Argentina Update: Milei’s first year in office

Level 2 - Value Investor

Welcome Avatar! We’re sure that all of you are interested in what is happening amongst various coins. That said, it’s a good time to zoom out and understand the base level point of crypto: governments will print money. The new president in Argentina took over headlines and was largely forgotten the past few months. Probably because what he is doing worked, similar to all the hate that the President of El Salvador got when he created a BTC friendly country.

On that note, here is what is happening in a country with Hyper Inflation with BowTiedMara (he’s also famous for consistently getting Elon Musk to respond somehow).

Argentina Update

Even though some skeptics like Ian Boomer were certain that an “Argentina collapse was coming imminently” under Milei (tweet has since been deleted), and local bang haircut progressives assured “his government will not make it through Q1”, nothing could be further from the truth.

Now that Milei has been in office for almost a full year, let’s go over some of the key changes that are geared towards transforming Argentina from a bureaucratic inferno of protectionism into an economy that could be listed higher on different economic freedom indexes.

Rental Law

One of the first measures by the Milei admin was to issue an executive order to apply changes in the labor system, simplify some bureaucratic procedures to modernize the State and to repeal the Rental Law.

That last item alone has shown the power of the Milei deregulation better than any other measure: before, with the Rental Law in place, property owners were not allowed to increase rent prices more than once a year, and rents could only be charged in pesos.

Obviously, very few owners considered renting out their property under those conditions with a 300% YoY inflation rate, lol. Long term rental properties in pesos were very hard to come by, and owners rushed to furnish their apartments to convert them into STRs on Airbnb.

Repealing the Rental Law flipped this dynamic completely: now, rental contracts can be signed in any currency – including Bitcoin if you so wish – and the owner is free to determine when rents can be increased or not. The result?

Dark blue: supply of rentals on the market (1-bedroom apartments), (left axis) | Light blue: real rents in pesos (right axis)

The supply for long term rental properties at a fixed dollar rate increased by 189.77%, and a drop in rents across the board of -38.6%.

Since the market was flooded with Airbnbs, many owners decided that converting them back into a long term rental at a fixed USD rate would actually be more profitable. Funny how that works.

Ley Bases and Ministry of Deregulation

In June of this year, Argentina finally made its first step towards a more open economy and less State intervention: the Senate approved all chapters of the Omnibus Law package or Ley Bases with only slight modifications

One of the most important items besides a 30+ year tax regime for investments of over $200M (RIGI) and further deregulation and state reform, was the fact that Milei was given emergency powers.

This is very common in Argentina, and usually these get extended throughout each presidency, which boils down to enabling the president to push virtually everything through by Executive Order. Normally presidents would receive 2 years of emergency powers at the start of their presidency, but since Milei doesn’t have a majority in Congress, the opposition pushed for it to be only one year. They are very scared to lose their privileges, and it shows.

The emergency powers were a godsend for the Milei administration, because now most deregulations can be pushed through by the Ministry of Deregulation directly without having to go through Congress first. Yes, Milei created a Ministry of Deregulation, the original DOGE where Elon got the inspiration from.

Minister Sturzenegger is at the helm there, and he has a timer that counts the number of days Milei still has emergency powers so they can nuke as many government regulations in that timeframe as humanly possible.

This week, deregulator Sturzenegger launched a separate deregulation website, where citizens can notify the deregulation ministry of insane and backwards regulations that are ripe for destruction. Citizens can report the following:

Another big deregulation was at the tax collection office in Argentina: Milei dissolved the AFIP (IRS) and created a new, smaller collection agency. Directors' salaries by -90%, and salaries of lower-level authorities were reduced by -30%, while the total number of employees was reduced by -15%

Elon and Vivek, take note.

Tax amnesty

One thing that is always in short supply (and in oversupply on the black market), is dollars.

Since such a large part of Argentina's economy runs in the shadows (estimates for the black market / below the table economy run from 40-55%), it's fairly common for each new government to try to get a hold of some of that undeclared money by offering a tax amnesty or blanqueo (literally: money laundering).

With more socialist-leaning governments like the previous admin under Alberto Fernández, few people to decide to declare any undeclared funds, and the tax collection on them is minimal since conditions tend to be less favorable.

The situation was completely different with a more fiscally responsible government: the Milei admin allowed Argentine mattress savers to launder up to $100k USD tax free, and everything above $100k would only be taxed at 5%.

Private sector USD deposits in the banking system under Fernández and Milei

With over US$ 20.6 billion entering the financial system through the tax amnesty, it was a real success, and for the first time private USD deposits were at a higher level than the international BCRA (Central Bank) reserves.

Many younger Argentines swapped their crypto to cash dollars – something fairly easy to do at black market money exchanges called cuevas – to later deposit those bills in a blanqueo bank account for laundry.

After the cutoff date, they were able to withdraw that USD in cash and buy crypto again. It’s funny to see cashiers at banks here do not even blink when you withdraw $100k USD in cash, that’s how normal dealing with cash is in Argentina.

The idea behind swapping the crypto for fiat instead of declaring the crypto itself is that this is a way to avoid the 15% capital gains tax in the future, plus all declared assets filed for the amnesty are valued at their valuation on December 31st, 2023, when Bitcoin was less than 50k. As you can see even when declaring undeclared assets, those savings will still be undeclared afterwards because they are in crypto again, lol.

The final numbers were 330,793 special laundromat bank accounts with a total of $20,631,000,000 dollars declared, so most people declared less than $100k to play it safe. An additional $30 million USD was declared in crypto assets.

In real ancap fashion, President Milei called for destroying the database of anyone who adhered to the tax amnesty, so it can’t be used against them in future administrations if they are short of cash and want to start auditing.

Surplus Above All Else

Milei's shock doctrine is mainly a fiscal shock doctrine. Curiously, and despite expectations, Milei has been gradualist in his monetary policy and very strict in his fiscal policy. Currency restrictions are still not lifted, but the fiscal surplus is non-negotiable.

The central point of the Argentine government's fiscal policy in its first 10 months has been zero tolerance for the deficit. So far, Milei’s admin has already accumulated 10 consecutive months of primary fiscal surplus.

Deficit / Surplus per month in 2021, 22, 23 and 2024 - Source

Between January and October 2024, Argentina has already accumulated almost 1.7% of its primary fiscal surplus over GDP (in contrast to the deficit of 1.5% of GDP in 2023).

Once the interests of the gigantic debt inherited from previous governments have been paid, Argentina will achieve a surplus of 0.5% of GDP, which is well above what organizations such as the IMF recommend when handing out loans

Just to give an idea of how unique this is in Argentina, here’s a graph of the fiscal deficit and surplus over the last 60 years:

Yes, that’s very little green, and the green from 2003 onwards was because Argentina had defaulted, which is not the case now.

Most of this surplus was achieved by cutting government programs, ministries and secretaries, and by downsizing the total headcount of federal employees:

Decrease in national public sector jobs since December 2023, around 33k have seen Milei’s chainsaw cut away their job positions so far

These kinds of measures, combined the monetary measures of pulling pesos out of the economy versus printing a new monetary base ever month, do not come without their short-term downsides: an overall slowdown in economic activity, and a short-lived recession in the first half of 2024.

From June onwards, industrial production started growing strongly and in September this was almost at the same level as in November 2023 (before the Milei government came into office).

Monthly economic activity before and after Milei - Source

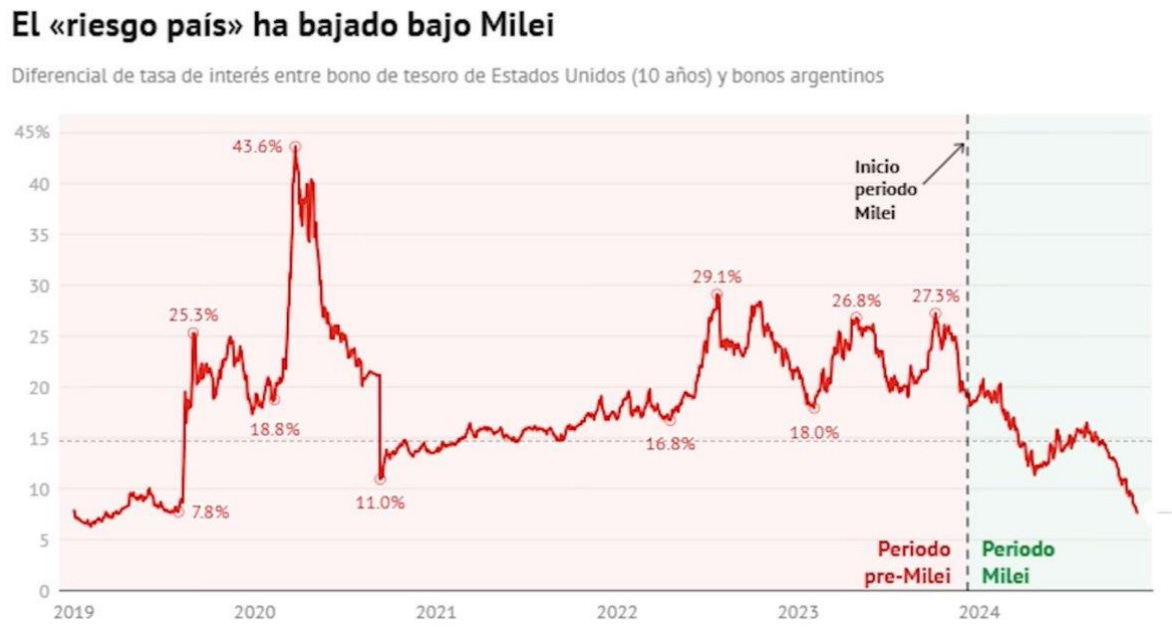

Country Risk

One crucial item to watch for most EM countries is the J.P. Morgan Country Risk Index, which measures the differential between the interest rate of a US bond and that of each country (specifically the 10-year bond). The higher the country risk, the higher the interest rates on dollar loans.

In the case of Argentina, country risk has plummeted after Milei started, due to the accumulation of fiscal surpluses and the relatively rapid emergence of economic growth – J.P. Morgan estimates that Argentina’s GDP will grow 8.5% in 2025, one of the highest growth rates in the world.

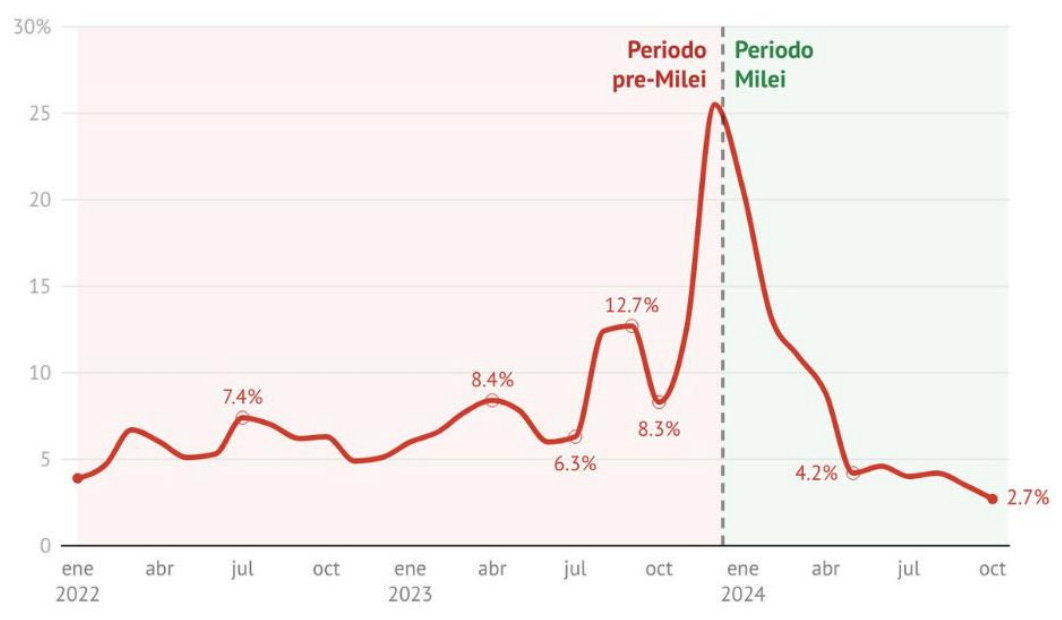

Inflation

After the risk of hyperinflation right before Milei started, his government decided to devalue the official peso rate, which was completely out of whack with the real-world dollar rate (official rate $360 vs $905 pesos at the blue rate, lol), which caused an initial spike in inflation in December (25.5% MoM).

After that, inflation has trended down thanks to winding down the peso debt ponzi at the BCRA and expectations are that inflation will hover around 30-50% for 2025. Still high, but a lot better than 300%.

Dollarization & Closing the BCRA?

Despite the potential outflow of dollars in the near term due to a tower of maturities in 2025, a few steps into the direction of either dollarizing or closing the BCRA have been completed thus far:

All BCRA debt was transferred to the Treasury

No more peso issuance (still some, but compared to previous gvmts this is close to zero)

Local dollar-denominated bank accounts can now be used for everyday expenses in pesos

The USD deposits of the private sector outweigh the BCRA dollar reserves for the first time in history

Different rates converging to ~$1,100 pesos per dollar

Closing the Central Bank will not be as straightforward as closing and restructuring the AFIP (IRS) office: in the Constitution there is mention of a Central Bank that has to issue currency in Argentina

In Dollarization Scenarios for Argentina you can read more about how the Milei government might circumvent that, by focusing on the Peso Oro and delete pesos (ARS) from the central bank database altogether.

Milei’s idea is to stimulate currency competetion, and have citizens decide what currency they prefer to use. If the peso is deleted, that would de facto boil down to a dollarization.

Just to give an idea of how common it is in Argentina to transact or save in dollars, about 17.2 million Argentines have a dollar bank account. This is roughly half of the adult population. The dollar is not going anywhere in Argentina, and when you mention a BRICS currency most Argies shrug, buy USDT or cash USD bills at a cueva, and laugh. Stablecoins are a day to day thing at cuevas, although Millenials do increasingly save in Bitcoin.

Real Estate in Argentina

Since the peak of the RE market in 2018, m2 prices in Buenos Aires had dropped -50% in real terms in dollars until around October 2023. In hindsight, that was the bottom, and prices have since increased, in some neighborhoods increases are over 20-30% YoY. In October 2024, average prices on deed have DOUBLED compared to October 2023

Pretty insane, but that’s the Argentina rollercoaster.

Average deed prices have DOUBLED compared to October 2023

Around 10% of the tax amnesty deposits mentioned earlier have already been withdrawn from the bank, and a lot of those dollars will convert into real estate. This dynamic, combined with rising wages in real dollar terms and the start of mortgage credit under Milei (300% more mortgages YoY), is a perfect set up for this uptrend to continue.

If you’re interested in property info on Buenos Aires you can find several guides and updates here.

Downsides?

Naturally, when coming out of 2+ decades of socialist protectionism, this doesn’t come without downsides. Argentina is definitely not sprayed over with libertarian rainbows all of a sudden. There is still a lot to improve, but the course is clear and steady.

Milei’s La Libertad Avanza party still has some growing pains in terms of internal power structures and political infrastructure, which is logical since it has only been spun up not even three years ago.

A recent falling out between Milei and vice president Villarruel is an example of some of the frictions at play, and shuffling of key positions has happened a few times already.

For the overall population of peso earners and digital brokemads alike, life has become a lot more expensive due to the peso appreciating thanks to the fiscal and monetary measures taken by Milei. Steak flexing on the gram is not what it used to be.

Even though inflation is down significantly, if a speeding car goes from 300mph to 60mph, it is still moving forward, and so are prices. And with a stable or even appreciating peso against the dollar, life just isn’t that much of a bargain anymore. That said, 2019-2023 was the anomaly in terms of ultra cheap prices for Argentina, and prices are now getting closer to the historic norm

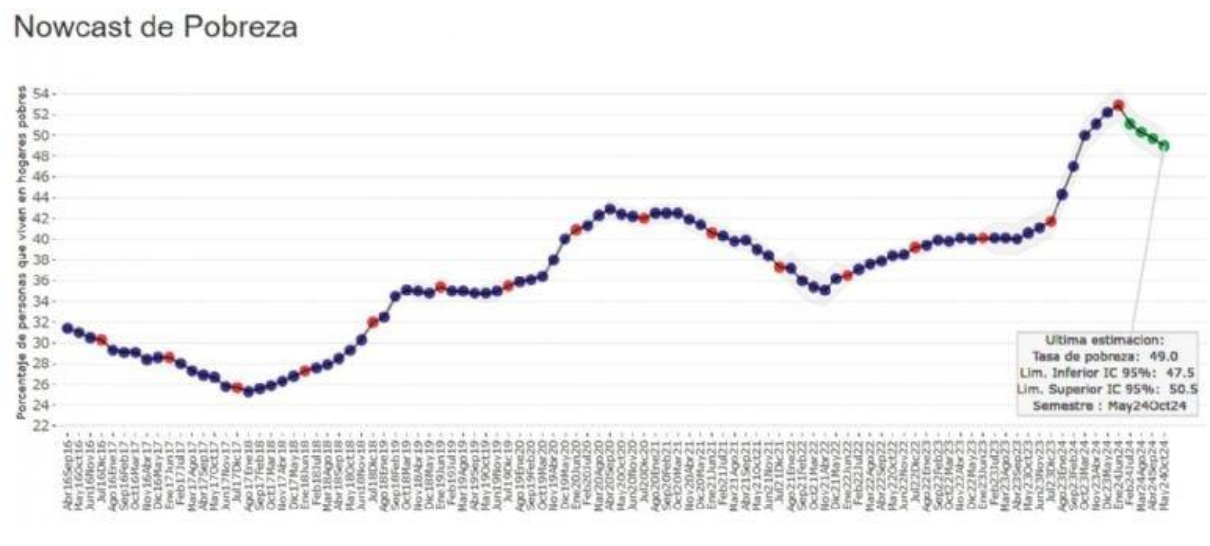

Ripping off the bandaid of the money printer initially cause the poverty rate to increase to over 50%, but this is now gradually declining and closer to 47.5%:

Local salaries are now finally increasing in real dollar terms and even outpacing inflation in the last 3 months, and the expectation is that this trend will continue.

Private and public sector real salaries in Argentina, log scale – source

Once deflation hits in, prices should decrease. The main thing to watch here is the speed at which these things happen, while still having a devaluation crawling peg and currency restrictions in place. You can read more about the dangers of this exchange rate dynamic under currency restrictions here, and in the past maintaining a crawling peg for too long with a relatively high peso has gone south more than once for Argentina. Key will be that the Milei team lifts the restrictions as soon as possible early 2025, with a floating exchange rate.

Argentina now has all the elements in place to move to a free-floating exchange rate in the next 12 months: 1) a trade surplus, 2) a fiscal and financial surplus, and 3) the economy is starting to grow and will grow at its highest rate in 15 years in 2025.

This will also boost foreign investments, which, besides mining and oil & gas, are still relatively low. Many international companies are “waiting it out” to see what the outcome of the October 2025 midterm elections will be before making a move.

So far, many different consultants estimate that Milei’s LLA and the PRO will get to more than 50% of the votes, which would be a landslide. Still 37% of Kirchernism/Peronism, but hey, you can’t change that overnight, and history shows that a hardcore 30% will never switch sides no matter how successful Milei is.

Final Thoughts

Going cold turkey, the Argentine economy has suffered considerably in the first two quarters of 2024 after the withdrawal of stimuli in the form of unbridled public spending carried out by the government of Javier Milei.

But removing the hyperinflationary helicopter money and the State from the economy has helped to achieve a fiscal surplus that was unimaginable a year ago. It helped to control inflation that was already bordering on hyperinflation and, although it has generated a recession, it looks like that recession has barely lasted two quarters.

One thing to always keep in mind was the state Argentina was in right before Milei came to power. The gap in the black market and official exchange rate was over 200%, inflation was running towards 300% YoY and hyperinflation was imminent with the degens at the BCRA printing an additional monetary base every 1.5 months due to local debt instruments in pesos.

In the words of minister Guillermo Franco:

"We are approaching our first year in office; a year marked by firm decisions, profound transformations […] which steered Argentina towards a future of growth, development and freedom. In these 12 months we have avoided an unprecedented crisis and, little by little, we are beginning to see concrete results that are reflected in macroeconomic solidity, the sharp drop in inflation, the reorganization of public accounts and the recovery of economic activity and wages."

The most amazing thing is that Milei was able to do all this virtually without any support in Congress.

Just imagine what is in store after the Midterms in 2025, which his party La Libertad Avanza, in combination with a PRO alliance, is set to win with over 50% of the votes. If that happens next October, you can bet on an even bigger chainsaw mowing through backwards regulations and a morbidly obese public sector.

Could you hand me over that chainsaw will you, Javo?

The key will be if provincial governors play ball: so far, they have not cut any significant deficits, and most municipalities and provinces raised local taxes to make up for the loss in handouts coming from the national government.

Another thing to watch in 2025 is when currency restrictions (cepo) will be lifted, and what happens to the exchange rate afterwards. Argentina is very much a bi-monetary and practically dollarized country, so a lot depends on the local demand for crispy Benjamins.

Until then, we can expect to see a lot more ¡AFUERA!

If you’re interested in Argentina updates you can follow this cartoon rodent’s substack here, and you can book a private consultation here in case you need more info on moving to or investing in Argentina specifically

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money

Amazing that to solve almost any problem at a national level, you can look at just what the left wants and do the exact opposite.

Bukele - "What if we solved our crime problem by locking up criminals?"

Milei - "What if we solved our economic problem by freeing up the markets?"

Still early days though, as you say.

Fantastic write-up, thank you for all of the work put into this