet another spectacular currency collapse, this Buenos Aires guide on BTB will help you get started.

See you in the Jungle, anon

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

I visited about a month ago so the Tucker interview was even more entertaining for me. I really felt the part about the beautiful, freedom-era architecture versus the disgusting socialist-era Lego buildings that are everywhere in between. I even learned on my trip that there’s a Harrods that’s been abandoned for 25 years.

The map of Milei voters outside of Buenos Aires that Mara shared on X was enlightening, because the conversations I had with people in the city made me think they still want more of the same despite how inflationary it has been (protectionism, capital controls, free tuition, free healthcare, free PET INSURANCE!!). I was stumbling out of Fogón the night Milei won the primary. I sat down at a bar and watched dozens of Argentinians soak in what just happened, feeling like I timed my trip perfectly.

I had to dial back the ‘tism when I got back to the states because my family and friends didn’t find it nearly as fascinating as I did. Meanwhile, 4 weeks later one of them says to me “the government should make it so that my girlfriends student loan interest rate isn’t higher than X% because she’s a [redacted debatable essential worker]” and I thought “shit, it’s beginning to happen here too.”

How do you re-educate the Argentinian population to get out of their own way (stop voting in Peronists/Socialists)? Or are the problems just so systematic that people just have to worry about themselves more and more? Mucha suerte. Thanks.

Argentina just lost a case to $BUR for a takeover of an energy company. Another $2-3Billion to print.

https://finance.yahoo.com/news/burford-capital-limited-bur-won-124554689.html