Watching the News - What Mid-Curve Believes

Level 1 - NGMI

Welcome Avatar! In a strange turn of events we took the time to watch the news for about 25 minutes. That’s 25 full minutes we can kiss goodbye and have totally wasted. That said, it was interesting to see how the propaganda machine is aggressively pushing the narrative that the economy is in great shape (not in a recession). There is also limited information on TSMC/Taiwan and the Nancy Pelosi visit. Limited information meaning, the value of TSMC and Taiwan in general.

Part 1 US Economy - Transition to Stable and Steady Growth

This is the new phrase being thrown around as we saw it pass by multiple White House representatives. It also took a pass through Joe Biden’s Twitter account (likely run by President Jerome Powell at this point). The last time we heard the phrase “transition” it was “transitory inflation”. Which aged like a dead fish in Dubai Summer heat.

Below are some of the talking head points from the indoctrination box.

“Experts Say We’re Not in a Recession”: This one is quite interesting. Many are still obsessed over special words in front of their names “MBA” “PHD” “CFA” etc. We forgot all about this but it somehow persists.

There is no real relationship between a three letter sequence and competence. If anything, the three letter phrase says that you follow orders/directions well. Even PHDs are told what to do as their “thesis papers” go under an ordained committee that “decides” if it is good or not.

That is neither here nor there. This is a simple tactic to sound more convincing to the public. It is the exact same reason why the phrase “DOCTORS HATE HIM” works on the masses for affiliate marketing. Same concept.

Use accolade or “scientific study” to make the claim sound more legitimate.

Minimal GDP Decline is Not a Recession: We’ll try to take a balanced approach here and say “sure minimal GDP changes is unlikely a recession”. For example if GDP was down 0.1% twice in a row that’s nothing to worry about. The problem is that interest rates have gone up significantly over the last eight months. Significantly.

If you know that demand in Q1 wasn’t good before interest rates go up, why would demand grow in the second half of the year when interest rates are even higher than they were before?

If you’ve run a business online you know that a lot of your sales are after pay/BNPL type payments. In these industries, the BNPL company fronts the payment in cash for people who can’t even afford a $200 item without spreading it across multiple weeks/months.

As rates go up, the risk on all of these payments goes up. This means when the BNPL *companies* begin to see pressure… we’re going to see real pain. The news is reporting on what is currently happening (GDP flattish due to debt) and is not looking forward (automatic declines and bad debt write offs).

Unemployment is so Low! This is probably the worst argument being pushed by the mainstream media. Unemployment has a lag. Read that again and again and again. Before a company lays off employees it typically needs to see deteriorating financials. Usually it is as follows: 1) stock prices go down, 2) unemployment remains stable, 3) unemployment ramps up quickly and 3) stock prices go down more.

Black Line = S&P. Blue Line Unemployment. As stock market starts to fall, eventually a sudden spike in unemployment begins.

As you can see from the chart above (Source for easier viewing), unemployment is not a “leading” indicator. The reason why tech companies have cut first is two fold: 1) many are unprofitable already and they are worried about cash burn and 2) they are the fastest to react to changing interest rates and market conditions. The Tech sector is telling you what is happening in the broader economy and most are in denial about this. If the highest earning people take a hit, why would the services economy (IE. the United States a whole) do better? It doesn’t make any sense at all.

Bonus Note: For those that are curious, you’re already seeing Wall Street bonus reductions in the investment banking analyst class (Fun Experience Here). These are the cheapest of the cheapest labor participants in the hierarchy: Analyst —> Associate —> VP —> Director —> Managing Director. If the cheapest individuals are getting hit we can tell you with extremely high confidence that cuts will occur at major banks as well. A 25-30% cut for top ranked junior employees and a 50% cut for bottom ranked junior employees is massive.

The VP bonus will be *horrendous*. There is no way IPO activity picks up enough in the last five months of the year to justify their comp packages from last year. No revenue? Will see $0 bonuses or the classic “F-you bonus” that means they want you to quit (typically $10K).

Powell Comments: “This process is likely to involve a period of below-trend economic growth and some softening in labor market conditions, but such outcomes are likely necessary to restore price stability and to set the stage for achieving maximum employment and stable prices over the longer-run.” - Powell (Source Page 3 and 4)

Per usual, no need to listen to talking heads or anyone else. Right there you have President Jerome Powell saying below trend growth and softening labor market which means layoffs. Budgets are made around September so the unemployment rate likely goes up Sept-October range.

For those in high up corporation positions (or were previously in a managerial position), you know that budgets are set at the end of Q3 (rough range). This includes all the bonus figures outside some small sum set aside depending on if certain deals close. The decisions are currently being made *now* so do everything you can to spike those performance numbers from here until end of September. If you’re concerned about your job stability, skip the vacation and use it in January after you survive the cuts.

Conclusion: Business owners do not change directions faster than your crazy ex-gf/ex-bf. They don’t suddenly fire people because they had a bad quarter. There are rules and regulations in many states for laying off people and they have to be certain of the cuts. As numbers deteriorate there is a *lag* in the layoffs. We haven’t seen that number come up (exception - certain tech companies). They are in the pipe as you can’t remove free money and expect higher growth with high interest rate debt.

Don’t trust us though, trust President Powell.

Part 2 Taiwan and Nancy Pelosi News

Most of the news on Taiwan was as follows: 1) CHINA SENDS STERN WARNING and 2) PELOSI IN TRANSIT. This is rather odd as none of these comments say anything about implications if a fight does break out between Taiwan and China. We can all agree that China vs. USA is not good.

However, not a single real mention of Taiwan businesses? Taiwan isn’t a random country, it is home to the backbone of the electronics industry - Chip Manufacturing.

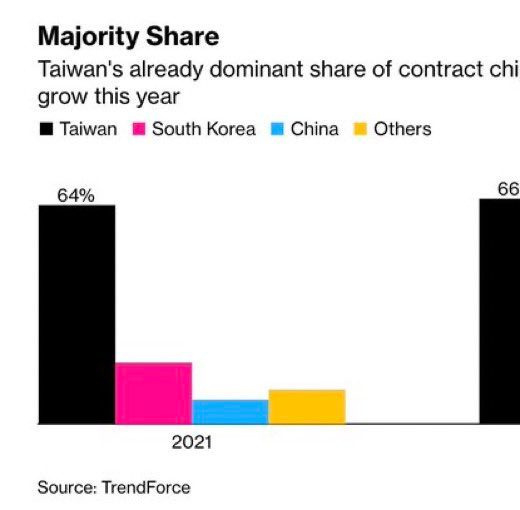

The above is a decent starting point from one of the anons in the jungle. That said it doesn’t say much about what type of chips are made by TSMC. You don’t need any sort of semiconductor background to figure it out either (we have none). While a background in internet and software is helpful, all you need to ask is “what are important chips”.

Important chips are: high-end computer chips in computers and servers.

Don’t think there is any real debate there. If you have an old chip that likely isn’t important for high-end sensitive equipment. If you have a brand new chip, that is likely leading the way (technology wise). With a simple google search “chip manufacturing lead” you get to this article with this image. It says that 7nm and 5nm are the latest chip technologies. Step 1 Complete.

If you don’t want to read the article (you should!) then you can just read this second chart as well which tells us 65% of all the important high-end expensive and leading technology is made by TSMC. Step 2 Complete - 65% of high-end

Before people claim that this simple analysis is wrong, you can check the SEC filing and confirm they make the most important chips (source - page 18 of 203)

“We count among our customers many of the world’s leading semiconductor companies, ranging from fabless semiconductor companies, system companies to integrated device manufacturers, including, but not limited to, Advanced Micro Devices, Inc., Broadcom Limited, Intel Corporation, MediaTek Inc., NVIDIA Corporation, NXP Semiconductors N.V., OmniVision Technology Inc., Qualcomm Inc., and Renesas Electronics Corporation”

Step 3 complete - They make chips for all the major US Chip companies for computers and servers

To put the final stamp on here. Now that we know they make chips for the biggest American companies, you’re probably wondering are those made in the USA? Or are they made in Taiwan? Well lucky for you that’s also public information and takes 30 seconds to pull up since it’s on the same page 18 and 19 of the filing (page 13 and 14 by labeling)!

“Fabs 2, 3, 5, 8 and Fab 12 are located in Hsinchu Science Park. Fab 6, Fab 14, and Fab 18 are located in the Southern Taiwan Science Park. Fab 15 is located in Central Taiwan Science Park. Fab 11 is located in the Washington State, United States. Fab 10 is located in Shanghai, China and Fab 16 is located in Nanjing, China”

15/18 of all the facilities are in Taiwan. Read that again. 15/18 facilities are in Taiwan which is 83%. Also. On the same pages we can see that Fab 10 is not high-end chips it is for 150nm (latests is 5nm!), Fab 11 is also 150nm and Fab 16 (is 16nm).

Conclusion: You now have verifiable proof that the major high-end chips are made in Taiwan. Not on US soil. Not on China soil. Taiwan. If China takes over Taiwan and TSMC as a whole, it means all important high-end chips will be controlled by China (hint: spyware!).

You can’t “make a 100,000+ square meter semiconductor plant in the USA overnight”. That’s not how construction works.

Even if you’re not interested in TSMC or the Taiwan stuff, we suggest using this thought process when hearing about major news. You could do the same thing with Russia/Ukraine by looking up the main exports/imports and figuring out where the pain would be.

Now you also know the news doesn’t even read SEC filings. It takes 3-4 minutes to look up and that’s just not worth their time apparently. “Potential war” gets more clicks. That’s all they care about.

One Last Note: There is no need to research every detail. It takes a few minutes to understand the basics and there is no need to know all the nuances. Simply ask: 1) what does that country/company make, 2) where is it made/sold to and 3) this will be good/bad for A/B. That’s really it. Honestly, this systematic approach is likely due to all that A/B testing for ads. IYKYK! Get that WiFi money while you can.

Till Next Time.

Image made by BowTiedApollo

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team.

Gonna be interesting to see who's bluff (USA or China) will be called. Almost all the plants in Taiwan are on the coast line and are almost collateral damage if China decides to go for it.

This is why TSMC building its most advanced semiconductor plant in Phoenix. Likely spending $30B. Intel also building huge plant there. Domestic supply is coming. May not be enough though.