A Different Way of Looking at Real Estate

Level 2 - Value Investor

Welcome Avatar! This is entirely an unedited guest post by The Real Estate God. For those looking for a different way to look at RE investing and want something to think over before the inevitable final battle tomorrow, this post is for you!

Once again point of emphasis, all of this is his opinion on the RE market and investing in it.

Intro

For those of you who don’t know me, I’m therealestateg6 on Twitter/X (can also be found at therealestategod on Youtube). I started my real estate business with just $2,500 and currently have over $30MM AUM (with investors). I left my job 3 years ago to run my own real estate private equity firm full-time and given the deal sizes I’m looking at now ($10MM - $50MM), my 3 year to 5 year goal is to deploy $100MM in (investor) equity per year into real estate, which should be hard but achievable.

This post will be about real estate but in reality it’s mainly a post about making money. I’ve always wanted to make a lot of money and, in my opinion, real estate is simply the best way to do that. I was once where I’m sure many of you are now - at a W2 job and in search of the best way to break out and start making real money. I chose real estate as my way out and have since done quite well. In this post I’m going to explain to you:

Why I think real estate is the best asset class to make money in (why I chose real estate)

How to get rich in commercial real estate without any stupid gimmicks (how you can get rich in real estate yourself)

Let’s get into it.

Why I Think Real Estate is the Best Asset Class to Make Money

Since you follow BowTiedBull, I’m sure you’re all interested in getting rich. I’m also sure that they’ve already taught you that the only way to get rich is by owning equity. That means you either have to own a business or invest in a business. No other options. If you want to get rich, it’s one of those two things.

Real estate confuses a lot of people mainly because it’s so tangible - it’s an actual physical building. This makes them think it’s not a business. But real estate, at its core, is just a business. And like every other business, it can be bought, sold, and flipped for a lot of money.

Why is this important?

Because buying and selling businesses (private equity) is the best business model in the world. And real estate is the best business to buy and sell.

Before I get into why real estate specifically is such a good business to buy and sell, let’s talk about why private equity is such a good business model.

The “normal” way to gain equity is to start a business from scratch. This requires working like a dog for 3+ years while making minimal money to get the business up and running. Does this work in the long run? Absolutely. Is it the most efficient way to make money? Absolutely not.

Private equity, on the other hand, involves buying an already successful business and simply tweaking it to improve operations. This is significantly less risky and can have a way shorter time horizon because you get to skip that tough-sledding “beginning” phase. Far better model than starting a business from scratch. There’s a reason why private equity investors all have beach houses.

Since all real estate deals are already currently operational businesses (aside from development deals), all real estate deals are technically private equity deals - which means you always get to skip the start-a-business from scratch phase.

So what is about real estate specifically that makes it such a good business to flip?

Probably the easiest business in the world to manage: Why is that? Well the hardest part of any business by far is generating leads. Multifamily real estate has the benefit of having the single most built-in demand of any business on the planet - people literally *need* a place to live - which makes lead generation incredibly easy. The leads come to you and the problems are generally simple to solve. This is why third party management is so common in real estate but so uncommon in other businesses (you can outsource management with only a small drop off in quality in real estate but if you outsourced the management in most other businesses, it would be a disaster)

It trades for roughly a 15x sale multiple: Most private businesses trade for roughly 5x, real estate trades for significantly higher. This means that small increases in NOI (the real estate version of EBITDA), result in huge increases to property value. If you increase the EBITDA of a property by just $2k/month (which isn’t hard to do at all), you put $360k of profit into your pocket ($24k * 15x multiple). If you add value to a different private business, that same $2k/month in EBITDA you added only puts $120k of profit into your pocket ($24k * 5x multiple). So your time is worth 3x more adding value to real estate than it is adding value to most other private asset classes

Repeatable value-add process: In real estate, the units in the building are typically identical. So if you buy a 50 unit deal, every unit is (nearly) the same. That makes the value-add process incredibly easy. Once you figure out how to add value to one unit, you now know the exact process, cost, and return on investment to doing it for the other 49 units - and you can rinse and repeat. Other asset classes are far harder to add value to because the process is not identical as you scale.

Most liquid asset class in the private markets: This is important when you’re buying and selling. If you want to get rich, you’re going to have to own a business. And starting a business takes a lot of time, so it’s far easier to simply buy an existing business, add value, then sell. The selling part is important - you need a liquid market to do it. There’re a lot of businesses that’re hard to sell (pretty much every other small business aside from real estate - this includes service businesses, ecommerce businesses, etc), which makes running a private equity process very difficult. You want a liquid asset class where you can get in and out quickly to execute this strategy.

Incredible tax treatment: Real estate gets the best tax treatment out of any asset class in the country. On a sale, you can 1031 and pay no taxes. On a refinance, you can pull your money out and pay no taxes. If you choose to pursue real estate full-time, you can get real estate professional tax status, which means that you can use depreciation from your deals against your active income (which basically means that you’ll never pay tax again, even if you’re making millions of dollars a year). Insane that more people don’t know about this, real estate is the only asset class where you can legitimately legally not pay taxes for the rest of your life.

In my opinion, all of these qualities make real estate the easiest and the best business to get rich in, which is why I ended up selecting it to pursue a career in.

How to Get Rich in Real Estate

A lot of people have misconceptions about real estate. Some people think real estate is unattractive because they get caught up in the cash flow - they think the cash flow can be low. And they’re actually right, the cash flow in real estate is nothing special. But cash flow isn’t how you make real money in real estate.

The real money in real estate is made through buying, adding value and then selling. It’s not made through cash flow and it’s not made through appreciation.

I know this is a framework switch for a lot of you, so how does this process work?

It’s very simple. You buy, get the stabilized yield over the market cap rate, then you sell.

Before I get into how this works, let me define a few terms:

NOI: Revenue minus operating expenses. Essentially the same thing as EBITDA. -

Market cap rate: Cap rates are how properties are valued in real estate. Cap rate = NOI / Purchase price. For those of you in the regular private equity space it’s essentially the inverse of an EBITDA multiple. A 5% cap rate = a 20x EBITDA multiple. The market cap rate is the average cap rate deals sell for in the market. For those of you in the regular private equity space, you can think of this as the industry EBITDA multiple deals sell for.

Stabilized yield: The stabilized NOI (after all renovations have been completed) divided by all your costs in the deal (the purchase price, the deal costs, the renovations, etc). This tells you how your deal is performing relative to the market. If you stabilize above the market cap rate, you sell back to the market for the market cap rate and make money. If you stabilize below the market cap rate, the market values the deal at less than your yield, which means you’re going to lose money on the deal.

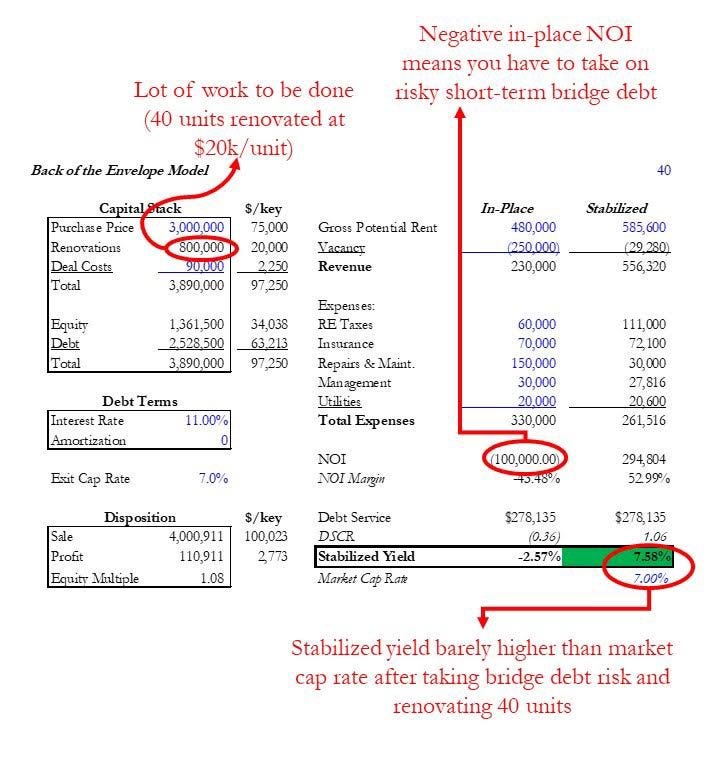

Stabilized Yield to Explain a Risky Deal (source)

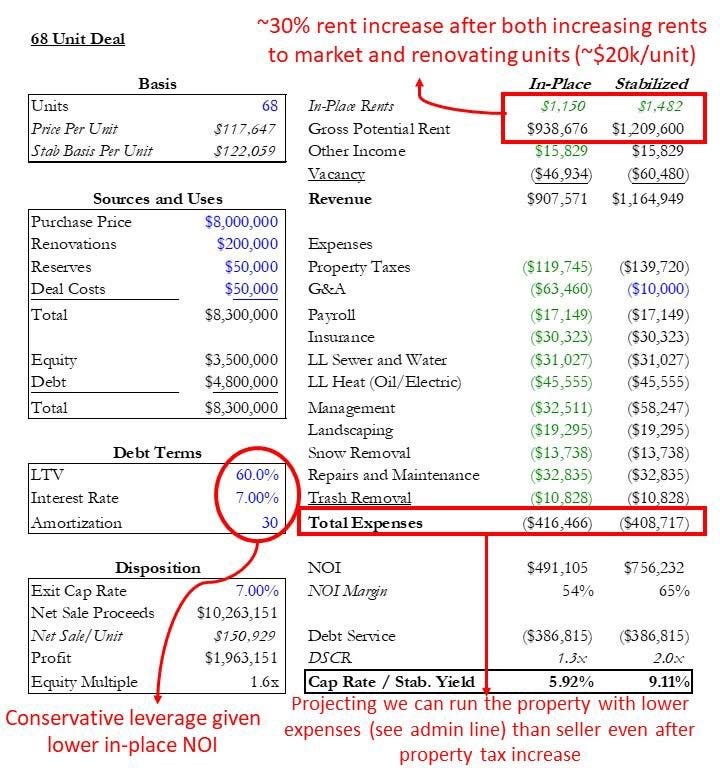

Compared to an Example of an Interesting Deal (source)

This is easiest shown through an example:

Let’s say you buy a 4-unit multifamily deal for $500k. The market cap rate is 6%. You buy the deal for a 6% cap rate, which means the NOI was $30k ($500k * 6%).

You invest $75k into renovations and are able to increase the NOI by $15k to $45k. So your basis in the deal is now $575k and your new NOI is $45k, which gives you a stabilized yield of 7.8% ($45k / $575k). That’s a 180 basis point spread over the market cap rate of 6%.

So you have a business with a cash flow stream of $45k that the market values at a 6% cap rate.

$45k NOI / 6% market cap rate = $750k.

Your total basis in the deal is $575k, the business is now worth $750k, you net $175k in profit on the deal. Rinse and repeat.

*(yes I’m ignoring transaction costs here to make the example easier to understand)

This is how you make real money in real estate. You buy the deal, get your personal stabilized yield at least 150 basis above the market cap rate, then you sell the deal back to the market at the market cap rate. Of course there are more things to look at when analyzing a deal (your entry basis, your exit basis, your DSCR, etc) but at its core, it’s a very simple business once you start focusing solely on the spread between your stabilized yield and the market cap rate.

A small deal like this (4 units) only takes a few months at max to renovate and you can be in and out of the deal in under a year.

The two biggest misconceptions in real estate are that you only make money through cash flow or through getting lucky with appreciation (market rents increasing). All of that is helpful but none of that is necessary. Once you learn this process, you don’t have to rely on cash flow to make money and you don’t have to rely on the market to make money - you can use your own skills to add the value yourself.

I know this sounds daunting but if you take it day by day and you scale, it really isn’t. My first deal was a $200k triplex that I only had $2,500 of my own money to invest in. Then I bought a 16-unit deal. Then I scaled up and up, getting bigger and bigger. The last deal I just closed on was $16MM. I’m about to close on an $8MM deal in a few weeks as well. Next I’ll be chasing $20MM deals. It all compounds.

My advice to anyone looking to get started in real estate is to get started immediately. Real estate is not a get rich quick business. The earlier you start, the closer you are to making real money. The real money isn’t made on the 1st deal, it’s made on the 3rd, 4th, 5th, 6th deals. That same math that netted you $175k profit on a 4 unit deal will net you $1.75MM on a 40 unit deal, as long as you stay the course.

In this business, everything compounds. Your relationships with brokers compound, your relationships with lenders compound, your relationships with investors compound, your market knowledge compounds. If you’re making more than a couple hundred thousand per year for your first few years, I’d be shocked - but if you’re making less than half a mill per year 10 years in, I’d also be shocked. There’re very few people who stay in for the long haul (and don’t take on a stupid amount of debt) who don’t do extremely well in the field.

Summary

You need to own equity to get rich.

Private equity is the best way to own equity because instead of having to start a business from scratch and barely scrape by for 3 years, you can save time and simply tweak/improve an already existing business.

Real estate is the easiest/best asset to operate a private equity model in because it’s easy to manage, trades for a high multiple, is financeable, has a repeatable value-add process, is relatively liquid for a private asset class and has the best tax treatment out of any asset class.

Once you learn how to bring your stabilized yield above the market cap rate, you can consistently generate large payouts, in an extremely low-risk asset class, while still at your W2 job

You want to reframe your mindset from thinking of real estate as a cash flow business to thinking of real estate as the best vehicle to “create your own private equity firm”, which is the best vehicle for creating wealth.

If you’d like to learn how to build your own real estate portfolio and escape your W2:

In addition to running my own private equity firm, I teach others how to as well. It’s an 8 week program and it’s all 1-on-1 with me.

Given the 1-on-1 time, spots are limited and it’s first come, first serve.

To apply click here: Acquisitions Bootcamp

If you’d like to learn more about real estate, I post tons of free content on my accounts as well: Twitter: therealestateg6 Youtube: at therealestategod

Once again point of emphasis, all of this is his opinion on the RE market and investing in it.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money

Great post- follows from solid X information.

I run a fairly good sized real estate operation and this is a great summary of strategy, and it works in many different markets and demographics. There’s a great deal of nuance and detail but you should paywall all of it if this is your plan/niche.

I’ll add just a couple things- you should have a deep understanding of YOUR market and product and many times politics will play a role at one point or another especially if you venture into development.

RE is a big relationship game.

Well done and congratulations!

Anyone have experince running 100% remote operation for buying and renovating? I'm based in Canada and been looking into US real estate since limited ops here, but looking to here some more first hand experiences (postive or negative of how feasible that is)