Wrapping Up the Banking Issues and Credit Suisse "Deal" Explained

Level 1 - NGMI

Welcome Avatar! As you know we’ve had the phrase “BANKS ARE ZEROS” for about 2 years now and most victory lapped us in 2021 when Investment Banking bonuses were high due to “massive loan origination and deal volume” (ironically we gave out the exact figure for bonuses for 2021 and 2022 ahead of time so it wasn’t a surprise to us)

Now the chickens have come home to roost and people get to see there was no way to avoid the phrase BANKS ARE ZEROS.

If rates go up, BANKS ARE ZEROS.

If rates get cut to zero… BANKS ARE ZEROS.

We’ll explain below.

But before that a quick message from our paid sponsor.

We received a $0 commission for this sponsored image.

Part 1: Banks Are Zeros Explained

With rates rising rapidly you can clearly see the issue we’re facing: 1) we have high inflation 6%+ if you believe government data and 2) we have banks failing because they don’t have the deposits.

Step 1: In 2021, Banks lent out Hundreds of Billions of Dollars. This is why you see all of the RE people saying “Prices won’t go down because people locked in low-rates”. Won’t even bother with explaining why that is ridiculous as we already explained why in a paid post a few weeks ago.

Step 2: Assume these rates are at 4% just to make it easy to follow.

Step 3: The banks think they are making tons of money. So. They pay out massive bonuses for “loan origination” and other deals that made sense when interest rates were at 0%.

Getting 4% for 30 years seems like a genius idea if you think rates will be at 0% for 30 years.

Step 4: Now the chickens have come home to roost! How so?

You have a bank account getting 1% yield (waste of your time). You look online and you can buy government treasuries getting you 5%. This is not a lot of money for average joe (who has $10K in his account) but for anyone rich this is MASSIVE.

If you have $10M in a bank or spread across two banks you are going to SUCK OUT every single cent to buy US treasuries. This is because you can get $500K a year instead of $0K or $100K a year. this is an obscene amount of money even for a small business. If you want to “Think Bigger” then you could imagine this on a $100 billion dollars ($5B vs. $1B is a publicly traded company spread!!!).

Step 5: Game over. The end.

As more people take their money out of the bank, the bank is experiencing a “digital bank run”. Wire transfer after wire transfer after wire transfer as people attempt to buy US treasuries. Since the deposits are not there (of course), the bank is insolvent.

If they *try* to sell the 4% mortgages back into the market they are worth 60% of the original value (why buy 4% mortgage bonds when you can get 5%+ backed by the printing press). In short, insolvent.

Step 6: We gave up on Twitter when someone said “oh they can just give out 8% mortgages”. This is seriously the craziest thing we’ve heard.

The demand for an 8% mortgage is going to be MASSIVELY lower than the demand for a 4% mortgage. This doesn’t take any thinking to figure out. If you want to borrow $1M there will be more people asking for that $1M if the rate is 4% vs. 8% and it’s a massive margin. There is no situation in which the demand for an 8% mortgage will be higher or equal to the demand for a 4% mortgage. High inflation, low inflation, it doesn’t matter. Demand for cheap debt is always higher than demand for expensive debt.

Step 7: Now you see the end game.

If you *don’t* raise rates we will experience high inflation for longer. Read hyper-inflation, value of dollar keeps going down and middle class struggles to buy food.

If you *do* raise rates, more banks will be insolvent because the *value* of all the loans they made in 2021 (after paying out crazy bonuses for those loans) will be cut in half or worse. Then? People move their money from 1% savings accounts to 5%+ treasuries in SIZE. The bank will be insolvent and we will see severe asset deflation - see massive unemployment

The Bandaid

Right now? The plan is to cover it up by giving money to the banks. With a catch. The ones that are “too big to fail” are the only ones that qualify for future deposit protection in excess of $250K.

If you are large enough, you will receive cash to give out to your customers. If you are not large enough the Fed *might* give you the money or they will force depositors to eat a loss.

As you can see, this just means banks will consolidate even more. What smart business is going to leave large deposits at a small/regional/community bank and risk cash flow/payment issues/potential loss of deposits? None.

Realistically? Your average American has no clue what is happening. As long as they can get their money out tomorrow they won’t care. For all of you though? You see the massive issue they’ve created.

Luckily we’ll see what happens this week with President Powell.

If the hikes are serious, they are going to send us into high unemployment. If the hikes are stopped and they want to pivot it means they are choosing inflation.

No way to spin it.

Note: anyone who has read us for years already knows what to do, play the tails and wait. If you’re a gambler you’re free to bet on one side and we have our own prediction for next week that was released on Sunday.

Part 2: Onto Credit Suisse

We know it didn’t officially “Go To Zero”.

This is the criticism we’ve already received on Twitter after saying it wouldn’t survive and it was done.

Instead, there is a massive bailout. The Swiss National Bank is effectively *forcing* UBS to Acquire Credit Suisse with an all stock transaction. In exchange for providing the bank with 100B in liquidity (yes 100,000,000,000).

This is quite similar to the first major shoe to drop in 2008 with the collapse of Bear Stearns (March 2008).

“The Deal” - for Newbies

The only reason UBS is in the deal is because no one else would touch this. The situation is so bad that if UBS tried to buy CS without the backing of the government it would also be bankrupt.

This isn’t a perfect analogy but it is easy to explain like this:

Joe owes $10K on his credit card due tomorrow, but only has $5K. This is CS.

Mark owes $10K on his credit card due tomorrow and he has $11K. This is UBS

Government tells Mark to buy Joe. The problem is that even if they pay $0 for it, they will also be bankrupt tomorrow (insolvent): $16K total cash but $20K owed the next day.

Therefore the government has to step in and give UBS money to buy CS.

If you explain this to a banker though, he will claim you’re wrong and it’s not perfect etc. He’ll then throw a bunch of word salad at you like CDS (Explainer Link) and try to make it sound more complicated.

The above is the easiest way to explain it to a normal person.

If UBS tried to buy CS without backing, they would be insolvent as well.

The Deal in Finance Terms

Now that you understand why the Government had to come to the rescue to get this deal done you get to read the scariest short sentence in recent memory: “The Swiss government has exercised its emergency powers to facilitate a swift consummation of this merger without the necessity of shareholder approval”

No confirmation on this. But. This is a *potential* live cartoon drawing of the board room meeting between the CEOs and the SNB.

No one knows for sure.

As you can see this deal was approved without shareholder vote. This would be like owning a company and the government says “you are being acquired by Company B, you get no vote on yes or no”. This is nationalization of the Swiss banking system but will be spun as something else (stay toon’d for the word salad!)

For the finance people you can access the PDF and press release Here

EPS Accretive by 2027: Okay for those that don’t get the financial terms on this, in “basic terms” they don’t expect to make any money on the deal until 2027. “EPS Accretive” just means adding money to the bottom line of the combined entity (once again simplified).

Now think this through. A bunch of 60 year olds sat down and decided over this weekend that it would take 4 years to make any money off this deal. The same guys who have failed to run their own company well as UBS has gone from $70 to $17 over the past ~15 years.

Now this is important because it is an *all stock deal*. This means all the people at CS who thought they had say $2,000,000 in CS shares (at $2) now have $800,000 worth of the New Combined Clown Company.

Not an Actual Quote from Plato.

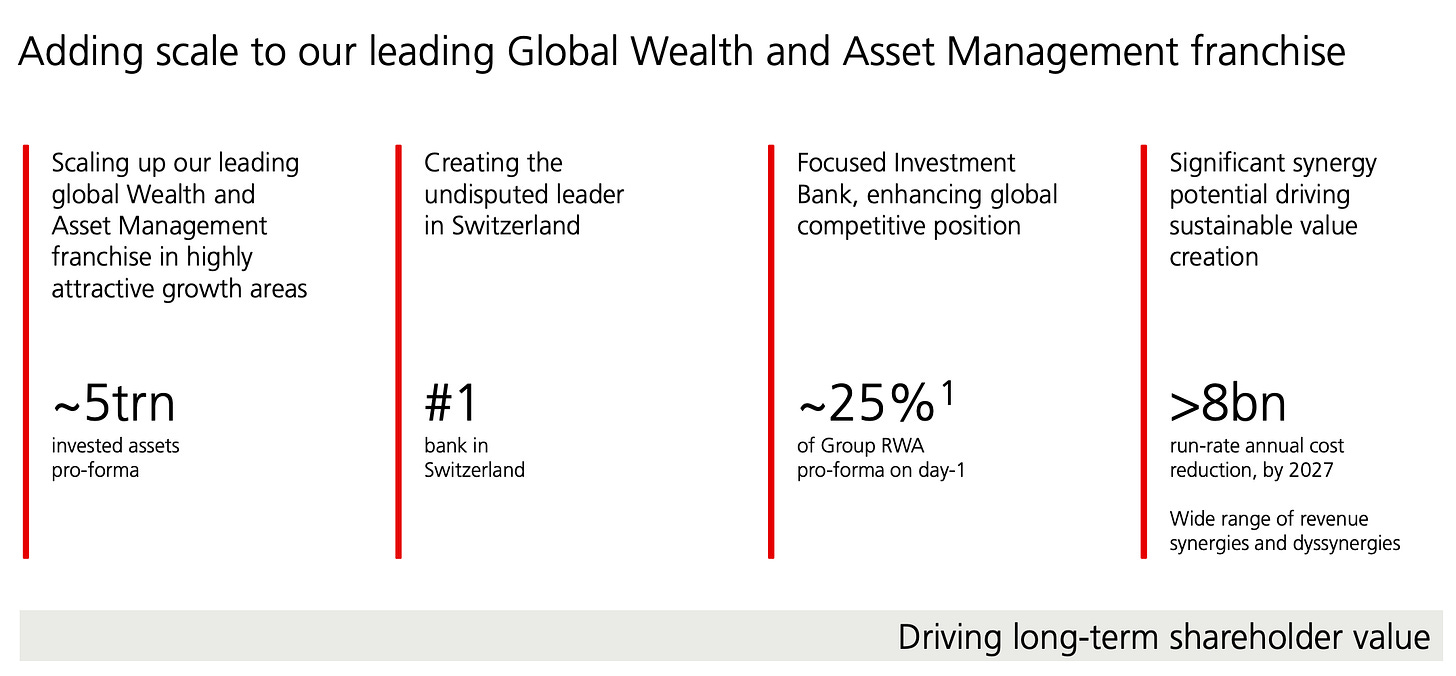

“Run-rate annual cost reduction of >8bn, by 2027”: Translation. A lot of bankers are about to be fired. Tens. Of. Thousands.

Autist Note: For reference Credit Suisse had operating expenses of about ~18.1 billion swiss francs (source). Assuming that the 8Bn is referring to swiss francs as well that means good by to 8/18.1 = 44% of costs!

With ~50,000 employees our public estimate of 20,000 is looking pretty close without even sitting in the board room! (check the date, no deal details at that time - Saturday)

Temporarily suspending share repurchases: The balance sheet is going to be a complete mess and instead of cutting the dividend and buying the stock… We’re saying we don’t think the stock is fairly valued at current prices so we’re keeping the dividend! You can figure that one out (upside down smiley face)

$5 Trillion and #1 in Switzerland: Well yeah, you are basically the only bank left so… Correct. (Jokes aside the only other major firm left is Raiffeisen - CHF customer desposits)

Stay Toon’d

Now that you’re up to speed on what has transpired over the weekend. Remember that this article is opinion only and the authors may or may not be homeless (never take financial advice from a homeless cartoon character on the internet).

As information comes out tomorrow, we may do an additional free post.

On that note, we’re also going to move more questions to paid only subscriptions. If the number of sign ups remains sky high (as it has been) free posts may be locked from comments.

On that note, back to the tent.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money. At 10,000+ Instagram follows we will publish some city guides ranking each region we’ve been to.

Very well explained

Can I get those stickers somehow? I will pay but want to aggressively put them everywhere.