AI Proofing Your Present and Future

Level 2 - Value Investor

Welcome Avatar! As a rule of thumb working backward typically yields the best decision trees. You’ve already learned this from middle school where you start at the back of the book and solve the problem correctly.

Thinking about AI is no different. Look at what it does then work backwards in terms of 1) what to avoid and 2) then look at what it won’t touch. If you start by looking at the displacement angle first, you can cross off hundreds of positions overnight.

Part 1: Avoid All Reporting Type Functions

If you were to come up with a single word it would be “Reporting”. That is currently what AI does best. Reporting can be: 1) summarize the conference, 2) what Team A/B/C got done this month, 3) how sales, profits and margins were this month, 4) which geographies had better/worse sales and 5) provide all the results from public company ABC the past 5 quarters.

Reporting and interpretation are completely different. Reporting is easy to automate because it takes no analysis of what it means for the future. If you’re looking at basic financial analyst roles or para legal roles… probably best to curb that idea. Since these positions are largely just organizing data and using templates, AI/Software will be doing that shortly.

Follow the Money

Biggest loser? Middle Management. If you are given an offer to go into middle management or become responsible for a slightly larger sales territory, always take the sales territory in 2025. Middle management can no longer tie their Compensation to Revenue. This is a massive drawback. You go from having tangible value to intangible value that is going to be replaced by automated KPIs anyway.

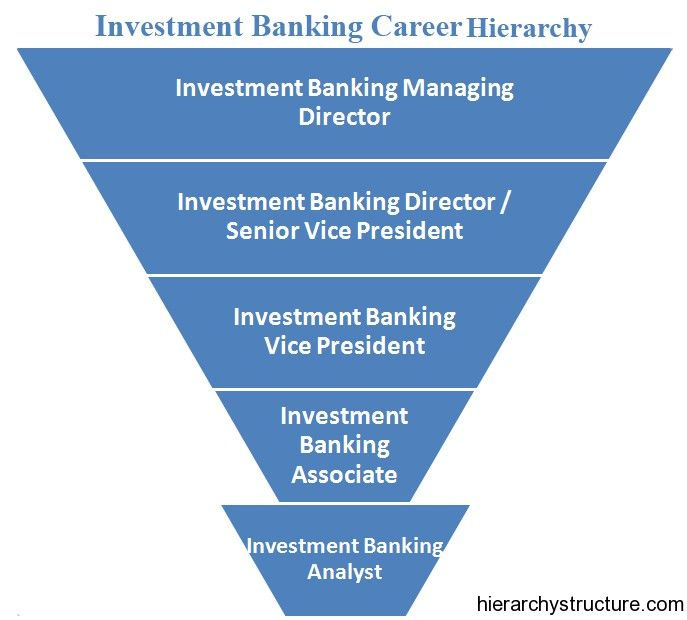

Upper management is a completely different role as you can see from this simplistic image. It actually doesn’t include one of the most important roles either: Recruitment. A truly irreplaceable upper management person can *recruit* the best and the brightest. Since the top 1% will continue to become more productive and command higher and higher compensation, it means a top recruiter will be invaluable.

Middle Management? They don’t do any of that stuff. Can’t say they helped land the Golden Goose sales guy if they never sent an email or even interviewed him.

What This Looks Like as a Wall St. Example

If you want to take investment banking as an example it looks a bit like this:

Analyst and associate various levels of grunt work

VP - staffing/middle manager + transition to revenue generation

Director/MD generating revenue at various success rates based on their title

Since AI/Software can automate a bunch of these tasks it means that you’ll see an eventual consolidation of the “Analyst/Associate” that becomes a quasi 5-year position. They probably don’t change the set up but the number of seats needed will decline. If you needed say 10 analyst/associate total, it’ll be down to 5-6 or so. In addition to that, it will be obvious if you’re ever going to move up to revenue generation.

Our assumption is the top associate will be the “VP” in most cases. IE. They will be forced into becoming a mini staffer as they prepare to go into revenue generation roles. This reduces the need for the VP role entirely. If you’re a VP, you’re already #1 on the list to get fired since you cost a lot and unlikely generate much revenue in year 1 or year 2.

Since Wall St. is a pretty rank and file industry they will keep the names for business card purposes. But it’ll break down like this in total comp territory

Analyst Associate - $200-300K as a range for the entire set

VP - This will be a "*SHORT* and sweet stint. You either generate revs in 1-2 years or you are gone. Comp doesn’t budge maybe $350-400K

Director/MD - Comp will be $0 bonus to $1M+ depending on performance with an average closer to $800K or so for an MD and $600K for a Director (across all banks including good and bad ones. All rock stars get millions all near zero performance = $0 bonus and eventually fired).

This image is a bit misleading as there are always more Analysts & Associates than MDs by a significant ratio. At least 4 to 1 or so.

Surprising no one who has followed us for years, you’re already seeing this happen.

Back in 2010-2014 or so an MD would make $1.0-$1.2M and a VP around $500K. Nowadays, after inflation, after a massive stock market boom and after a huge wave of interest rate increases = compensation is flat to down. Typical MD is around $850K-$1M and a VP is around $450K or so. By the end of the 2020s, probably settles around $800-850K average MD and $400-425K for a VP

What This Means for a Career / Income Options

Job = exchange time for money with $/hour pay out. Career = performance based. Business = makes money in your sleep.

Now the majority here probably enter into a career. Based on the above you can see clearly that the best role is now Sales. Second best is Tech. Distant third is Wall St.

The only reason to choose Tech over Sales or Wall St over Sales is *if* you are certain you will be 100x better at that task. In that case you have to go to your talent/skillset.

Sales is Best: Sales is measurable. You will not have Robo calls for buying $100,000 items. No sales team in India is going to call up the CEO of F500 companies. Not happening. Not today, not any time soon in the future.

Also. Sales requires *less* hours. If you’re a handsome man or beautiful woman, sales will come easier and you’ll work 1/2 the hours of a banker. For the same pay and more time to build your own business (hilariously, you will need to learn online sales anyway so your job already partially prepares you for escaping the cube)

Other Income Options: If you don’t want to play any of those three games there are still a few options. You can go into a basic medical field. This is because people want to talk to humans for medical diagnostics etc. They don’t want to get feed back from the latest version of Optimus. Just reality.

You can also go down the trade path, just know it is physically demanding and a grind. That’s another relationship based product. If you install HVAC or paint homes, it’s a heavy referral based business and you just gotta put in the hours and slowly scale up.

Avoid: Do not go into accounting, basic financial analyst roles, paralegals, customer support, manufacturing and even truck driving. All of these items have huge risk for AI as the tasks are pretty easy to replicate once they are streamlined.

To be more specific, the only type of accounting you could go into would need to be niche. Would need to work for companies only and find tax set ups that save them money to justify your rates. If you’re just doing accounting for a random F500 company you’ll be in trouble since it’s a process of reporting. Limited value add.

Quick Summary

Quasi internet fren, Real Estate God made a good point. The majority of these roles will be automated and set up into the $150-250K band. This does not include outright rain makers like an MD and is just a directional comment on white collar workers. The majority of the work is reporting and will be automated to reduce the need for hundreds of workers in any large organization.

You already see Tesla, META, Alphabet and other major tech firms doing this. Wall St. has been doing it more quietly and it’ll trickle into the rest of the F500 over time.

Sales is the best option at this point (ideally enterprise sales since high ticket items = higher commission).

Expect a flattening of organizations, the middle manager role should be *avoided*. If offered a promotion just say “only if i can retain my revenue role”. Otherwise you’re in big trouble within a couple years.

Part 2: Using AI today

Anyone on the paid stack is already keeping tabs with all of this. Due to automation tools you can do a ton of stuff. If you’re brand new you can spin up a internet based income that does about $500-$1,000 a month in about a day (source). For people with experience it will be easy to do, for people with no experience probably a few months to really get it down pat but the point is the same. You can spin it up with near no cost and no employees. The industrial age is over. High headcount is a sign of *inefficiency*.

The firm is not keeping pace with new tech tools and their headcount is a sign of bloat and wasted money (overhead walks on two legs).

The General Step By Step is now:

Pick a Business Model: We’ve preferred E-com since anyone can do it, but anything with recurring or consumable revenue is good enough. IE. You need repeat purchases. This can be SaaS, e-commerce and anything that requires repeat usage

Use AI for Content Shells: We’ve used all the image and text tools you see online. They are not at the top yet but it is improving at rapid speed. The way to use it is by taking the AI shell, changing it to fit your marketing voice/image and then use AI again to send it out to all channels: X, LinkedIn, YouTube, TikTok etc

Chatbots and Predictive Analytics: Once you’re in business you can install chatbots instead of hiring people. Then use analytics to decide when you should email a customer that they left their checkout cart. Or hit them with a promo to get the sale. These answers will be delivered to you without an expensive “analytics” person

Scale: Generally you can get to around 8 figures with under five people. Yes seriously. There are several monster performers out there with < 5 people and over 8 figures in revs or mid 7-figures in profits. As a rule of thumb it cuts down your work force by about 75%. In the past a well oiled machine company could do 8-figures top line with about 16-20 people. Now it’s down to 4-5 (perhaps less soon)

Iterate and Streamline

Once again on the paid stack we’ve shown how AI can tell you exactly what is wrong with a business you’re looking at (source). This is unfathomable from 10 years ago. You were forced to guess and try to solve the “why is this dude selling” question for months at a time.

Now? You can basically solve the jist of the problem in a day or two. If you specialize in solving the problem the Company lacks, then hit the go button.

Iterate Your Own Product: Doesn’t stop there. No need for some meth head to decide when to order inventory. Instead you can set up software/AI to alert you when to order inventory based on seasonal trends. It can estimate your sales for Q1/Q2/Q3/Q4 and you just click buy. This means you’re only required to follow major trends. Such as tariffs where anyone organized ordered all their inventory in Q4 to avoid the inevitable back and forth we’re seeing today.

A/B Testing: For those that are using the template AI ads, you already know they are good shells but don’t really convert all that well *yet*. Instead you use the shells to copy general ads that work, edit them and A/B test them.

This may seem trivial to many but it saves days/weeks of time. Instead of having to think of the general shell/structure it’s largely done based on what other ads have done well (and target audience).

If you can somehow train it to get the ads done perfectly every time, then you’re really printing forever. No need for any digital agencies, ad specialists etc. Just churn them out test and let the campaign run until failure.

Summary

The basic skill needed nowadays is just observations. If you’re able to quickly see why an ad is bad, what market is going to heat up and which audience is trending in direction A or B… You’re pretty much set.

The main headache is developing that instinct. The vast majority of all companies are not massive innovations. Just find something that has huge demand already and make a modest iteration/new angle.

Part 3: AI In The Future

The biggest one we’re waiting for is video content. That stuff is extremely expensive to make either in time or financial payouts. Currently it is a gold mine. If you’re good at video content you can write your own ticket to financial freedom.

In the future we expect the following items to have “shells” as well.

Short form Video Ads

Short form before and after results of your product

Short form demos of your product

Long-form landing pages that are not completely targeted at 64IQ mouth breathers

That’s our guess. Once the video stuff is done you’ll then see a further trend to “live” response ads.

You’ve probably seen all those 5 second TikTok sales videos. They just show the product for split seconds and they cost around $5 each. The same is going to happen once the videos come about. Sadly, we’re actually going with the flow a bit here as well. Loading actual photos of before/after real estate flips since that’s the reality of the future. People will no longer be impressed by cool video ads. They will work but the slow and steady move will be to *live* information. Live Demos. Live before and after.

You all know how this works. Once its commoditized, people get desensitized. Guess that leaves some hope for the Only Fans models when VR/AR girlfriends come out!

A Future Pod Awaits the Majority

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money