Are You On Track to Be Elite? Find Out...

Level 2 - Value Investor

Welcome Avatar! We’re having some fun seeing how much better off our community is versus the general population and the results are interesting. Even in the free Twitter poll 3 out of 4 people who simply follow the account are going *up* the socioeconomic ladder (61/82.2 = roughly 75%). As an interesting note, we’d wager that practically everyone on the paid section is going up the socioeconomic ladder.

Quick Giveaway! This is a free giveaway for CryptoTag. Pretty simple rules and is *not* limited to just BowTied individuals, anyone reading this can make a simple meme: 1) have to be following both BowTiedBull and CryptoTag on Twitter and 2) have to make a meme with the following concept “Keys lost forever due to paper storage”.

On Monday February 7, you can submit your meme photos on twitter and CryptoTag will choose the three winners.

Part 1- Seeing if You’re Getting Ahead or Not

This is not a fun conversation. Most will take a step back and realize that it’s a lot harder to get ahead than they originally expected. A simple definition of getting ahead is that you should be able to afford a *better* quality of life every ~4-5 years. While everyone on Twitter somehow wins every single year, we’ve noticed that you will have good years, bad years and medium years. The difference is that over a ~4-5 year time frame it should be up.

What is Up? Up means that you’re able to do two things: 1) increase your lifestyle and 2) save a higher percentage of earnings. This is a pretty difficult task for the majority of the population (except the Jungle which is slaughtering the game). This is a *huge* departure from the frugality crowd that teaches you to never have lifestyle inflation. That strategy just leads to a low quality of life (we know we know, who are we to say we’re homeless on a beach)

Example of This: If you earn $5K US Trash Tokens per month after taxes and save $500 it means that your savings rate is 10%. The amount you keep determines how fast you get rich. Therefore, if you earn $6K US Trash Token per month next year you have to save *MORE* than $600 a month. This is possible since you’re making $12,000 per year in additional after tax income.

For those that understand compounding, this means that the traditional advice of saving 10% doesn’t work *and* the frugality advice that suggests never upgrading doesn’t work as well (you will become a boring and strange person over time). Autist Note: flat savings rates don’t create wealth because you should make significantly more every 3-5 years or so. If you made $100K this year and make $300K next year, that $10K from last year would represent only 3.33% of annual savings for a person making $300K (doesn’t move the needle)

Solution: The solution is always the same, which is to earn more money with a wide range of strategies: 1) multiple careers, 2) career + WiFi business and 3) ideally tons of WiFi businesses since they have infinite scale - good luck checking out 1,000 customers in 60 seconds with a Brick and Mortar!

Crunching the Numbers - Are You Getting Ahead? Instead of doing something overly complicated we’ll simply look at the price of an average home. This is a better use of the calculation when compared to the S&P 500 or inflation since the S&P includes tech stocks that went parabolic and inflation is simply made up numbers at this point (no one who buys their own food believes the 7% number it’s 20%+ at minimum).

Roughly speaking a home will cost $350,000 US Token which is up from around $175,000 at the bottom around 2010.

First the Calculations: 1) Over the past 10 years have you doubled your *after-tax* income? If the answer is yes then you are keeping up with the rising cost of living. 2) Is your net worth up 2x over the past 10 years? If you’re under 25, this should be an easy yes as you haven’t earned much until the last few years. This is more for people over the age of 30-35 or so; 3) is your quality of life better than your parents at the same age band?

If you answered yes to all of these, congrats on swimming against the current (“financial athleticism”)! From a big picture perspective you’re doing better than the majority. This is a low bar for readers of this website. And. It’s always good to look at the bright side when the masses are panicking over 10% stock price corrections.

The Chart Below Shows that even the Top 5% didn’t see 100% after tax income growth (Source) Therefore if you answered yes to the first question alone, you did better “socioeconomic income climbing” than the top 5% on average.

Wait a Second.. .That is right. Unless you did better than the top 5% you were not able to keep up with the rising prices of an average home. Pretty insane don’t you think? The only reason we haven’t had full blown panic is that Technology is Deflationary!

The standard of living for people improved due to technology. An iPhone made maps, landlines, CDs, calculators, cameras and hundreds of other products worthless. Since you don’t have to buy them and the iPhone costs less than all of those combined (by a large margin) you don’t feel the pain as much. The pain is only felt if you try to buy an asset.

Asset Comparison? Can you buy as much of the S&P 500 now as you could before with your earnings? The S&P 500 is up ~322% which means that you have to increase your earnings by 3.2x after taxes in 10 years ($100K after taxes = you need $322K US tokens after tax to buy the same amount of S&P 500). As you can see, this is even *worse* than the real estate market which required a double ($100K versus $200K)

Staying Balanced: Once again, we don’t believe the 2% inflation and the 7% inflation numbers (it’s much higher). Cost of living and standard of living should be a better benchmark and it is the “American Dream” to own a home (an asset and consumer flex item that historically appreciates over time). Therefore we’ve used 100% after tax growth over ~10-12 years (ball park estimate).

Part 2- Wait Who Benefits?

Of course you already know the answer but anyone who owns a bunch of assets benefits. As we’ve said many times before top 1% income is not rich. Top 1% *wealth* is rich.

Top 1% wealth = $12,000,000 US Trash Token after tax

Top 1% income = $500,000 US Trash Token = $300,000 US Trash Token After Tax (closer to $297,000 in New York City).

This means if everything goes up 100%, the $12,000,000 is now worth $24,000,000!

$12,000,000 is 40 years of top 1% earnings and assumes you live for free somehow

From the above, we can see that the top 1% own about $44 trillion and the bottom 90% (vast majority) own about $41.5 trillion of the stock market (source from the Fed). Since the top 1% owns more than the bottom 90% combined it means that money printing and asset inflation allows the top 1% to create a bigger gap (this is simple maths!)

Part 3- What to Do About It and Becoming Elite

Well you already know our strategy: 1) career that pays the most for least amount of time - ideally work from home, 2) spin up a WiFi internet business and 3) eventually quit and focus on nothing but internet businesses. Remember, never quit your career until your WiFi money is making more than your career by 2x after taxes.

Benchmarks: For those that followed us back in the Wall Street days (a dying industry), you know that the most common number touted as “set” is $10,000,000 US Trash Tokens. You also know (if you actually worked on the Street), that the vast majority don’t even get close due to: 1) lifestyle inflation; 2) divorces; 3) stock vesting - LOL! at Citi and Lehman Stock; 4) recessions/layoffs and 5) the current secular decline of the industry making it hard to pay in excess of inflation unless you’re at a top M&A firm (Qatalyst, Moelis, Evercore, etc.).

Definition of Elite (Here): The good news is that we don’t think it’s necessary to get to $10,000,000 even in 2022 (of course if you can that’s amazing and many of our readers already have and/or will before they are even 40 years old).

Instead an elite person has the following characteristics: 1) happy with his/her life; 2) in shape physically - top 10% at minimum for their age bracket determined by lifting strength and 3) *passive* income of $15,000 US Trash Token per month.

The first part is obvious. There is no point in being wealthy if your health is a disaster and your personal life is a mess. There are thousands of people like this. They live lives of “quiet desperation”

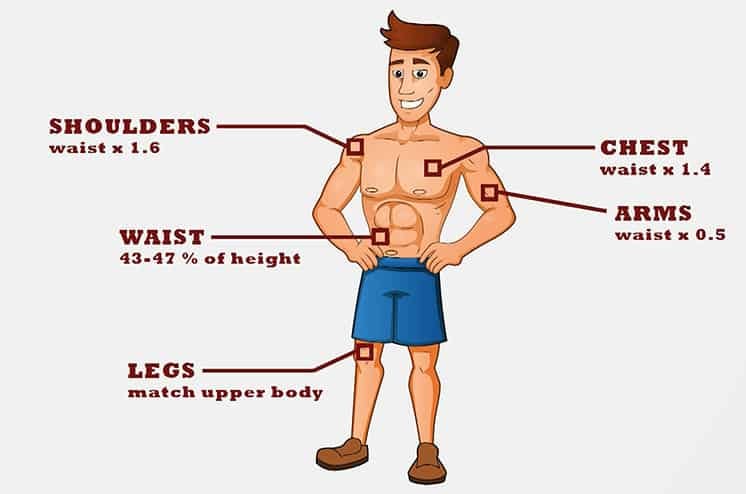

The second part is quite easy to measure since we know people will ask: 1) resting heart rate in the 50s, 2) 10-15% body fat and 3) be within 10% of the measurements below (mens example) while doing cardio and lifting every week (as usual this is art not science but close enough).

The third part is why people follow this corner of the internet. Most people put this “first” on their priority list which is why you see so many guys who are rich but bitter and unhappy. You can do all three with ease if you prioritize correctly. We digress. Here are the simple benchmarks

30 Years old, $1,000,000 US Token (10+ BTC). Possible with the same strategy: M&A, Tech, Enterprise sales and a WiFi business being built while working

40 Years old, $4,000,000 US Token (40+ BTC). Possible with the above strategy if you can *sell* one of your successful WiFi businesses

Space level wealth - $25,000,000 US Token (250+ BTC).

For fun we skipped everything in-between. If you get to $25,000,000 or more there is just no lifestyle changes unless you want a jet. At that point you’re worth multiple nine figures. If for some reason you want to get there congrats! That said, at $25,000,000 there is no real “utility” to more money unless you “need” a jet for some reason.

Conclusion

Many of you think the numbers are too high, some of you think the numbers are too low. The reality is that the number of people that have made it over the last 10 years has already proven to us that the strategy works and is time tested (too many success stories).

While you may think it’s “not achievable” this is likely because you’re underestimating what you can do over 10 years and believe this will happen in 1 month. Classic human greed psychology.

Everyone needs to start somewhere and every single day we get a new person who made their first $500 or $1,000 a month online. We sit back and laugh since we know that number will be 10x in a few years or even 10 years depending on effort and talent level (we don’t make the rules talent is real!). Autist note: this is why some of your DMs and messages simply get a “cool” or “thumbs up” response. We already know it’s a drop in the bucket compared to the message we’ll get in a few short years.

Over the coming months we’ll be offering small to medium sized opportunities to people on the paid stack (whopping $0.25 a day cost) and any member of the BowTiedJungle (free). As usual, Equal Opportunity, Unequal Results.

We suggest subscribing to link up with other future multi-millionaires. Otherwise enjoy the bugs. Twas’ Written in the Stars.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

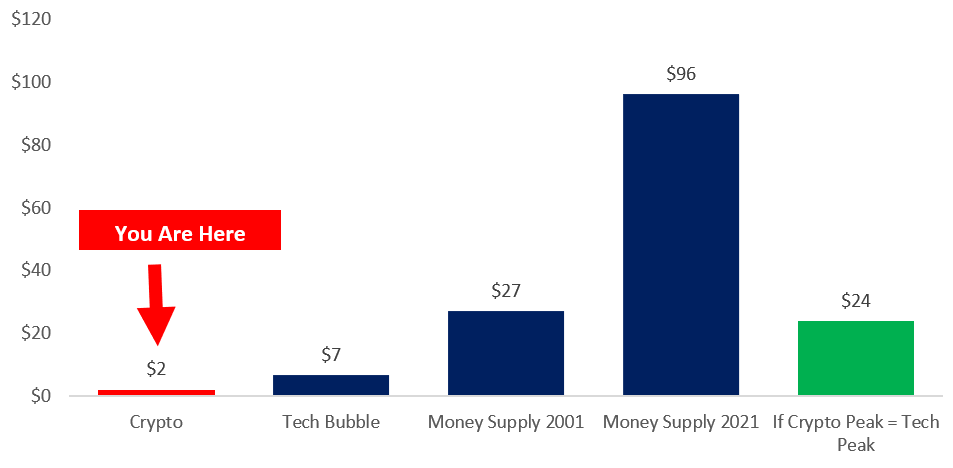

You’re Early: Remember that you’re early. If you need to zoom out see our post here on Crypto versus the Tech bubble (which was only the US stock market).

Below Chart in $Trillions of US Tokens

$1m by 30, $4m by 40 is a bar set too low. You need to be at least 1.1m now by 30 with inflation, or $6-8m by 40

Pls future post on what to do with time/life after being set. The 3 to 6 months vacationing/video games or whatever get boring real fast, no motivation to increase NW further, just flying around the globe discovering new places having fun?